Rains in top US wheat growing areas after drought improve crop outlook. Will the wheat price continue falling?

Recent rains in southern Plains after dry conditions following colder than usual winter in top US wheat-growing states has improved the US wheat crop outlook. Colder winter has slowed crop development, limiting crop’s water needs, and more rains support better crop outlook which is bearish for wheat prices.

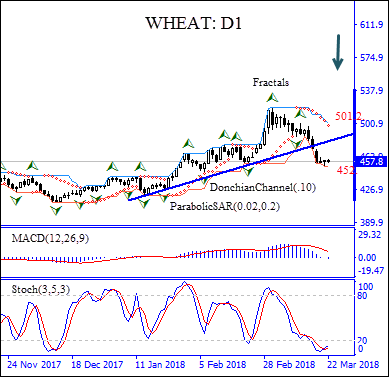

On the daily timeframe, WHEAT: D1 is trading with a negative bias after retracing higher following the decline from the eight-month high in mid-July. The price has fallen below the support line.

- The Donchian channel gives a neutral signal: it is flat.

- The Parabolic indicator has formed a sell signal.

- The MACD indicator gives a bearish signal: it is below the signal line and the gap is widening.

- The stochastic oscillator is in the oversold zone, which is bullish.

We expect the bearish momentum will continue after the price closes below the lower Donchian bound at 452. A price point below that level can be used as an entry point for a pending order to sell. The stop loss can be placed above the last fractal high at 501.2. After placing the pending order the stop loss is to be moved following Parabolic signals. Thus, we are changing the profit/loss ratio to the breakeven point. If the price meets the stop loss level (501.2) without reaching the order (452), we recommend cancelling the order: the market sustains internal changes which were not taken into account.

Technical Analysis Summary

Position - Sell

Sell stop - Below 452

Stop loss - Above 501.2