The International Sugar Organization lowered world sugar production deficit estimate for 2016-17. Will sugar prices decline?

The International Sugar Organization lowered its estimate for the world sugar production shortfall in 2016-17 by 324,000 tonnes, on an October-to-September basis. Despite a reduction in consumption estimate more than offset a cut to its world output forecast, ISO sees current imbalance as supportive for world market prices. Besides a "critically low level of stocks" left at the end of this season, the ISO highlighted an "extremely tight" trade balance with the amount of sugar available for export, at 58.25m tonnes, less than 160,000 tonnes exceeding expected import needs.

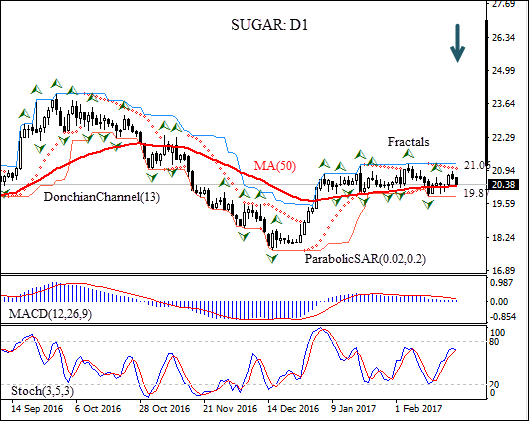

On the daily timeframe SUGAR: D1 has been trading in a range since the start of 2017. The price is falling toward the 50-day moving average MA(50).

- The Parabolic indicator gives a sell signal.

- The Donchian channel indicates no trend yet: it is flat.

- The MACD indicator is giving a bearish signal.

- The stochastic oscillator is rising and hasn’t reached the overbought zone yet.

We believe the bearish momentum will continue after the price closes below the MA(50) and the lower Donchian boundary at $19.87, confirmed also by fractal low. A pending order to sell can be placed below that level. The stop loss can be placed above the Parabolic signal at $21.06. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. The most risk-averse traders may switch to the 4-hour chart after the trade and place there a stop-loss moving it in the direction of the trade. If the price meets the stop loss level ($21.06) without reaching the order ($19.87), we recommend canceling the position: the market sustains internal changes which were not taken into account.

Summary of technical analysis:

Position: Sell

Sell stop: Below 19.87

Stop loss: Above 21.06