Corn rises on import demand expectations

Corn prices rose on expectations of higher import demand due to a drought in South Africa, while Russia was considering limiting grain exports. At the same time exports from South America continued to grow with crop outlook uncertain due to dry weather conditions. Will the price of corn continue rising?

According to Commodity Futures Trading Commission data last week speculators turned bullish toward agricultural commodities for the first time in the new year with a net long position of 11648 contracts in the top 13 US-traded agricultural commodities. The sentiment improved on expectations of higher corn imports from South Africa due to a drought and lower grain exports from Russia, as well as oil price rebound. Meanwhile US Department of Agriculture January report of World Agricultural Supply and Demand Estimate forecast 53 million bushels lower corn production for 2015-2016 in US, the world’s biggest corn producer. Nevertheless the total crop at 13.6 billion bushels is estimated to be the third largest on record. USDA lowered the projected range for the 2015-2016 season-average corn farm price 5 cents to $3.30 - $3.90 per bushel because of weaker export demand as evidenced by the slow pace of shipments and continued strong competition from South American suppliers. According to International Grains Council, Argentine farmers have increased export sales of corn after the government of recently elected Argentine president Mauricio Macri removed or reduced crop export taxes and quotas, and let Argentine peso depreciate against dollar. While export and currency reforms boosted Argentine’s export supply of corn pressuring world corn prices, dry weather in country’s north east has hindered late sowings. Drought conditions may result in lower crops in the sixth biggest producer of corn, supporting the corn price. However, expected rainfalls this weekend may provide the much needed moisture for developing plants according to Commodity Weather Group forecast. This may boost Argentine crop outlook and limit price growth potential.

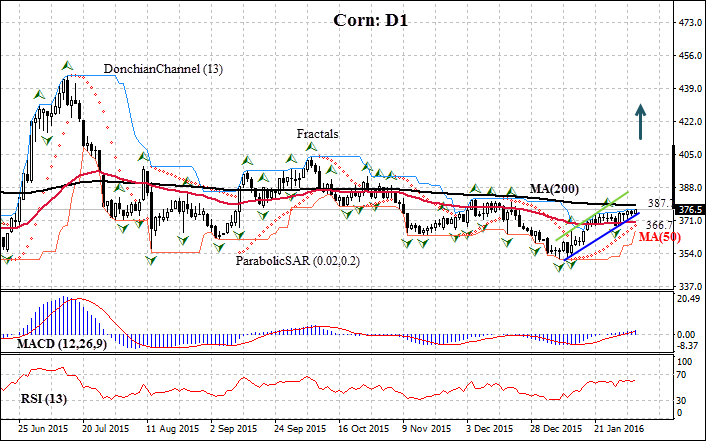

On the daily timeframe corn price has been rising roughly from the start of the new year. The RSI oscillator is also rising and hasn’t reached the overbought zone yet. The MACD indicator is above the signal line and the zero level which is a bullish signal. The Donchian channel is tilted upward, indicating an uptrend. The price is above the 50-day Moving Average, which is below the 200-day Moving Average but is edging toward it. This is also a bullish signal. We believe breaching the upper Donchian channel and closing above the 200-day Moving Average at 378.7 will signify continuation of the bullish momentum, which can be used also as an entry point. A pending order to buy can be placed above that level. The stop loss can be placed below the last fractal low at 366.7. After placing the pending order the stop loss is to be moved every day to the next fractal low, following Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. If the price meets the stop loss level at 366.7 without reaching the order at 378.7, we recommend cancelling the position: the market sustains internal changes which were not taken into account.

Position Buy Buy stop above 378.7 Stop loss below 366.7