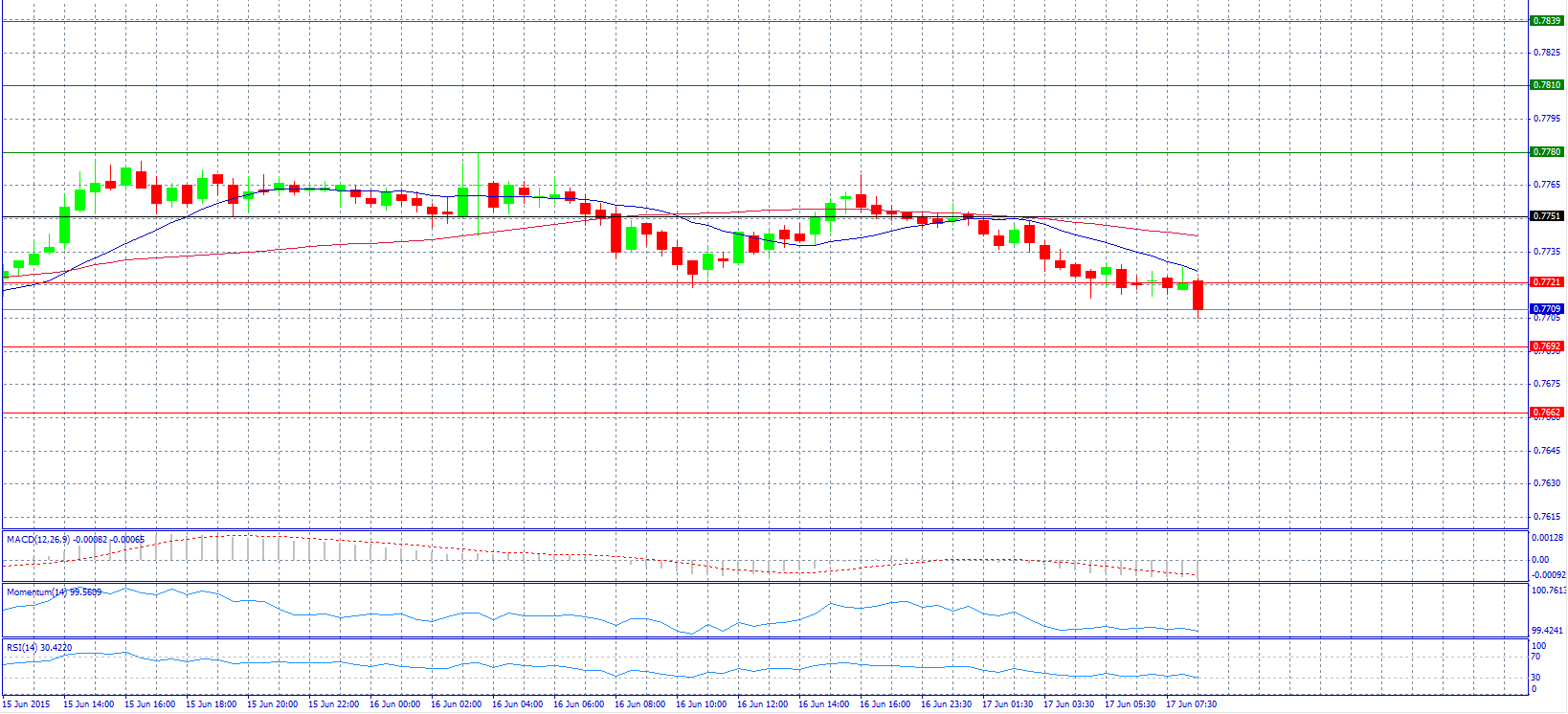

Market Scenario 1: Long positions above 0.7721 with target at 0.7751.

Market Scenario 2: Short positions below 0.7692 with target at 0.7662.

Comment: The pair has a bearish tone and broke below support level 0.7721.

Supports and Resistances:

R3 0.7839

R2 0.7810

R1 0.7780

PP 0.7751

S1 0.7721

S2 0.7692

S3 0.7662

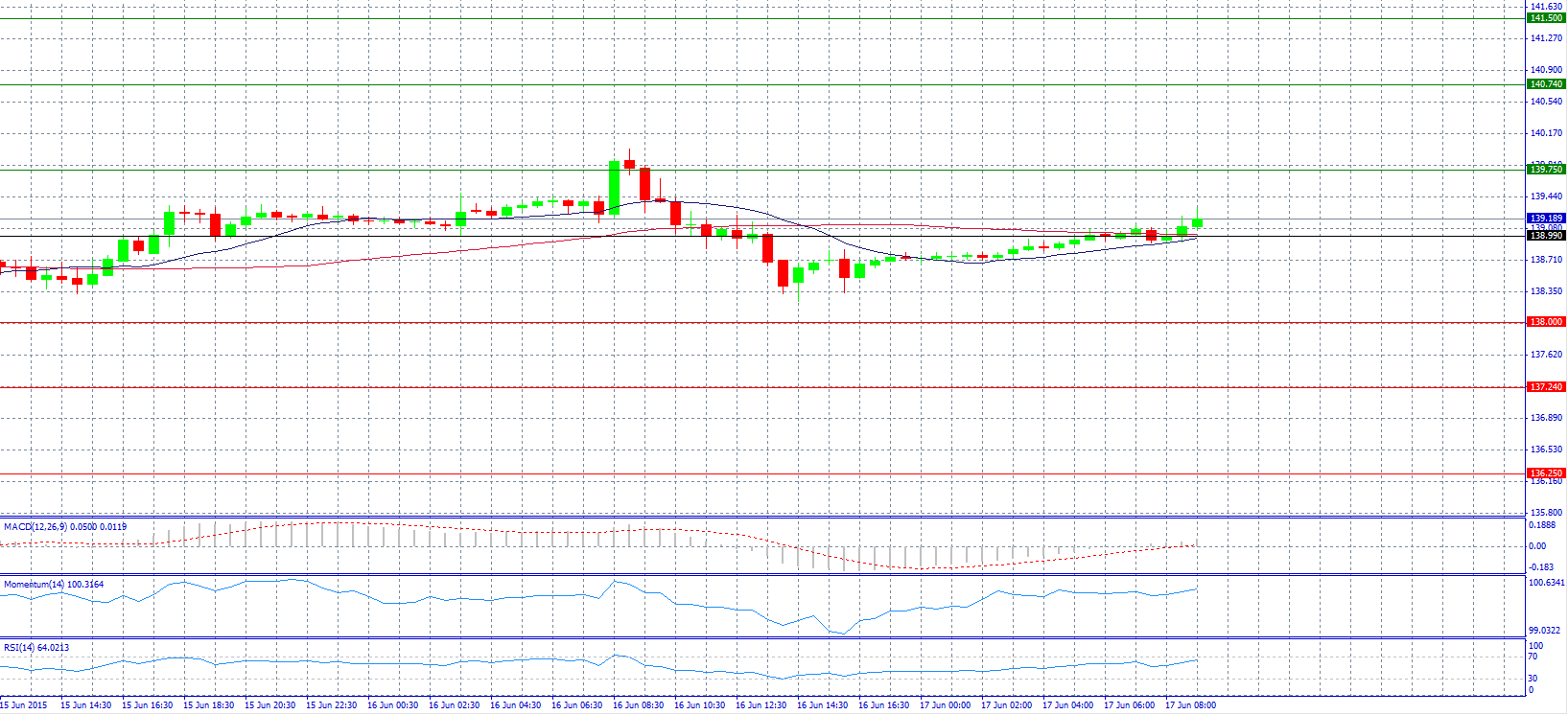

Market Scenario 1: Long positions above 138.99 with target at 139.75.

Market Scenario 2: Short positions below 138.99 with target at 138.00.

Comment: The pair advanced and managed to surpass pivot point 138.99.

Supports and Resistances:

R3 141.50

R2 140.74

R1 139.75

PP 138.99

S1 138.00

S2 137.24

S3 136.25

Market Scenario 1: Long positions above 1.1260 with target at 1.1317.

Market Scenario 2: Short positions below 1.1260 with target at 1.1192.

Comment: The pair was taken higher than pivot point 1.1260 due to the bid tone on the common currency that strengthened in the early European session.

Supports and Resistances:

R3 1.1442

R2 1.1385

R1 1.1317

PP 1.1260

S1 1.1192

S2 1.1135

S3 1.1067

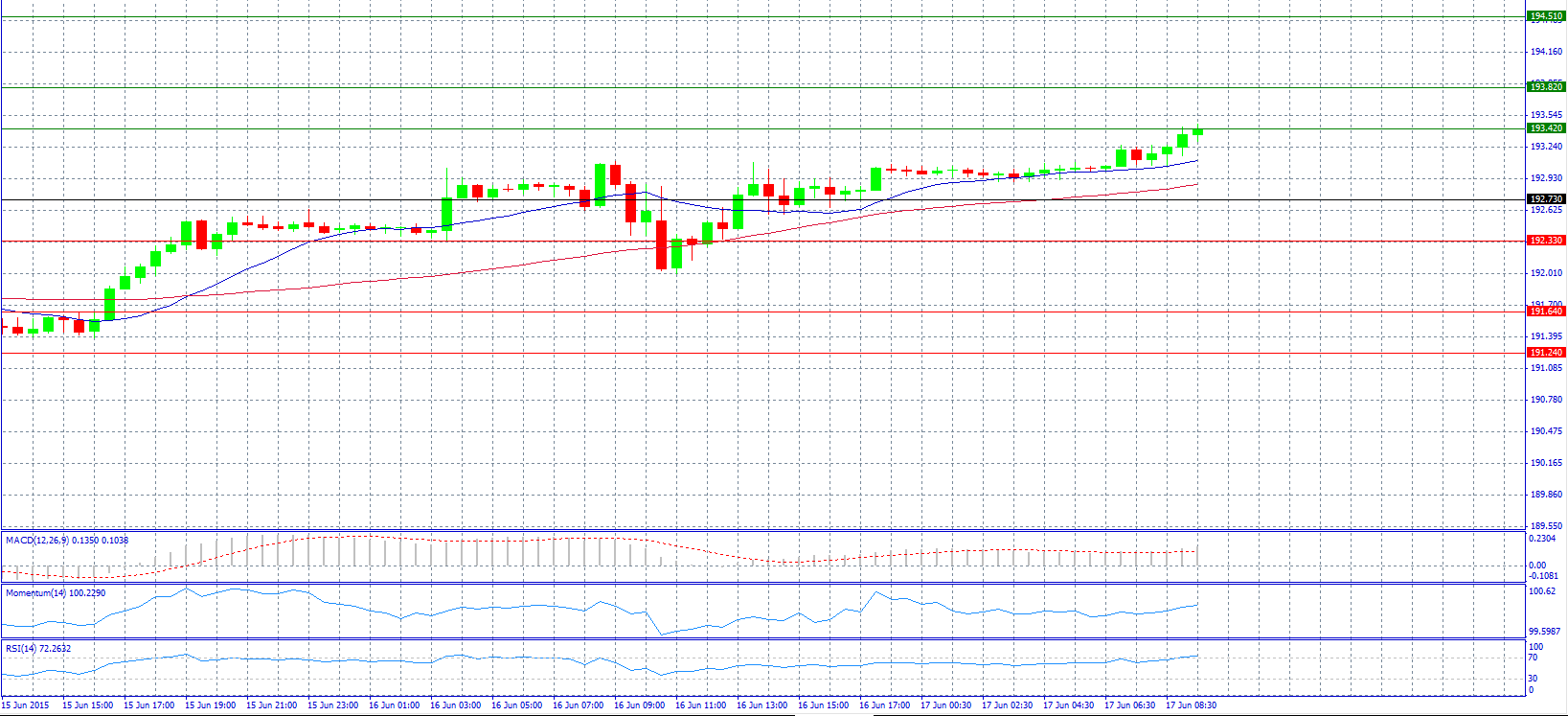

Market Scenario 1: Long positions above 193.42 with target at 193.82.

Market Scenario 2: Short positions below 193.42 with target at 192.73.

Comment: The pair’s rally extended and now trades near resistance level 193.42.

Supports and Resistances:

R3 194.51

R2 193.82

R1 193.42

PP 192.73

S1 192.33

S2 191.64

S3 191.24

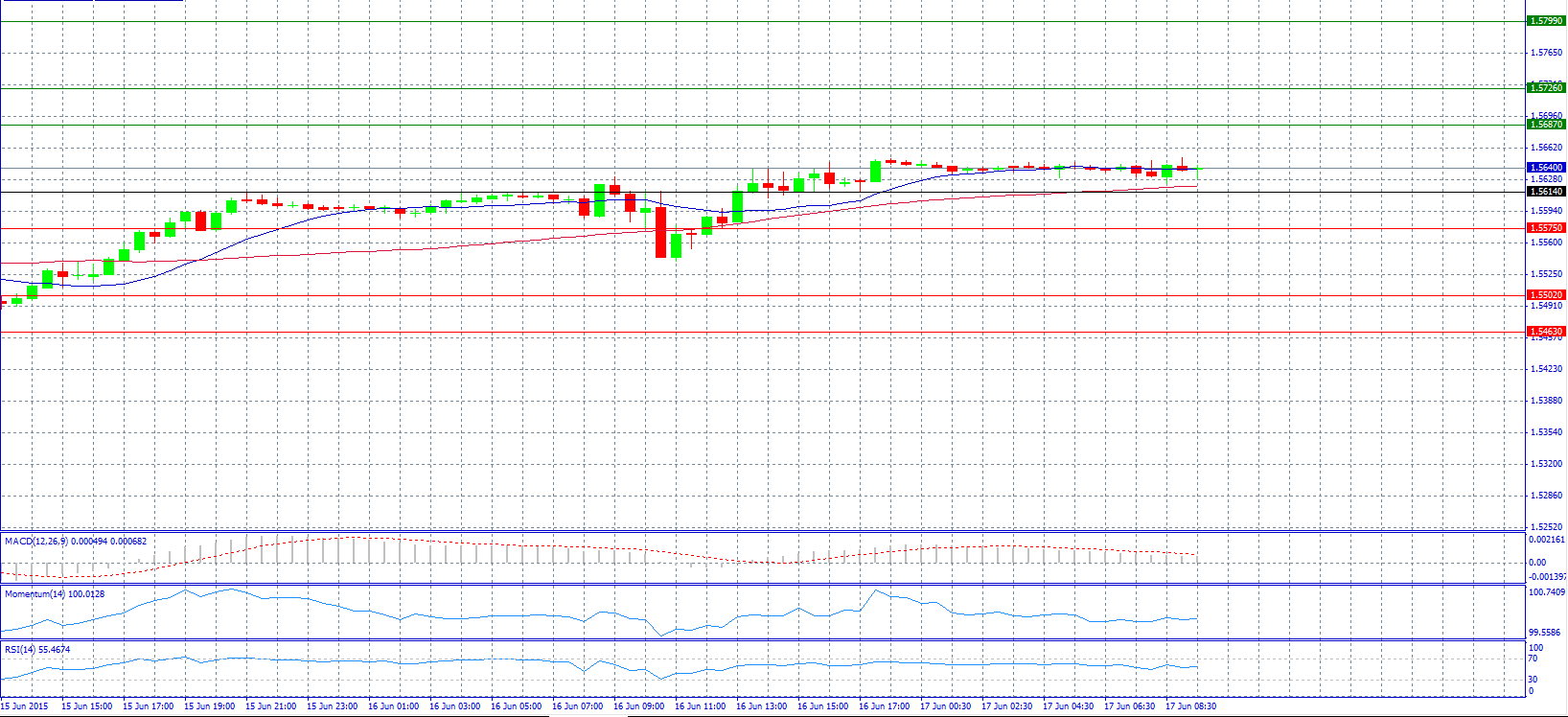

Market Scenario 1: Long positions above 1.5614 with target at 1.5687.

Market Scenario 2: Short positions below 1.5614 with target at 1.5575.

Comment: The pair trades neutral near 1.5640 level.

Supports and Resistances:

R3 1.5799

R2 1.5726

R1 1.5687

PP 1.5614

S1 1.5575

S2 1.5502

S3 1.5463

Market Scenario 1: Long positions above 123.67 with target at 123.98.

Market Scenario 2: Short positions below 123.47 with target at 123.16.

Comment: The pair advanced and now faces resistance at 123.67 level.

Supports and Resistances:

R3 124.18

R2 123.98

R1 123.67

PP 123.47

S1 123.16

S2 122.96

S3 122.65

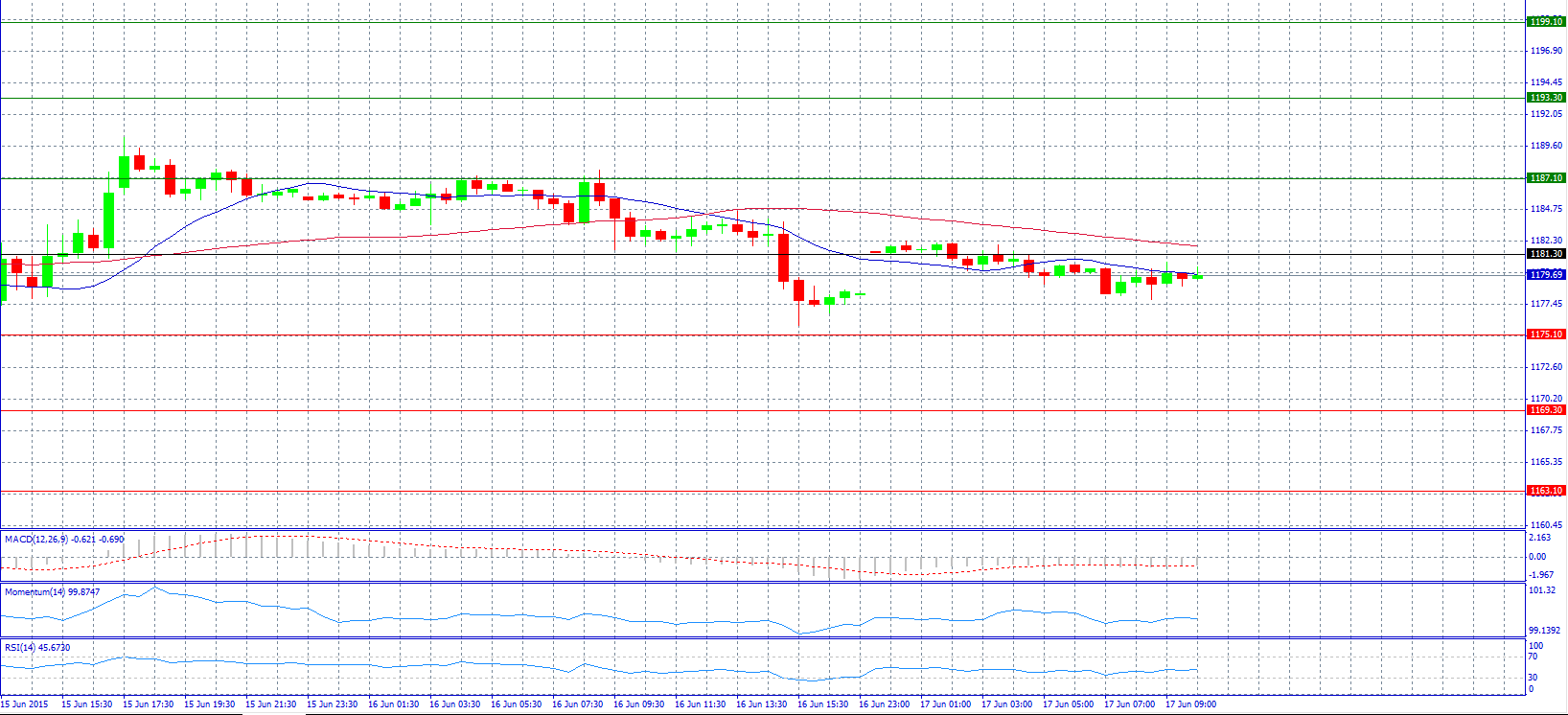

Market Scenario 1: Long positions above 1181.30 with target at 1187.10.

Market Scenario 2: Short positions below 1181.30 with target at 1175.10.

Comment: Gold prices trade lower ahead of FOMC statement.

Supports and Resistances:

R3 1199.10

R2 1193.30

R1 1187.10

PP 1181.30

S1 1175.10

S2 1169.30

S3 1163.10

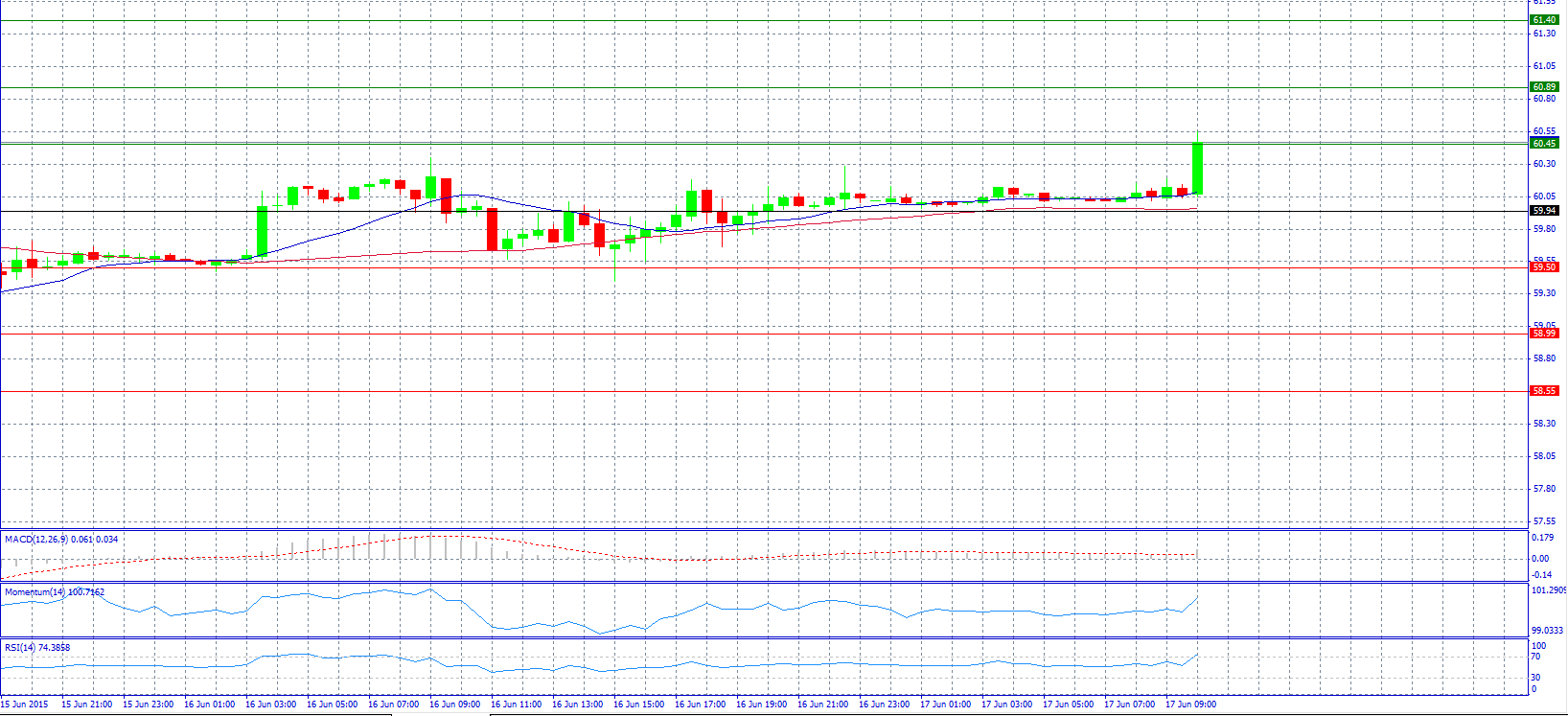

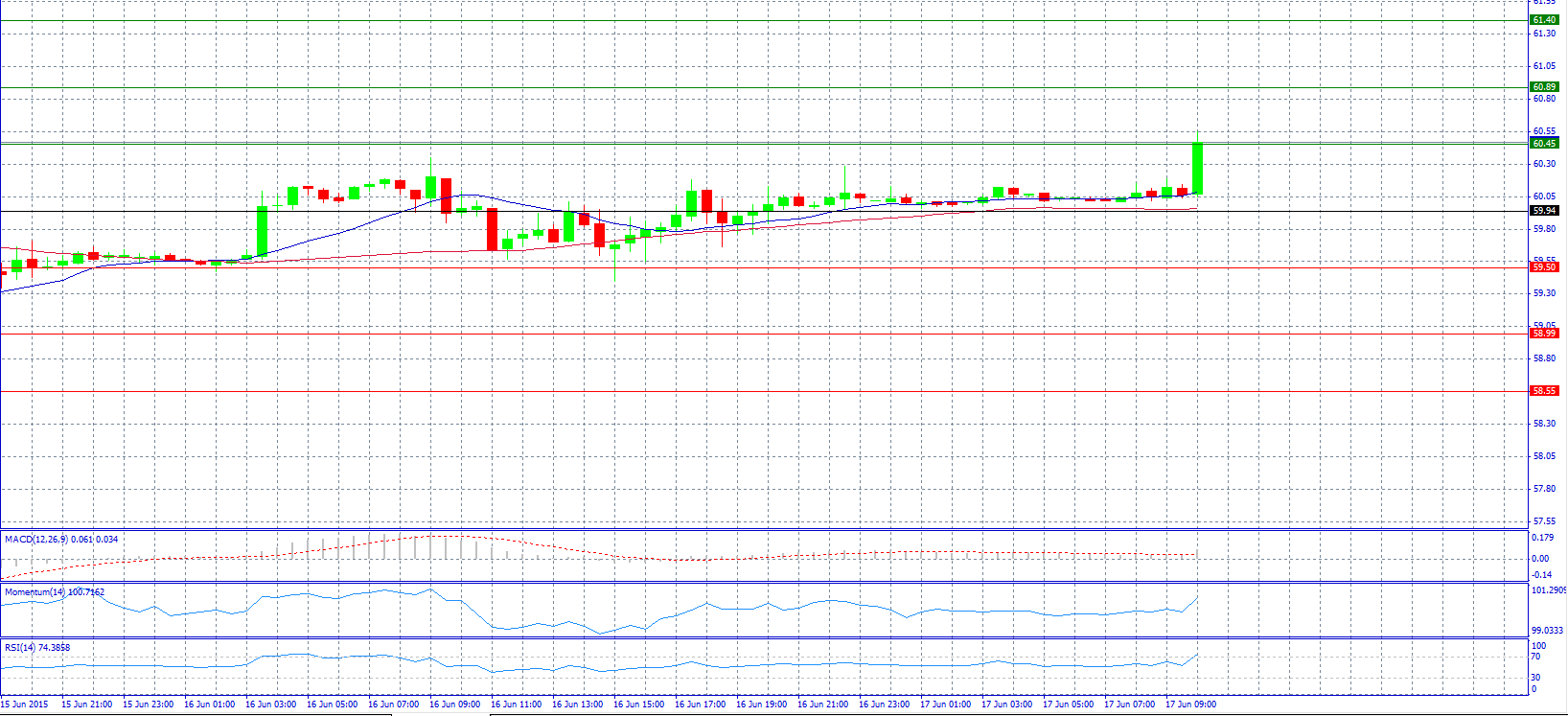

Market Scenario 1: Long positions above 60.45 with target at 60.89.

Market Scenario 2: Short positions below 59.94 with target at 59.50.

Comment: Crude oil prices jumped and try to surpass resistance level 60.45.

Supports and Resistances:

R3 61.40

R2 60.89

R1 60.45

PP 59.94

S1 59.50

S2 58.99

S3 58.55

Market Scenario 1: Long positions above 53.068 with target at 53.718.

Market Scenario 2: Short positions below 53.068 with target at 51.966.

Comment: The pair rose and now is testing pivot level 53.068.

Supports and Resistances:

R3 56.573

R2 54.822

R1 53.718

PP 53.068

S1 51.966

S2 51.316

S3 49.563