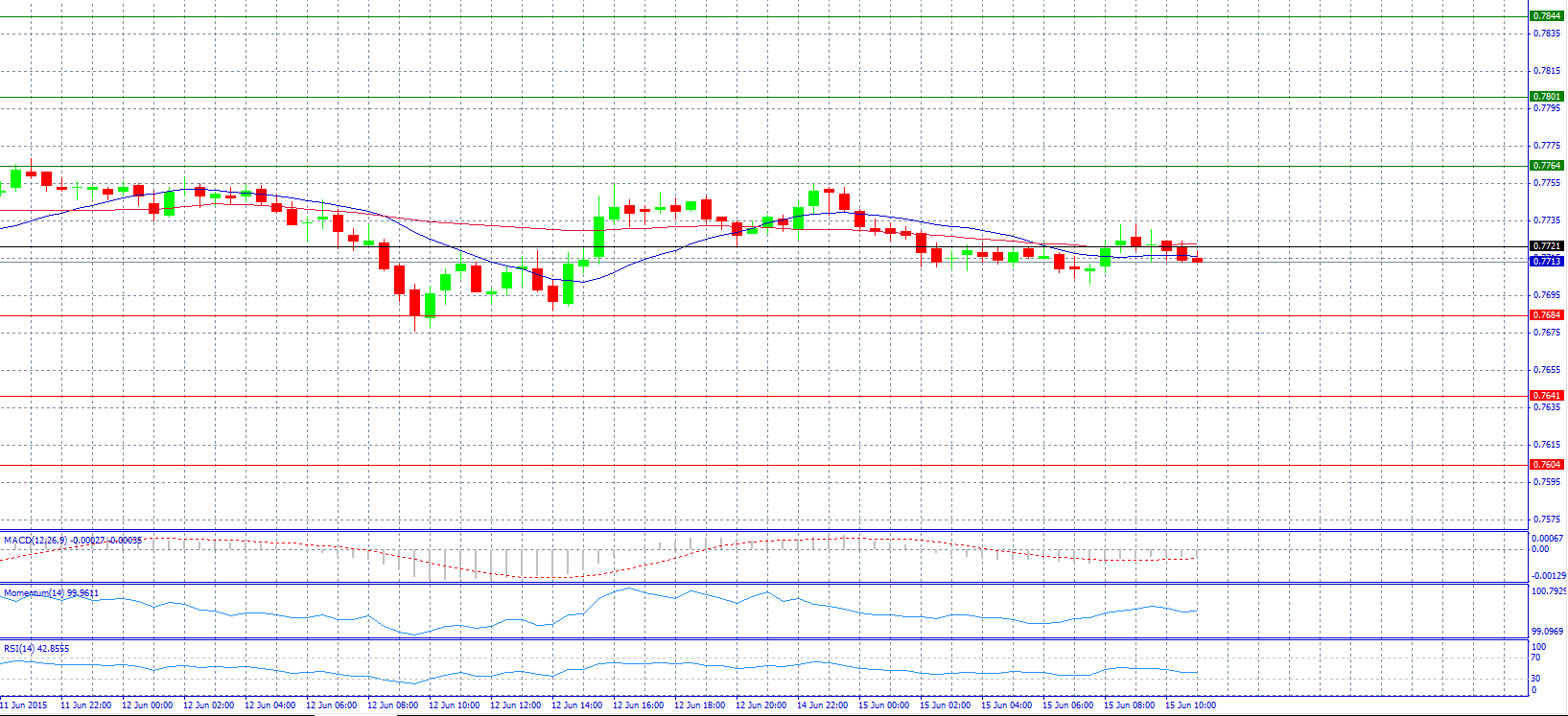

Market Scenario 1: Long positions above 0.7721 with target @ 0.7764.

Market Scenario 2: Short positions below 0.7746 with target @ 0.7684.

Comment: The pair trades steady near pivot point 0.7721.

Supports and Resistances:

R3 0.7844

R2 0.7801

R1 0.7764

PP 0.7721

S1 0.7684

S2 0.7641

S3 0.7604

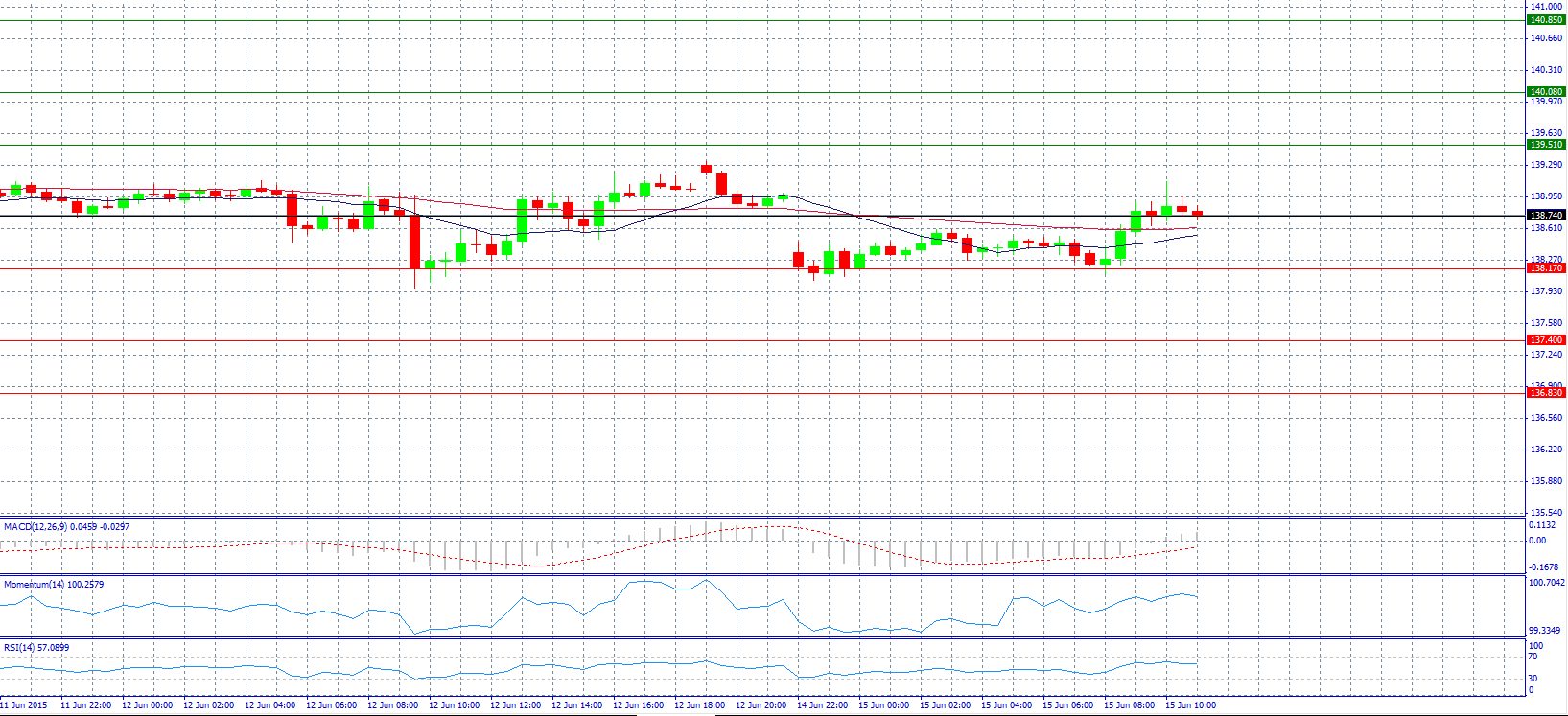

Market Scenario 1: Long positions above 138.74 with target @ 139.51.

Market Scenario 2: Short positions below 138.74 with target @ 138.17.

Comment: The pair jumped and challenges resistance level at pivot point 138.74.

Supports and Resistances:

R3 140.85

R2 140.08

R1 139.51

PP 138.74

S1 138.17

S2 137.40

S3 136.83

Market Scenario 1: Long positions above 1.1235 with target @ 1.1321.

Market Scenario 2: Short positions below 1.1235 with target @ 1.1175.

Comment: The pair advanced and tries to break pivot point 1.1235.

Supports and Resistances:

R3 1.1467

R2 1.1381

R1 1.1321

PP 1.1235

S1 1.1175

S2 1.1089

S3 1.1029

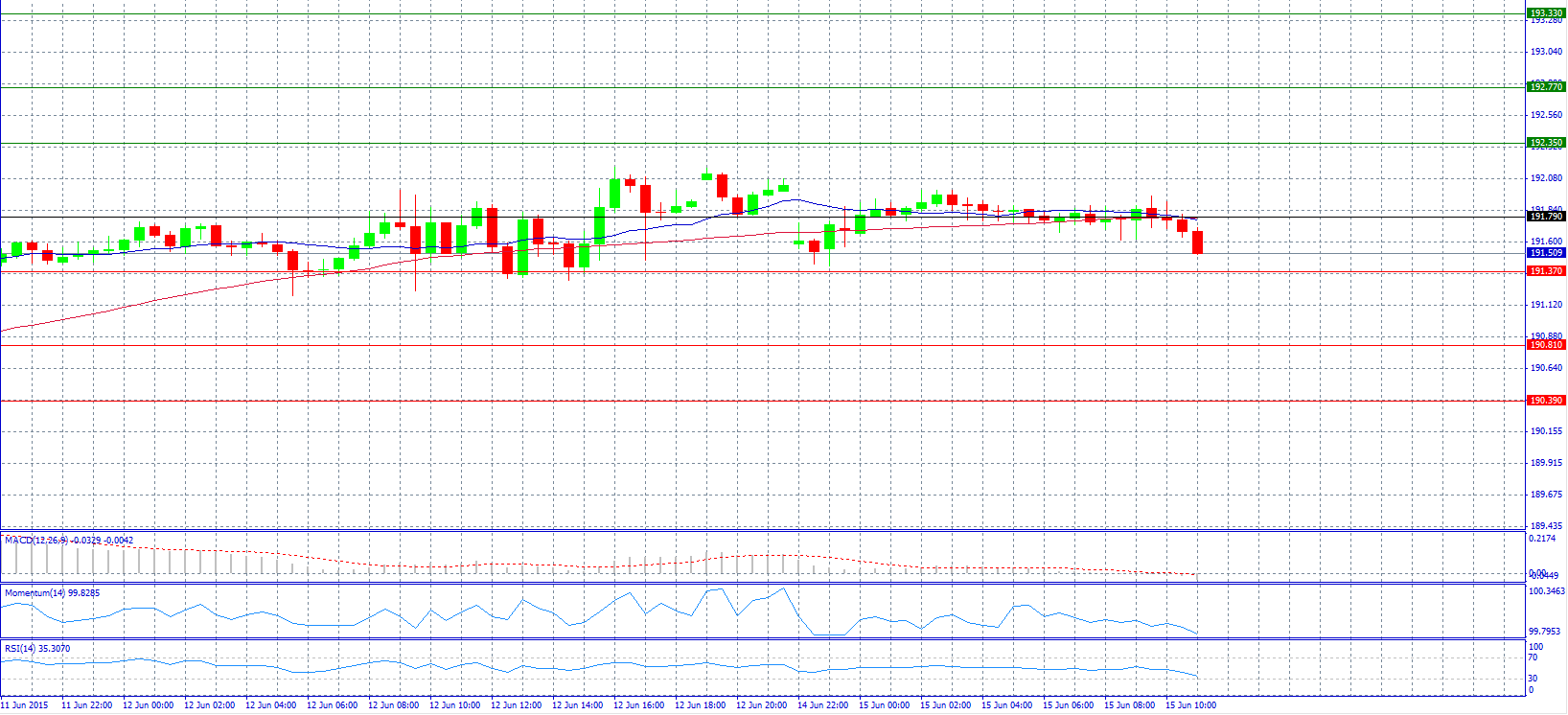

Market Scenario 1: Long positions above 191.79 with target @ 192.35.

Market Scenario 2: Short positions below 191.37 with target @ 190.81.

Comment: The pair weakened and fell near 191.50 level.

Supports and Resistances:

R3 193.33

R2 192.77

R1 192.35

PP 191.79

S1 191.37

S2 190.81

S3 190.39

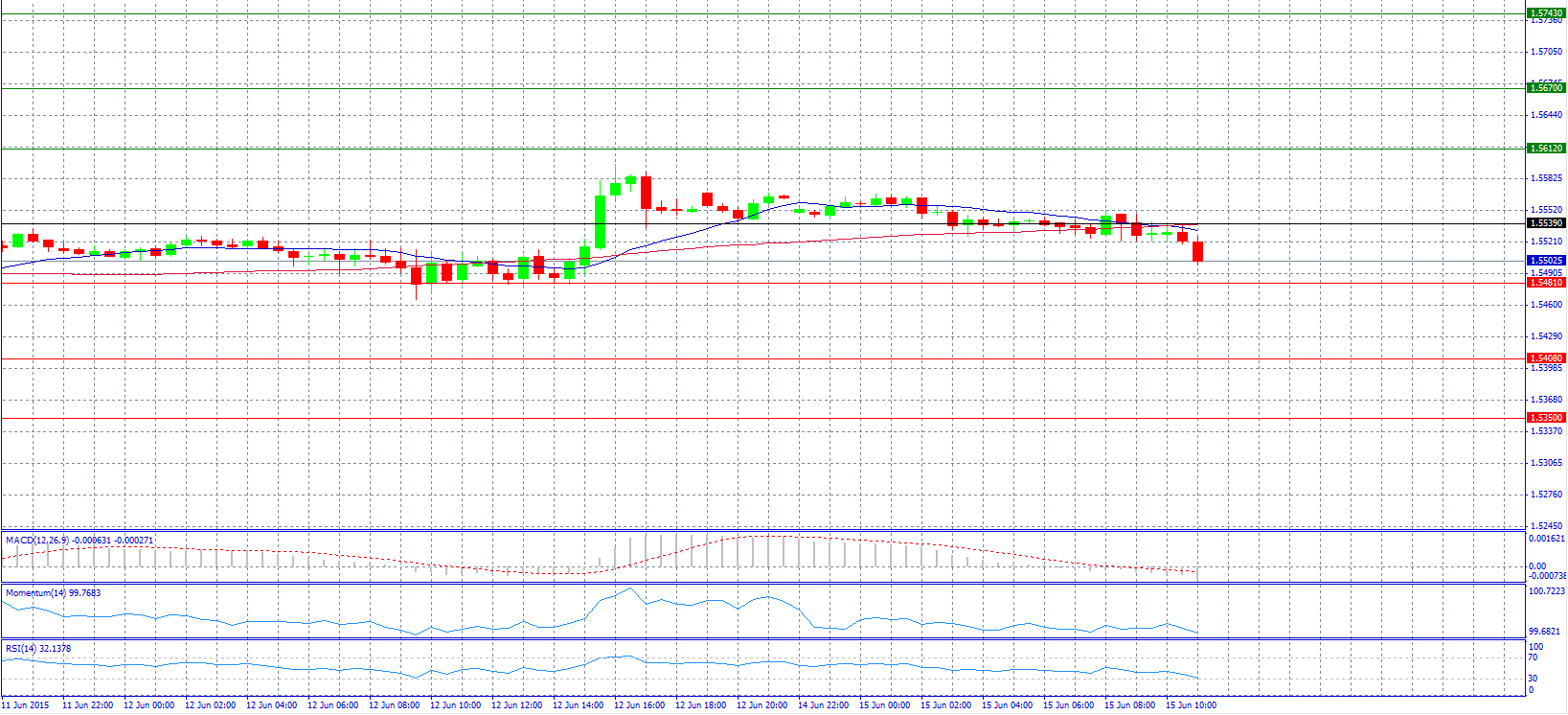

Market Scenario 1: Long positions above 1.5539 with target @ 1.5612.

Market Scenario 2: Short positions below 1.5481 with target @ 1.5481.

Comment: The pair dropped near 1.5500 level.

Supports and Resistances:

R3 1.5743

R2 1.5670

R1 1.5612

PP 1.5539

S1 1.5481

S2 1.5408

S3 1.5350

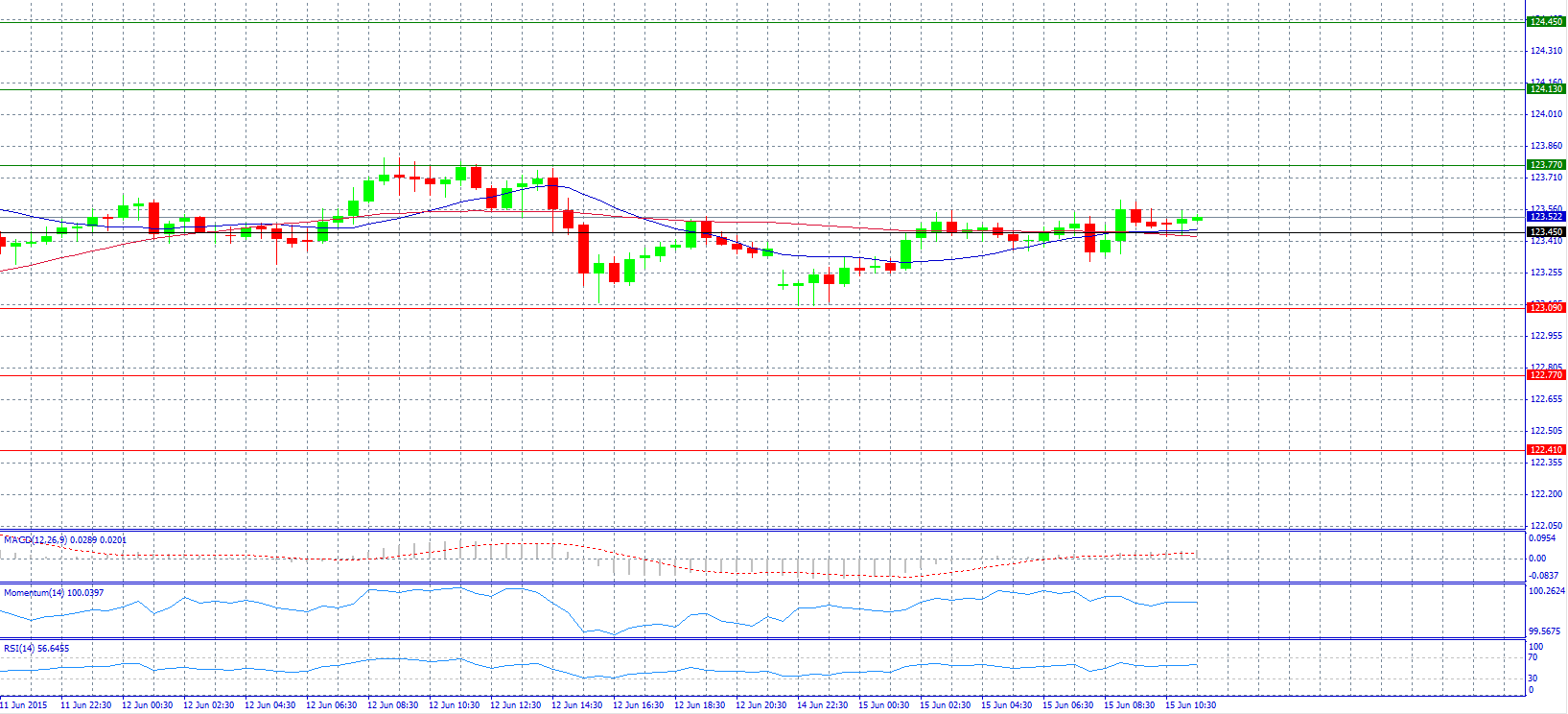

Market Scenario 1: Long positions above 123.45 with target @ 123.77.

Market Scenario 2: Short positions below 123.45 with target @ 123.09.

Comment: The pair managed to break pivot point 123.45 and now trades neutral above it.

Supports and Resistances:

R3 124.45

R2 124.13

R1 123.77

PP 123.45

S1 123.09

S2 122.77

S3 122.41

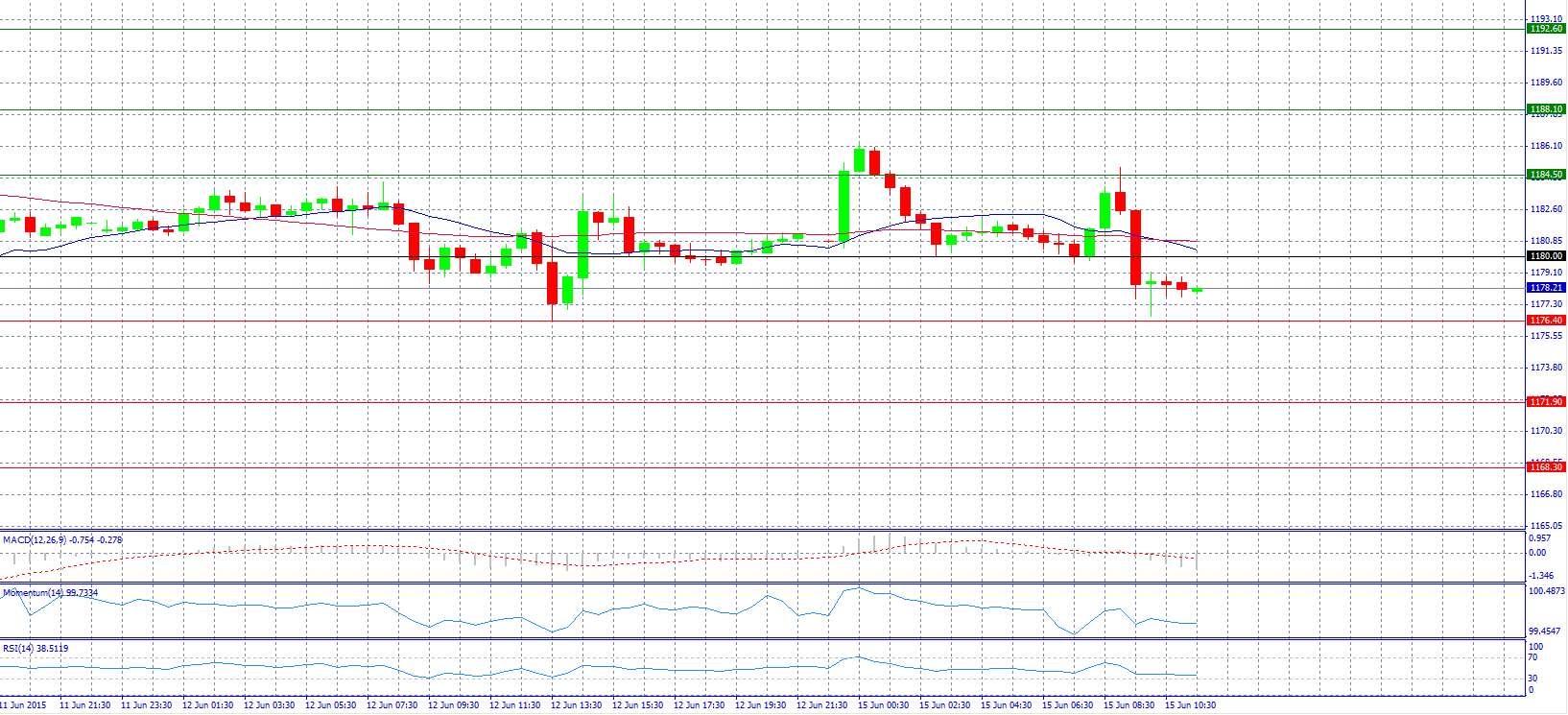

Market Scenario 1: Long positions above 1180.00 with target @ 1184.50.

Market Scenario 2: Short positions below 1176.40 with target @ 1171.90.

Comment: Gold prices begun the week on a negative note as investors stay cautious ahead of the FOMC rate decision due on Wednesday.

Supports and Resistances:

R3 1192.60

R2 1188.10

R1 1184.50

PP 1180.00

S1 1176.40

S2 1171.90

S3 1168.30

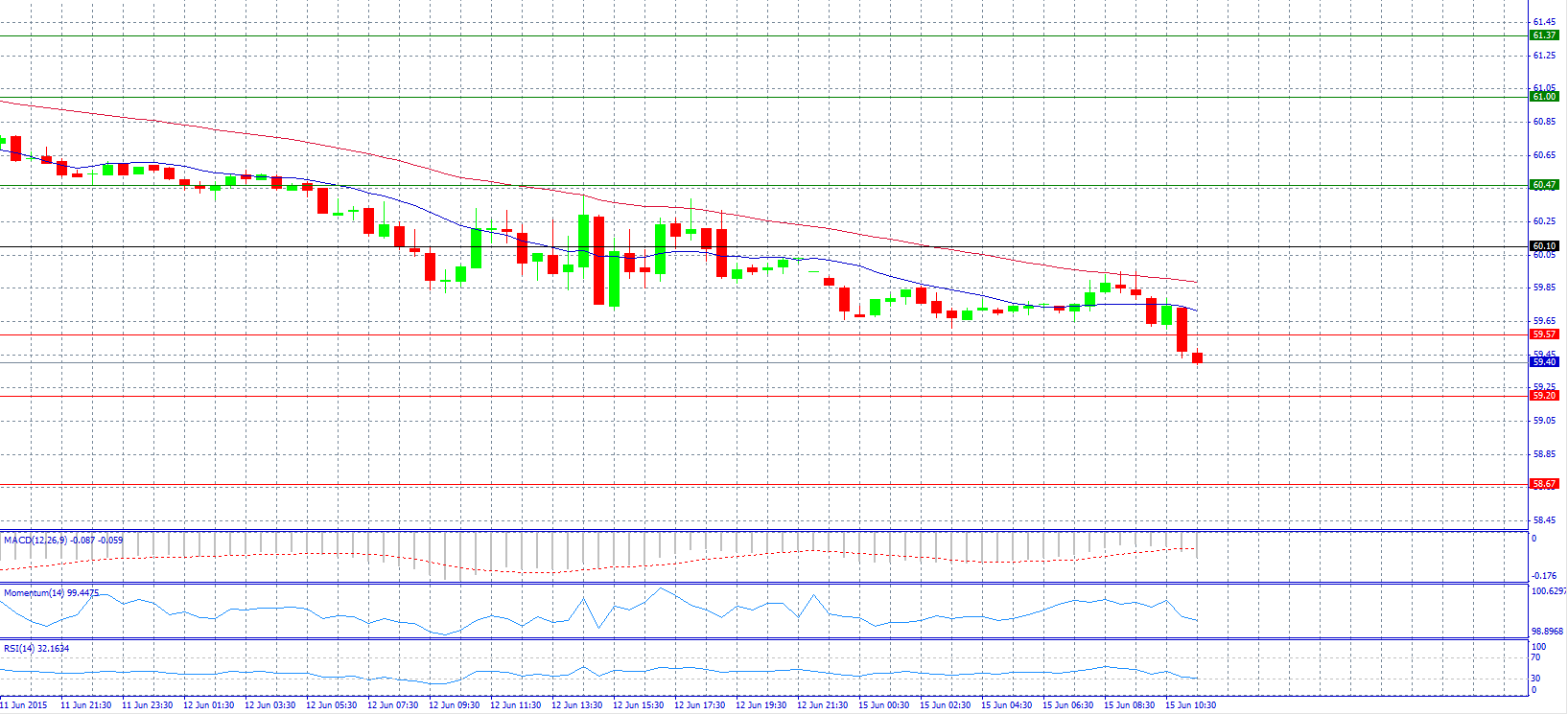

Market Scenario 1: Long positions above 59.57 with target @ 60.10.

Market Scenario 2: Short positions below 59.20 with target @ 58.67.

Comment: Crude oil prices declined on MCX on account of weak trend in Asian market as dealers fretted over a collapse in Greece's debt talks and a possible return of Iranian supplies disrupted by global sanctions.

Supports and Resistances:

R3 61.37

R2 61.00

R1 60.47

PP 60.10

S1 59.57

S2 59.20

S3 58.67

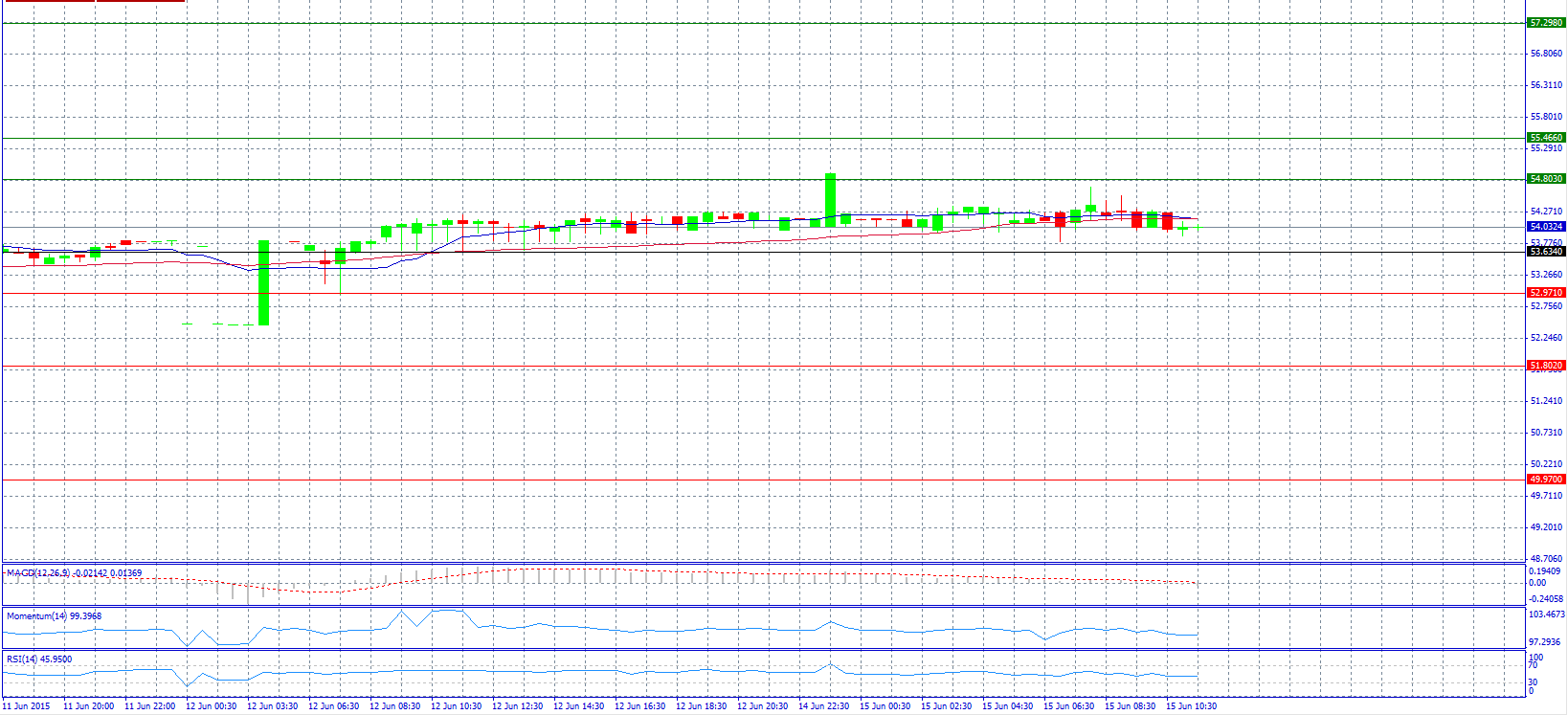

Market Scenario 1: Long positions above 54.803 with target @ 55.466.

Market Scenario 2: Short positions below 53.634 with target @ 52.971.

Comment: The pair trades neutral near 54.000 level.

Supports and Resistances:

R3 57.298

R2 55.466

R1 54.803

PP 53.634

S1 52.971

S2 51.802

S3 49.970