Expected increase in Brazil sugar export is bearish for sugar prices

Higher expected sugar export from Brazil is bearish for sugar. Will the sugar price continue falling?

Continued real slide against the dollar makes Brazilian sugar more competitive, boosting sugar export prospects. This is bearish for sugar prices against the background of higher world sugar production. Several commodity analysts forecast global sugar production will return back to the surplus sugar output in next season. Thus, S&P Global Platts estimates a sugar surplus of 3.138 million tons for the 2017-18 season after the deficits of last two seasons.

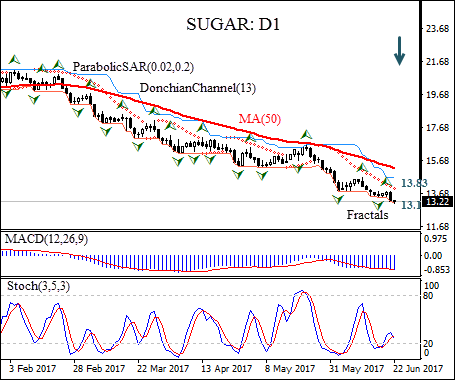

On the daily timeframe SUGAR: D1 has been trading with negative bias since early February. Price is below the 50-day moving average MA(50) which is falling.

- The Parabolic indicator gives a sell signal.

- The Donchian channel gives downtrend signal: it is tilted lower.

- The MACD indicator is bearish: it is below the signal line and the gap is widening.

- The stochastic oscillator is edging to the oversold zone but hasn’t reached it yet.

We believe the bearish momentum will continue after the price closes below lower boundary of Donchian channel at 13.1. This level can be used as an entry point for placing a pending order to sell.

The stop loss can be placed above the fractal high at 13.83. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. If the price meets the stop loss level (13.83) without reaching the order (13.1), we recommend cancelling the position: the market sustains internal changes which were not taken into account.

Technical Analysis Summary

Position - Sell

Sell stop - Below 13.1

Stop loss - Above 13.83