China sells reserves

China sells cotton from state reserves in the domestic market. Will the cotton prices drop in the world market?

On Monday, May 8, 2017, China sold at the auction 19. 9 thousand tonnes of cotton from state reserves in the domestic market. Theoretically, this may partially reduce the volume of imports. Previously, in Q1 2017, China imported 370 thousand tonnes of cotton, which is by 68% more than the same period of the last year. Note that auctions have been recently held regularly in China. Thus, on May 5, 21.3 thousand tonnes of cotton were sold.

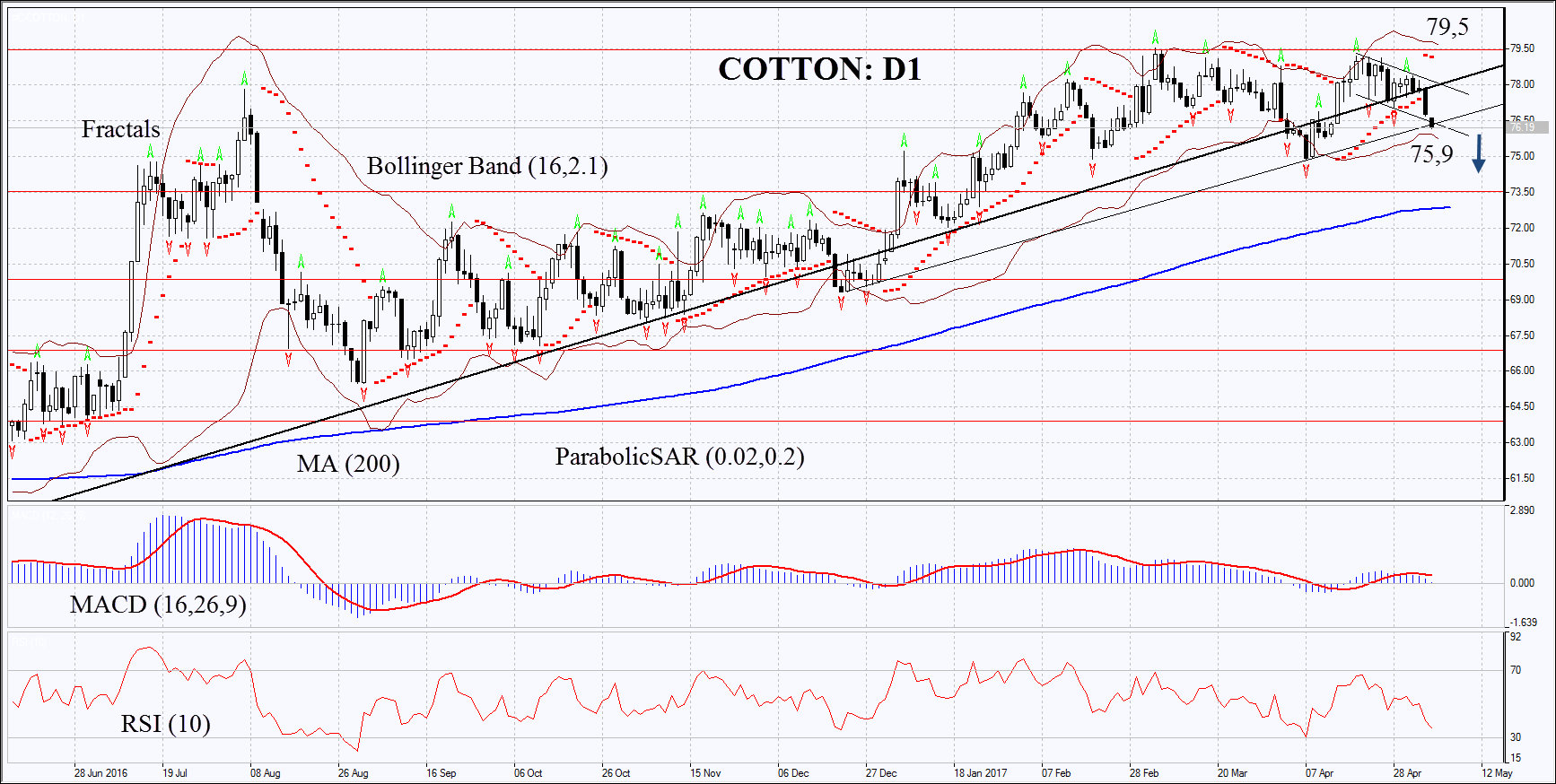

On the daily time frame, the Cotton: D1 ended the uptrend and is correcting down. A further price decline is possible in case of a decrease in demand in China and deterioration of weather conditions if the El Niño cyclone develops.

- The Parabolic indicator gives a bearish signal.

- The Bollinger bands indicate normal volatility. They are titled downwards.

- The RSI indicator is below 50. No divergence.

- The MACD indicator gives bearish signals.

The bearish momentum may develop in case Cotton falls below the Bollinger bands® at 75,9. This level may serve as an entry point. The initial stop-loss may be placed above the two last fractal highs and the maximum since June 2014 at 79,5. After opening the pending order, we shall move the stop to the next fractal high following the Bollinger and Parabolic signals. Thus, we are changing the potential profit/loss to the breakeven point. More risk-averse traders may switch to the 4-hour chart after the trade and place there a stop-loss moving it in the direction of the trade. If the price meets the stop level at 79,5 without reaching the order at 75,9, we recommend cancelling the position: the market sustains internal changes that were not taken into account.

Summary of technical analysis:

Position: Sell

Sell stop: below 75,9

Stop loss: above 79,5