Corn prices slip on planting delay relief

Corn prices decline as concerns about planting delays subside. Will the price of corn continue falling?

With concerns about corn planting delays due to rains in US subsiding as plantings exceeded market expectations while continuing to lag behind the five-year average, hedge funds increased their net short position by 24000 lots to 208642 contracts last week, according to the Commodity Futures Trading Commission data.

At the same time the risk off mood after increased Washington turmoil surrounding President Trump’s controversial firing of FBI director adds to bearish sentiment for commodities too.

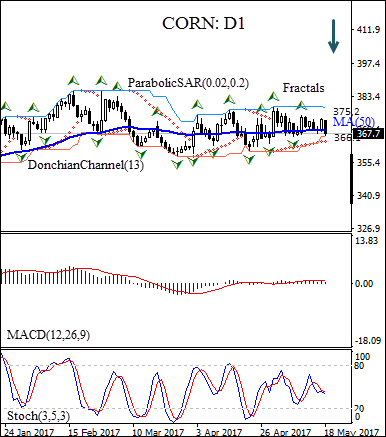

On the daily timeframe, CORN:D1 has been trading within a range since early April. The price has breached below the 50-day moving average MA(50).

- The Donchian channel indicates no trend: it is flat.

- The Parabolic indicator gives a buy signal.

- The MACD indicator is above the signal line and the gap is falling, which is a bearish signal.

- The stochastic oscillator is falling and hasn’t crossed into the oversold zone, which is a bearish signal.

We believe the bearish momentum will continue after the price breaches below the lower Donchian boundary at 366.1, confirmed also by last fractal low. It can be used as an entry point and a pending order to sell can be placed below that level. The stop loss can be placed above the last fractal high at 375.2. After placing the pending order the stop loss is to be moved every day following Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point.

If the price meets the stop loss level (375.2) without reaching the order (366.1), we recommend cancelling the position: the market sustains internal changes which were not taken into account.

Summary of technical analysis:

Position: Sell

Sell stop: Below 366.1

Stop loss: Above 375.2