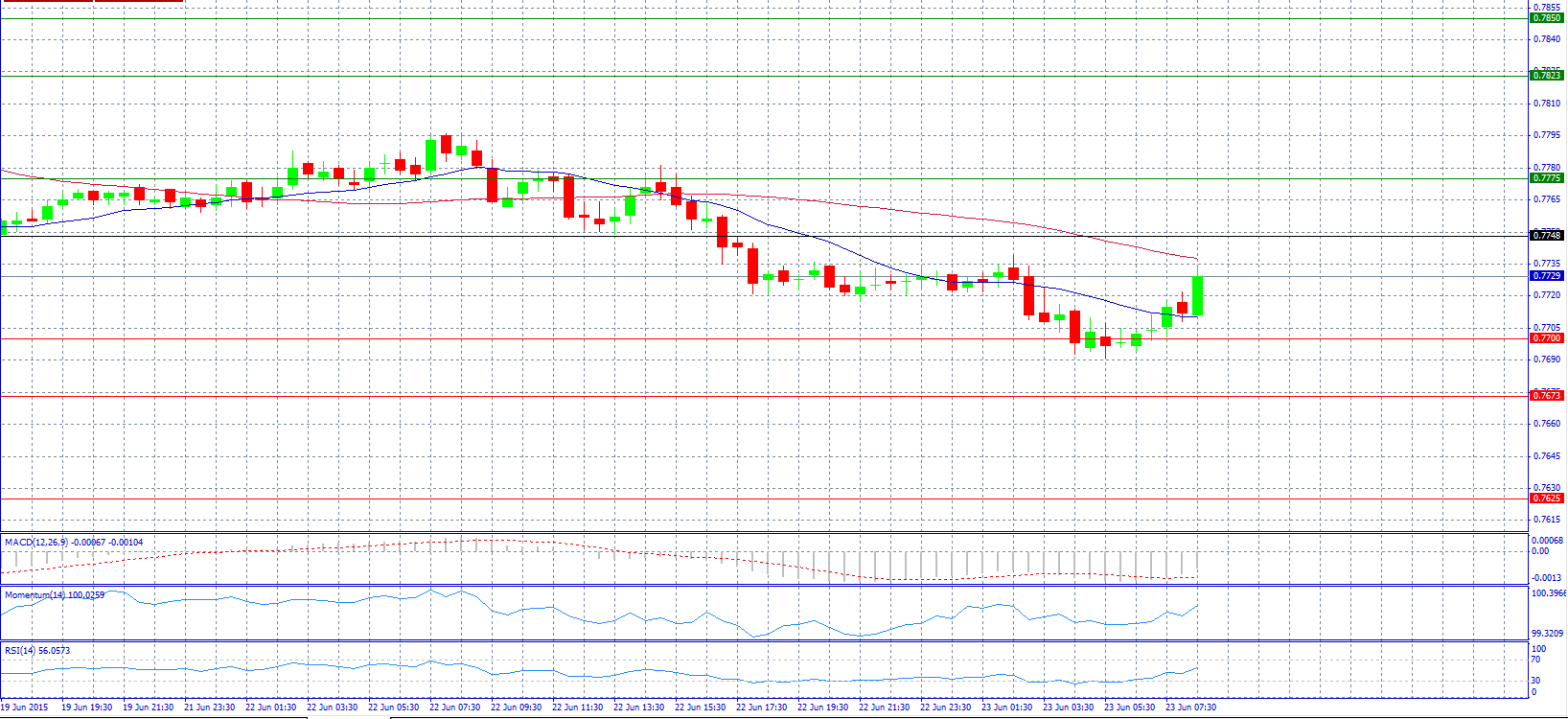

Market Scenario 1: Long positions above 0.7748 with target at 0.7775.

Market Scenario 2: Short positions below 0.7700 with target at 0.7673.

Comment: The pair jumped near 0.7730 level.

Supports and Resistances:

R3 0.7850

R2 0.7823

R1 0.7775

PP 0.7748

S1 0.7700

S2 0.7673

S3 0.7625

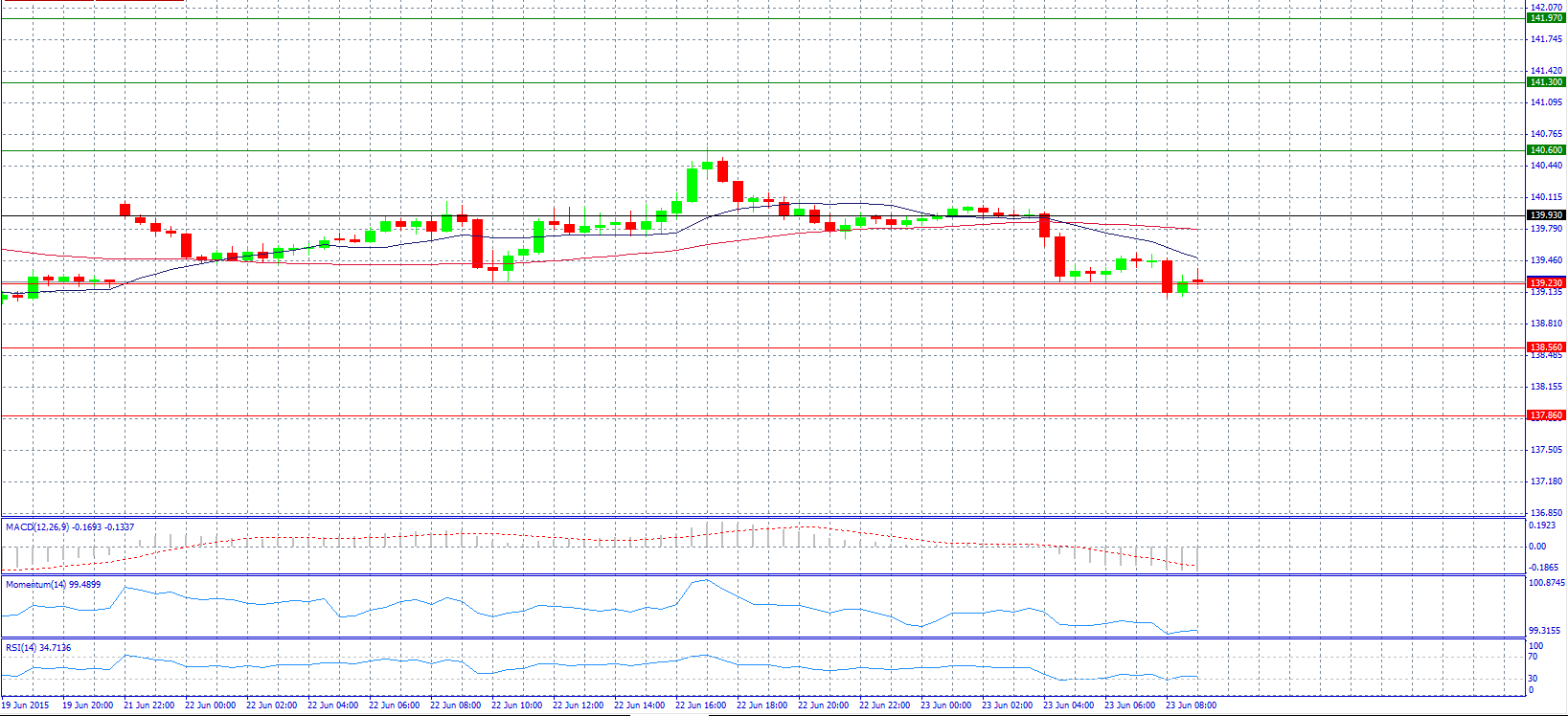

Market Scenario 1: Long positions above 139.23 with target at 139.93.

Market Scenario 2: Short positions below 139.23 with target at 138.56.

Comment: The pair weakened and now is facing support level 139.23 after Greek talks failed at Eurogroup meeting on Monday, while the latest comments from Goldman Sachs (NYSE:GS) added fuel to the downside.

Supports and Resistances:

R3 141.97

R2 141.30

R1 140.60

PP 139.93

S1 139.23

S2 138.56

S3 137.86

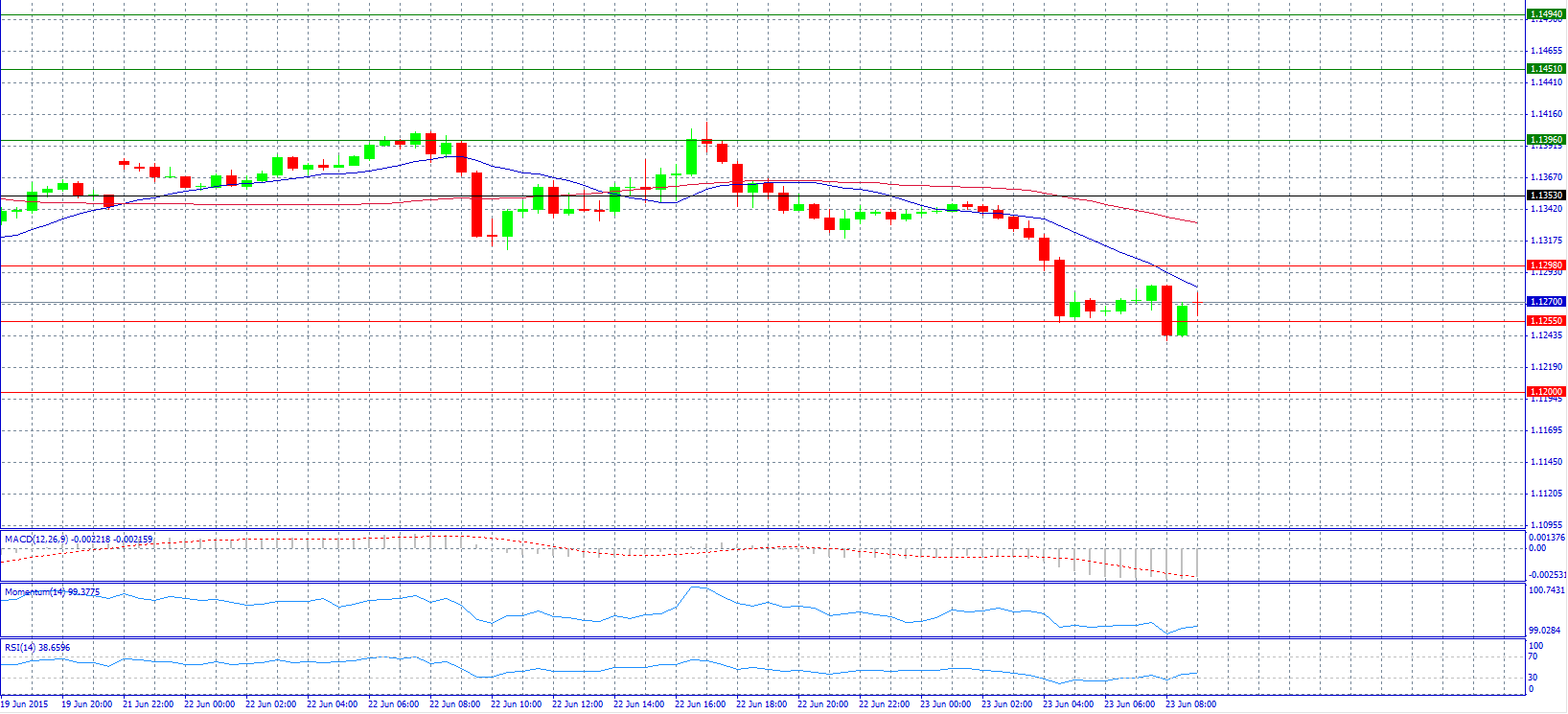

Market Scenario 1: Long positions above 1.1298 with target at 1.1353.

Market Scenario 2: Short positions below 1.1255 with target at 1.1200.

Comment: The pair trades lower ahead of the Eurozone’s manufacturing and services PMI data.

Supports and Resistances:

R3 1.1494

R2 1.1451

R1 1.1396

PP 1.1353

S1 1.1298

S2 1.1255

S3 1.1200

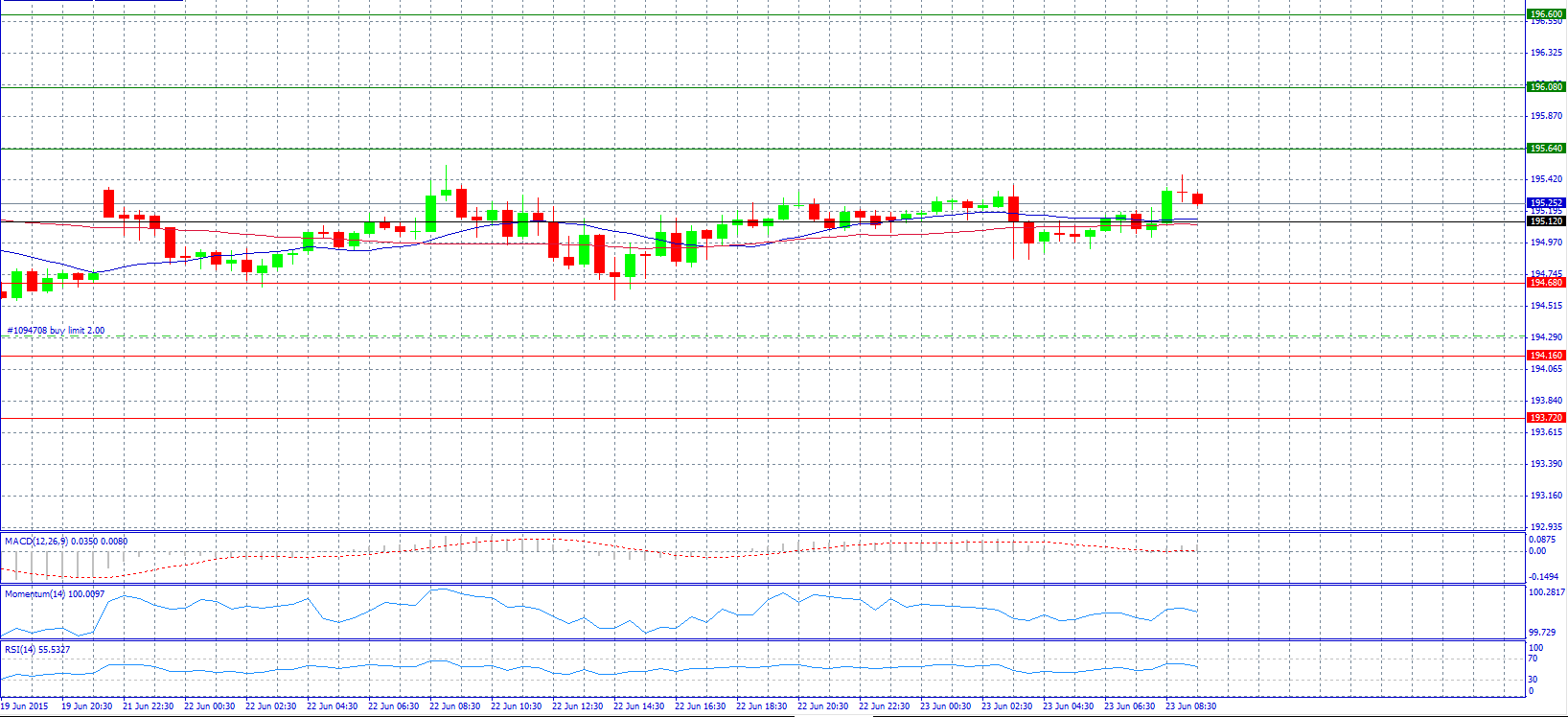

Market Scenario 1: Long positions above 195.12 with target at 195.64.

Market Scenario 2: Short positions below 195.12 with target at 194.68.

Comment: The pair trades at 195.25 level and consolidates recent gains in a sideways holding pattern.

Supports and Resistances:

R3 196.60

R2 196.08

R1 195.64

PP 195.12

S1 194.68

S2 194.16

S3 193.72

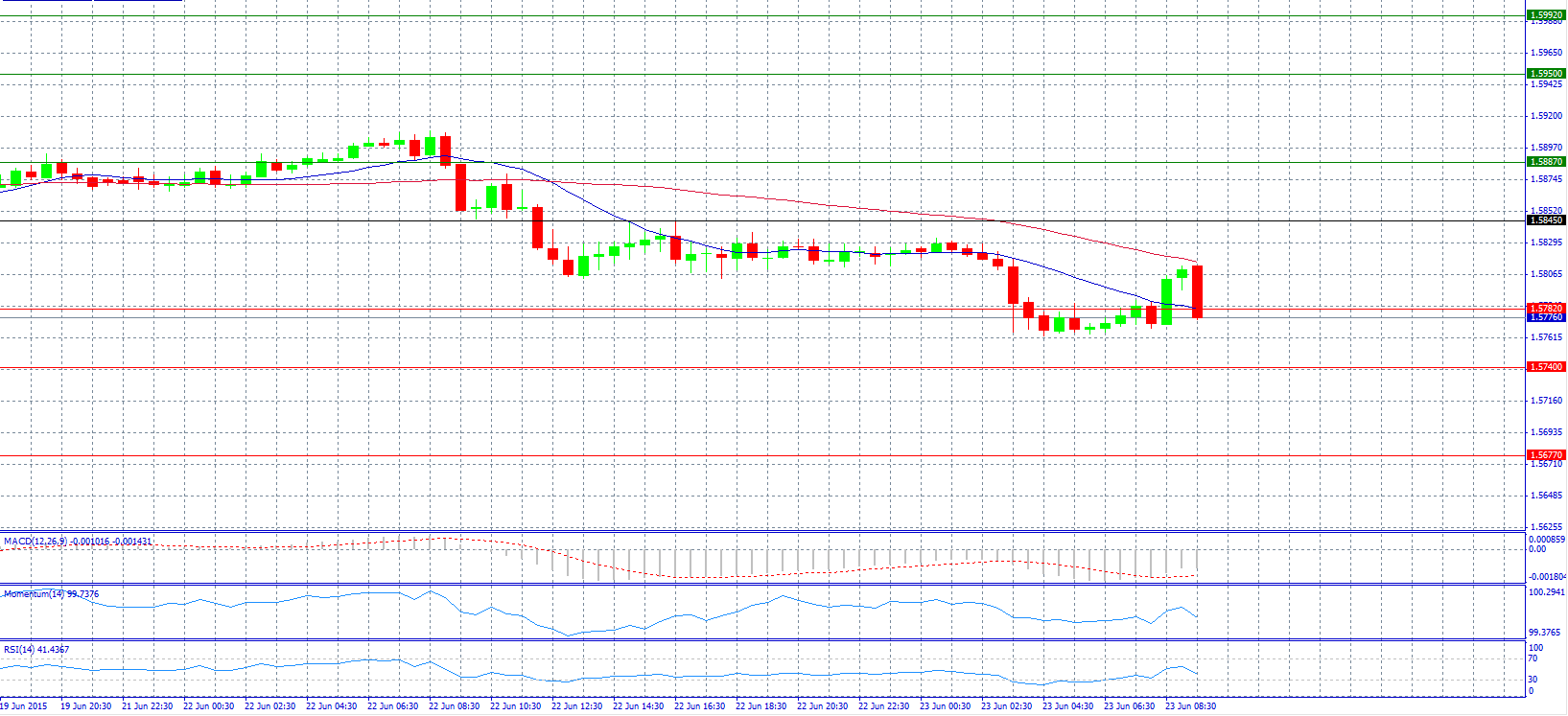

Market Scenario 1: Long positions above 1.5782 with target at 1.5845.

Market Scenario 2: Short positions below 1.5782 with target at 1.5740.

Comment: The pair made a small attempt to rebound, but fell again below 1.5800 level.

Supports and Resistances:

R3 1.5992

R2 1.5950

R1 1.5887

PP 1.5845

S1 1.5782

S2 1.5740

S3 1.5677

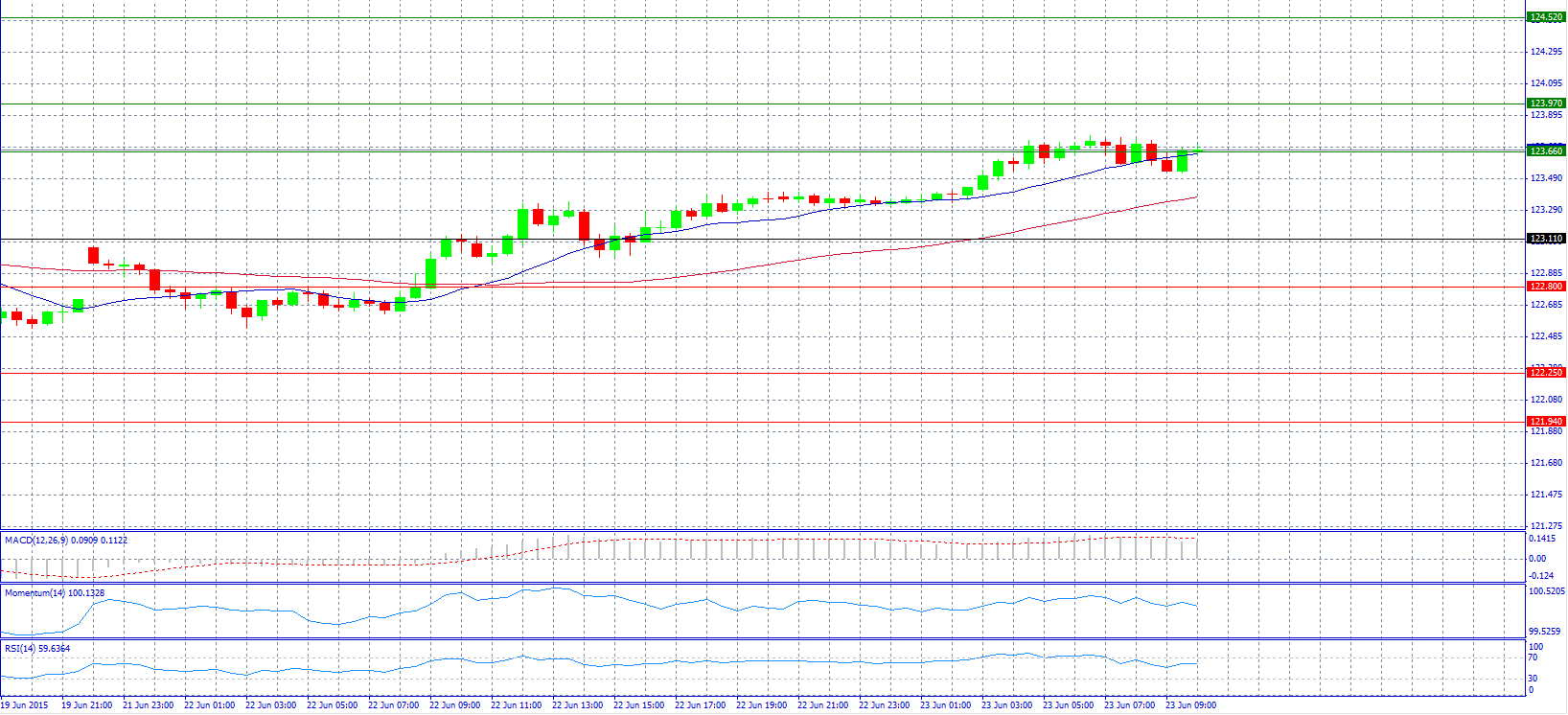

Market Scenario 1: Long positions above 123.66 with target at 123.97.

Market Scenario 2: Short positions below 123.66 with target at 123.11.

Comment: The pair advanced, but then stabilized by trading near resistance level 123.66.

Supports and Resistances:

R3 124.52

R2 123.97

R1 123.66

PP 123.11

S1 122.80

S2 122.25

S3 121.94

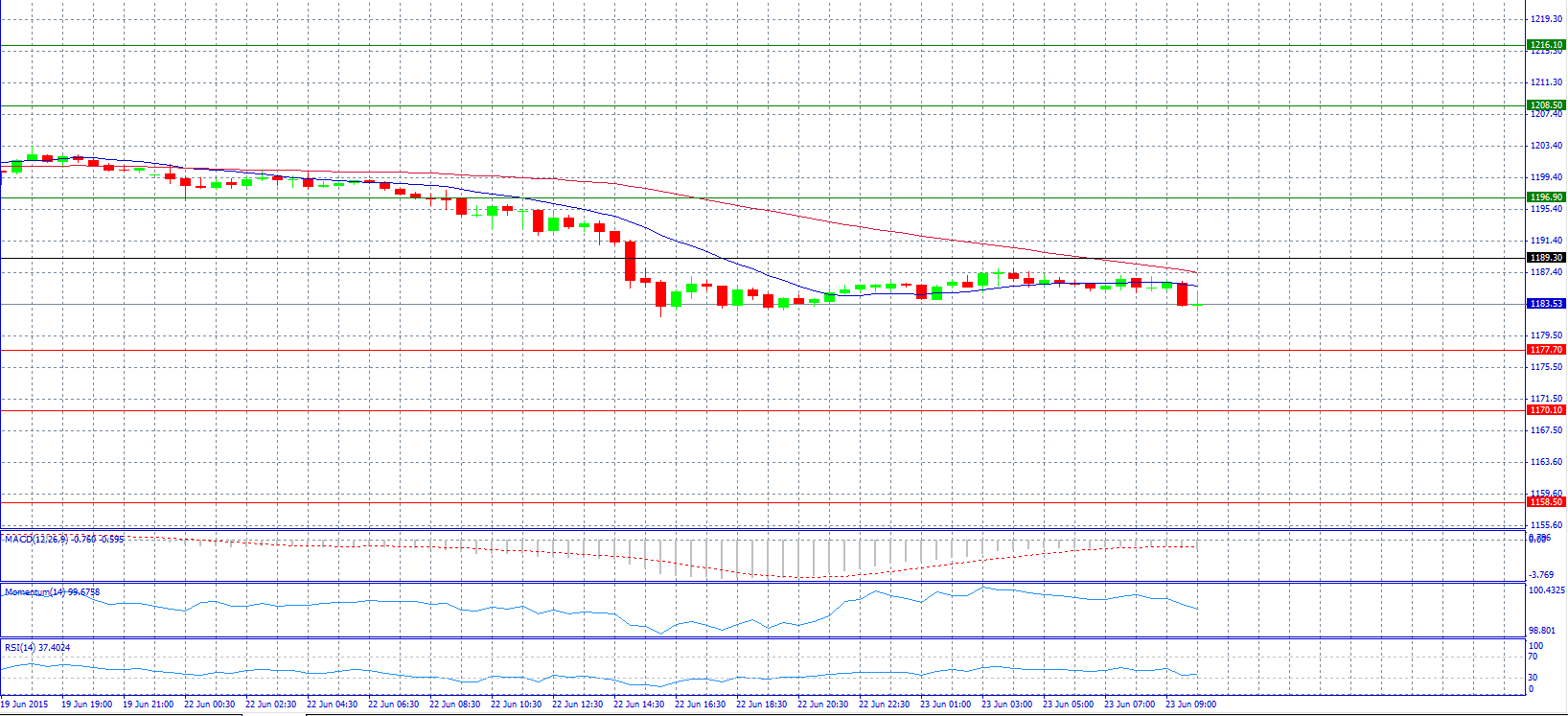

Market Scenario 1: Long positions above 1189.30 with target at 1196.90.

Market Scenario 2: Short positions below 1177.70 with target at 1170.10.

Comment: Gold prices trade neutral near 1183.50 level.

Supports and Resistances:

R3 1216.10

R2 1208.50

R1 1196.90

PP 1189.30

S1 1177.70

S2 1170.10

S3 1158.50

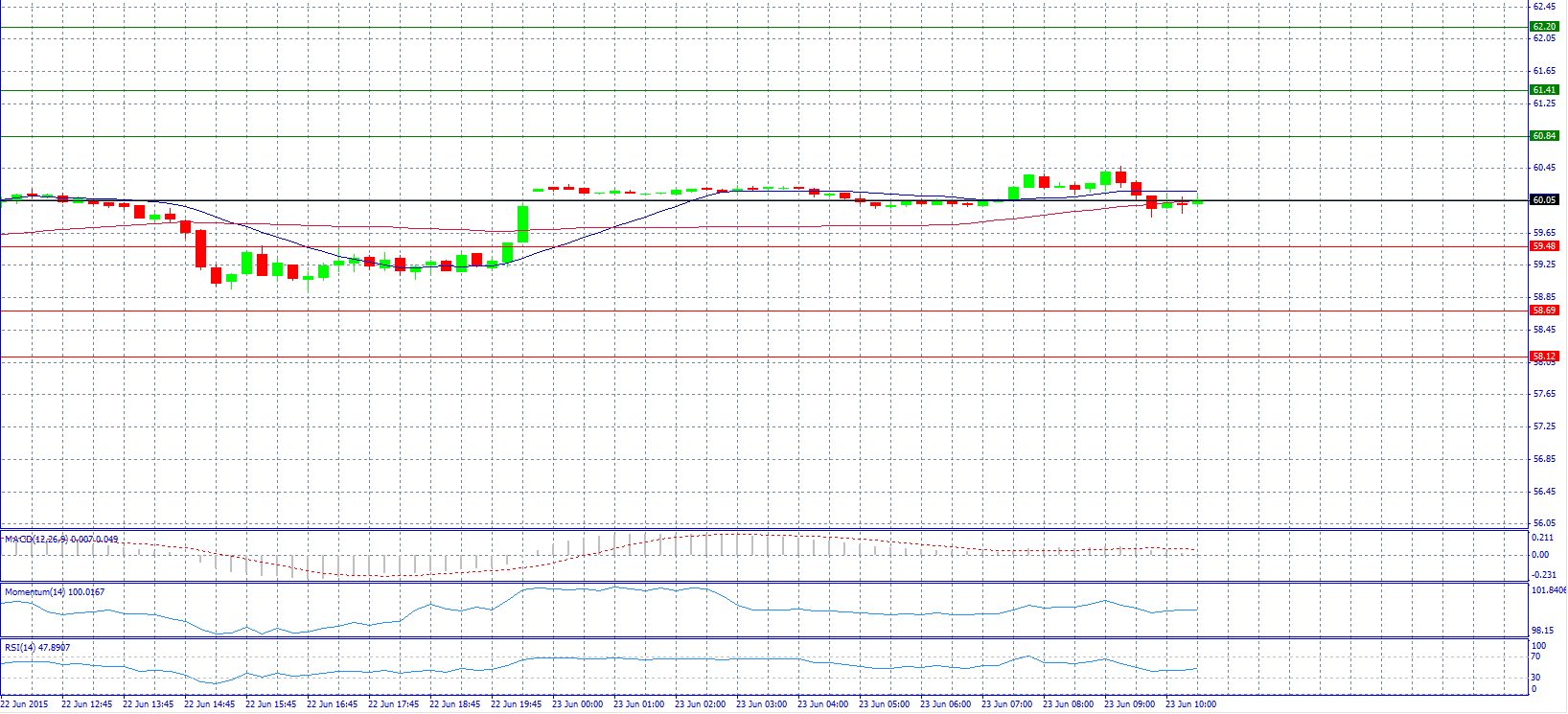

Market Scenario 1: Long positions above 60.05 with target at 60.84.

Market Scenario 2: Short positions below 60.05 with target at 59.48.

Comment: Crude oil prices fell after weak Chinese factory data.

Supports and Resistances:

R3 62.20

R2 61.41

R1 60.94

PP 60.05

S1 59.48

S2 58.69

S3 58.12

Market Scenario 1: Long positions above 53.639 with target at 54.308.

Market Scenario 2: Short positions below 53.639 with target at 52.562.

Comment: The pair stopped trading neutral and rose above 53.000 level.

Supports and Resistances:

R3 56.055

R2 54.308

R1 53.639

PP 52.562

S1 51.892

S2 50.815

S3 49.069