Higher Expected Global Demand Bullish For Cocoa Prices

Cocoa world demand is expected to rise in 2017-18. Will cocoa prices continue rising?

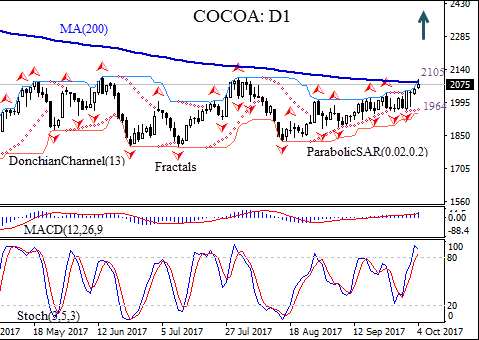

On the daily timeframe COCOA: D1has been rising toward the 200-day moving average MA(200).

- The Donchian channel is tilted higher, signaling uptrend.

- The MACD indicator gives a bullish signal: it is above the signal line and the gap is widening.

- The Parabolic indicator gives a buy signal.

- The stochastic oscillator is in the overbought zone which is bearish.

- We expect the bullish momentum will continue after the price breaches above MA(200) and the upper Donchian bound at 2095.00 . A price above this level can be used as an entry point for a pending order to buy. The stop loss can be placed below the fractal low at 1964.00. After placing the pending order, the stop loss is to be moved to the next fractal low, following Parabolic signals. By doing so, we are changing the probable profit/loss ratio to the breakeven point. If the price meets the stop loss level (1964.00) without reaching the order, we recommend canceling the position: the market sustains internal changes which were not taken into account.

Technical Analysis Summary

Position:Buy

Buy stop: Above 2105

Stop loss: Below 1964