Grain Stocks report supports soybean prices

US Department of Agriculture lowered soybean stocks in its quarterly grain stocks report on Wednesday. The report supported soybean prices. Will the price of soybean continue rising after the report?

The Grain Stocks quarterly report released on Wednesday indicated the US Department of Agriculture lowered the soybean carryover stocks to about 191 million bushels from the 2014-2015 expected carryover of 205 million bushels. The figure was lower than the 210 million bushels soybean ending stocks the agency projected for 2014-2015 in its World Agricultural Supply and Demand Estimate in September. Experts note also that the change was the result of lowered yield for last year's crop, and point to the possibility that the yield this year may also turn out to be lower, as it is just below last year’s yield. Both factors boosted the price of soybean.

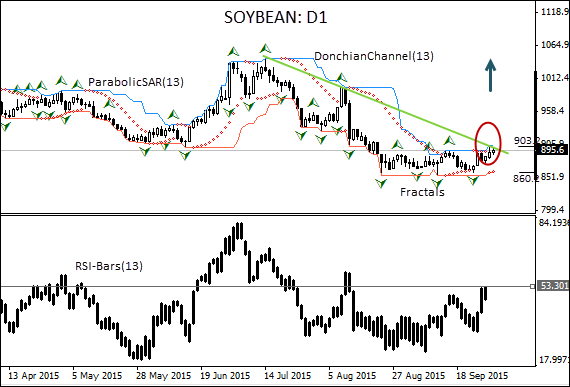

The soybean price has been falling from mid-July after forming a double top pattern on the daily timeframe. It is about to break above the resistance line. The parabolic indicator has formed a buy signal. The Donchian channel is tilted upward. The RSI-Bars oscillator is also rising and hasn’t reached the overbought zone yet. We believe the bullish momentum will continue after the price closes above the resistance line and upper Donchian channel at 903.2. A pending order to buy can be placed above that level. The stop loss can be placed below the last fractal low at 860.2. After placing the pending order, the stop loss is to be moved every day to the next fractal low, following Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the position: the market sustains internal changes which were not considered.

Position Buy Buy stop above 903.2 Stop loss below 860.2