Hurricane damage concerns are bullish for sugar prices

Concerns about damage to sugar cane fields in Caribbean and Florida are bullish for sugar prices. Will the sugar price continue rising?

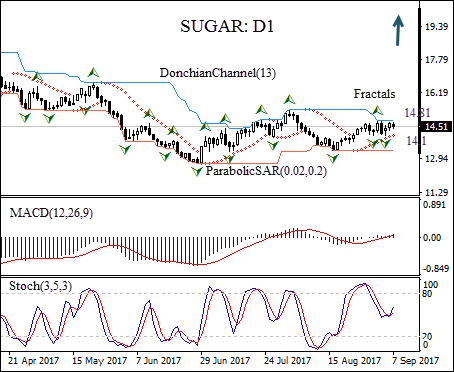

On the daily timeframe SUGAR: D1has been retracing higher after hitting 19 month low in early June.

- The Donchian channel indicates no trend yet: it is flat.

- The MACD indicator is bullish: it is above the signal line and the gap is widening.

- The Parabolic indicator gives a buy signal.

- The stochastic oscillator is rising but hasen't reached the overbought zone yet.

We believe the bullish momentum will continue after the price closes above upper boundary of Donchian channel at 14.81. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed below the fractal low at 14.1. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. If the price meets the stop loss level (14.81) without reaching the order (14.1), we recommend cancelling the position: the market sustains internal changes which were not taken into account.

Summary of technical analysis:

Position Buy

Buy stop Above 14.81

Stop loss Below 14.1