No bullish news for corn prices

Corn prices decline on ample US crop and favorable weather forecast. Will the price of corn continue falling?

The US Department of Agriculture August 10 WASDE report estimated the domestic corn production at unexpectedly high 14.15 billion bushels based on yields of 169.5 bushels per acre. USDA made no changes to its recent nationwide corn crop weekly ratings. Two-week weather forecasts show cool weather with above average rainfall in the eastern Corn Belt. Favorable weather and high crop forecasts remain bearish for corn prices.

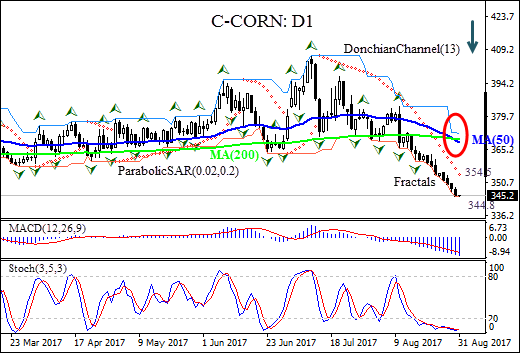

On the daily timeframe, CORN:D1 continues the slide after a sharp decline on August 10. The price has fallen below the 50-day and 200-day moving averages MA(50) and MA(200), which have formed a Death Cross chart pattern.

- The Donchian channel indicates a downtrend: it is tilted downward.

- The Parabolic indicator gives a sell signal.

- The MACD indicator is below the signal line and the gap is widening, which is a bearish signal.

- The stochastic oscillator is rising in the oversold zone, which is a bullish signal.

We believe the bearish momentum will continue after the price breaches below the lower Donchian boundary at 344.80. It can be used as an entry point and a pending order to sell can be placed below that level. The stop loss can be placed above the Parabolic signal at 354.50.

After placing the pending order the stop loss is to be moved every day following Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. If the price meets the stop loss level (354.5) without reaching the order (344.8), we recommend cancelling the position: the market sustains internal changes which were not taken into account.

Technical Analysis Summary

Position - Sell

Sell stop - Below 344.8

Stop loss - Above 354.5