Corn prices advance as rains delay sowing in Midwest. Will the price of corn continue rising?

Rains are causing delays to early sowings of corn in the Midwest, which is bullish for corn prices. Wet weather is expected in the next two weeks also, though delays from mid-May, which is the mid-point of planting, will be more harmful. At the same time weakening of the dollar is another bullish factor for corn prices as cheaper dollar makes corn more affordable for users of other currencies.

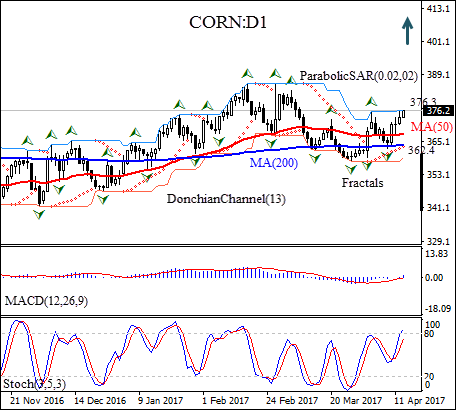

On the daily timeframe CORN:D1 had been trading with negative bias after hitting ten-month high in early February. The price has risen above the 50-day and 200-day moving averages MA(50) and MA(200).

- The Donchian channel indicates an uptrend: it is tilted up.

- The Parabolic indicator gives a buy signal.

- The MACD indicator is above the signal line and the gap is rising, which is a bullish signal.

- The stochastic oscillator has crossed into the overbought zone, which is a bearish signal.

We believe the bullish momentum will continue after the price breaches above the upper Donchian boundary at 376.3. It can be used as an entry point and a pending order to buy can be placed above that level. The stop loss can be placed below the last fractal low at 362.4. After placing the pending order the stop loss is to be moved every day following Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. If the price meets the stop loss level (362.4) without reaching the order (376.3), we recommend cancelling the position: the market sustains internal changes which were not taken into account.

Summary of technical analysis:

Position: Buy

Buy stop: Above 376.3

Stop loss: Below 362.4