Holiday in the US may reduce demand for beef

The demand for beef is expected to decline in the US on the eve of a long weekend before Thanksgiving. Will the Cattle quotes drop?

The US meat processing factories may be partially closed on November 23-24, 2017, during the Thanksgiving celebration. Traditionally, these days, the US residents have turkey. The beef price reduction may also be contributed by relatively low grain prices, used for fattening. In particular, the US company Tyson Foods (NYSE:TSN) reported an increase in overall profitability in meat production. However, grain is mainly used in poultry farming. The US Department of Agriculture announced an increase by 14% in beef exports from the US in January-September 2017 compared with the same period of the last year.

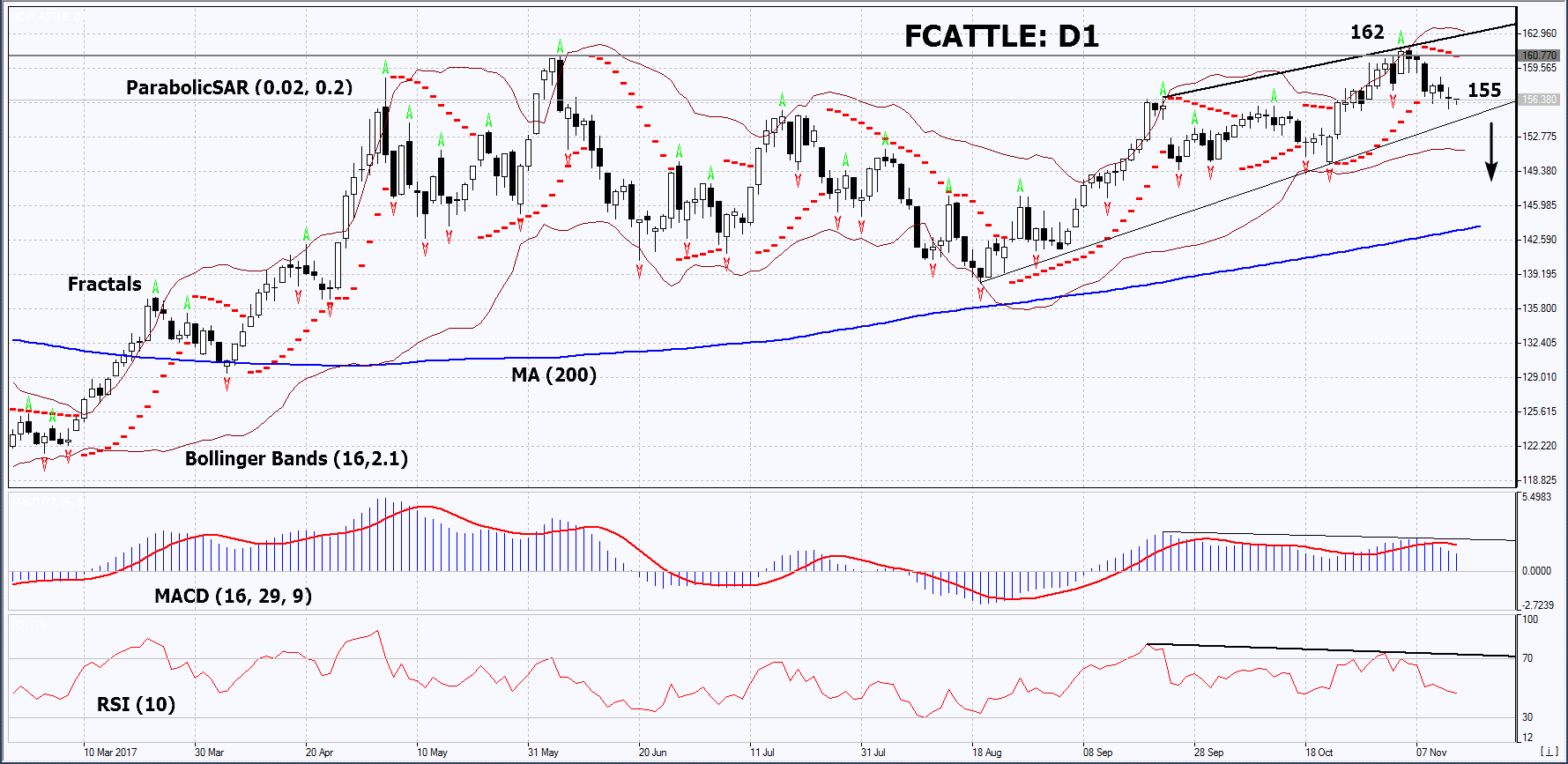

On the daily timeframe, FCATTLE: D1 is dropping and moving to the support level of the rising trend. A downward correction is possible in case of a decrease in the demand for beef and an increase in its production.

- The Parabolic indicator gives a bearish signal.

- The Bollinger bands have narrowed, which means lower volatility. They are tilted down.

- The RSI indicator is below 50. It has formed a negative divergence.

- The MACD indicator gives a bearish signal.

The bearish momentum may develop in case FCATTLE drops below support line of the rising trend at 155. This level may serve as an entry point. The initial stop loss may be placed above the last fractal high, the 20-month high and the Parabolic signal at 162. After opening the pending order, we shall move the stop to the next fractal high following the Bollinger and Parabolic signals. Thus, we are changing the potential profit/loss to the breakeven point. More risk-averse traders may switch to the 4-hour chart after the trade and place there a stop loss moving it in the direction of the trade. If the price meets the stop level at 162 without reaching the order at 155, we recommend cancelling the position: the market sustains internal changes that were not taken into account.

Summary of technical analysis

Position - Sell

Sell stop - below 155

Stop loss - above 162