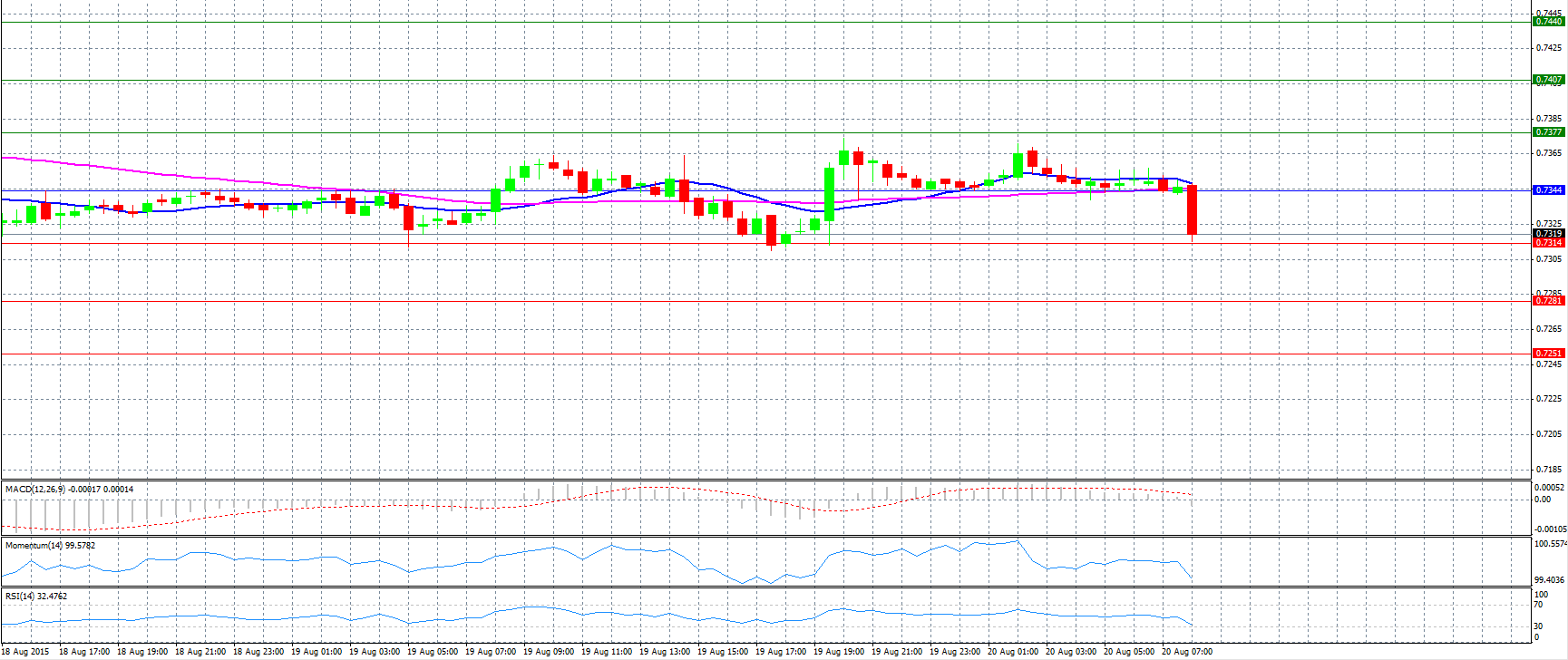

Market Scenario 1: Long positions above 0.7344 with targets at 0.7377 and 0.7407.

Market Scenario 2: Short positions below 0.7344 with targets at 0.7314 and 0.7281.

Comment: The pair broke the support at pivot point 0.7344 and now attempts to reach second support at 0.7314 level.

Supports and Resistances:

R3 0.7440

R2 0.7407

R1 0.7377

PP 0.7344

S1 0.7314

S2 0.7281

S3 0.7251

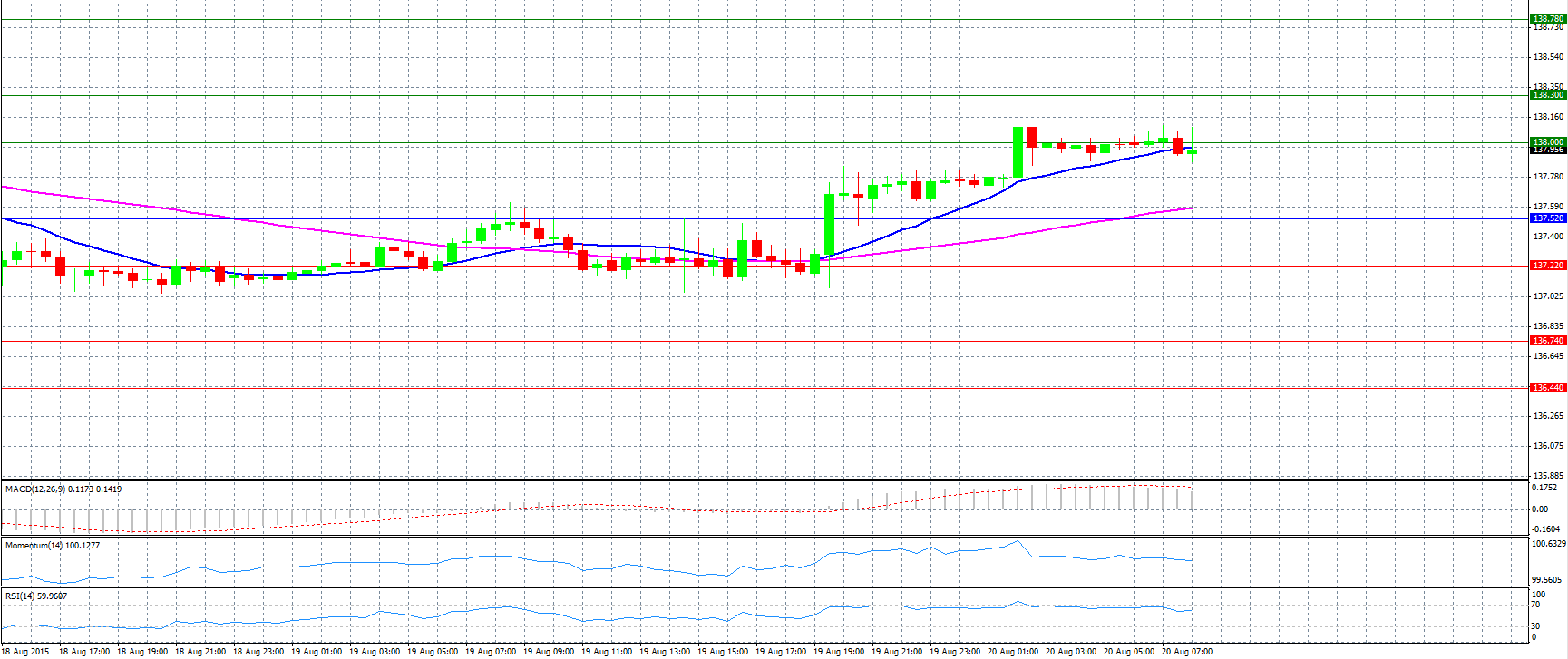

Market Scenario 1: Long positions above 137.52 with targets at 138.00 and 138.30.

Market Scenario 2: Short positions below 137.52 with targets at 137.22 and 136.74.

Comment: The pair advanced, but faces a difficulty to break resistance level 138.00.

Supports and Resistances:

R3 138.78

R2 138.30

R1 138.00

PP 137.52

S1 137.22

S2 136.74

S3 136.44

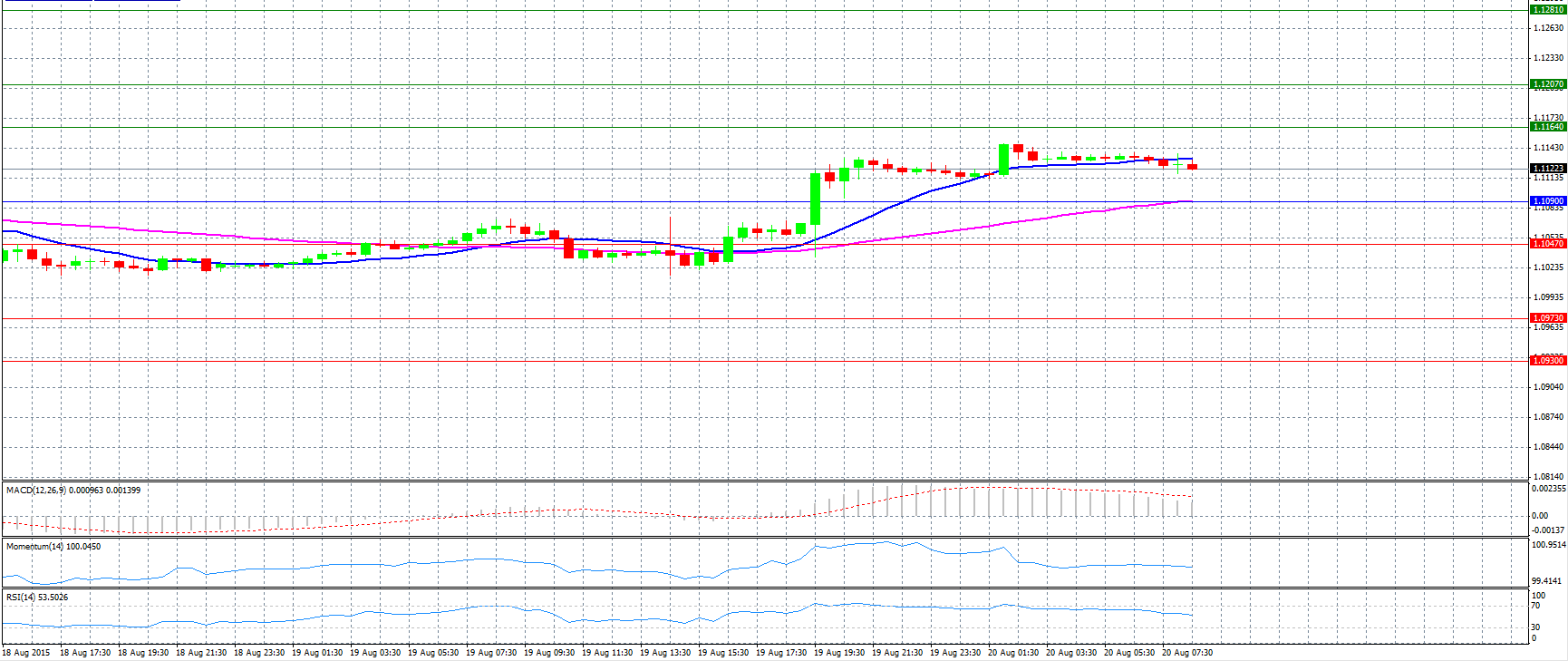

Market Scenario 1: Long positions above 1.1090 with targets at 1.1164 and 1.1207.

Market Scenario 2: Short positions below 1.1090 with targets at 1.1047 and 1.0973.

Comment: The pair rose above pivot point 1.1090 and now trades neutral near 1.1120 level.

Supports and Resistances:

R3 1.1281

R2 1.1207

R1 1.1164

PP 1.1090

S1 1.1047

S2 1.0973

S3 1.0930

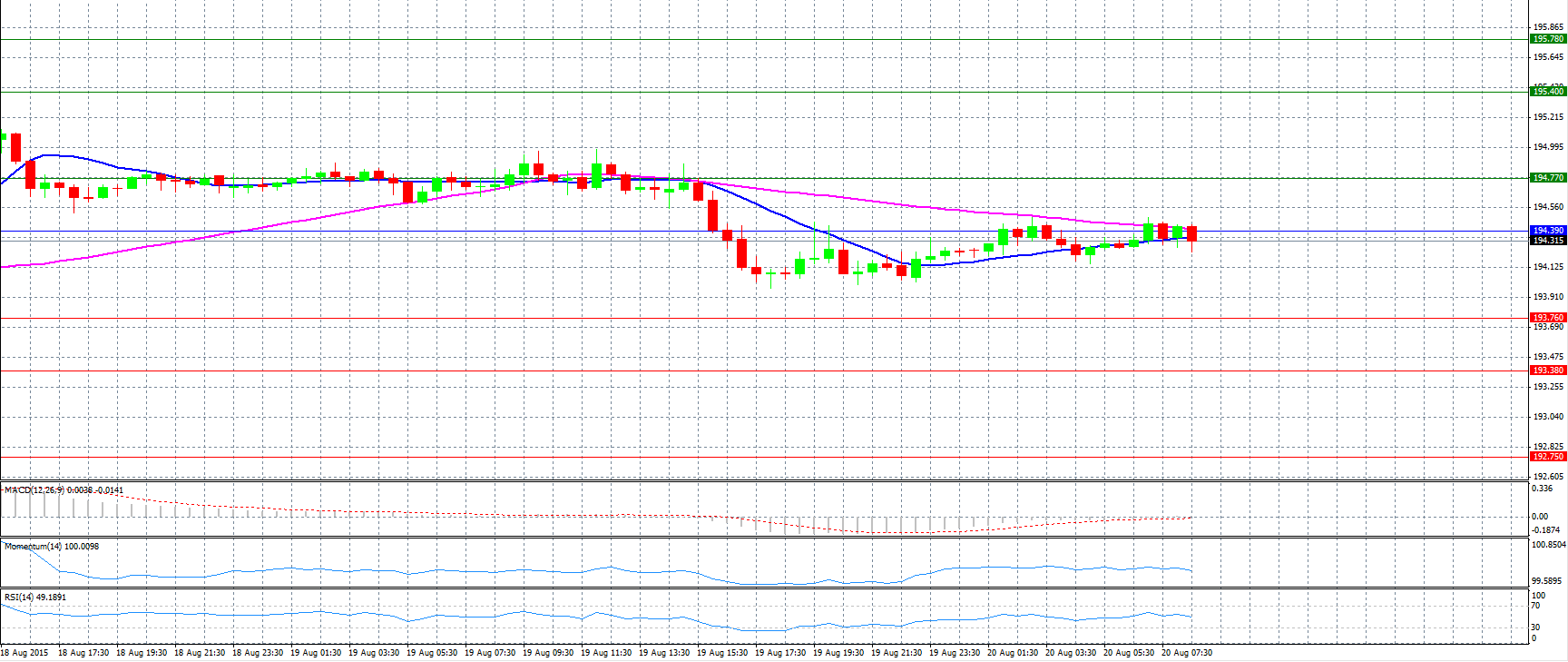

Market Scenario 1: Long positions above 194.39 with targets at 194.77 and 195.40.

Market Scenario 2: Short positions below 194.39 with targets at 193.76 and 193.38.

Comment: The pair hovers around pivot point at 194.39 level.

Supports and Resistances:

R3 195.78

R2 195.40

R1 194.77

PP 194.39

S1 193.76

S2 193.38

S3 192.75

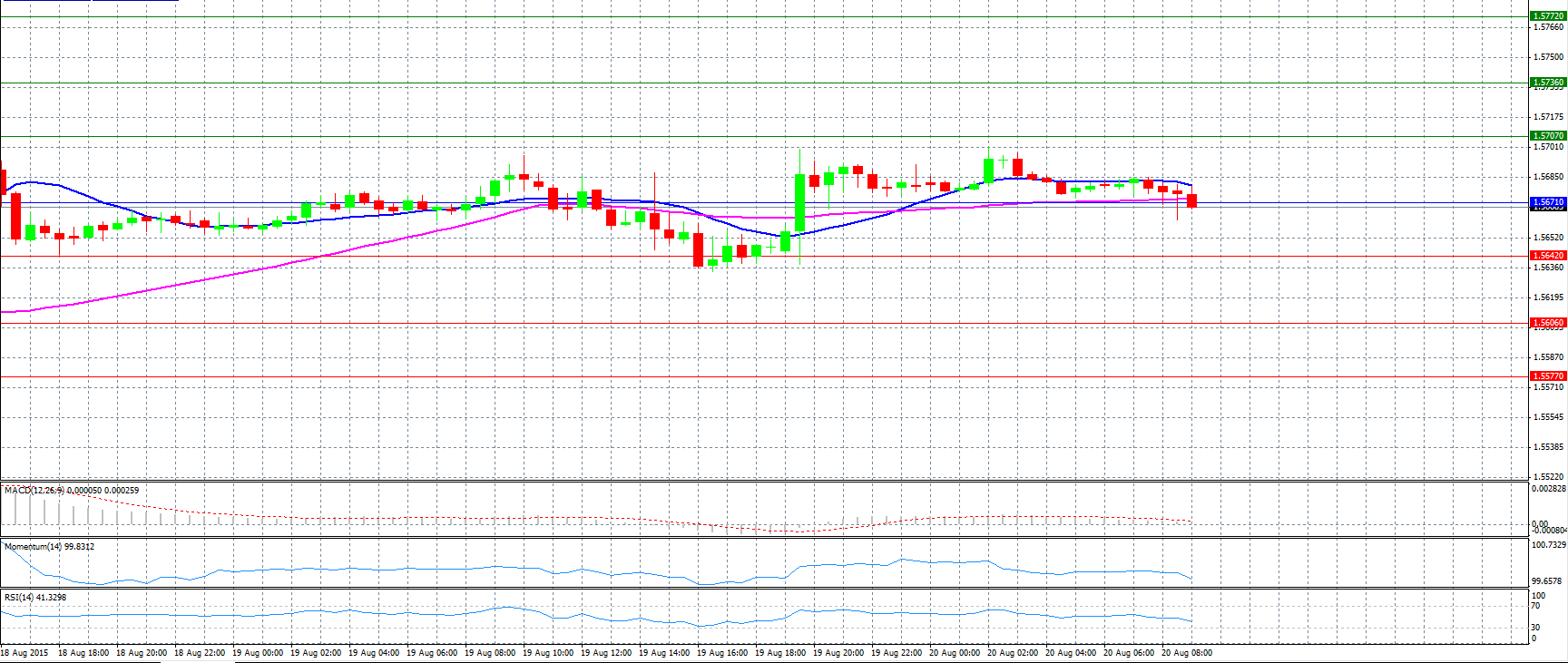

Market Scenario 1: Long positions above 1.5671 with targets at 1.5707 and 1.5736.

Market Scenario 2: Short positions below 1.5671 with targets at 1.5642 and 1.5606.

Comment: The pair trades lower ahead of Retail Sales data.

Supports and Resistances:

R3 1.5772

R2 1.5736

R1 1.5707

PP 1.5671

S1 1.5642

S2 1.5606

S3 1.5577

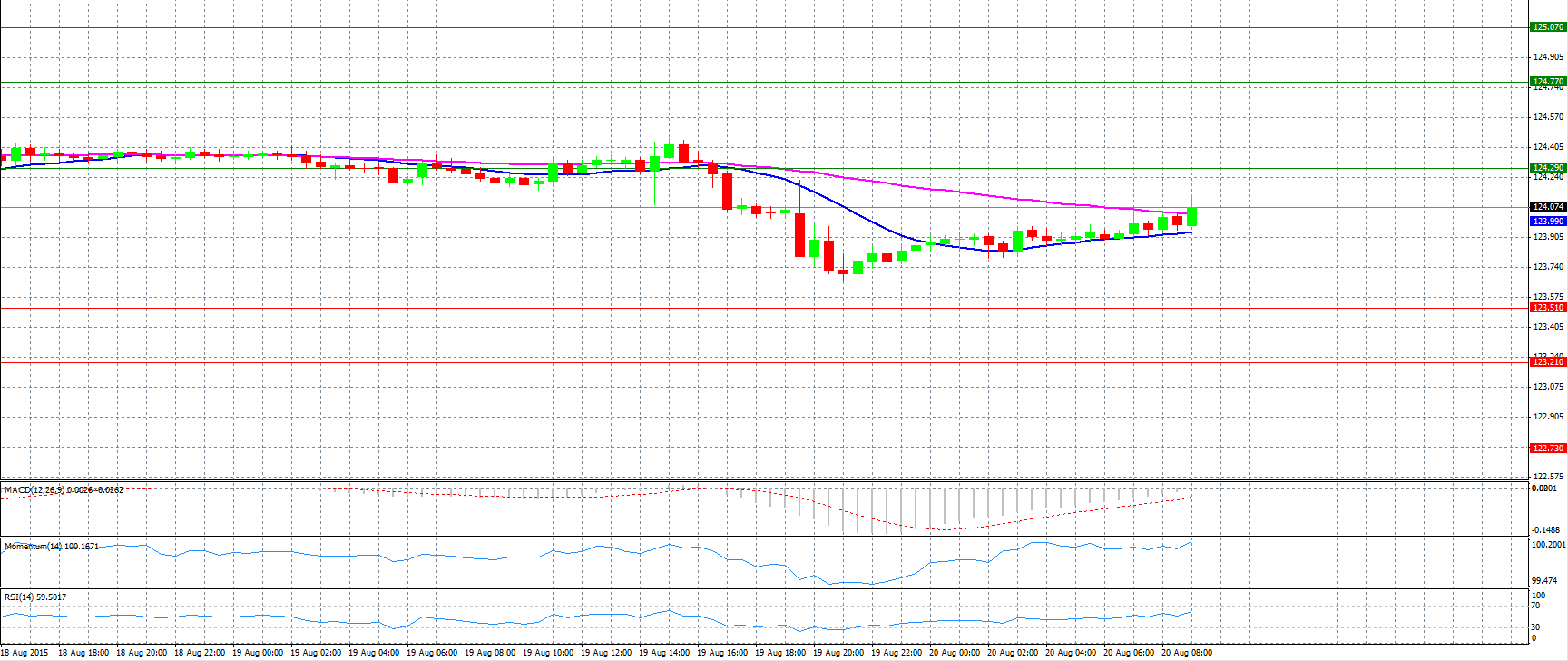

Market Scenario 1: Long positions above 123.99 with targets at 124.29 and 124.77.

Market Scenario 2: Short positions below 123.99 with targets at 123.51 and 123.21.

Comment: The pair has a bullish tone and tries to surpass pivot point 123.99.

Supports and Resistances:

R3 125.07

R2 124.77

R1 124.29

PP 123.99

S1 123.51

S2 123.21

S3 122.73

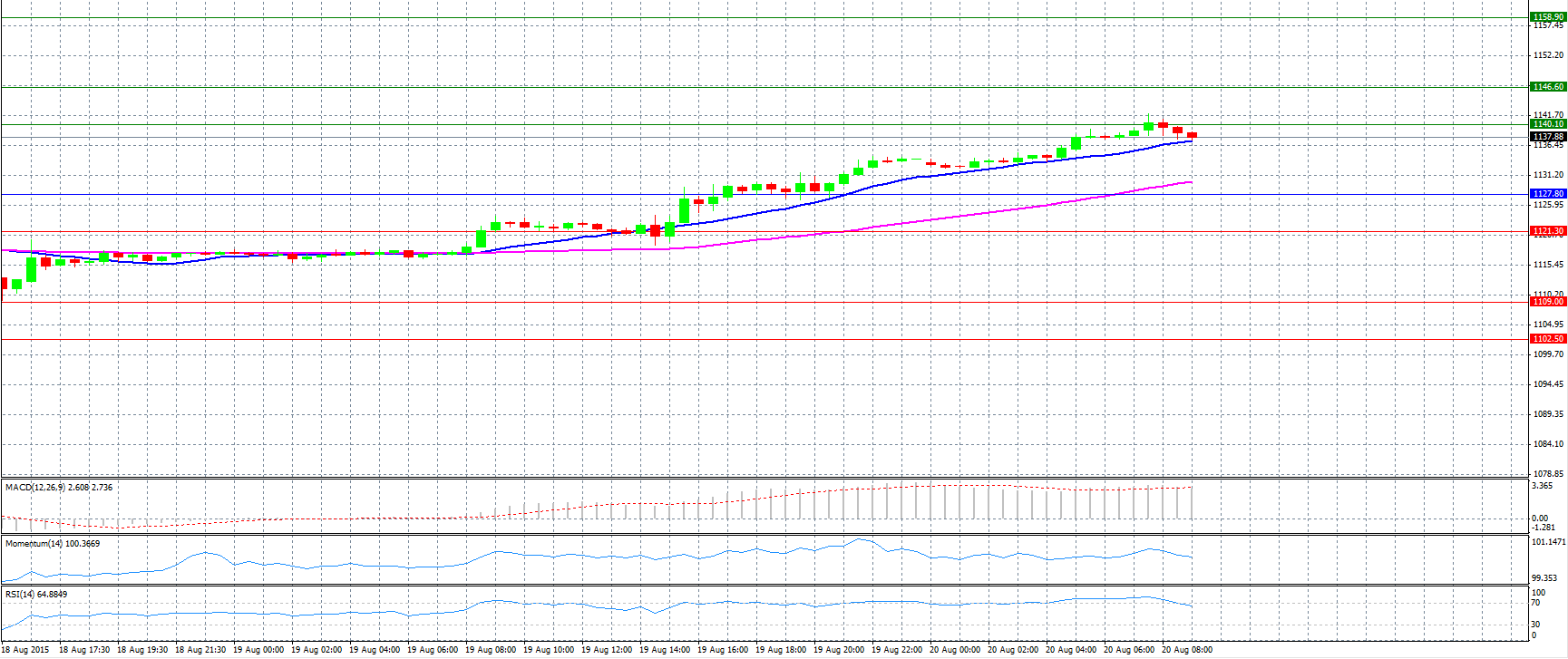

Market Scenario 1: Long positions above 1127.80 with targets at 1140.10 and 1146.60.

Market Scenario 2: Short positions below 1127.80 with targets at 1121.30 and 1109.00.

Comment: Gold prices rose and found support at 1140.10 level amid sliding Asian stock markets.

Supports and Resistances:

R3 1158.90

R2 1146.60

R1 1140.10

PP 1127.80

S1 1121.30

S2 1109.00

S3 1102.50

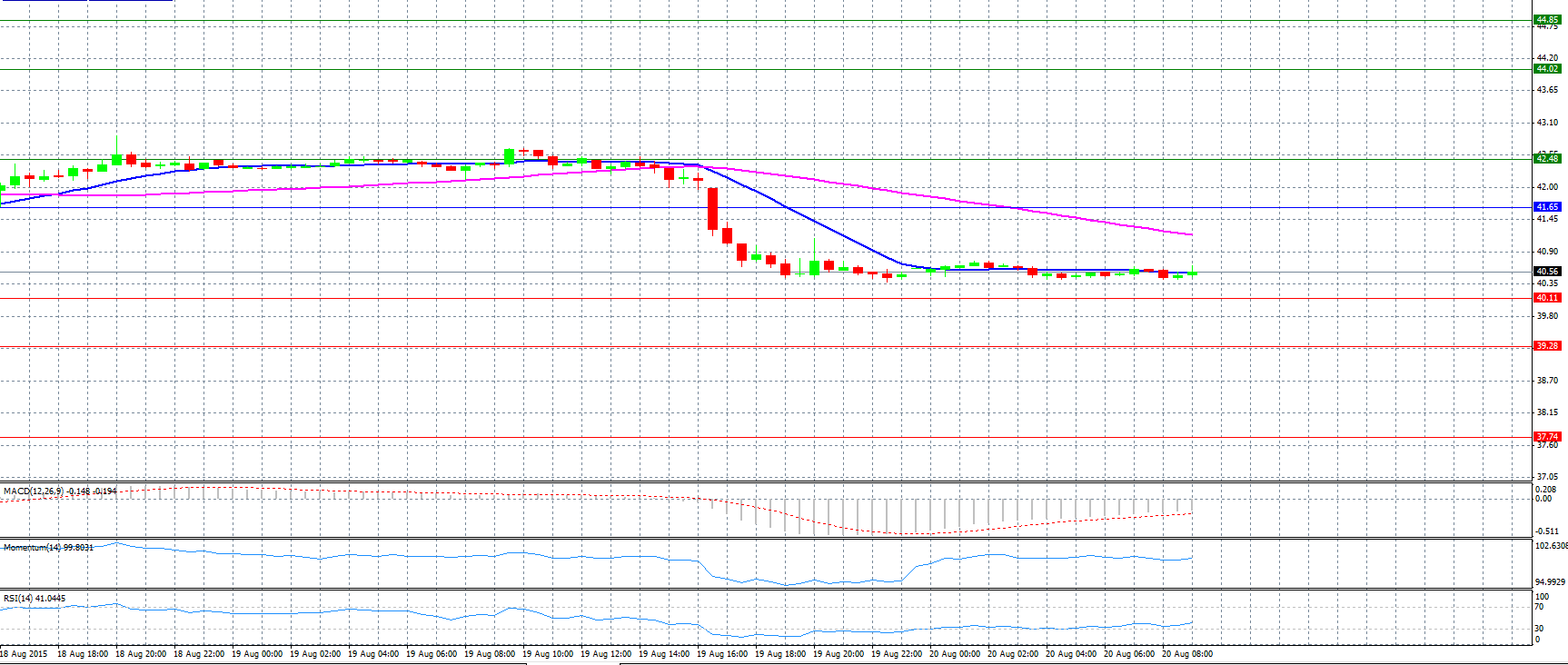

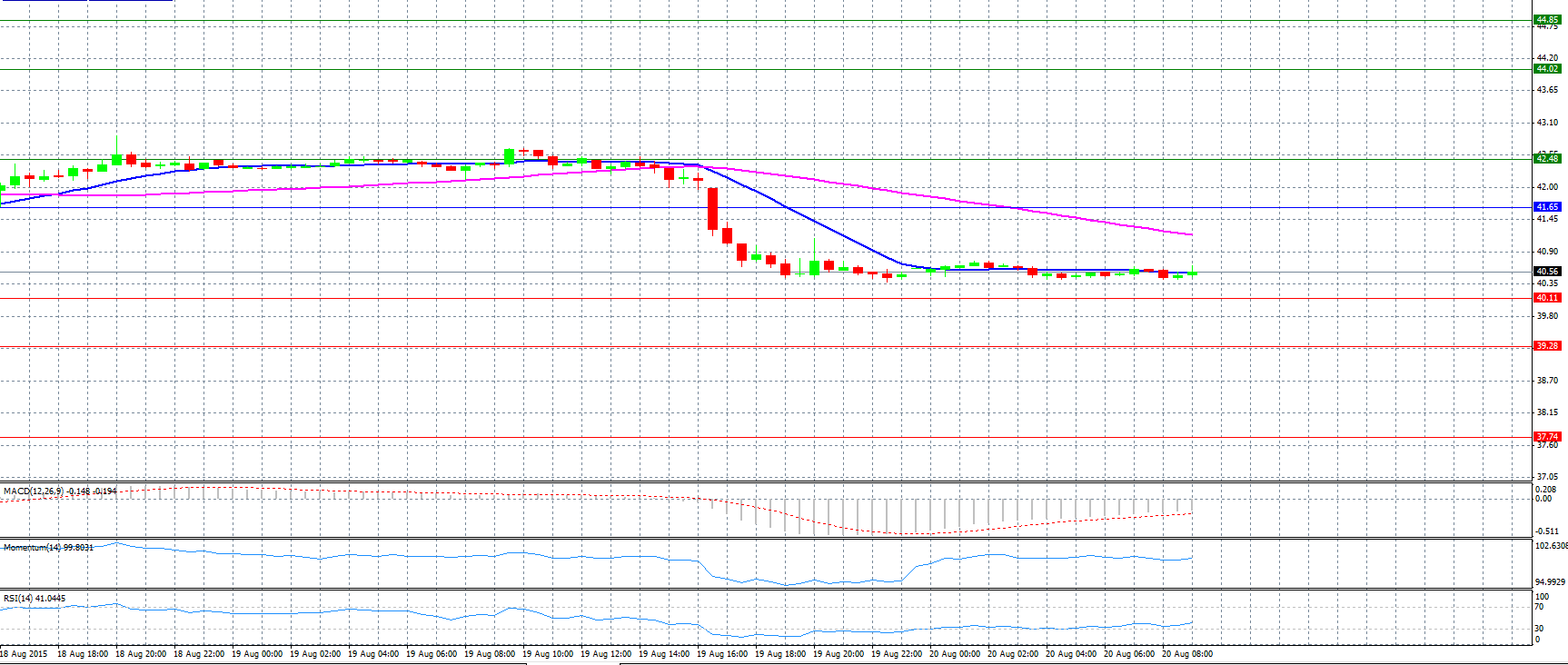

CRUDE OIL

Market Scenario 1: Long positions above 41.65 with targets at 42.48 and 44.02.

Market Scenario 2: Short positions below 41.65 with targets at 40.11 and 39.28.

Comment: Crude oil prices reached a 6-year low after EIA reported that crude oil inventories unexpectedly increased 2.6 million barrels last week.

Supports and Resistances:

R3 44.85

R2 44.02

R1 42.48

PP 41.65

S1 40.11

S2 39.28

S3 37.74

Market Scenario 1: Long positions above 64.868 with targets at 66.388 and 67.197.

Market Scenario 2: Short positions below 64.868 with targets at 64.058 and 62.538.

Comment: The pair advanced towards resistance level 66.388.

Supports and Resistances:

R3 69.527

R2 67.197

R1 66.388

PP 64.868

S1 64.058

S2 62.538

S3 60.208