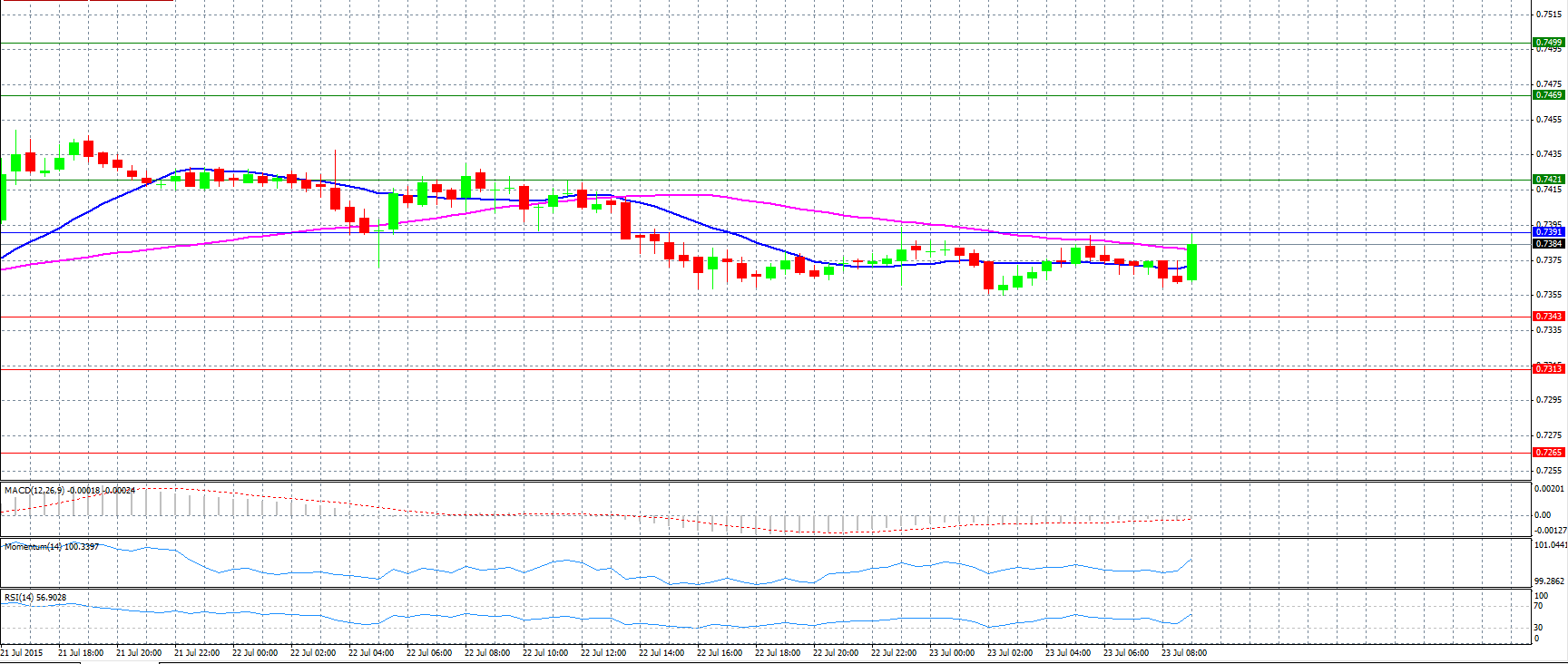

Market Scenario 1: Long positions above 0.7391 with targets at 0.7421 and 0.7469.

Market Scenario 2: Short positions below 0.7391 with targets at 0.7343 and 0.7313.

Comment: The pair advanced slightly, but still remains well below its trading average as commodity and commodity currencies decline.

Supports and Resistances:

R3 0.7499

R2 0.7469

R1 0.7421

PP 0.7391

S1 0.7343

S2 0.7313

S3 0.7265

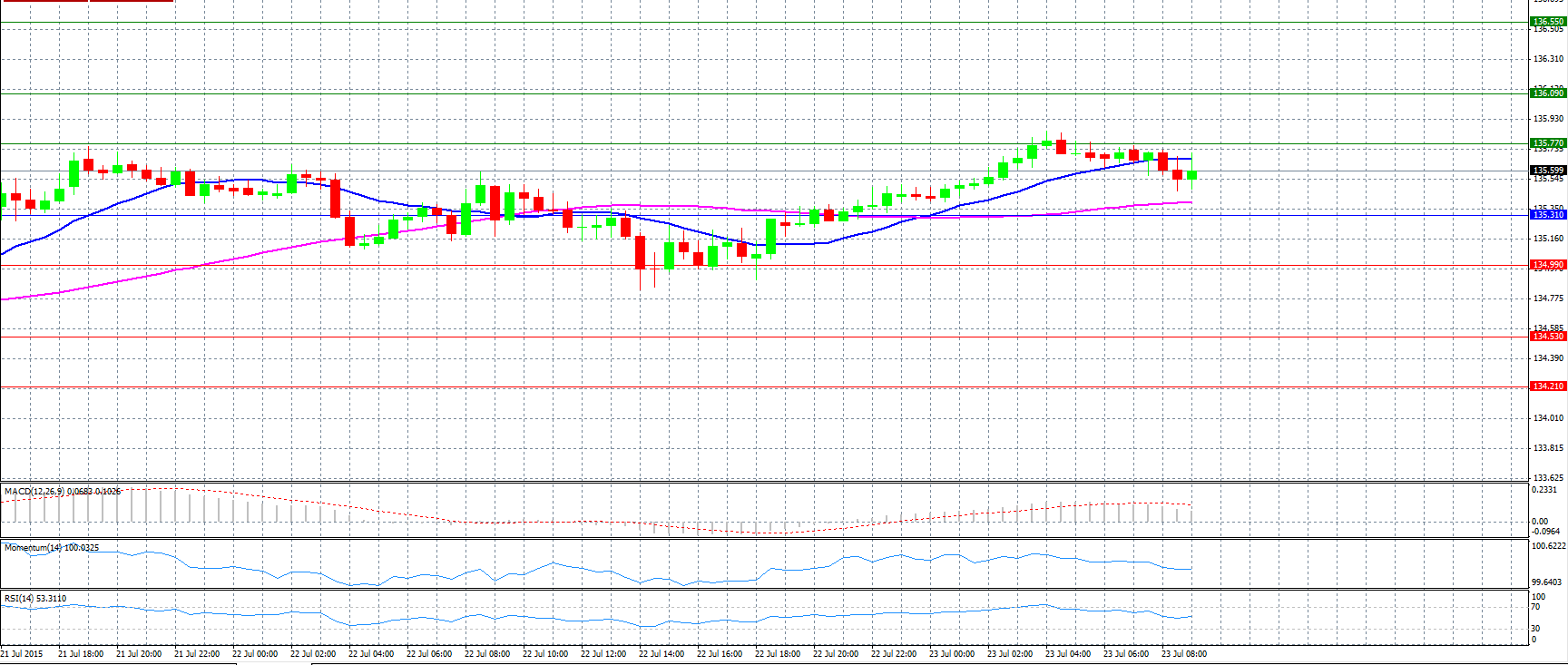

Market Scenario 1: Long positions above 135.31 with targets at 135.77 and 136.09.

Market Scenario 2: Short positions below 135.31 with targets at 134.99 and 134.53.

Comment: The pair couldn’t break resistance level 135.77 and now declines.

Supports and Resistances:

R3 136.55

R2 136.09

R1 135.77

PP 135.31

S1 134.99

S2 134.53

S3 134.21

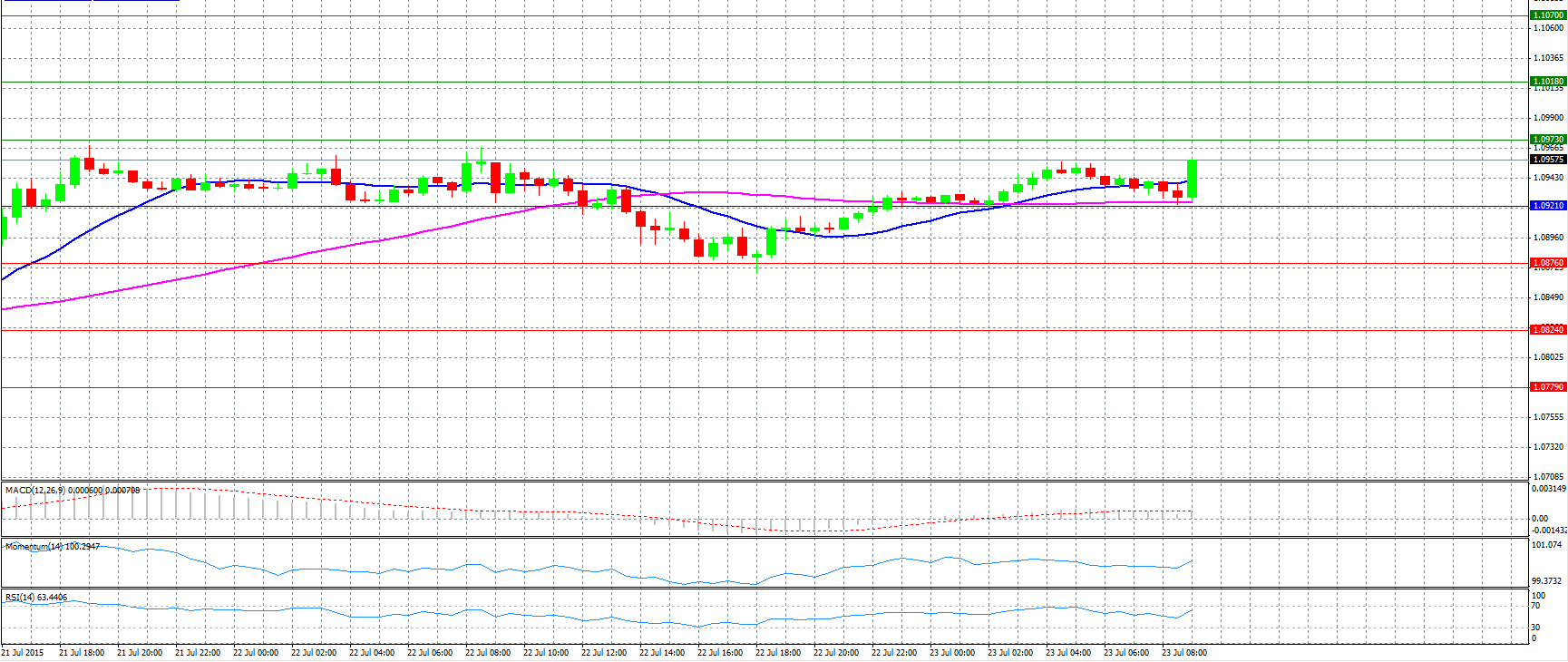

Market Scenario 1: Long positions above 1.0921 with targets at 1.0973 and 1.1018.

Market Scenario 2: Short positions below 1.0921 with targets at 1.0876 and 1.0824.

Comment: The pair advanced to the area 1.0950/60 near session peaks.

Supports and Resistances:

R3 1.1070

R2 1.1018

R1 1.0973

PP 1.0921

S1 1.0876

S2 1.0824

S3 1.0779

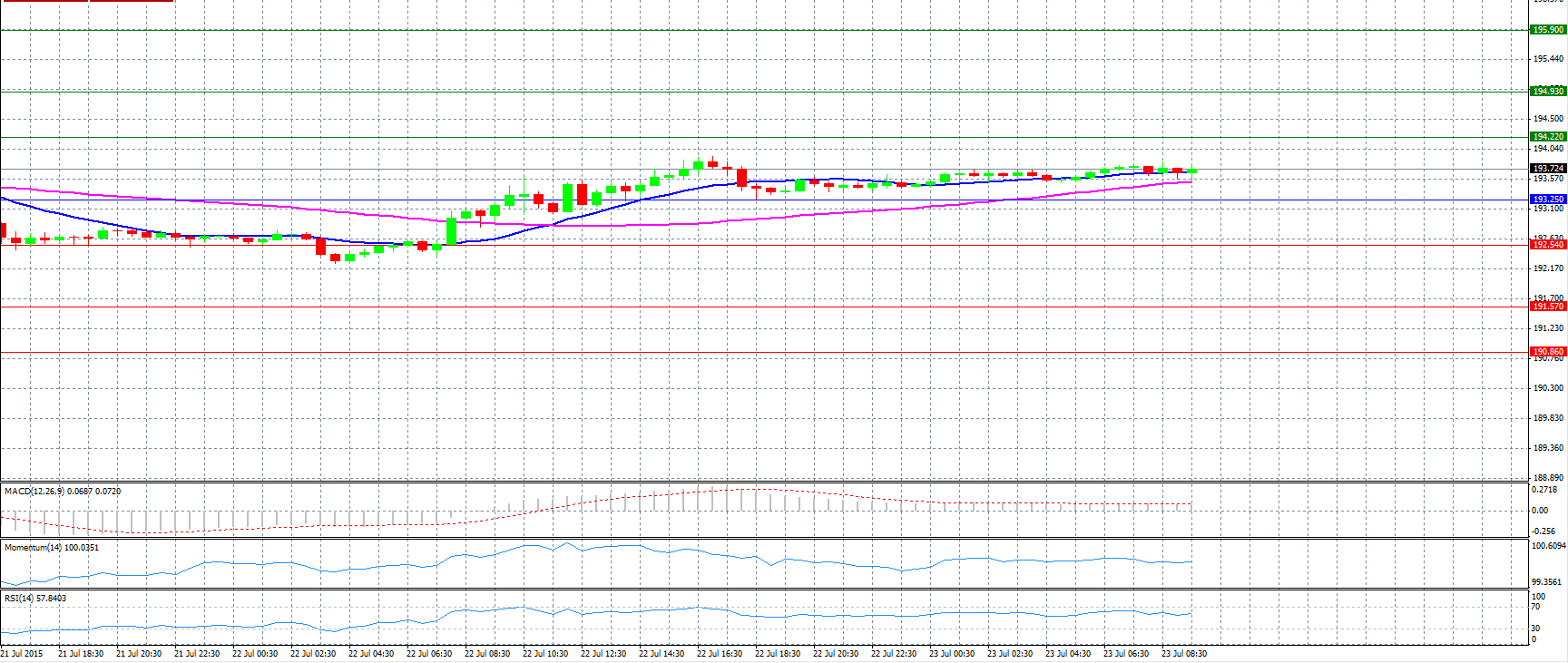

Market Scenario 1: Long positions above 193.25 with targets at 194.22 and 194.93.

Market Scenario 2: Short positions below 193.25 with targets at 192.54 and 191.57.

Comment: The pair trades neutral slightly above 193.70 level.

Supports and Resistances:

R3 195.90

R2 194.93

R1 194.22

PP 193.25

S1 192.54

S2 191.57

S3 190.86

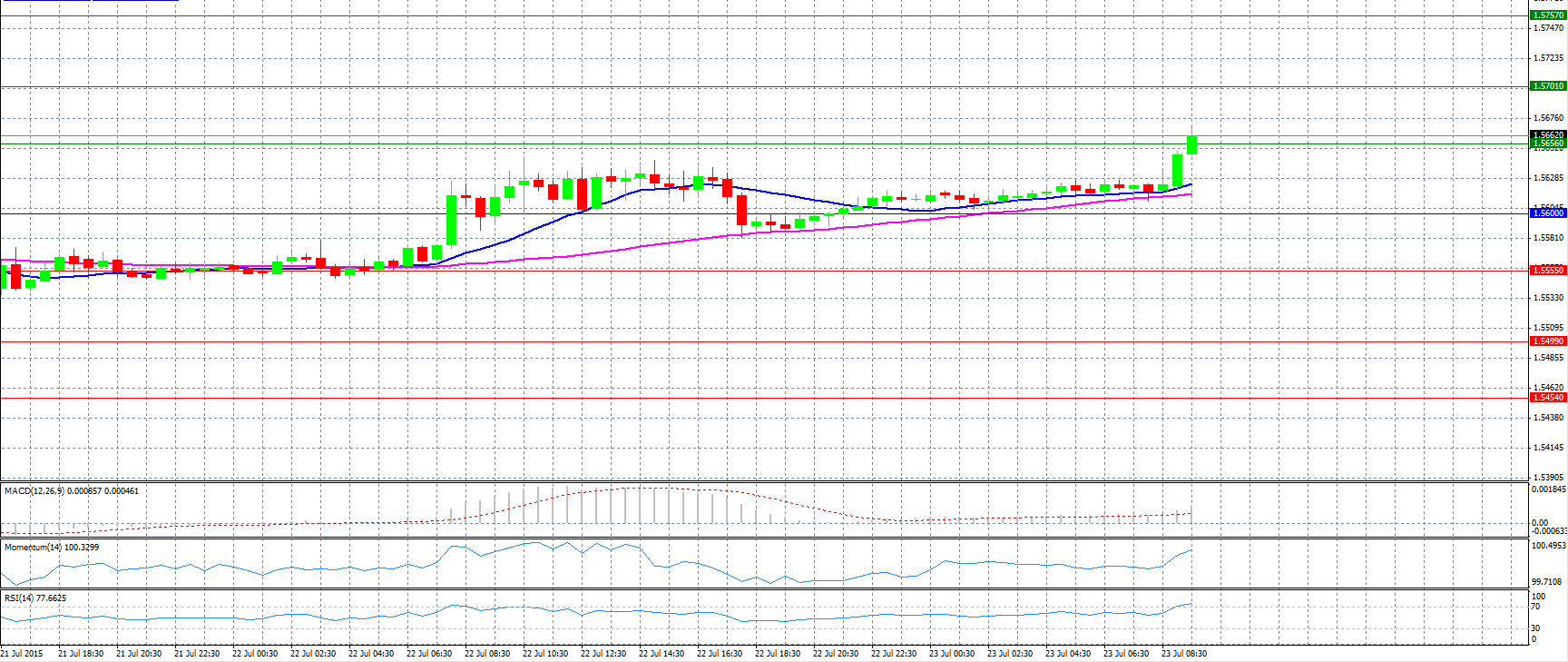

Market Scenario 1: Long positions above 1.5600 with targets at 1.5656 and 1.5701.

Market Scenario 2: Short positions below 1.5600 with targets at 1.5555 and 1.5499.

Comment: The pair jumped and tries to surpass resistance level 1.5656.

Supports and Resistances:

R3 1.5757

R2 1.5701

R1 1.5656

PP 1.5600

S1 1.5555

S2 1.5499

S3 1.5454

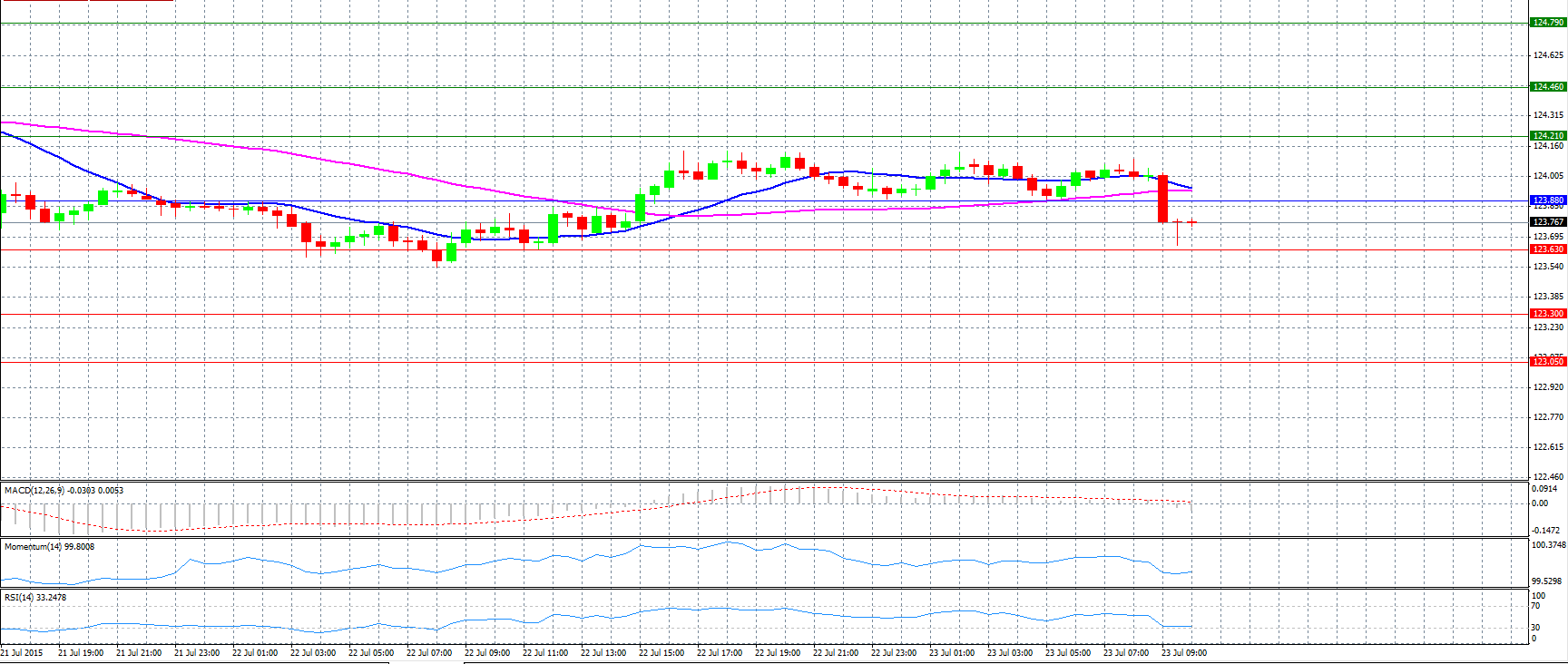

Market Scenario 1: Long positions above 123.88 with targets at 124.21 and 124.46.

Market Scenario 2: Short positions below 123.88 with targets at 123.63 and 123.30.

Comment: The pair dropped sharply below pivot point 123.88.

Supports and Resistances:

R3 124.79

R2 124.46

R1 124.21

PP 123.88

S1 123.63

S2 123.30

S3 123.05

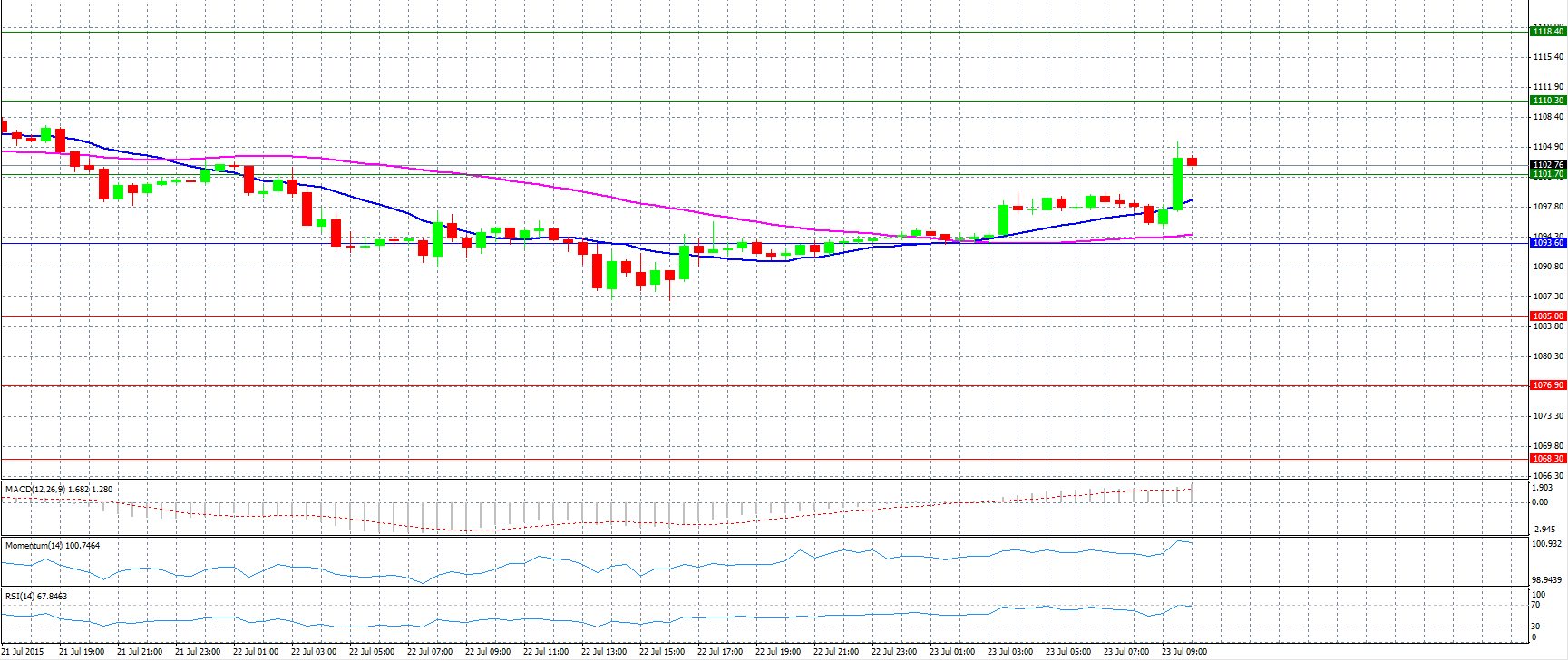

Market Scenario 1: Long positions above 1093.60 with targets at 1101.70 and 1110.30.

Market Scenario 2: Short positions below 1093.60 with targets at 1085.00 and 1076.90.

Comment: Gold prices made a rebound above resistance level 1101.70.

Supports and Resistances:

R3 1118.40

R2 1110.30

R1 1101.70

PP 1093.60

S1 1085.00

S2 1076.90

S3 1068.30

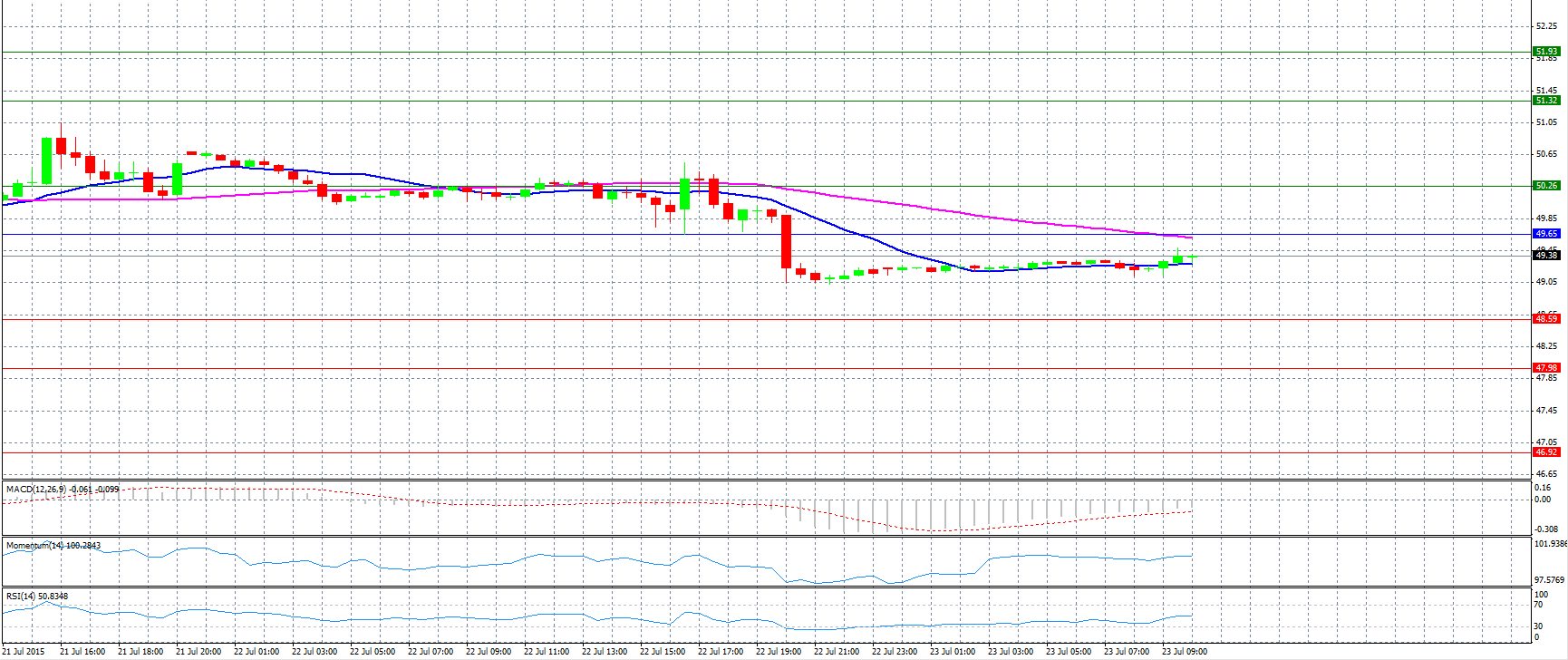

Market Scenario 1: Long positions above 49.65 with targets at 50.26 and 51.32.

Market Scenario 2: Short positions below 49.65 with targets at 48.59 and 47.98.

Comment: Crude oil prices trade near 49.40 level.

Supports and Resistances:

R3 51.93

R2 51.32

R1 50.26

PP 49.65

S1 48.59

S2 47.98

S3 46.92

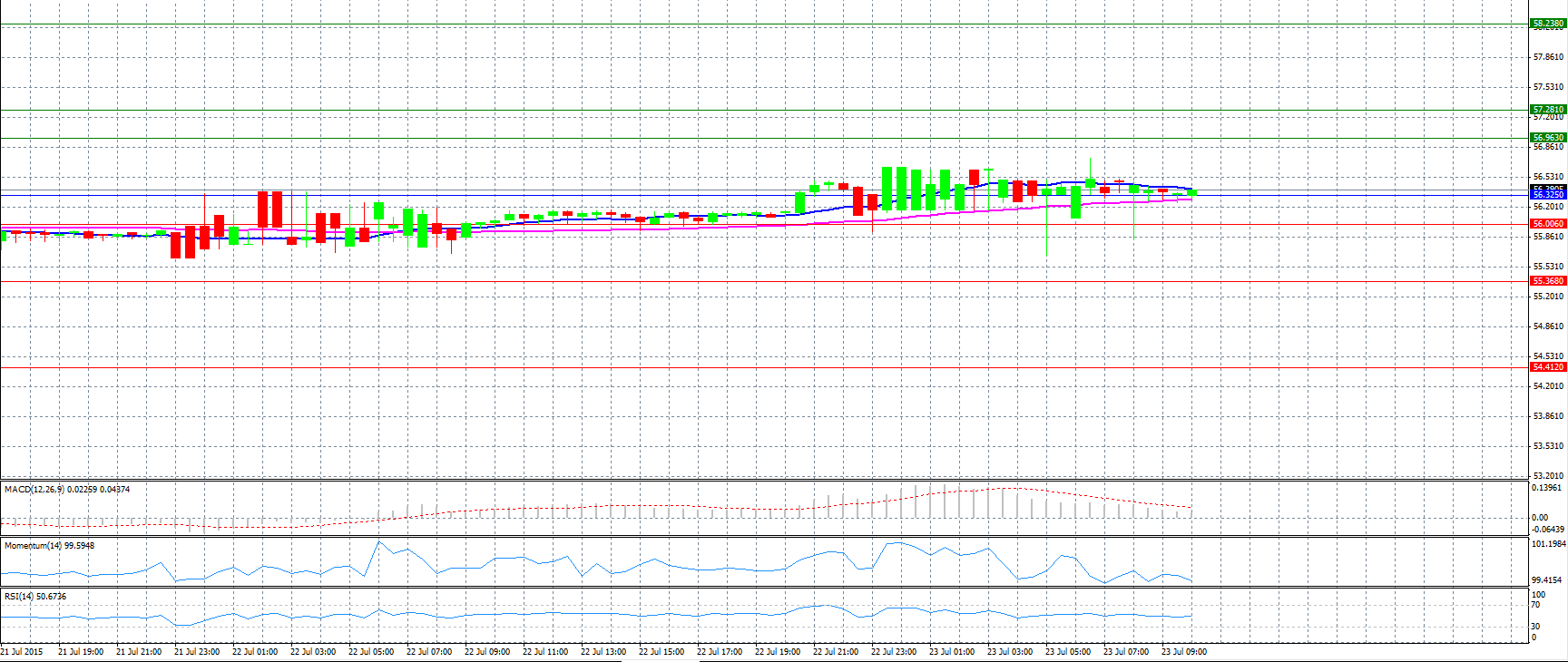

Market Scenario 1: Long positions above 56.325 with targets at 56.963 and 57.281.

Market Scenario 2: Short positions below 56.325 with targets at 56.006 and 55.368.

Comment: The pair trades neutral above pivot point 56.325.

Supports and Resistances:

R3 58.238

R2 57.281

R1 56.963

PP 56.325

S1 56.006

S2 55.368

S3 54.412