No change in trend

Let us consider the #C-SUGAR continuous CFD on sugar on daily timeframe. It is priced in US dollars per 100 pounds. The Organization of Economic Cooperation and Development and United Nation’s Food and Agriculture Organization July report forecasts that sugar prices will be falling over the next decade. Dry weather conditions that started in June in Thailand, the second largest exporter of sugar, raised expectations for higher prices, as lack of rainfall caused concerns for the country’s 2015-16 crop, estimated at 11.4 million tonnes, a 3.9% rise over the previous year's. US Department of Agriculture estimates that sugar exports from Thailand will increase 10.0% to 8.80 million tonnes in 2015-16. ED&F Man, a leading merchant of agricultural commodities, warned that it is too early to rate the drought as a support for sugar prices, highlighting also that with Thai sugar exports slow, there was even more of the sweetener available in the country than a year ago.

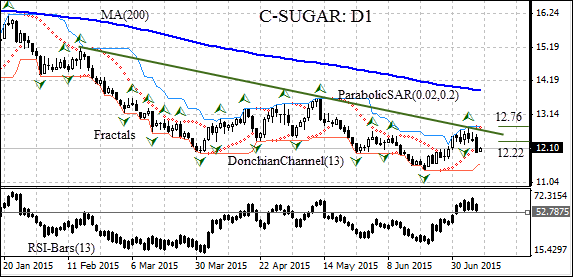

The price of sugar has been falling for the past five years. The recent correction rally, which started over two weeks ago, ended as the price hit the resistance and failed to breach it. The next session, the price opened with a bearish gap and managed to record a small gain, though still closing below the resistance. It closed then below the last fractal low at 12.22, as the Parabolic indicator reversed to downtrend signal, and the RSI-Bars oscillator started falling too. We believe the pullback will continue, and we can go short straight away. The stop loss can be placed at last fractal high at 12.76, which is confirmed also by the Parabolic and upper Donchian channel. After placing the order, the stop loss is to be moved following Parabolic signals. If the price meets the stop loss level without reaching the order, we recommend cancelling the position: the market sustains internal changes which were not taken into account.

Position Sell Sell limit below 12.22 Stop loss above 12.76