Removal of sugar production limits in the European Union will increase EU sugar output, which is bearish for sugar. Will the sugar price continue falling?

The European Union will turn into a sugar exporter for the first time in over a decade after the removal of limits on production this year, US Department of Agriculture experts forecast. EU sugar production is expected to jump by 2.1m tonnes in 2017-18 to a record 18.6m tonnes after the limits are lifted. Sugar imports are expected to fall to 2.0m tonnes in the coming season, at the same time exports will rise by 700,000 tonnes to 2.2m tonnes. Increased output is bearish for sugar prices.

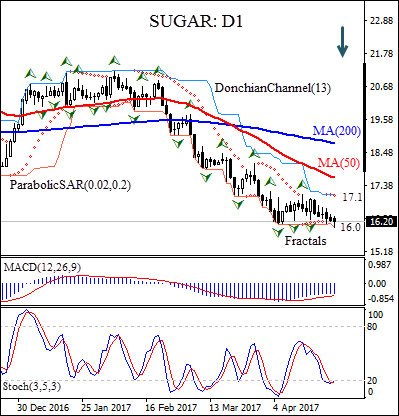

On the daily timeframe, SUGAR: D1 has been trading with negative bias since early February. Both the 50 -day and 200-day moving averages MA(50) and MA(200) are falling and the gap between them is widening, which is a bearish signal.

- The Parabolic indicator gives a sell signal.

- The Donchian channel is tilted downward, which signals downtrend.

- The MACD indicator is neutral: it is below the signal line and the gap is steady.

- The stochastic oscillator is edging up from the oversold zone.

We believe the bearish momentum will continue after the price closes below lower boundary of Donchian channel at 16.0. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed above the last fractal high at 17.1. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. If the price meets the stop loss level (17.1) without reaching the order (16.0), we recommend cancelling the position: the market sustains internal changes which were not taken into account.

Summary of technical analysis:

Position: Sell

Sell stop: Below 16.0

Stop loss: Above 17.1