Strong demand bullish for LHOG

Rising US pork exports indicate strong pork demand. Will the LHOG continue rising?

US pork export demand is strong: exports hit historic record in 2017 exceeding $1 billion in total value. Recent trade agreements also point to increasing export trend this year too: the new export agreement with South Korea provides for essentially duty free export of US pork into that country, with latest data showing an increase in volume of about 33% for February. US pork demand is up in Central and South America too, and trade agreements support higher export into that area. At the same time seasonally high domestic demand is expected as the Memorial Day weekend marked the unofficial beginning of the summer grilling season. Higher demand is bullish for pork prices.

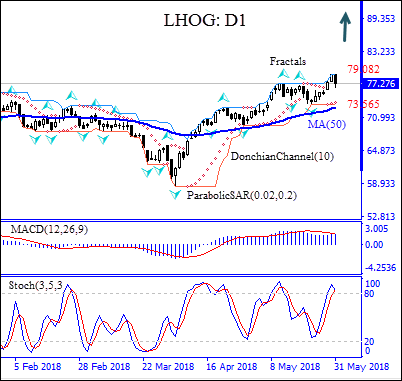

On the daily timeframe the LHOG: D1 has been rising after hitting 7-month low in the beginning of April. It is above the 50-day moving average MA(50) which is rising too.

- The Parabolic indicator has formed a buy signal.

- The Donchian channel indicates no trend yet: it is flat.

- The MACD indicator gives a bullish signal: it is above the signal line and the gap is widening.

- The Stochastic oscillator is in the overbought zone, this is bearish.

We expect the bullish momentum will resume after the price breaches above the upper Donchian bound at 79.082. A price above that level can be used as an entry point for a pending order to buy. The stop loss can be placed below the lower Donchian bound at 73.565. After placing the pending order, the stop loss is to be moved to the next fractal low, following Parabolic signals. By doing so, we are changing the probable profit/loss ratio to the breakeven point. If the price meets the stop loss level (73.565) without reaching the order, we recommend canceling the order: the market sustains internal changes which were not taken into account.

Technical Analysis Summary

Position Buy

Buy stop Above 79.082

Stop loss Below 73.565