In this review, we suggest considering the personal composite instrument (PCI) BRENT vs the ruble. It reflects the dynamics of the price change per barrel of Brent relative to the Russian ruble. Will BRENT/RUB prices rise?

The PCI declines when oil prices fall, and the ruble strengthens against the US dollar, and, on the contrary, it grows when oil prices rise, and the ruble weakens simultaneously. As a rule, the Russian currency strengthens with high oil prices and weakens with low prices. Because of this, BRENT/RUB prices tend to fluctuate near their moving average line. Now they have deviated from it by a historically maximal value and reached a record high. In other words, the ruble remains weak against the US dollar, despite the steady growth in world oil prices. The fluctuation of the PCI near the moving average line is due to the structure of Russian exports. Now it has not changed. According to customs statistics in January-March 2018, the share of fuel and energy products in Russian exports was 64.5%. It was approximately the same in the same period of 2017. The main factor hindering the strengthening of the ruble is the so-called "budget rule", according to which the Ministry of Finance of the Russian Federation buys currency at the expense of funds from budget surpluses at high oil prices. Theoretically, they are designed to smooth fluctuations of the ruble and make its rate less volatile than the price of oil.

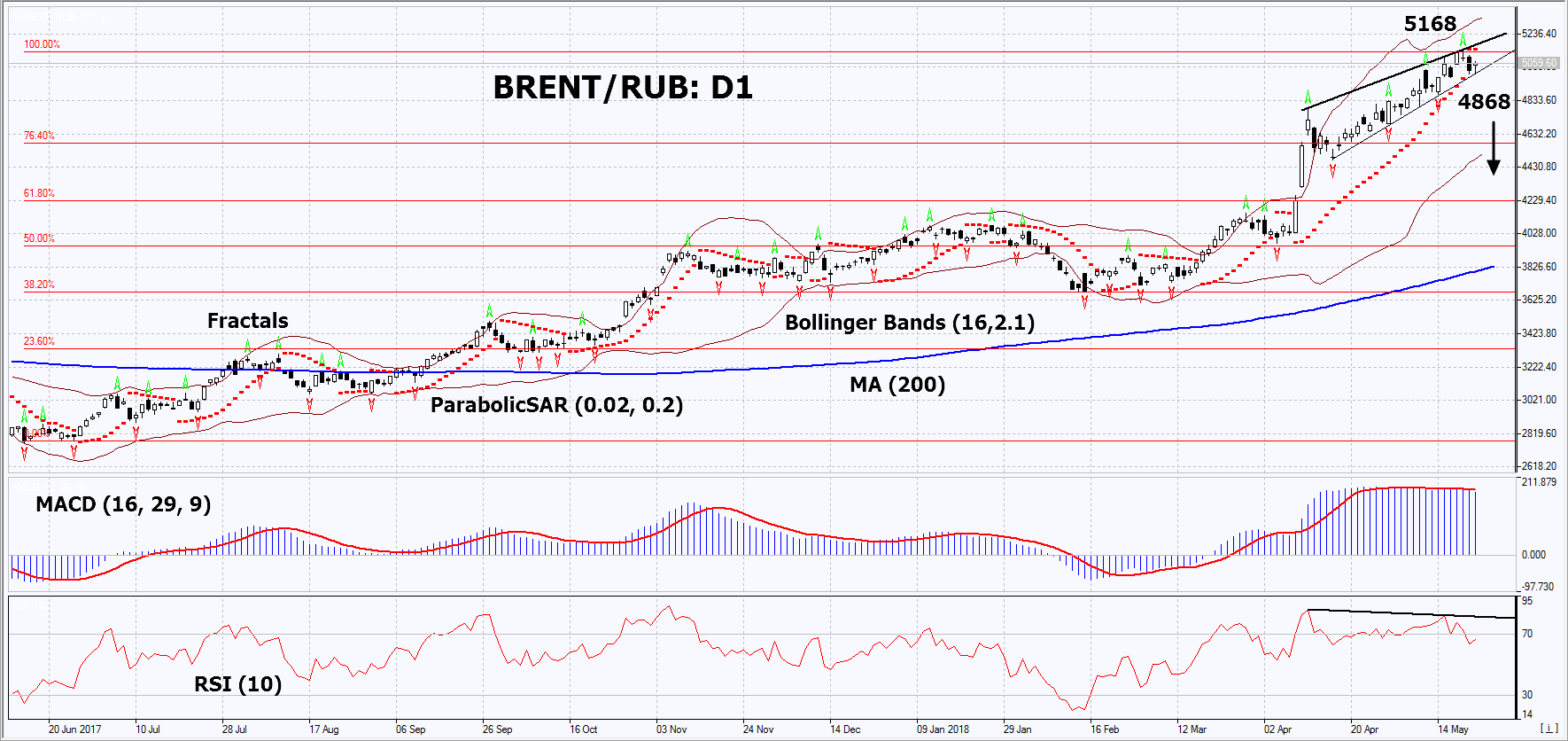

On the daily time frame, BRENT/RUB D1 is in a rising trend. The price increase has slowed down and technical analysis indicators have formed bearish signals. Before opening a sell position, it is necessary to breach down the support line of the uptrend. The price decrease is possible in case of the strengthening of the ruble amid persistently high global oil prices or a stable ruble exchange rate with falling oil prices.

- The Parabolic indicator gives a bearish signal.

- The Bollinger bands® have widened, which indicates high volatility.

- The RSI indicator is above 50. It has formed a negative divergence.

- The MACD indicator gives a bearish signal.

The bearish momentum may develop in case BRENT/RUB falls below its last low at 4868. This level may serve as an entry point. The initial stop loss may be placed above the last fractal high, the historic high and the Parabolic signal at 5168. After opening the pending order, we shall move the stop to the next fractal high following the Bollinger and Parabolic signals. Thus, we are changing the potential profit/loss to the breakeven point. More risk-averse traders may switch to the 4-hour chart after the trade and place there a stop loss moving it in the direction of the trade. If the price meets the stop level at 5168 without reaching the order at 4868, we recommend to close the position: the market sustains internal changes that were not taken into account.

Summary of technical analysis

Position Sell

Sell stop Below 4868

Stop loss Above 5168