Positive UK Data Support GBP/NZD

UK average earnings and retail sales rose more than expected in October. Will the GBP/NZD continue rising?

UK consumer price inflation remained at a five-year high of 3% in October. Average weekly earnings during 3 months ending in September rose more than expected and retail sales in October did too. Meanwhile, the Reserve Bank of New Zealand left interest rates at 1.75% at its November 8 meeting, stating monetary policy will remain accommodative for a considerable period. The New Zealand central bank hopes low interest rates will keep the exchange rate low helping boost the external trade and growth. Improving UK data and accommodative RBNZ policy are bullish for GBP/NZD.

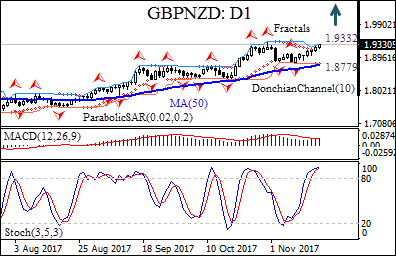

On the daily chart, the GBPNZD: D1 is above the 50-day moving average MA(50).

- The Parabolic indicator has formed a buy signal.

- The Donchian channel is neutral, it is flat.

- The MACD indicator is above the signal line and the gap is widening, which is a bullish signal.

- The stochastic oscillator has breached into the overbought zone, this is a bearish signal.

We believe the bullish movement will continue after the price breaches above the upper Donchian boundary at 1.9332. A price above that level can be used as an entry point for a pending order to buy. The stop loss can be placed below the fractal low at 1.8779. After placing the pending order the stop loss is to be moved every day to the next fractal low, following Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. If the price meets the stop-loss level (1.8779) without reaching the order (1.9332) we recommend cancelling the order: the market sustains internal changes which were not taken into account.

Technical Analysis Summary

Position - Buy

Buy stop - Above 1.9332

Stop loss - Below 1.8779