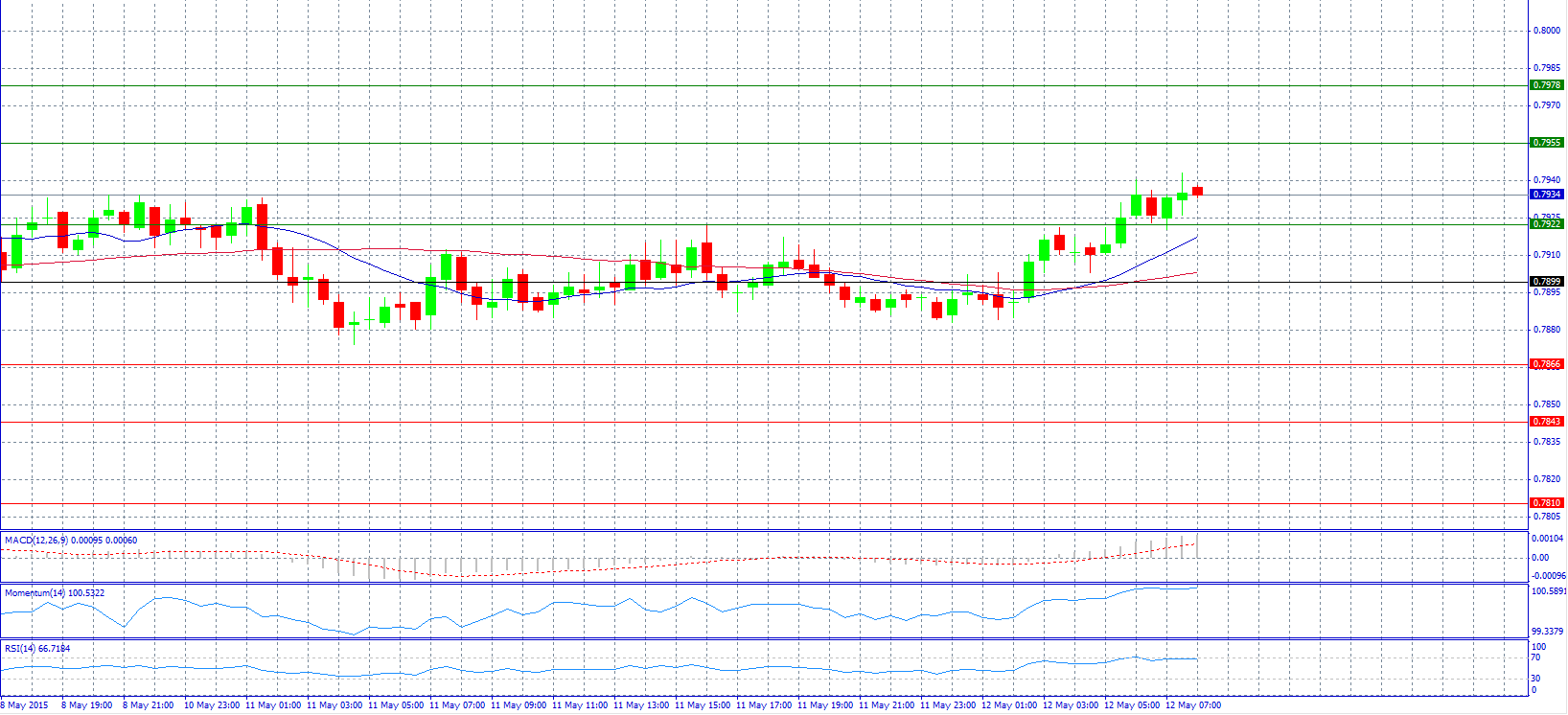

Market Scenario 1: Long positions above 0.7955 with target @ 0.7978.

Market Scenario 2: Short positions below 0.7922 with target @ 0.7899.

Comment: The pair extended beyond 0.7900 and trades near 0.7935.

Supports and Resistances:

R3 0.7978

R2 0.7955

R1 0.7922

PP 0.7899

S1 0.7866

S2 0.7843

S3 0.7810

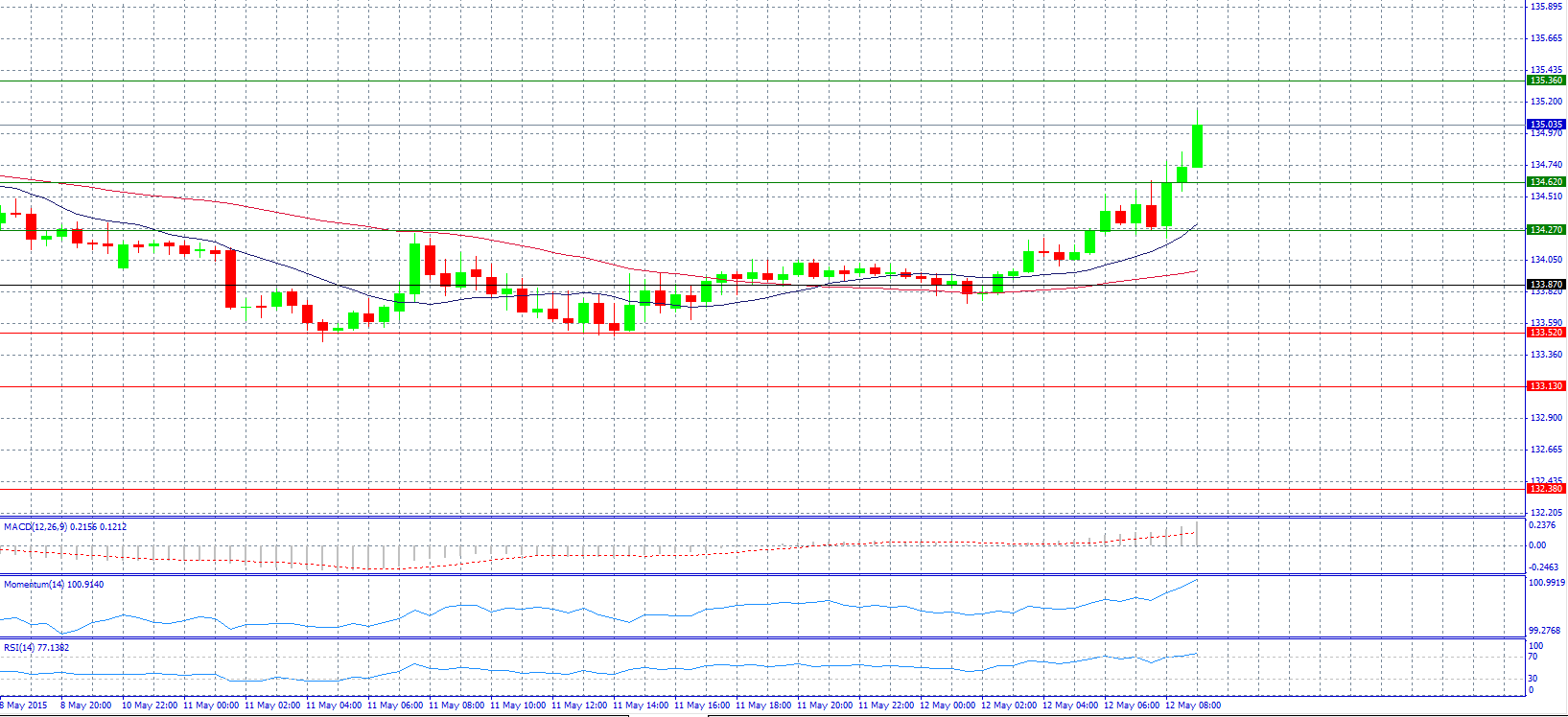

Market Scenario 1: Long positions above 134.62 with target @ 135.36.

Market Scenario 2: Short positions below 134.62 with target @ 134.27.

Comment: The pair rose and surpassed 135.00 level.

Supports and Resistances:

R3 135.36

R2 134.62

R1 134.27

PP 133.87

S1 133.52

S2 133.13

S3 132.38

Market Scenario 1: Long positions above 1.1304 with target @ 1.1376.

Market Scenario 2: Short positions below 1.1232 with target @ 1.1190.

Comment: The pair strengthened and sees a further potential to 1.1270 level.

Supports and Resistances:

R4 1.1376

R3 1.1304

R2 1.1232

R1 1.1190

PP 1.1160

S1 1.1118

S2 1.1088

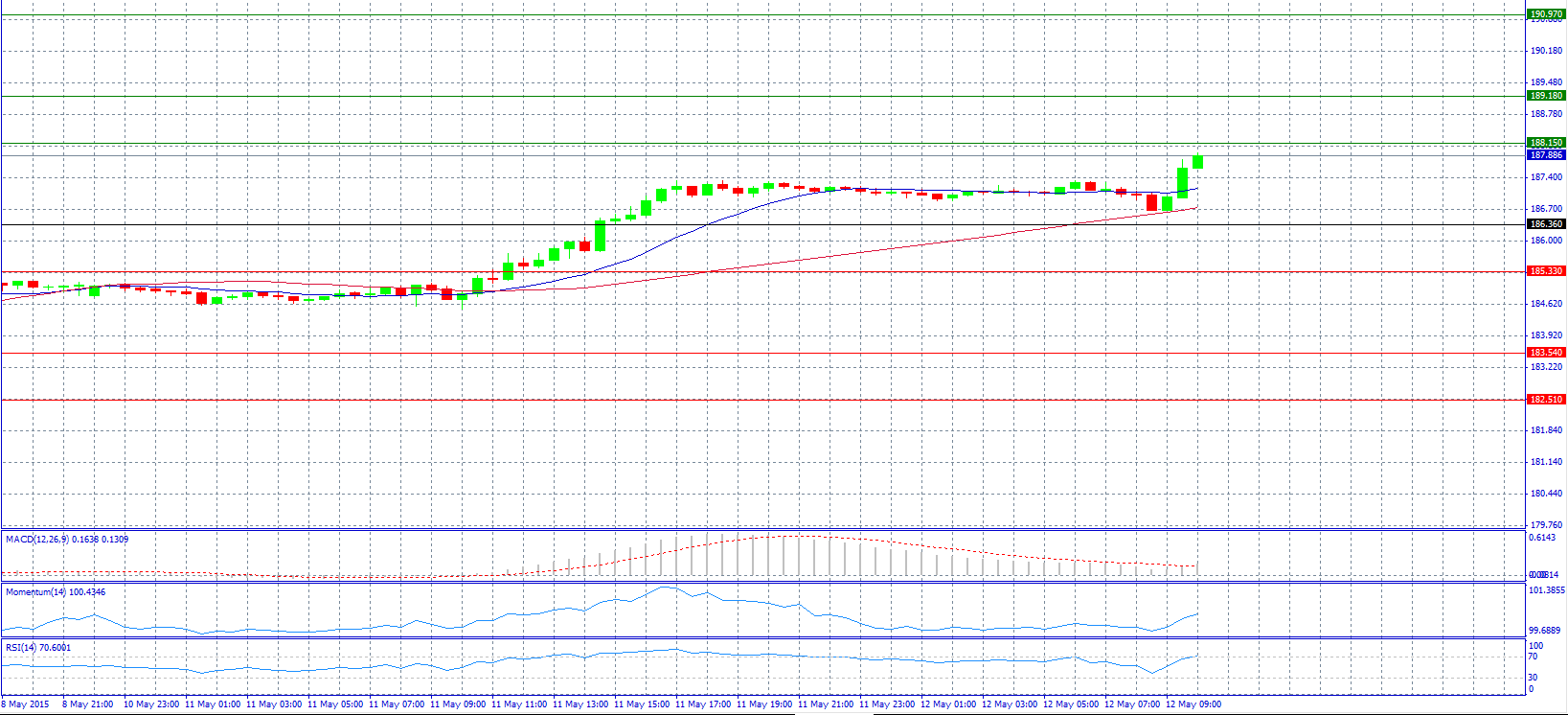

Market Scenario 1: Long positions above 188.15 with target @ 189.18.

Market Scenario 2: Short positions below 186.36 with target @ 185.33.

Comment: The pair advanced and sees a potential to break resistance level 187.15.

Supports and Resistances:

R3 190.97

R2 189.18

R1 188.15

PP 186.36

S1 185.33

S2 183.54

S3 182.51

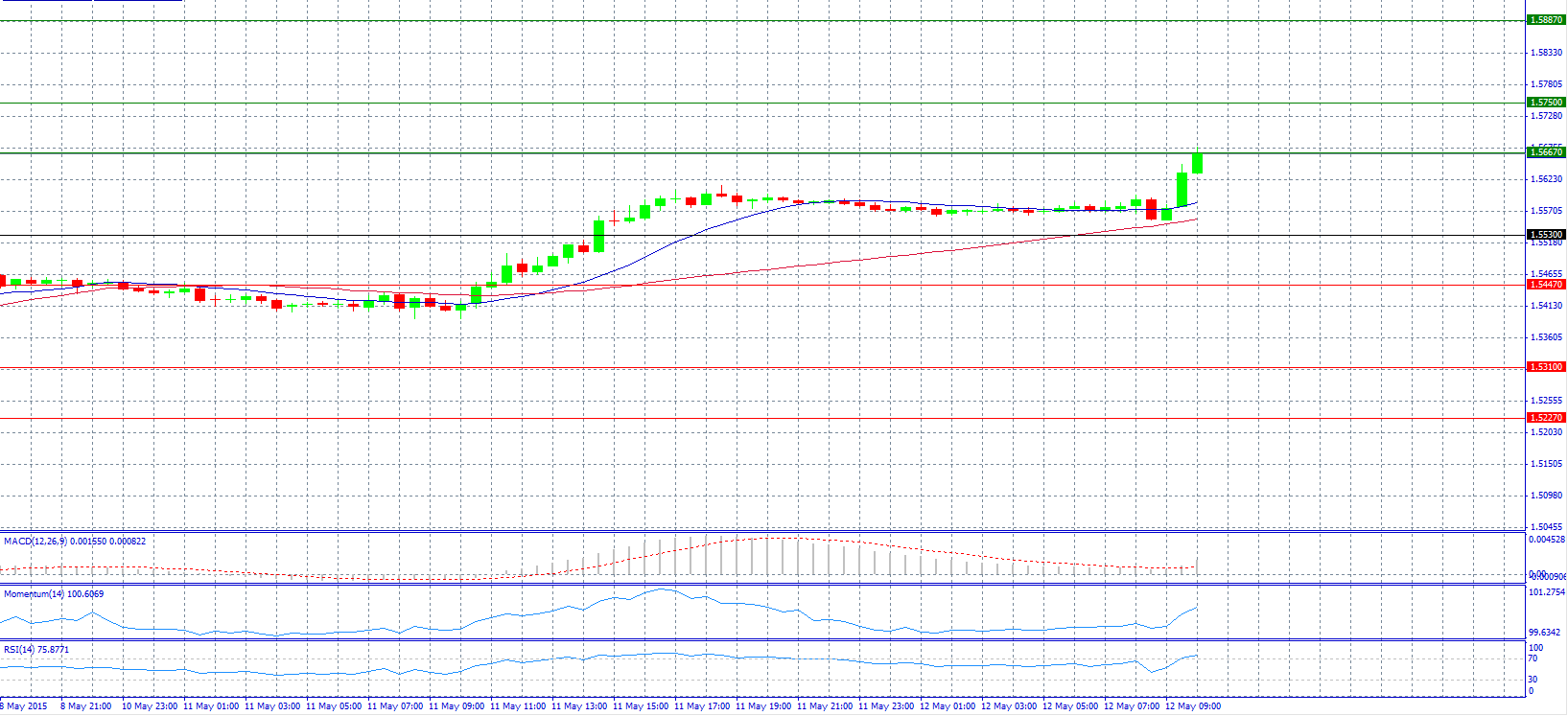

Market Scenario 1: Long positions above 1.5667 with target @ 1.5750.

Market Scenario 2: Short positions below 1.5667 with target @ 1.5530.

Comment: The pair jumped and tried to break resistance level 1.5567.

Supports and Resistances:

R3 1.5887

R2 1.5750

R1 1.5667

PP 1.5530

S1 1.5447

S2 1.5310

S3 1.5227

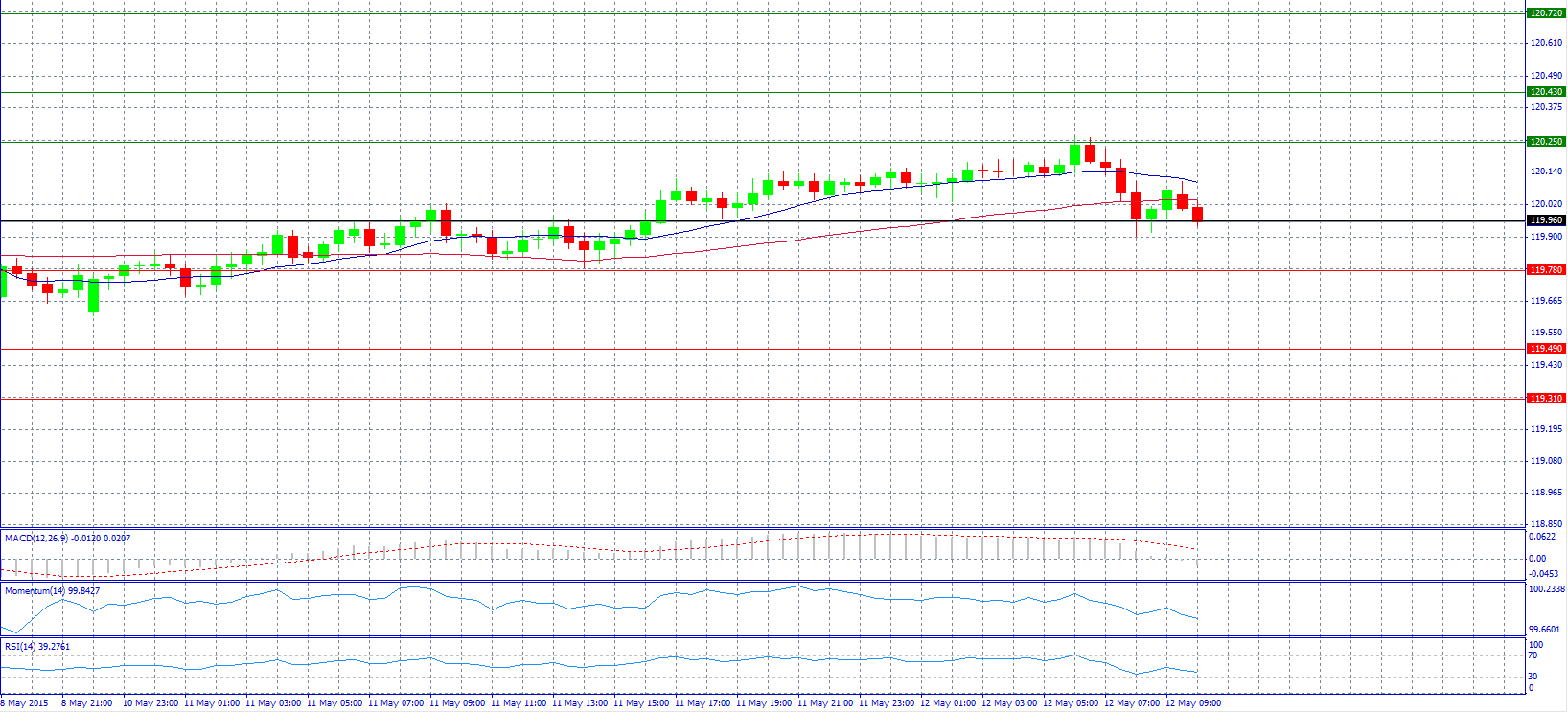

Market Scenario 1: Long positions above 119.96 with target @ 120.25.

Market Scenario 2: Short positions below 119.96 with target @ 119.78.

Comment: The pair finds support near pivot point 119.96.

Supports and Resistances:

R3 120.72

R2 120.43

R1 120.25

PP 119.96

S1 119.78

S2 119.49

S3 119.31

Market Scenario 1: Long positions above 1184.46 with target @ 1190.16.

Market Scenario 2: Short positions below 1184.46 with target @ 1177.33.

Comment: Gold prices trade neutral near pivot point 1184.46.

Supports and Resistances:

R3 1210.12

R2 1197.29

R1 1190.16

PP 1184.46

S1 1177.33

S2 1171.63

S3 1158.80

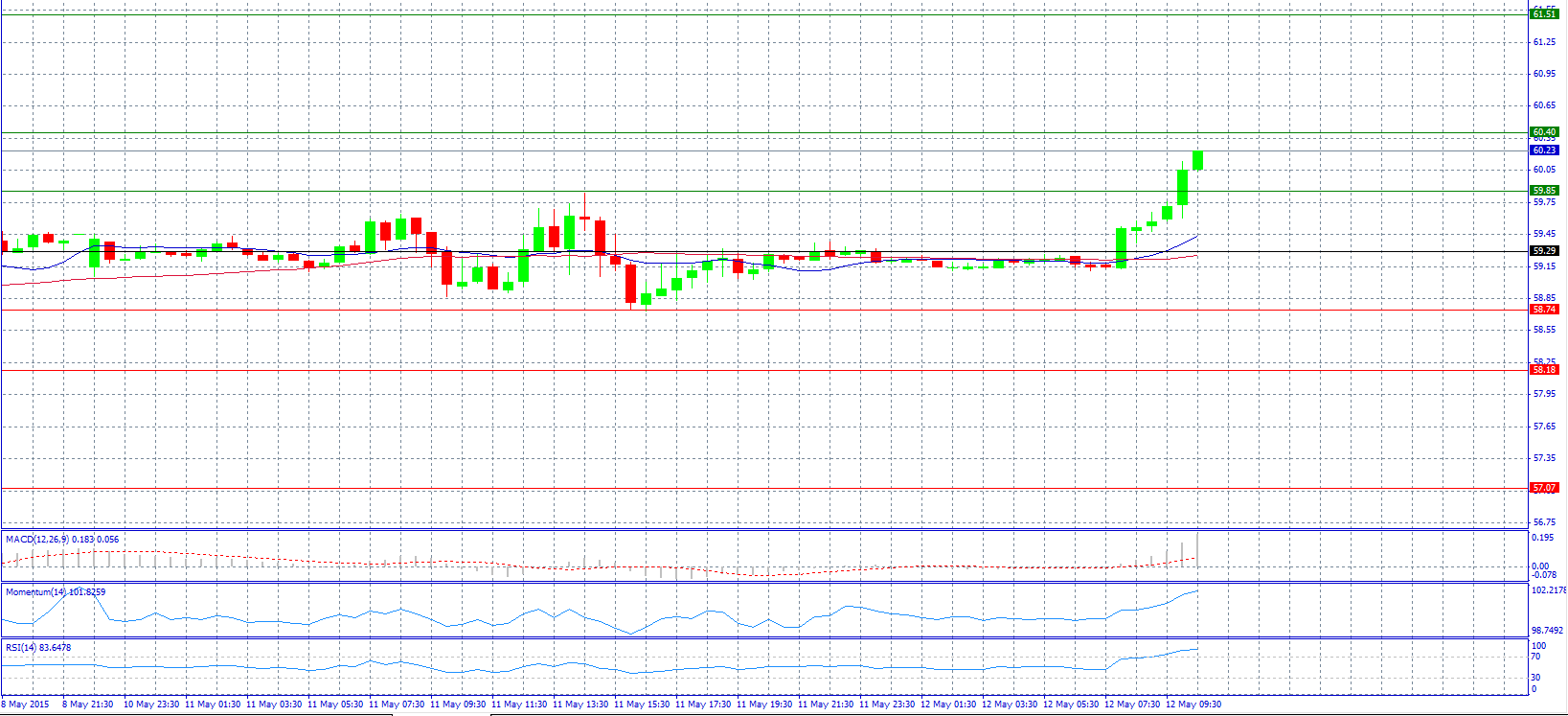

Market Scenario 1: Long positions above 60.40 with target @ 61.51.

Market Scenario 2: Short positions below 59.85 with target @ 59.29.

Comment: Crude oil prices try to advance above the resistance level 60.40.

Supports and Resistances:

R3 61.51

R2 60.40

R1 59.85

PP 59.29

S1 58.74

S2 58.18

S3 57.07

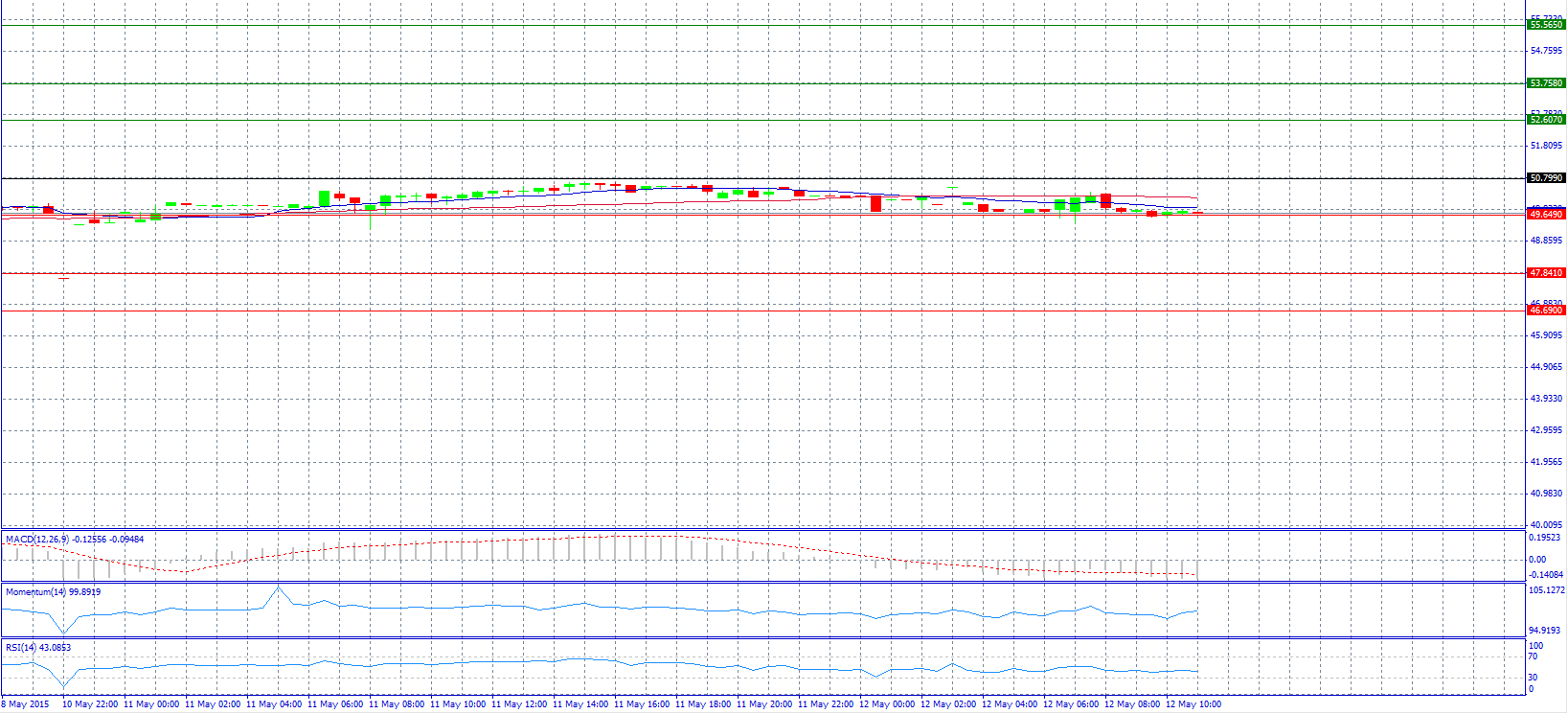

Market Scenario 1: Long positions above 49.649 with target @ 50.799.

Market Scenario 2: Short positions below 49.649 with target @ 47.841.

Comment: The pair trades unchanged near support level 49.649.

Supports and Resistances:

R3 55.565

R2 53.758

R1 52.607

PP 50.799

S1 49.649

S2 47.841

S3 46.890