Drought bullish for wheat prices:

Drought conditions are expected to continue across US South Western Plains. Will the Wheat price resume advancing?

Radiant Solutions forecast indicated dry weather across the South Western Plains over the weekend, with little likelihood of showers next week. Continued drought conditions are bullish for wheat, as data shows the US exported 487,902 tons of wheat last week, up from 324,794 tons in the same week of 2017, also supporting wheat prices.

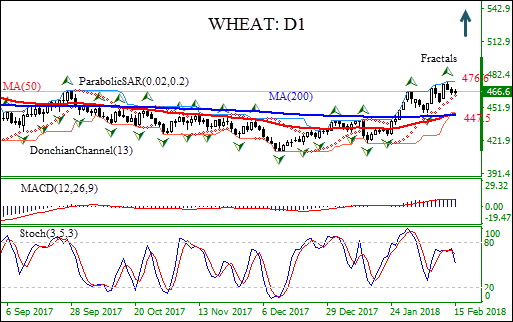

On the daily time frame WHEAT: D1 is edging lower after hitting a five-month high on Tuesday. The price is above the 50-day moving average MA(50), which is set to cross the 200-day moving average MA(200) from below. It will constitute the bullish chart pattern Golden Cross when that happens.

- The Donchian channel gives a neutral signal: it is flat.

- The Parabolic indicator has formed a buy signal.

- The MACD indicator gives a bullish signal: it is above the signal line and the gap is widening.

- The stochastic oscillator is falling and has not reached the overslod zone.

We expect the bullish momentum will continue after the price closes above the upper Donchian bound at 476.6. A price point above that level can be used as an entry point for a pending order to buy. The stop loss can be placed below the last fractal low at 447.5. After placing the pending order the stop loss is to be moved to next fractal low following Parabolic signals. Thus, we are changing the profit/loss ratio to the break even point. If the price meets the stop loss level (447.5) without reaching the order (476.6), we recommend cancelling the order: the market sustains internal changes which were not taken into account.

Technical Analysis Summary:

Position - Buy

Buy stop - Above 476.6

Stop loss - Below 447.5