Drought hits cane

Sugar prices slightly edged up on the forecast of 25% lower cane sowings in India’s state of Maharashtra in 2016/17 farming season because of the drought. Previously USDA cut the US sugar production outlook in its monthly report by 100 thousand tons this season from the previous month to 8.8mln short tons. Will the prices continue advancing?

USDA has also lowered the estimate of the stocks-to-use ratio to 12.8% from 13% a month earlier. The ratio was much higher at 14.4% in the same period of last season. Now, according to the previously signed agreements, the US may start importing sugar from Mexico. Another factor for price growth may be the La Nina storm forecast from the National Weather Service's Climate Prediction Center. The storm may form in March for the first time since 2012 and may cause poor weather in Brazil. Now the weather in the region is favourable for cane processing which caused the significant increase of its volume in the second half of January. In general, the cane processing volume has increased in Brazil by 5% to 600mln tons compared to the last farming season.

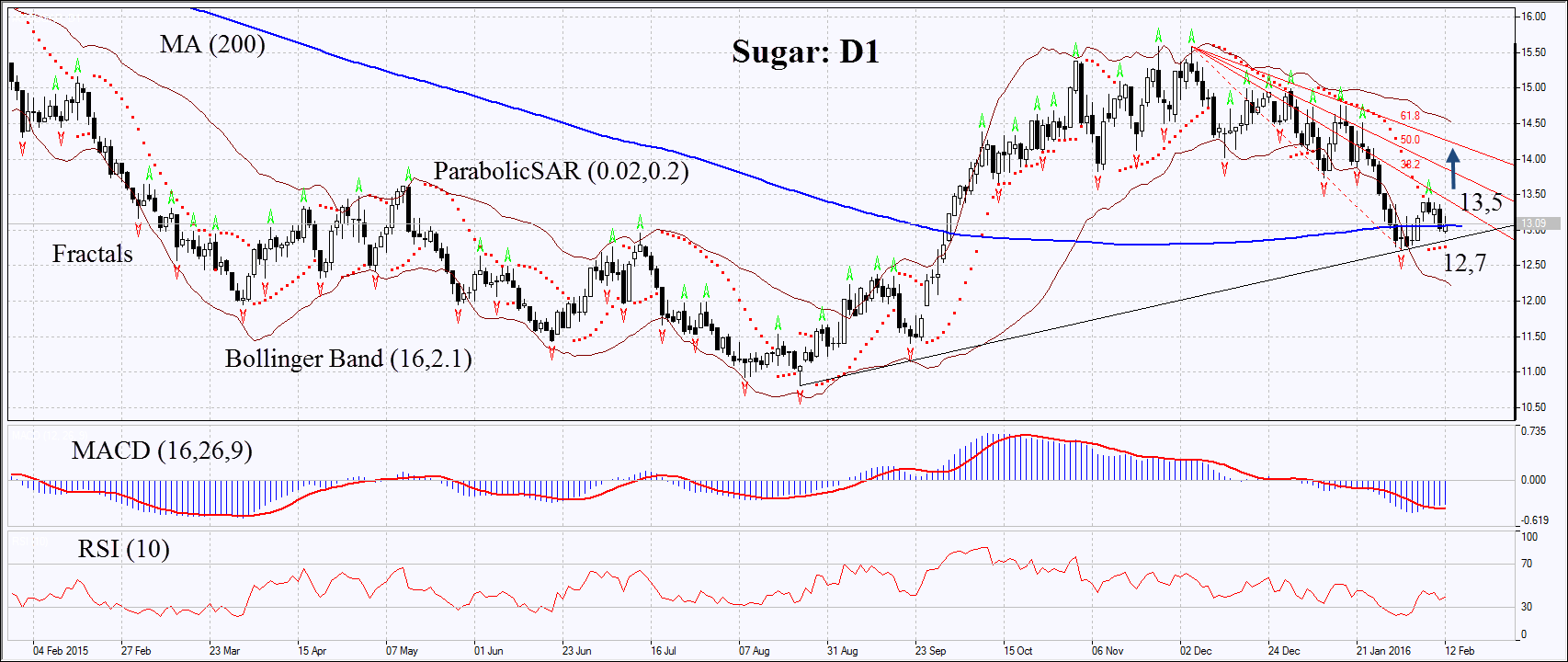

On the daily chart Sugar: D1 is in downtrend but failed yet to break through the 200-day moving average. The MACD and Parabolic indicators give buy signals. RSI is neutral and below 50? No divergence. The Bollinger bands® have widened a lot which means higher volatility. The trend may reverse and the bullish momentum may develop in case the cane surpasses the last fractal high, the Fibonacci retracement and the Parabolic signal at 13.5. This level may serve the point of entry. The initial risk-limit may be placed below the Parabolic signal and the last fractal low at 12.7. Having opened the pending order we shall move the stop to the next fractal low following the Parabolic and Bollinger signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. The most risk-averse traders may switch to the 4-hour chart after the trade and place there a stop-loss moving it in the direction of the trade. If the price meets the stop-loss level at 12.7 without reaching the order at 13.5, we recommend cancelling the position: the market sustains internal changes which were not taken into account.

Position Buy Buy stop above 13,5 Stop loss below 12,7