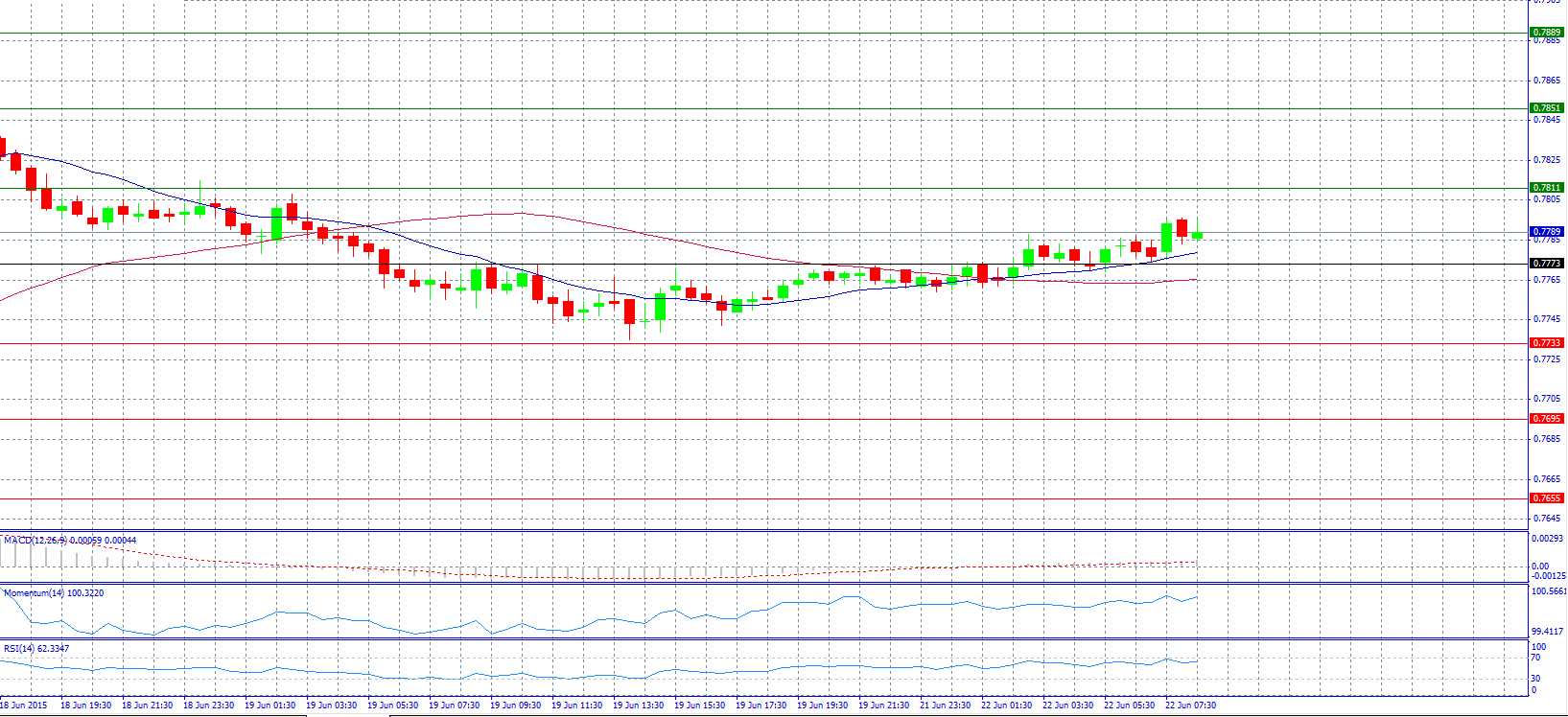

Market Scenario 1: Long positions above 0.7811 with target @ 0.7851.

Market Scenario 2: Short positions below 0.7773 with target @ 0.7733.

Comment: The pair trades higher in the Asian session near 0.7790 level.

Supports and Resistances:

R3 0.7889

R2 0.7851

R1 0.7811

PP 0.7773

S1 0.7733

S2 0.7695

S3 0.7655

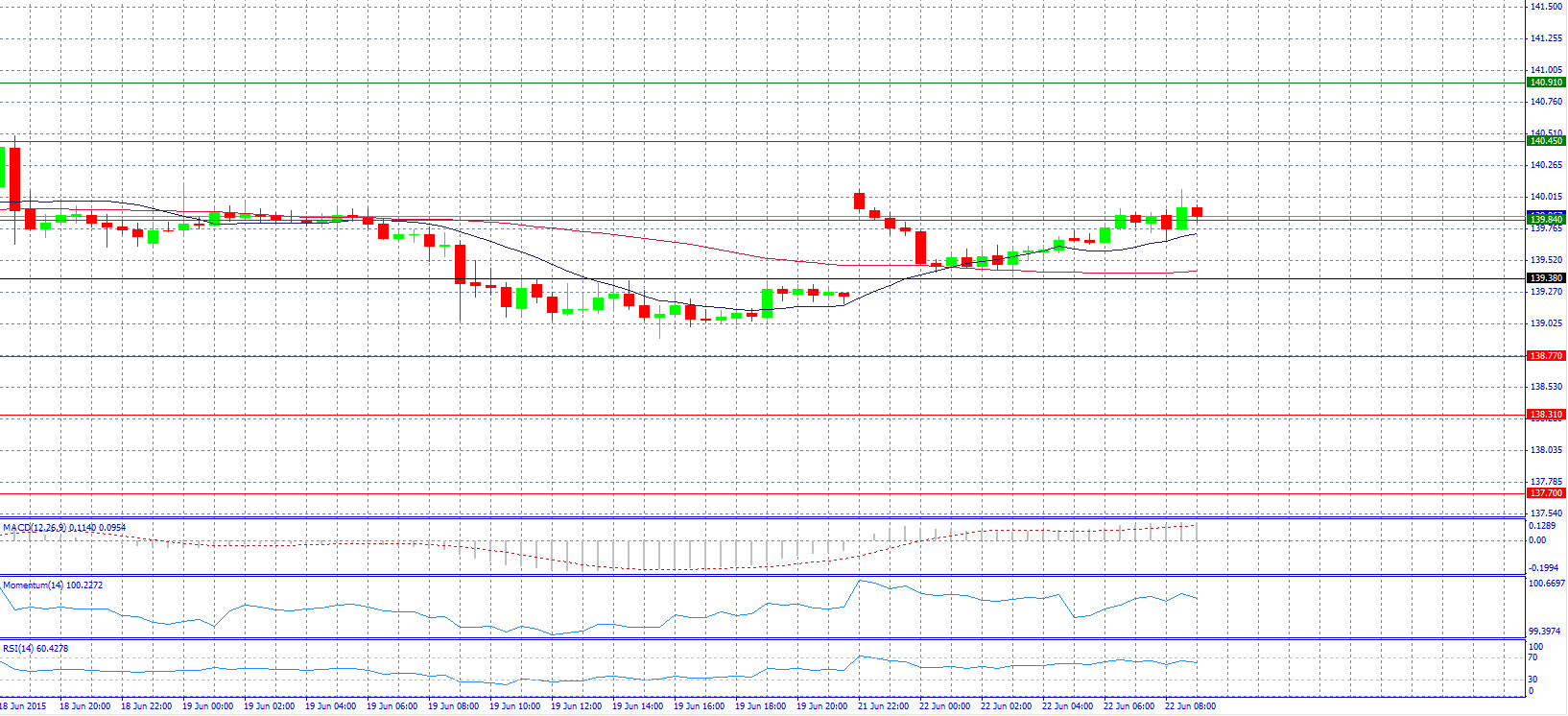

Market Scenario 1: Long positions above 139.84 with target @ 140.45.

Market Scenario 2: Short positions below 139.84 with target @ 139.38.

Comment: The pair has a bullish tone and trades tries to stay above resistance level 139.84.

Supports and Resistances:

R3 140.91

R2 140.45

R1 139.84

PP 139.38

S1 138.77

S2 138.31

S3 137.70

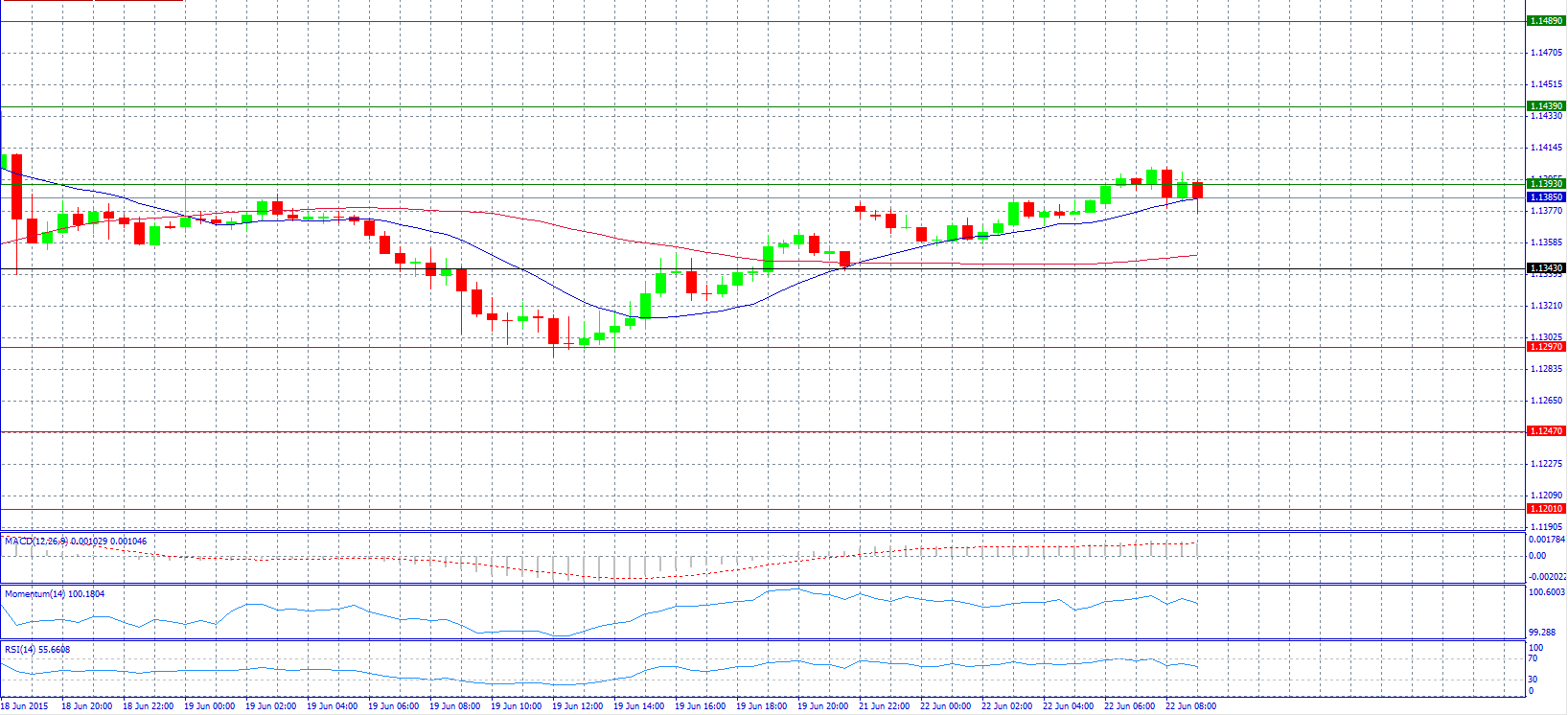

Market Scenario 1: Long positions above 1.1393 with target @ 1.1439.

Market Scenario 2: Short positions below 1.1393 with target @ 1.1343.

Comment: The pair trades higher ahead of the Euro-group meeting.

Supports and Resistances:

R3 1.1489

R2 1.1439

R1 1.1393

PP 1.1343

S1 1.1297

S2 1.1247

S3 1.1201

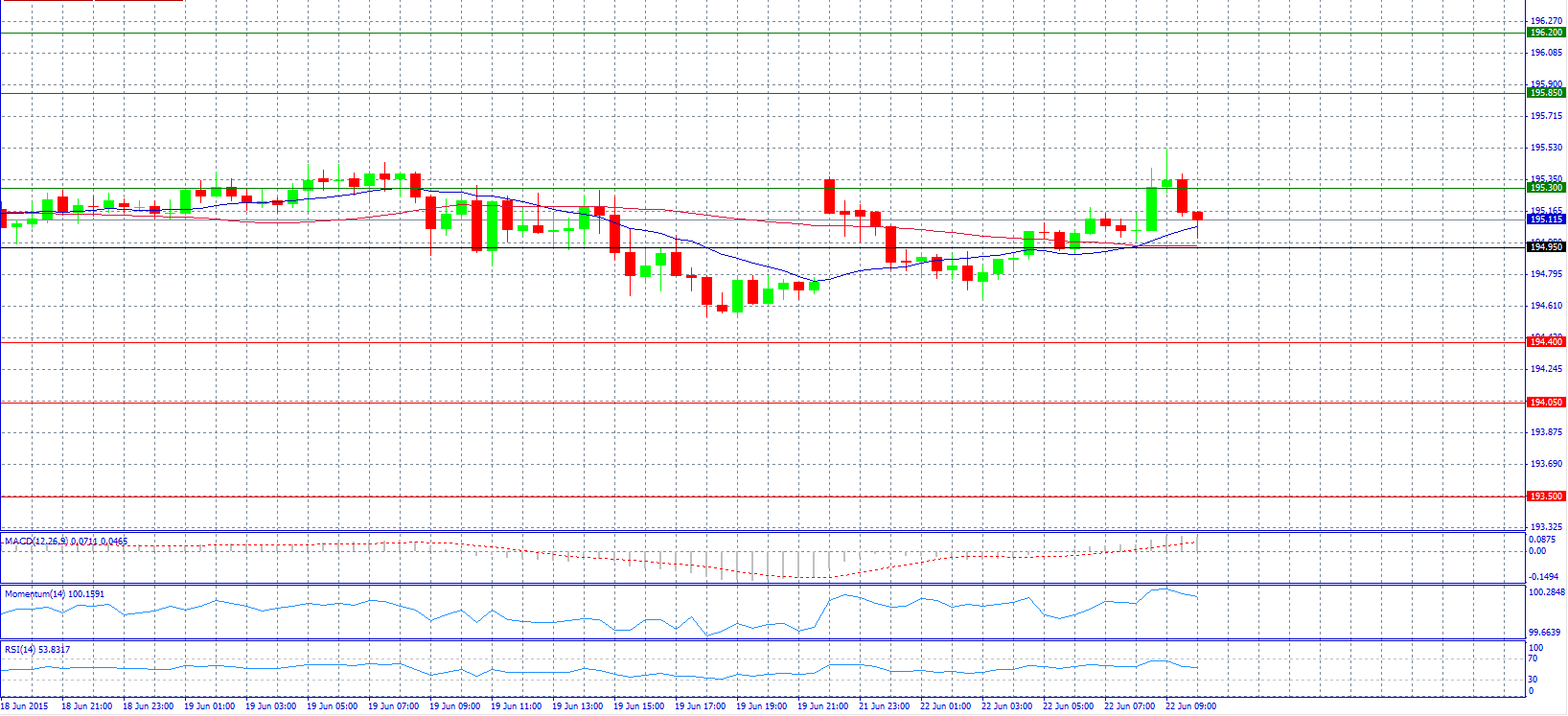

Market Scenario 1: Long positions above 195.30 with target @ 195.58.

Market Scenario 2: Short positions below 194.95 with target @ 194.40.

Comment: The pair rose to challenge resistance level 195.30 but dropped again.

Supports and Resistances:

R3 196.20

R2 195.85

R1 195.30

PP 194.95

S1 194.40

S2 194.05

S3 193.50

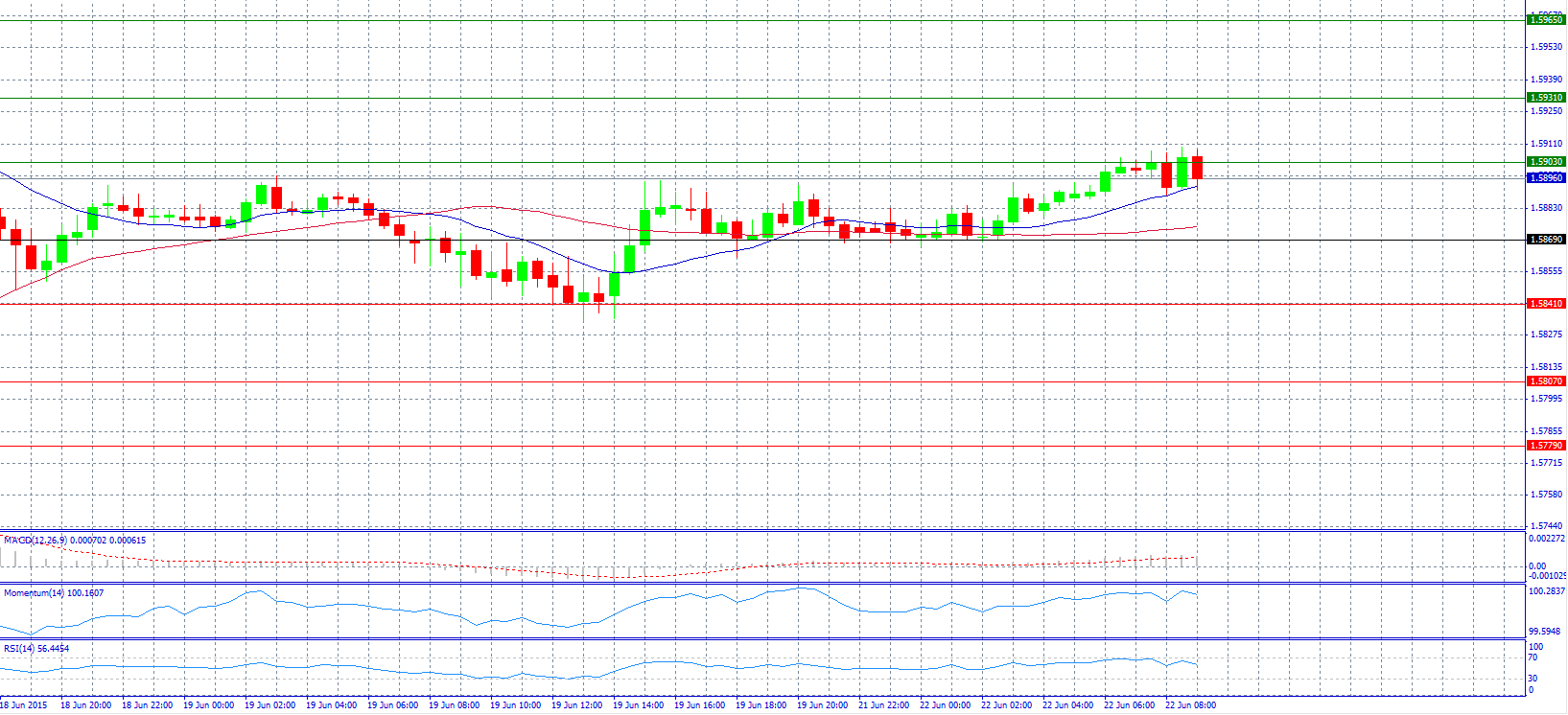

Market Scenario 1: Long positions above 1.5903 with target @ 1.5931.

Market Scenario 2: Short positions below 1.5903 with target @ 1.5869.

Comment: The pair reversed its losses in the early European session.

Supports and Resistances:

R3 1.5965

R2 1.5931

R1 1.5903

PP 1.5869

S1 1.5841

S2 1.5807

S3 1.5779

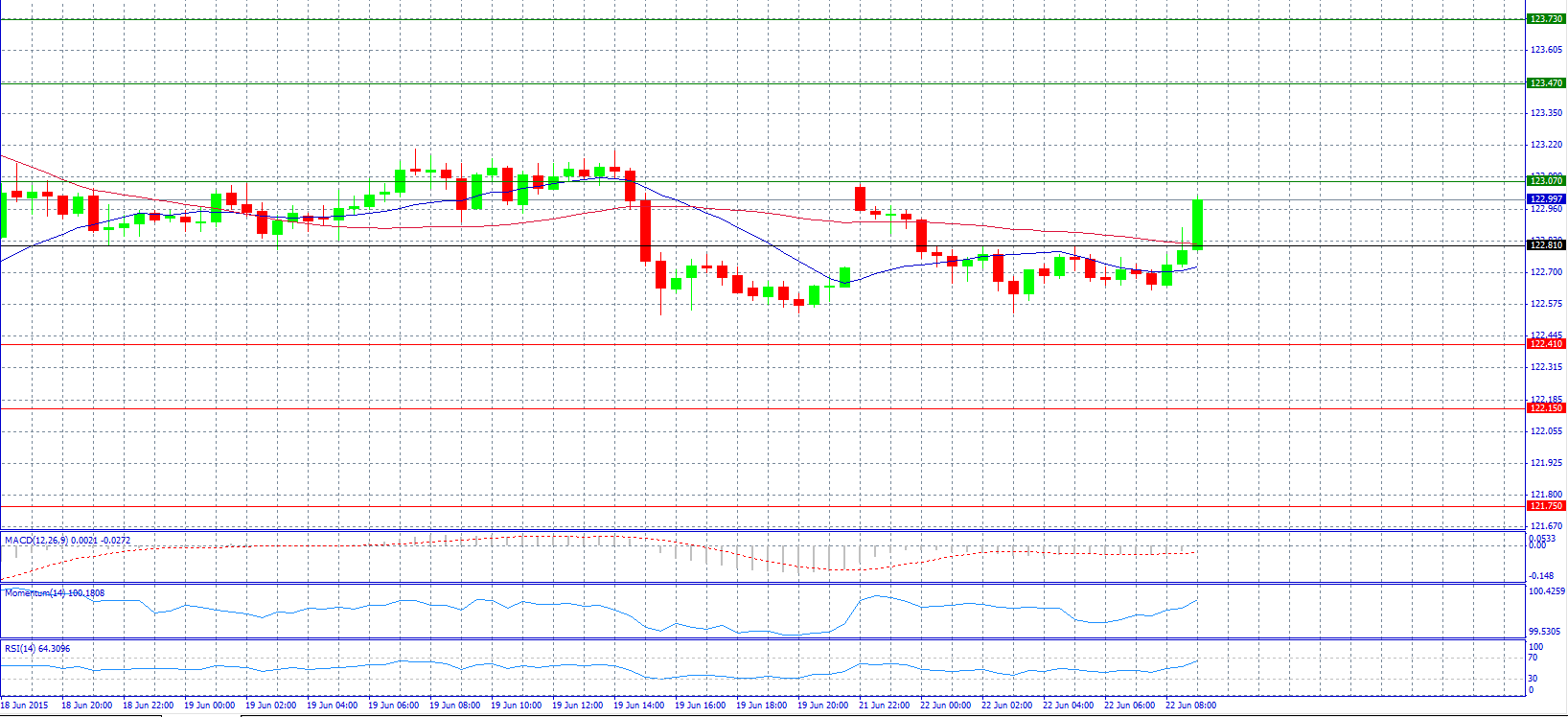

Market Scenario 1: Long positions above 123.07 with target @ 123.47.

Market Scenario 2: Short positions below 122.81 with target @ 122.41.

Comment: The pair jumped above pivot point and tries to reach resistance level 123.07.

Supports and Resistances:

R3 123.73

R2 123.47

R1 123.07

PP 122.81

S1 122.41

S2 122.15

S3 121.75

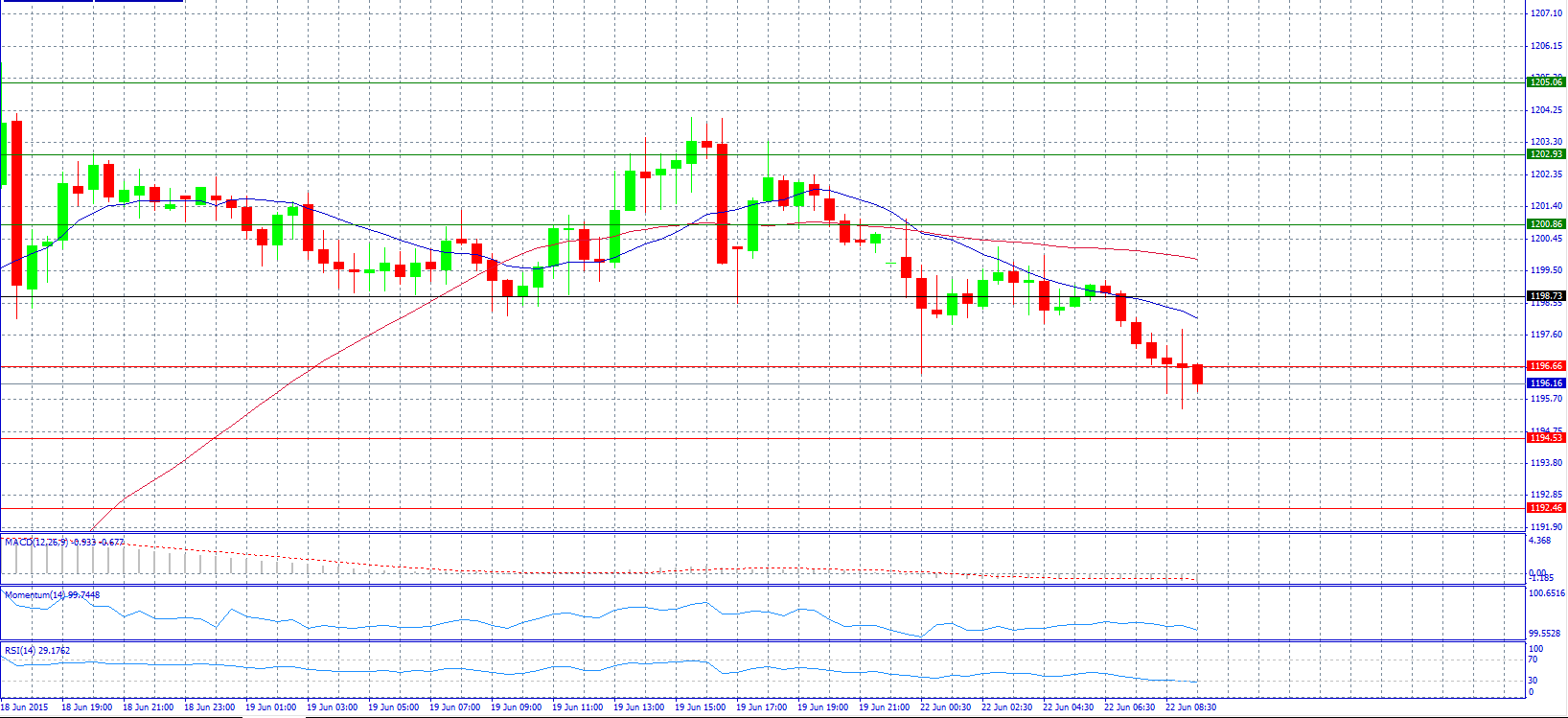

Market Scenario 1: Long positions above 1196.66 with target @ 1198.73.

Market Scenario 2: Short positions below 1196.66 with target @ 1194.53.

Comment: Gold prices perhaps slipping as hopes for a Greece deal tarnish its haven allure.

Supports and Resistances:

R3 1205.06

R2 1202.93

R1 1200.86

PP 1198.73

S1 1196.66

S2 1194.53

S3 1192.46

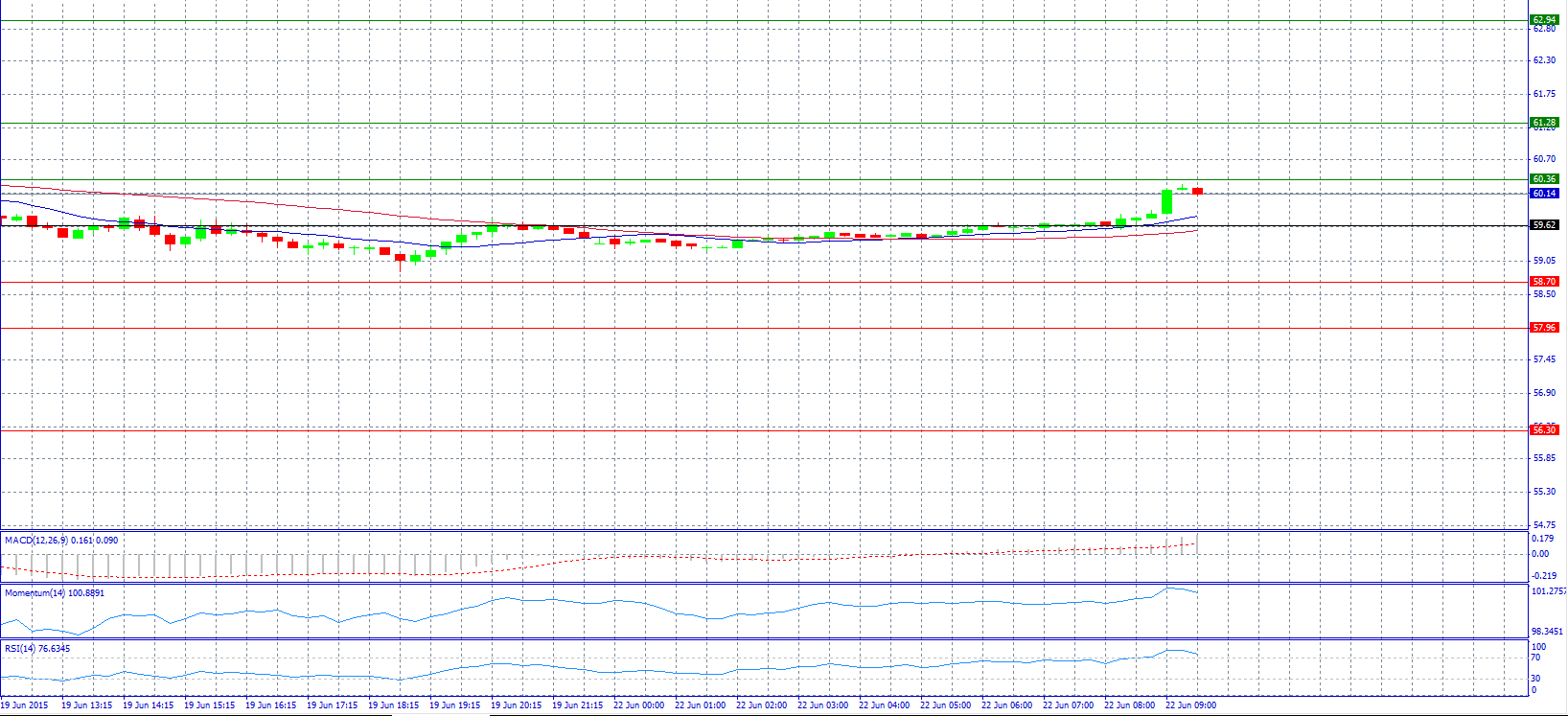

Market Scenario 1: Long positions above 60.36 with target @ 61.28.

Market Scenario 2: Short positions below 59.62 with target @ 58.70.

Comment: Crude oil prices were facing downward pressure due to concerns over the Greek financial crisis, according to analysts.

Supports and Resistances:

R3 62.94

R2 61.28

R1 60.36

PP 59.62

S1 58.70

S2 57.96

S3 56.30

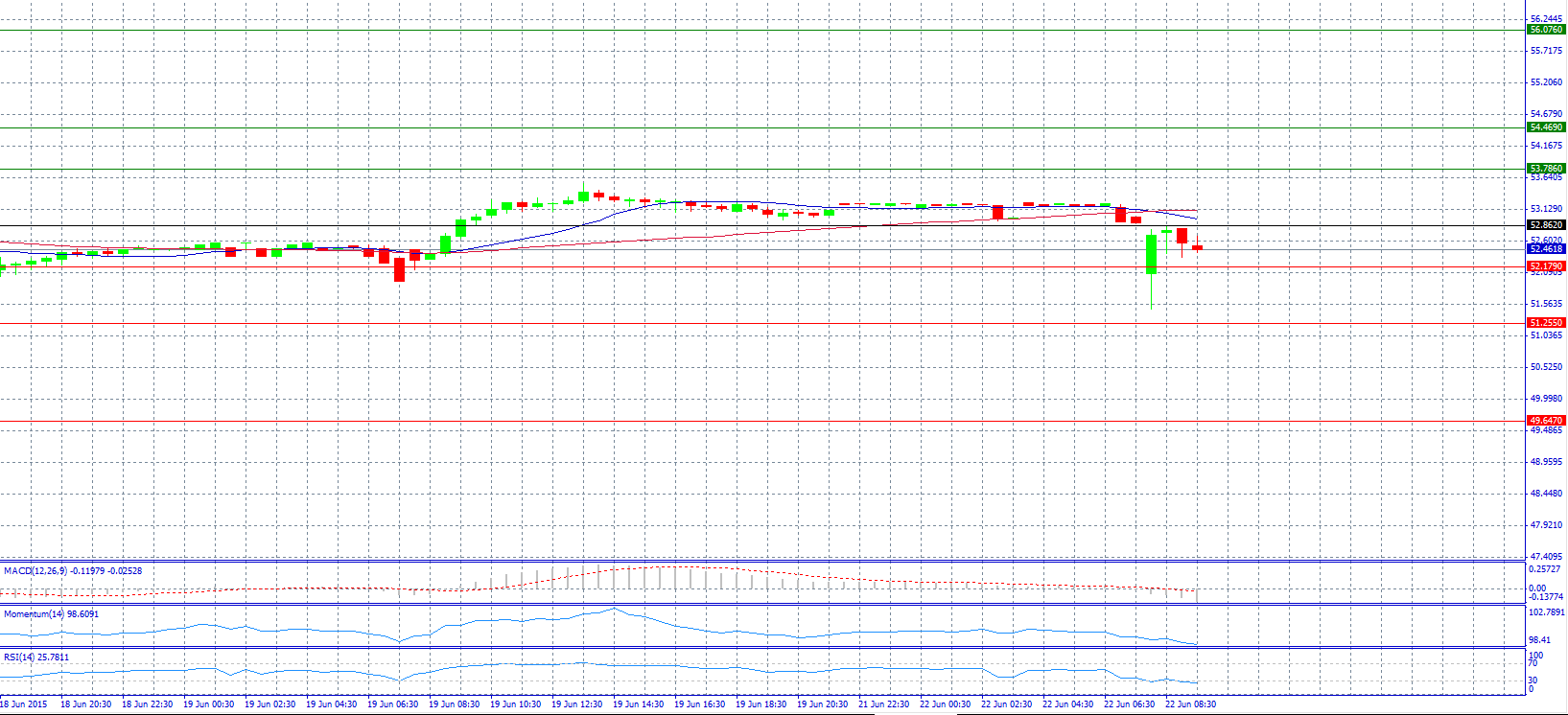

Market Scenario 1: Long positions above 52.862 with target @ 53.786.

Market Scenario 2: Short positions below 52.179 with target @ 51.255.

Comment: The pair has a bearish pressure and trade below pivot point 52.862.

Supports and Resistances:

R3 56.076

R2 54.469

R1 53.786

PP 52.862

S1 52.179

S2 51.255

S3 49.647