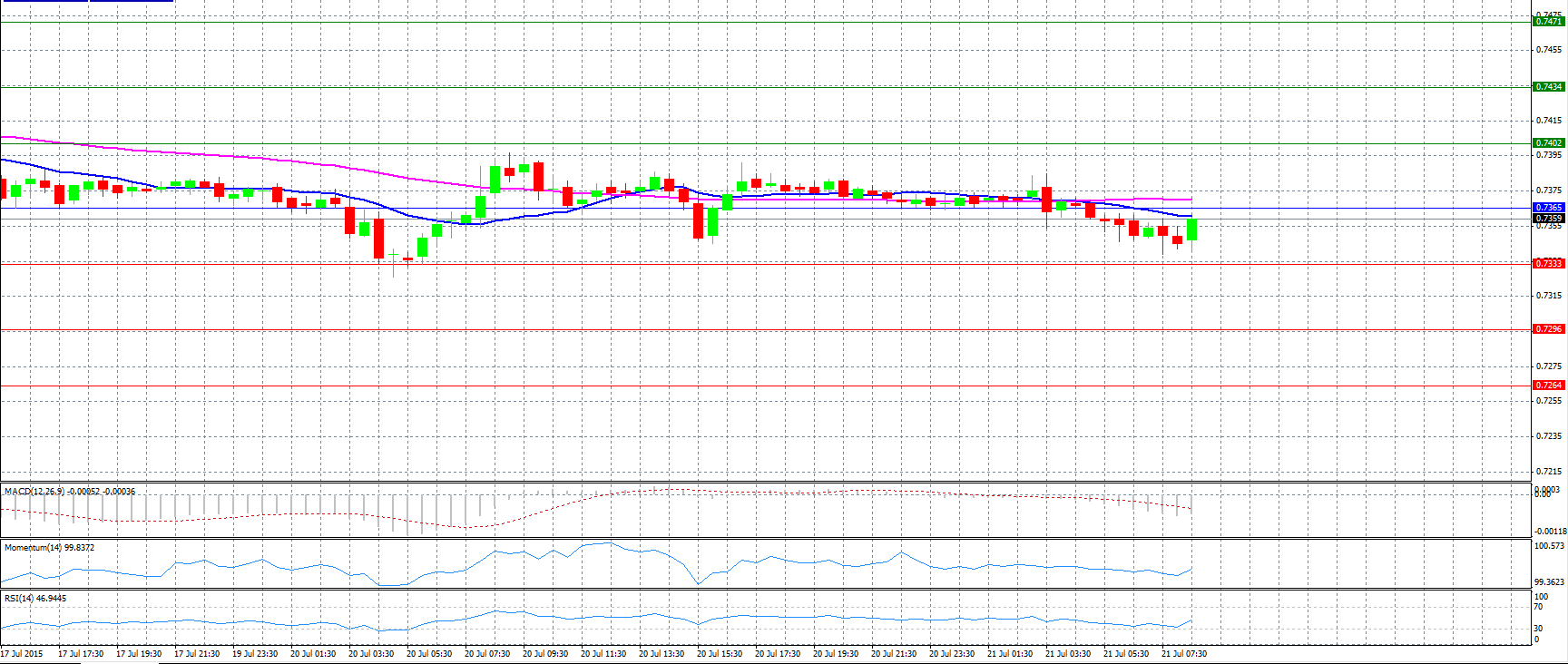

Market Scenario 1: Long positions above 0.7365 with targets at 0.7402 and 0.7434.

Market Scenario 2: Short positions below 0.7365 with targets at 0.7333 and 0.7296.

Comment: The pair has resumed its descent in recent weeks, hitting a new 6-year low of 0.7350 in mid-July. The fall has coincided with rising concerns over China and weak commodity prices.

Supports and Resistances:

R3 0.7471

R2 0.7434

R1 0.7402

PP 0.7365

S1 0.7333

S2 0.7296

S3 0.7264

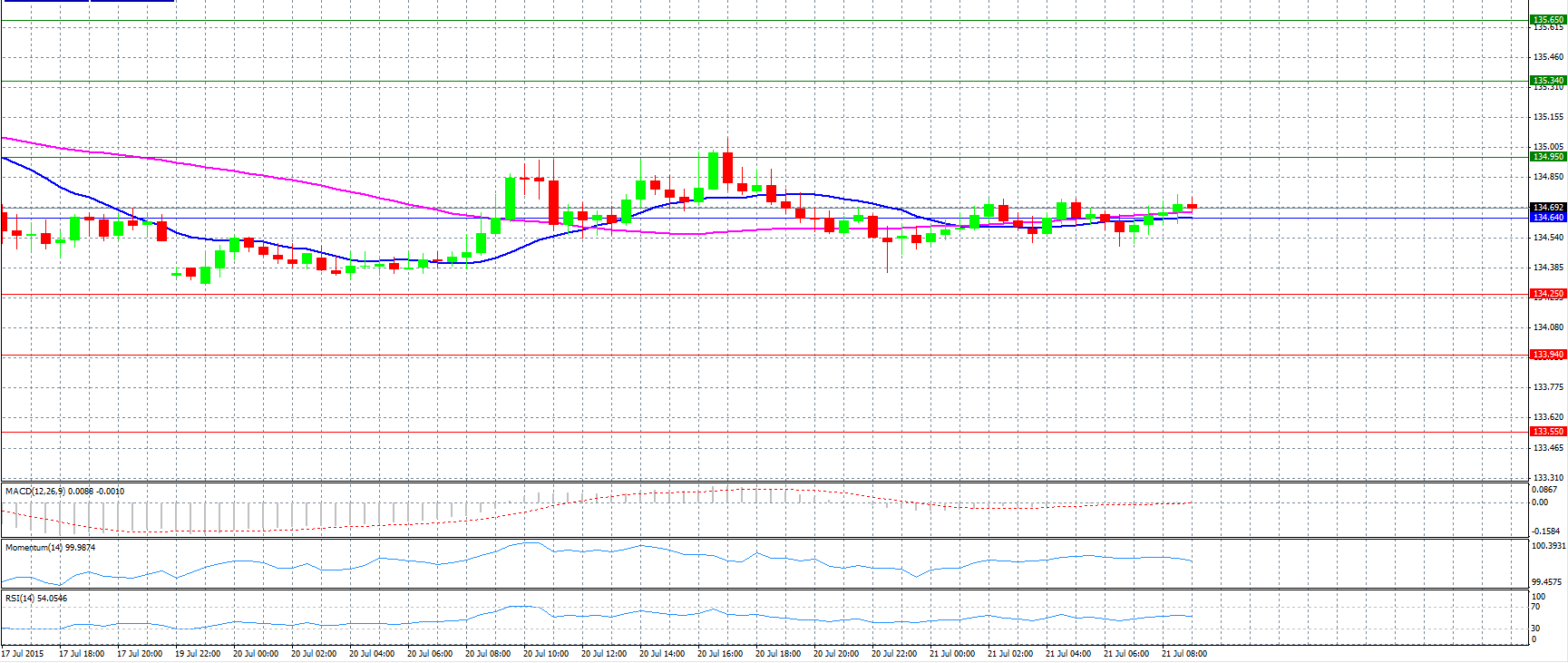

Market Scenario 1: Long positions above 134.64 with targets at 134.95 and 135.34.

Market Scenario 2: Short positions below 134.64 with targets at 134.25 and 133.94.

Comment: The pair hovers above pivot point 134.64.

Supports and Resistances:

R3 135.65

R2 135.34

R1 134.95

PP 134.64

S1 134.25

S2 133.94

S3 133.55

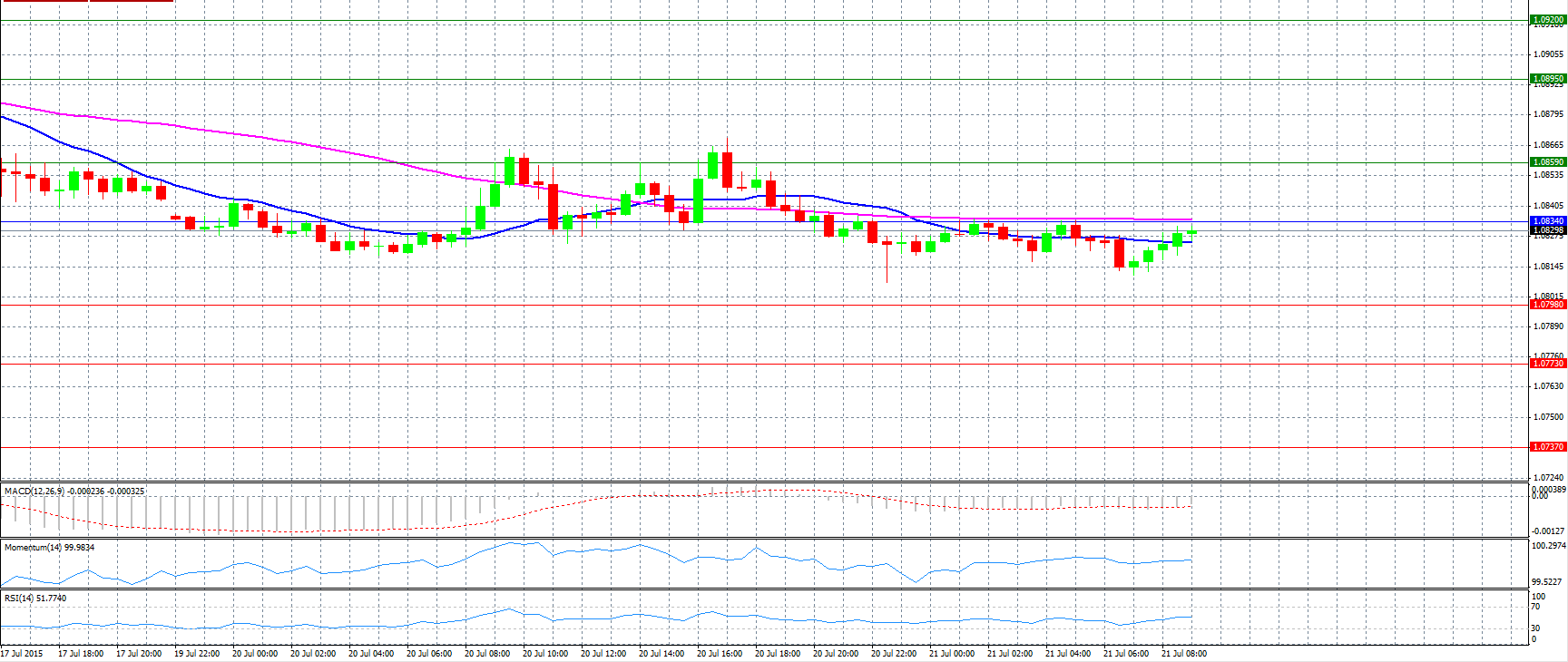

Market Scenario 1: Long positions above 1.0834 with targets at 1.0859 and 1.0895.

Market Scenario 2: Short positions below 1.0834 with targets at 1.0798 and 1.0773.

Comment: The pair alternated gains with losses during the European morning on Tuesday and hangs on to the 1.0820 area.

Supports and Resistances:

R3 1.0920

R2 1.0895

R1 1.0859

PP 1.0834

S1 1.0798

S2 1.0773

S3 1.0737

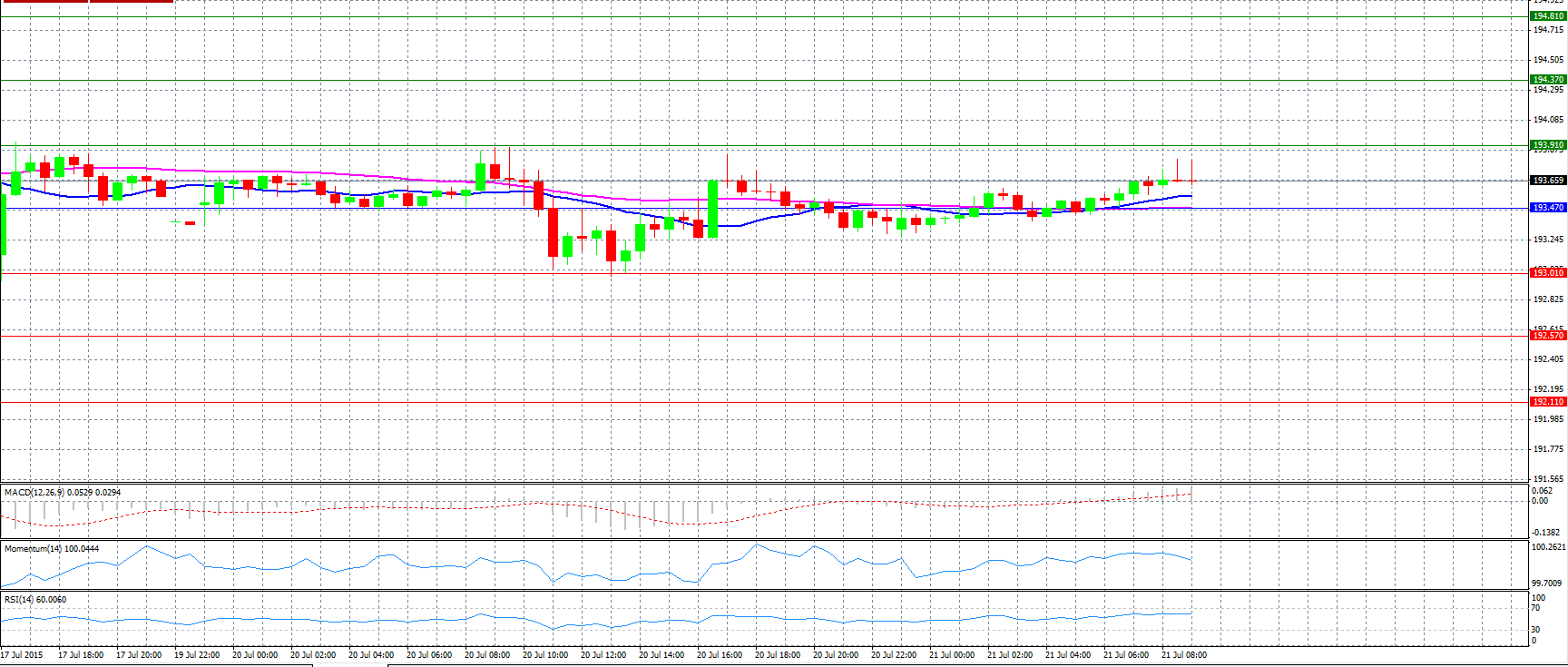

Market Scenario 1: Long positions above 193.47 with targets at 193.91 and 194.37.

Market Scenario 2: Short positions below 193.47 with targets at 193.01 and 192.57.

Comment: The pair advanced and trades above 193.60 level.

Supports and Resistances:

R3 194.81

R2 194.37

R1 193.91

PP 193.47

S1 193.01

S2 192.57

S3 192.11

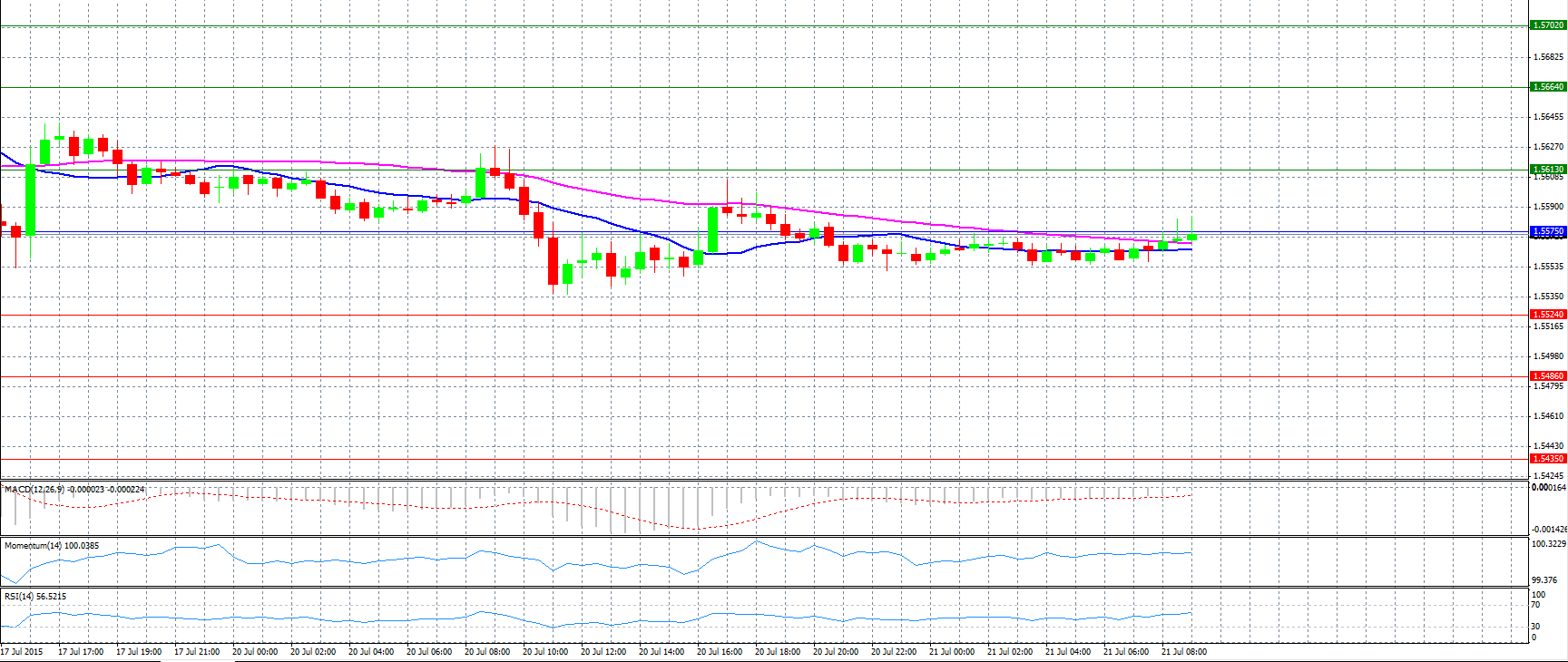

Market Scenario 1: Long positions above 1.5575 with targets at 1.5613 and 1.5664.

Market Scenario 2: Short positions below 1.5575 with targets at 1.5524 and 1.5486.

Comment: The pair is expected to remain quite thin for the time being for chances of further gains.

Supports and Resistances:

R3 1.5702

R2 1.5664

R1 1.5613

PP 1.5575

S1 1.5524

S2 1.5486

S3 1.5435

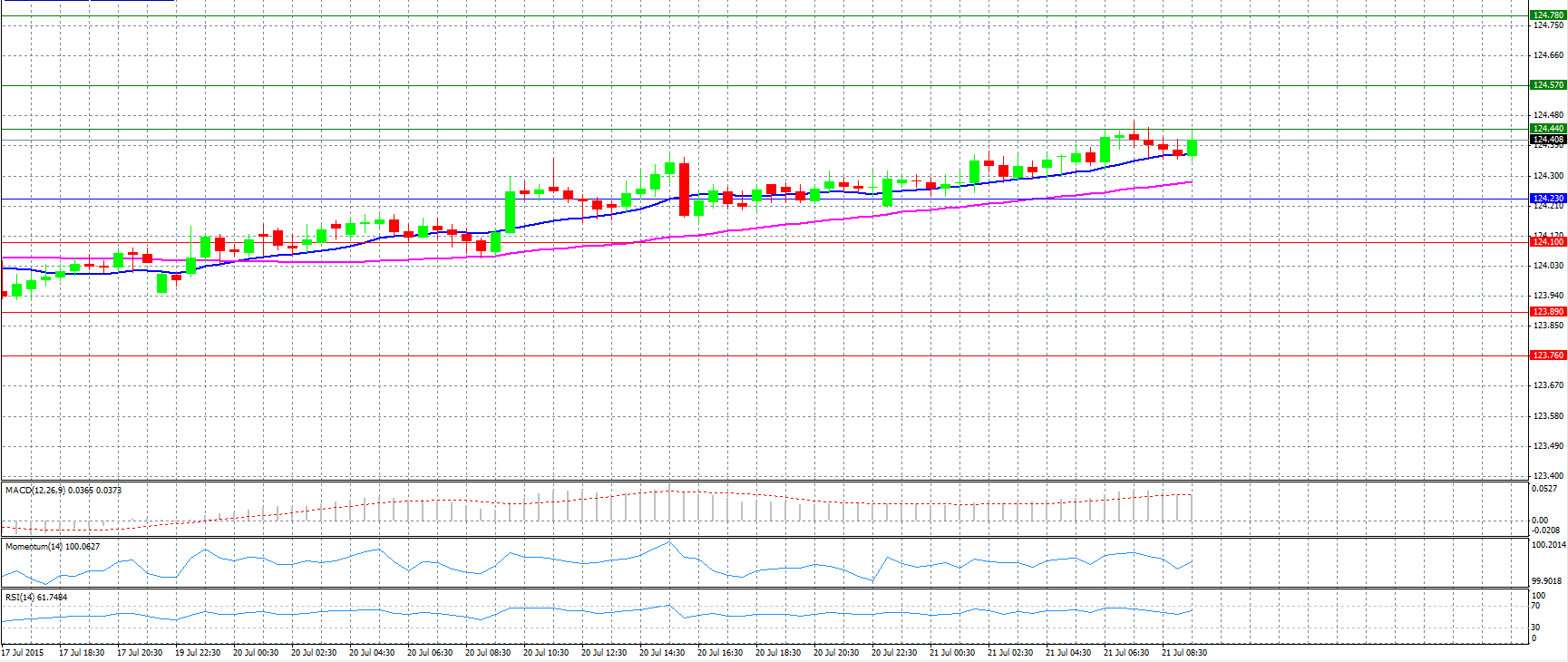

Market Scenario 1: Long positions above 124.23 with targets at 124.44 and 124.57.

Market Scenario 2: Short positions below 124.23 with targets at 124.10 and 123.89.

Comment: The pair has a bullish tone and now faces resistance level 124.44.

Supports and Resistances:

R3 124.78

R2 124.57

R1 124.44

PP 124.23

S1 124.10

S2 123.89

S3 123.76

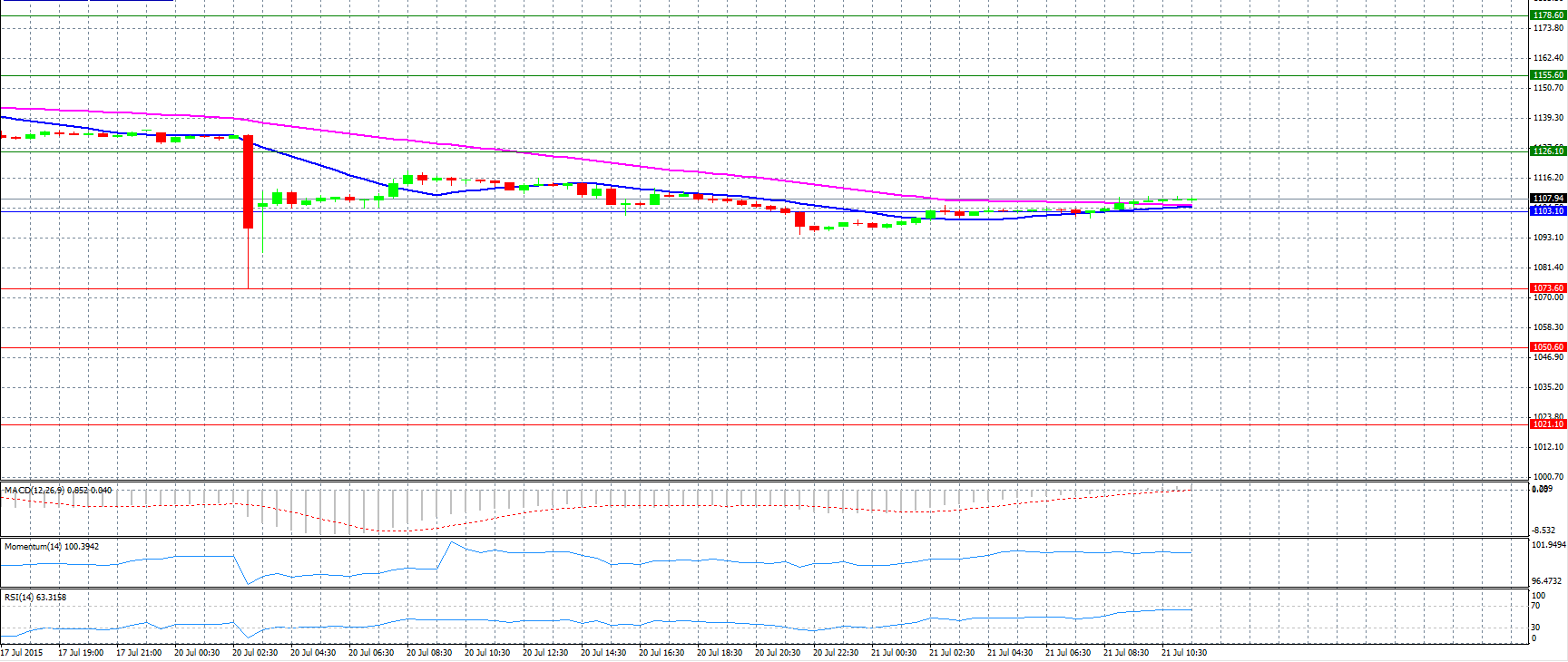

Market Scenario 1: Long positions above 1103.10 with targets at 1126.10 and 1155.60.

Market Scenario 2: Short positions below 1103.10 with targets at 1073.60 and 1050.60.

Comment: Gold prices trade neutral near pivot point 1103.10.

Supports and Resistances:

R3 1178.60

R2 1155.60

R1 1126.10

PP 1103.10

S1 1073.60

S2 1050.60

S3 1021.10

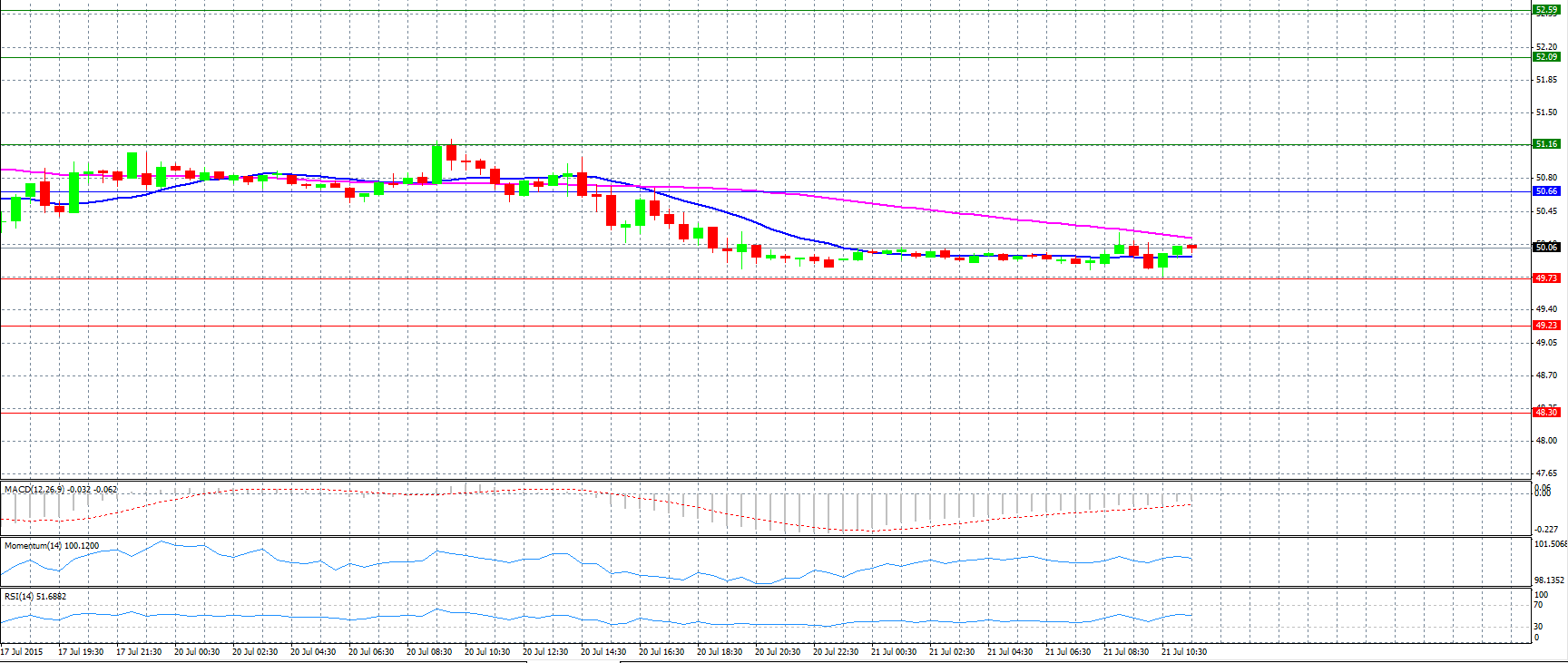

Market Scenario 1: Long positions above 50.66 with targets at 51.16 and 52.09.

Market Scenario 2: Short positions below 50.66 with targets at 49.73 and 49.23.

Comment: Crude oil prices trade unchanged near 50.00 level.

Supports and Resistances:

R3 52.59

R2 52.09

R1 51.16

PP 50.66

S1 49.73

S2 49.23

S3 48.30

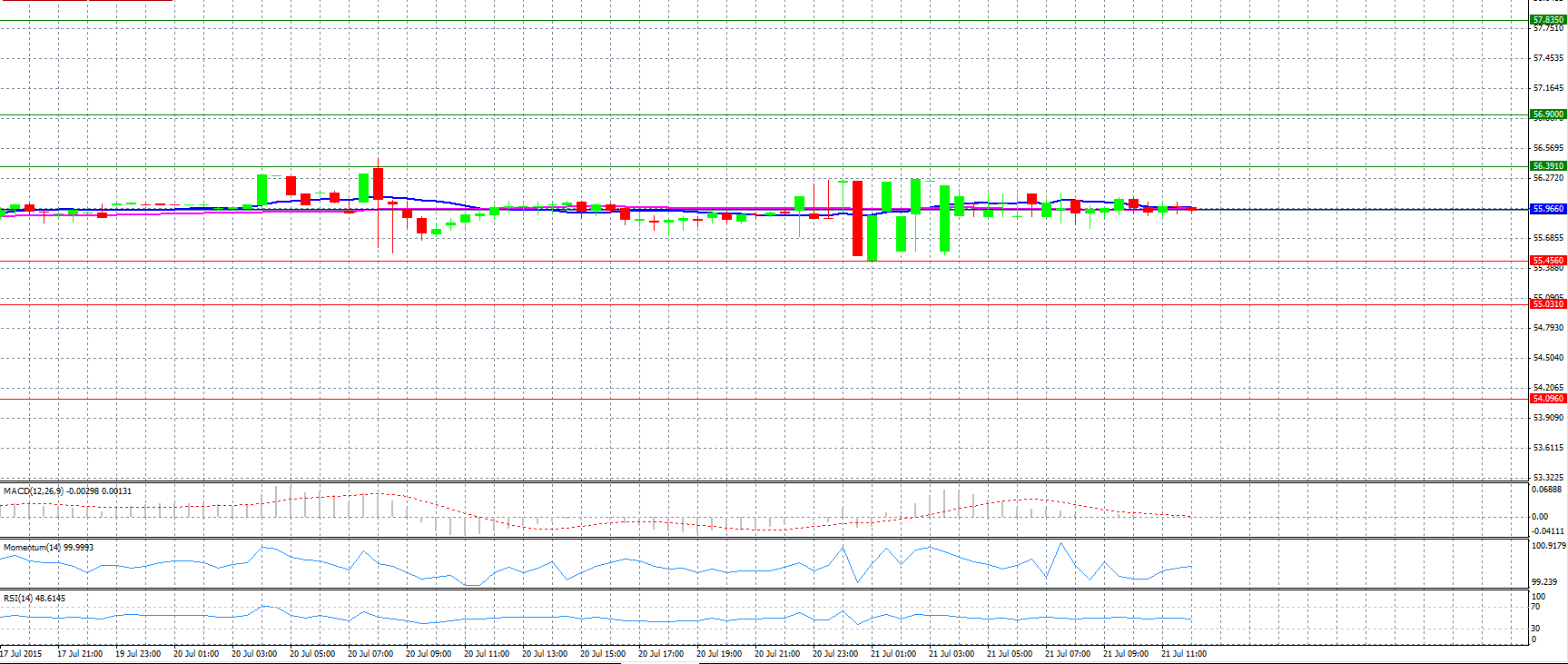

Market Scenario 1: Long positions above 55.966 with targets at 56.391 and 56.900.

Market Scenario 2: Short positions below 55.966 with targets at 55.456 and 55.031.

Comment: The pair trades flat near pivot point 55.966.

Supports and Resistances:

R3 57.835

R2 56.900

R1 56.391

PP 55.966

S1 55.456

S2 55.031

S3 54.096