Lower Chinese imports expected

US Department of Agriculture is expected to lower weekly export sales figure for soybeans. Wet weather in South America also alleviated concerns for soybean crop in the region. Will the price of soybean continue falling?

US Department of Agriculture is expected to lower weekly export sales figure for soybean to 700,000-1.1mln tonnes from the 1.30mln tonnes the previous week. Commodity Weather Group predicted continued rains for Brazil during the 11-15 day period, with only modest moisture deficits expected in Mato Grasso, major Brazilian soybean producing state. Rising Chinese stocks after record imports earlier in autumn and lower profitability of soybean crushers in China, the biggest importer of soybean, points to likely fall in import demand from China. Experts note also that elections in Argentina may usher reforms, which may boost huge crop sales. All these developments are bearish for soybean prices.

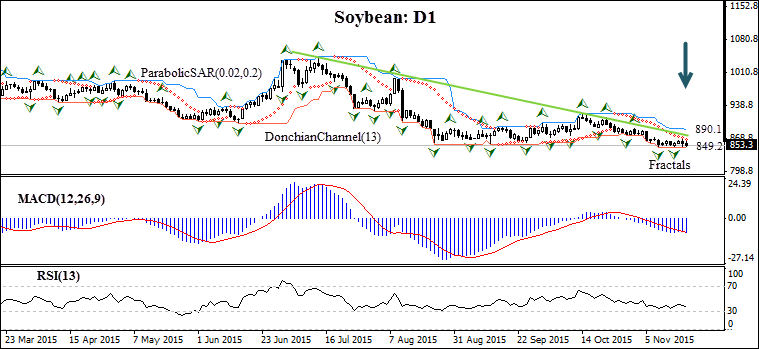

On the daily timeframe, the soybean price has been trading with a negative bias from mid-July. The Parabolic indicator has formed a sell signal. The Donchian channel is tilted downward. The MACD indicator is trending below the signal line and the zero level, which is a bearish signal. The RSI indicator is below 50 level and falling, but has not reached the oversold zone yet. We believe the bearish momentum will continue after the price closes below the lower Donchian channel at 849.2. A pending order to sell can be placed below that level. The stop loss can be placed above the last fractal high and upper Donchian channel at 890.1. After placing the pending order, the stop loss is to be moved every day to the next fractal high, following Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the position: the market sustains internal changes which were not considered.

Position Sell Sell stop below 849.2 Stop loss above 890.1