China is increasing its high fructose corn syrup exports to the Philippines, which may signal increased use of corn syrup as sweetener, which is bearish for sugar. Will the sugar price continue falling?

China is increasing its high fructose corn syrup exports to the Philippines. China has been the only substantial user of high fructose corn syrup (HFCS) in Asia, with use equivalent to some 4m-5m tonnes a year. However, Philippines imported 235,000 tonnes of HFCS last year, with imports pressuring local prices of sugar. And increasing China’s exports of HFCS may signal increased use of corn syrup instead of sugar, which is bearish for sugar prices.

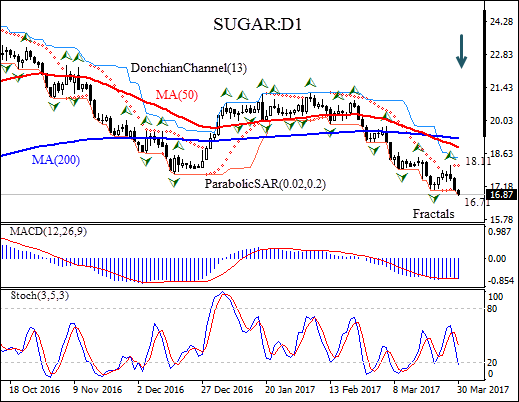

On the daily timeframe SUGAR: D1 has been trading with negative bias since late September 2016. The 50-day moving average MA(50) is falling further below the200-day moving average MA(200), which is a bearish signal.

- The Parabolic indicator gives a sell signal.

- The Donchian channel is tilted downward, which signals downtrend.

- The MACD indicator is below the signal and the gap is widening, which is a bearish signal.

- The stochastic oscillator is falling and has breached into the oversold zone.

We believe the bearish momentum will continue and we can go short straight away. The stop loss can be placed above the fractal high at 18.11. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the position: the market sustains internal changes which were not taken into account.

Summary of technical analysis:

Position: Sell

Sell limit: Above 16.71

Stop loss: Above 18.11