A decrease in sugar crop is expected in Cuba

Cuba canceled sugar exports for a month to meet domestic demand. The crop was damaged because of the hurricane. Will the sugar quotes grow?

According to the AZCUBA Sugar Group, in Cuba, only 31% out of the planned level of the sugar crop was harvested in January 2018. The main reason for this was the way too rainy weather. The sugar crop forecast is 1.6 mln tonnes in the current agricultural season. This is less than 1.8 mln tonnes in the previous season. Domestic sugar consumption in Cuba is 600-700 thousand tonnes per year.

Cuba annually supplies China with another 400 thousand tonnes in accordance with a long-term contract. The remaining sugar can be sold in the world market. Over the past 16 months, sugar quotes have dropped by almost 2 times, and by more than 10% since the beginning of 2018. According to the U.S. Commodity Futures Trading Commission, the volume of net short positions on sugar reached a historic high last week. Their closure may strengthen the upward correction.

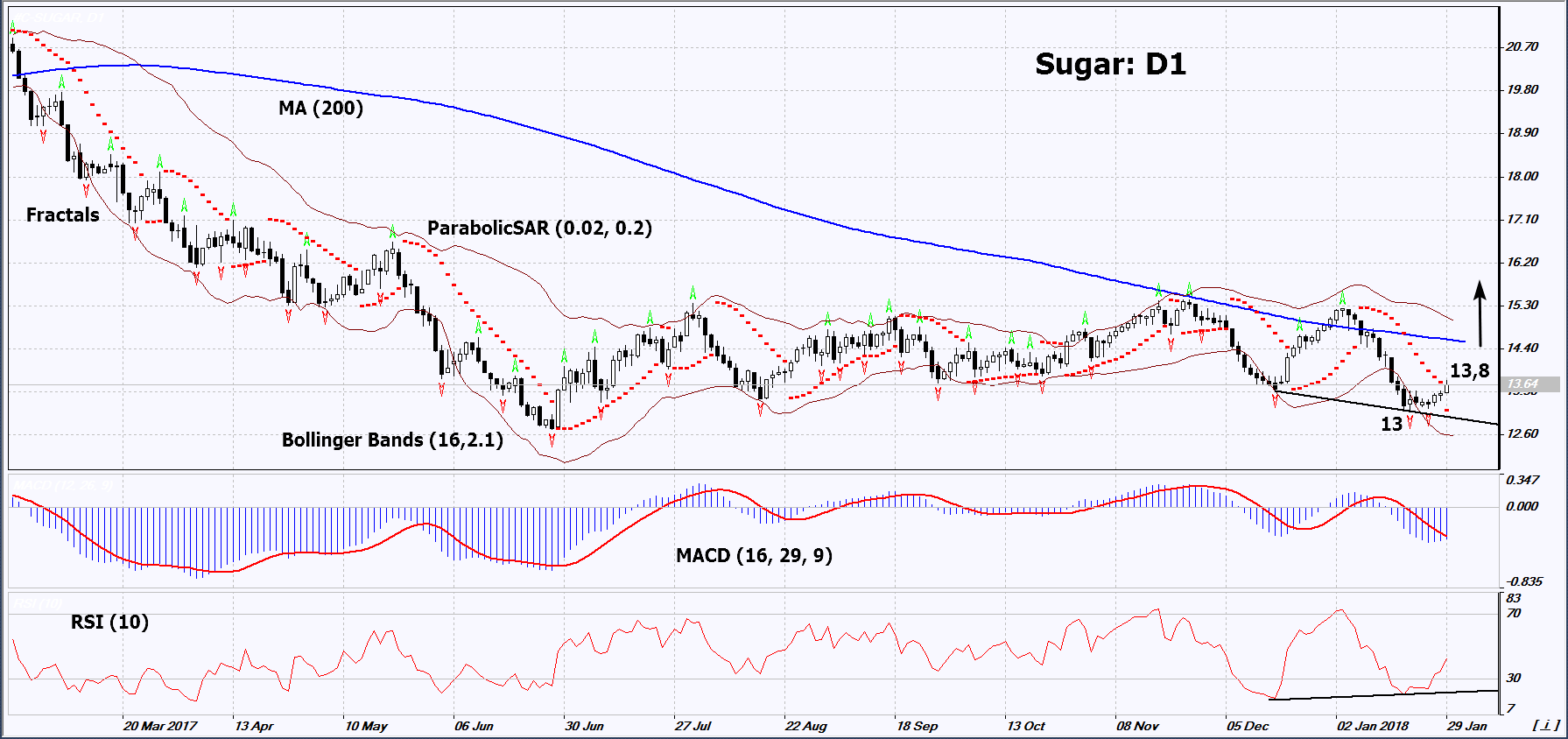

On the daily timeframe, Sugar: D1 is in the downtrend. However, its decline has slowed down and a number of technical analysis indicators formed Buy signals. The further price increase is possible in case of a decrease in the world crop.

- The Parabolic indicator gives a bullish signal.

- The Bollinger bands have widened, which means higher volatility.

- The RSI indicator is below 50. It has formed a positive divergence.

- The MACD indicator gives a bullish signal.

The bullish momentum may develop in case Sugar exceeds its last high at 13.8. This level may serve as an entry point. The initial stop loss may be placed below the Parabolic signal, the 6-month low and the two last fractal lows at 13. After opening the pending order, we shall move the stop to the next fractal low following the Bollinger and Parabolic signals. Thus, we are changing the potential profit/loss to the breakeven point.

More risk-averse traders may switch to the 4-hour chart after the trade and place there a stop loss moving it in the direction of the trade. If the price meets the stop level at 13 without reaching the order at 13.8, we recommend cancelling the position: the market sustains internal changes that were not taken into account.

Summary of technical analysis

Position - Buy

Buy stop - above 13,8

Stop loss - below 13