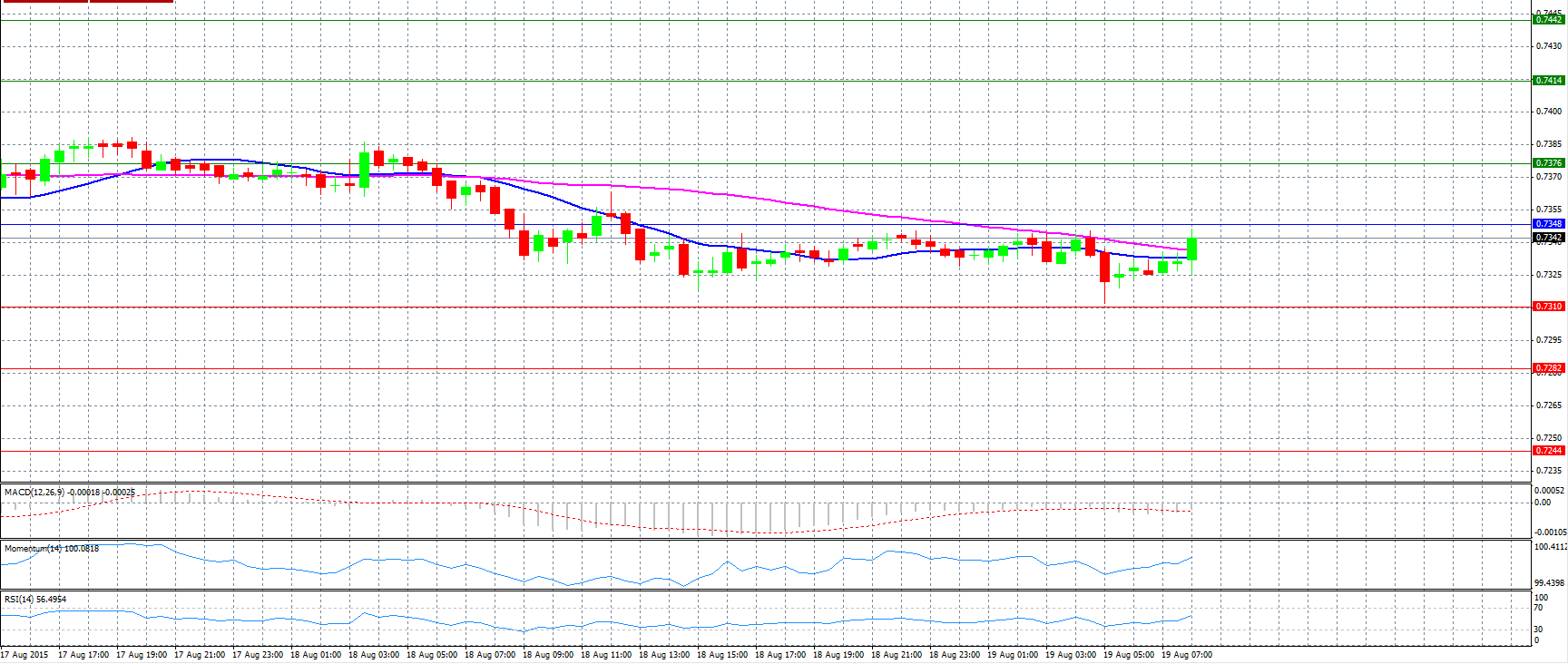

Market Scenario 1: Long positions above 0.7348 with targets at 0.7376 and 0.7414.

Market Scenario 2: Short positions below 0.7348 with targets at 0.7310 and 0.7282.

Comment: The pair trades lower after July leading index remains unchanged.

Supports and Resistances:

R3 0.7442

R2 0.7414

R1 0.7376

PP 0.7348

S1 0.7310

S2 0.7282

S3 0.7244

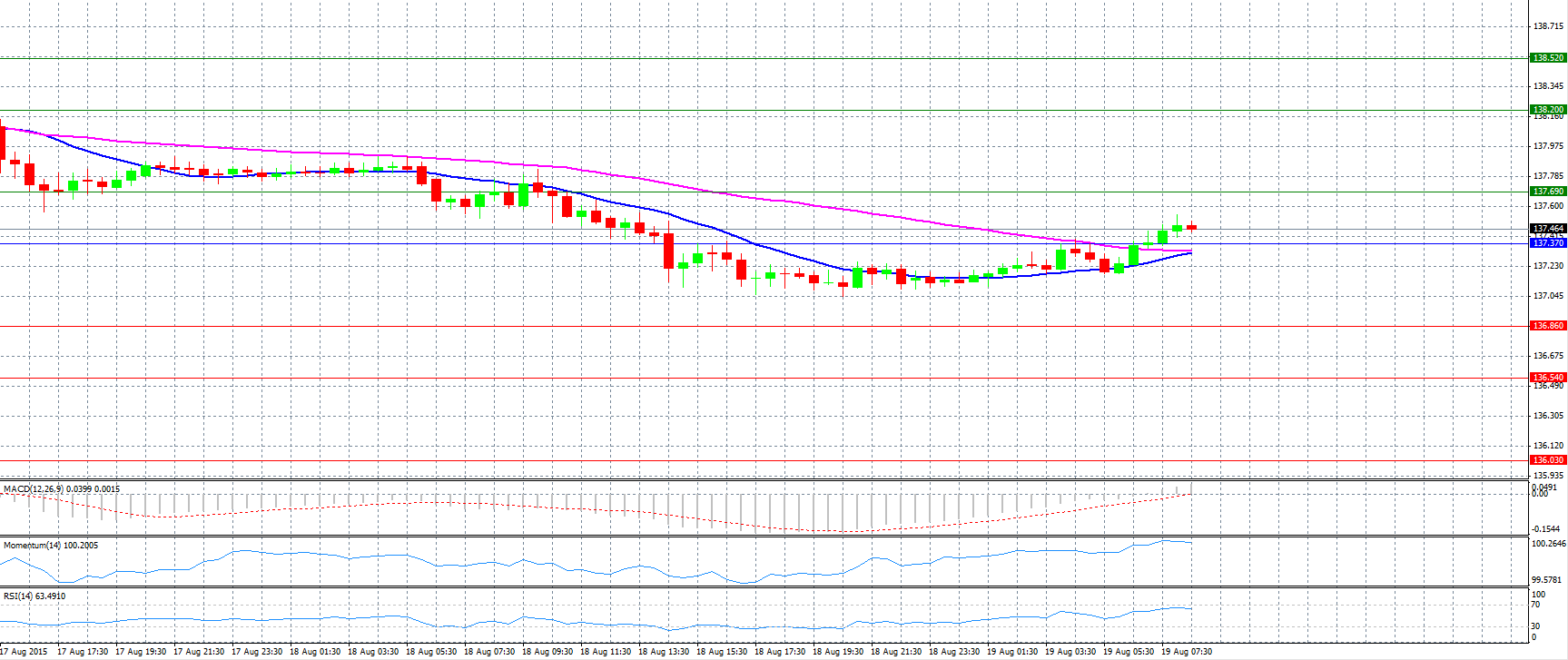

Market Scenario 1: Long positions above 137.37 with targets at 137.69 and 138.20.

Market Scenario 2: Short positions below 137.37 with targets at 136.86 and 136.54.

Comment: The pair strengthened and surpassed pivot point 137.37.

Supports and Resistances:

R3 138.52

R2 138.20

R1 137.69

PP 137.37

S1 136.86

S2 136.54

S3 136.03

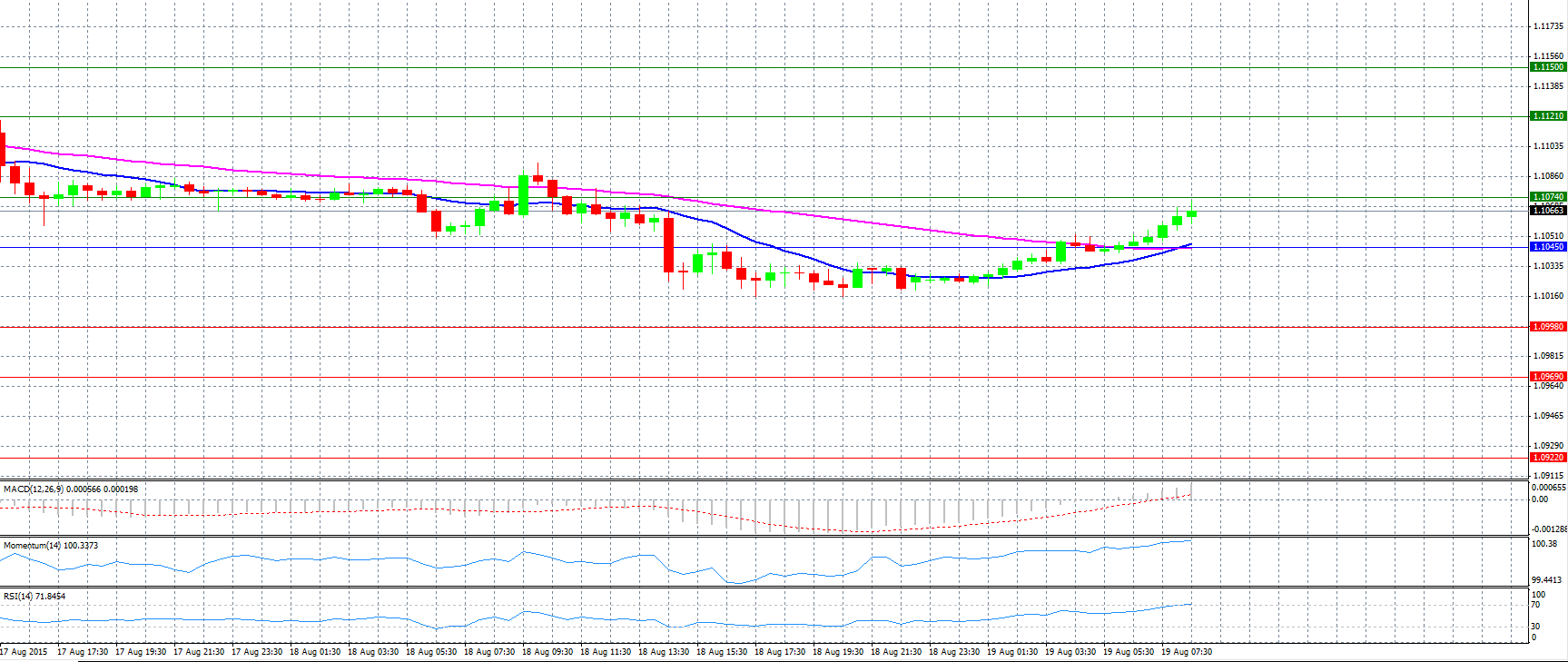

Market Scenario 1: Long positions above 1.1045 with targets at 1.1074 and 1.1121.

Market Scenario 2: Short positions below 1.1045 with targets at 1.0998 and 1.0969.

Comment: The pair advanced and tries to reach resistance level 1.1074.

Supports and Resistances:

R3 1.1150

R2 1.1121

R1 1.1074

PP 1.1045

S1 1.0998

S2 1.0969

S3 1.0922

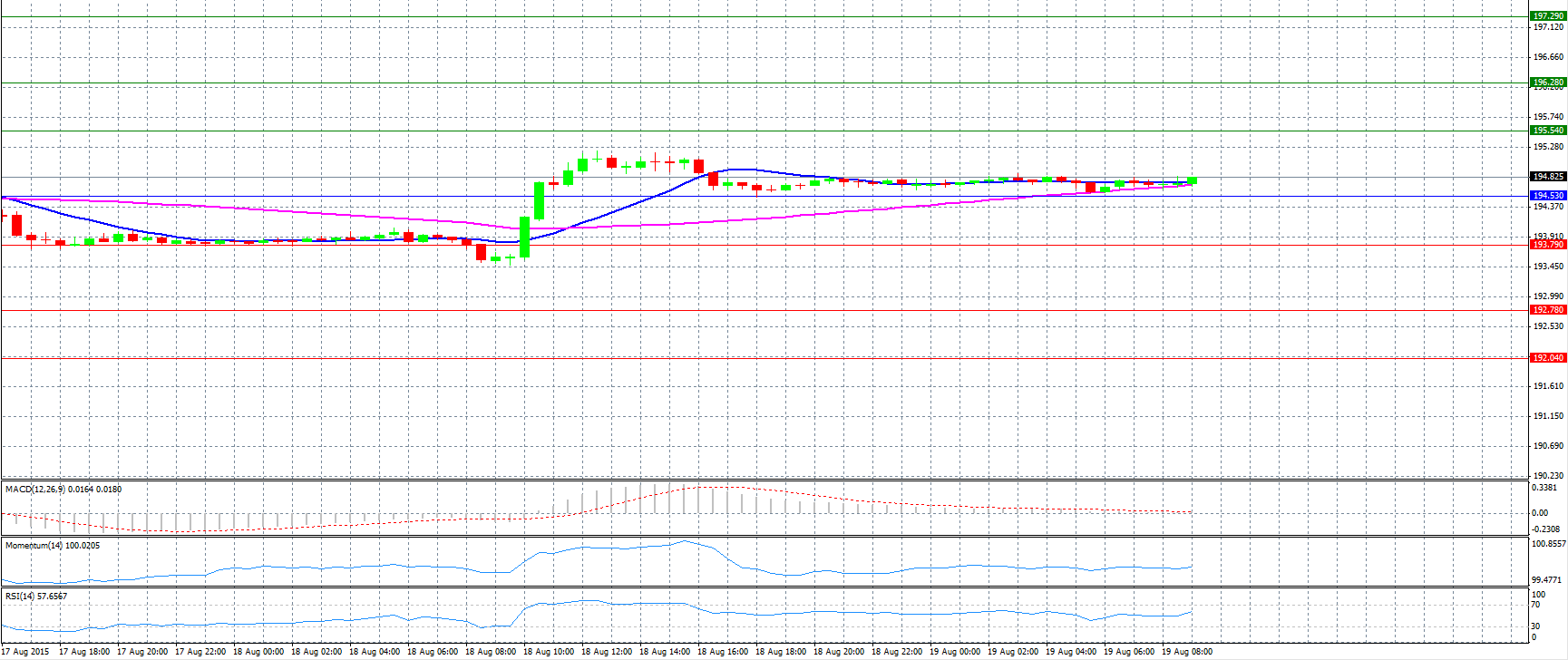

Market Scenario 1: Long positions above 194.53 with targets at 195.54 and 196.28.

Market Scenario 2: Short positions below 194.53 with targets at 193.79 and 192.78.

Comment: The pair trades neutral near 194.80 level.

Supports and Resistances:

R3 197.29

R2 196.28

R1 195.54

PP 194.53

S1 193.79

S2 192.78

S3 192.04

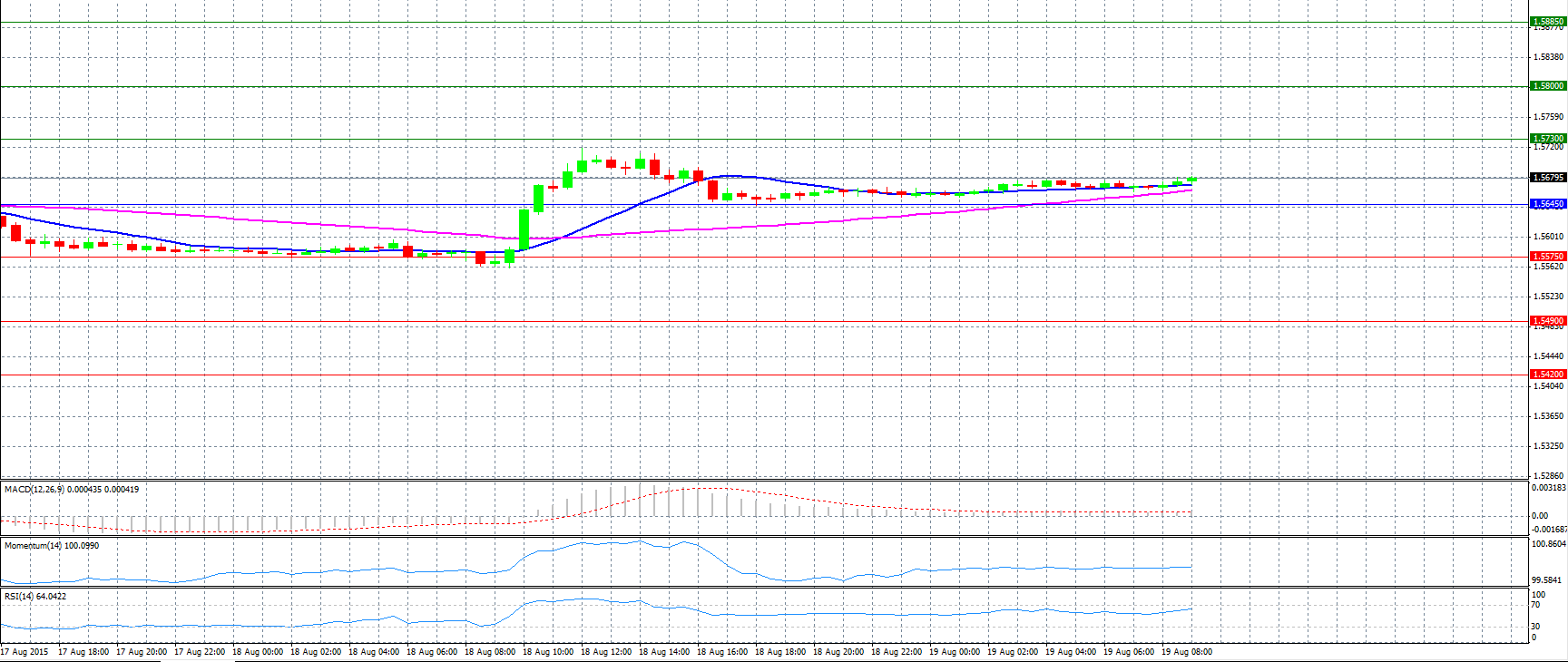

Market Scenario 1: Long positions above 1.5645 with targets at 1.5730 and 1.5800.

Market Scenario 2: Short positions below 1.5645 with targets at 1.5575 and 1.5490.

Comment: The pair hovers around 1.5680 level.

Supports and Resistances:

R3 1.5885

R2 1.5800

R1 1.5730

PP 1.5645

S1 1.5575

S2 1.5490

S3 1.5420

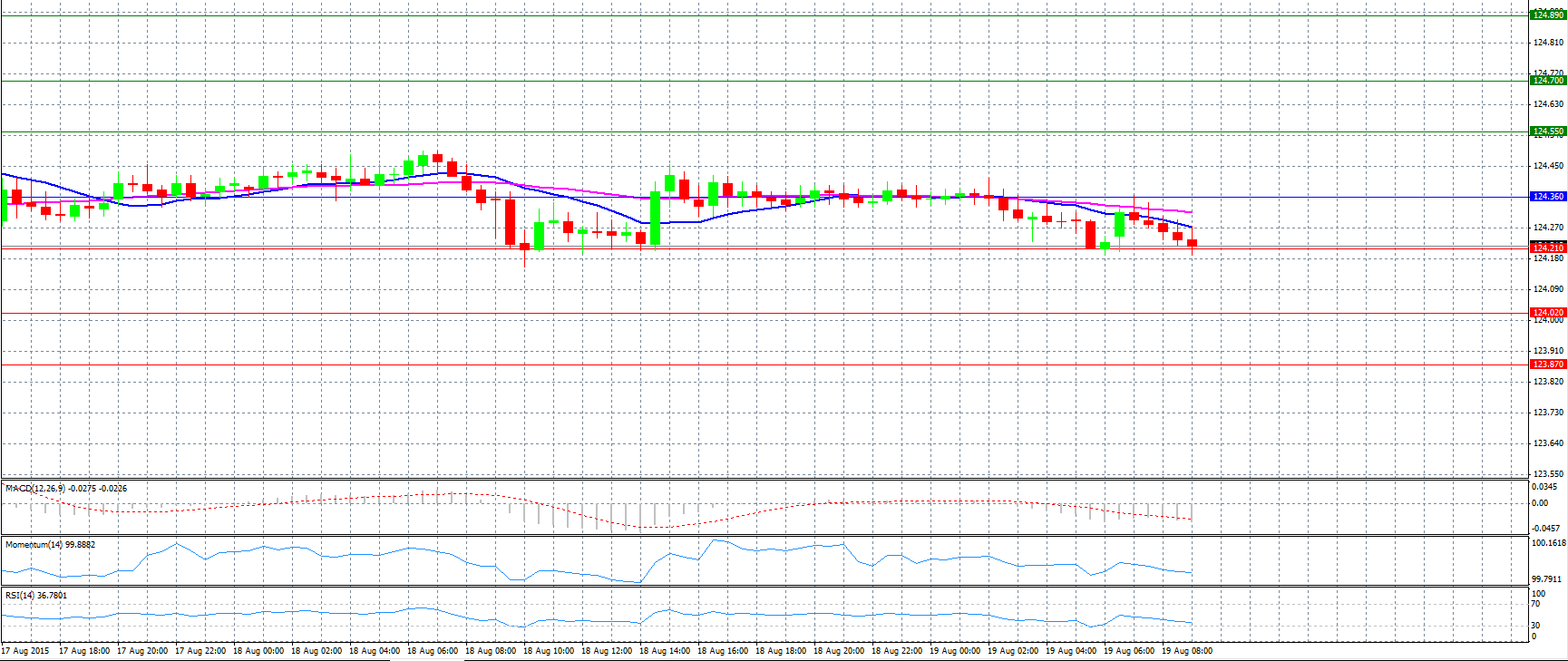

Market Scenario 1: Long positions above 124.36 with targets at 124.55 and 124.70.

Market Scenario 2: Short positions below 124.36 with targets at 124.21 and 124.02.

Comment: The pair is pushed downwards, but it is well supported at 124.21 level.

Supports and Resistances:

R3 124.89

R2 124.70

R1 124.55

PP 124.36

S1 124.21

S2 124.02

S3 123.87

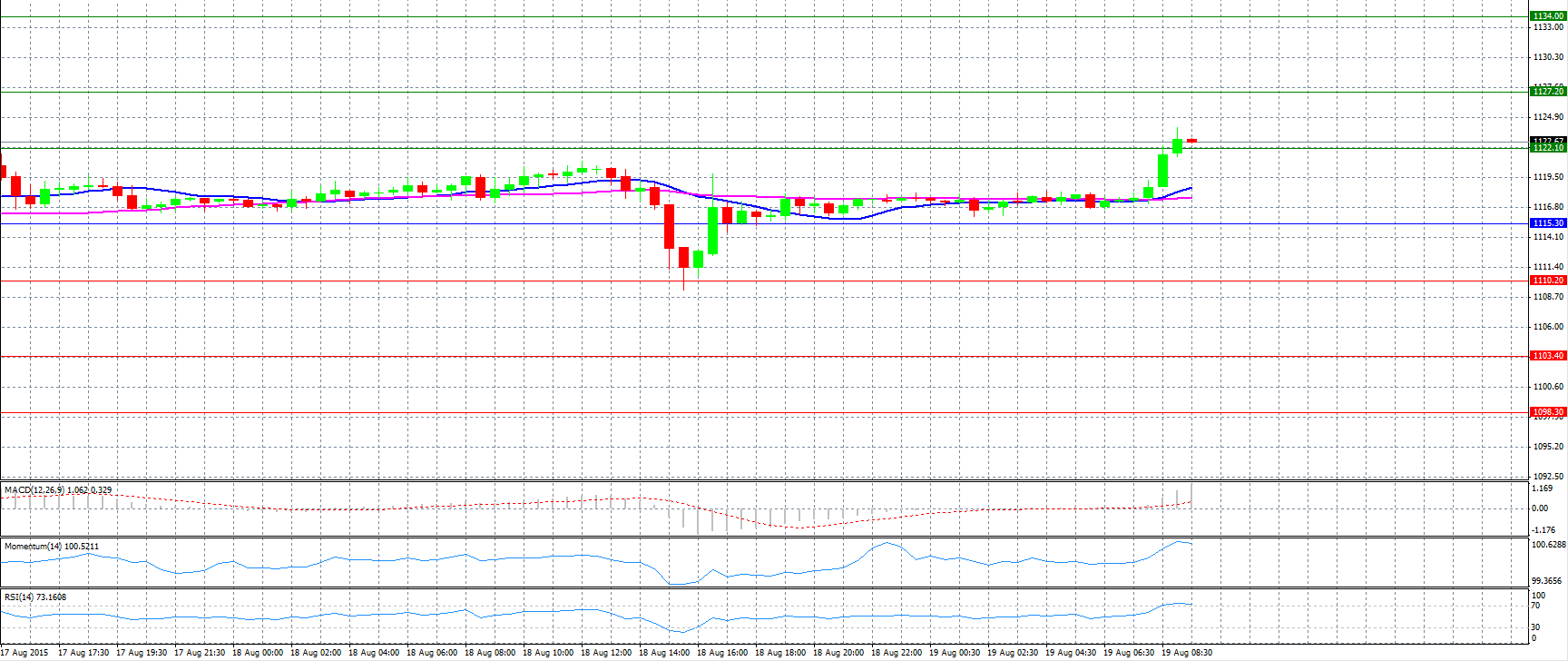

Market Scenario 1: Long positions above 1115.30 with targets at 1122.10 and 1127.20.

Market Scenario 2: Short positions below 1115.30 with targets at 1110.20 and 1103.40.

Comment: Gold prices jumped above resistance level 1122.10 ahead of Fed minutes, U.S. inflation data.

Supports and Resistances:

R3 1134.00

R2 1127.20

R1 1122.10

PP 1115.30

S1 1110.20

S2 1103.40

S3 1098.30

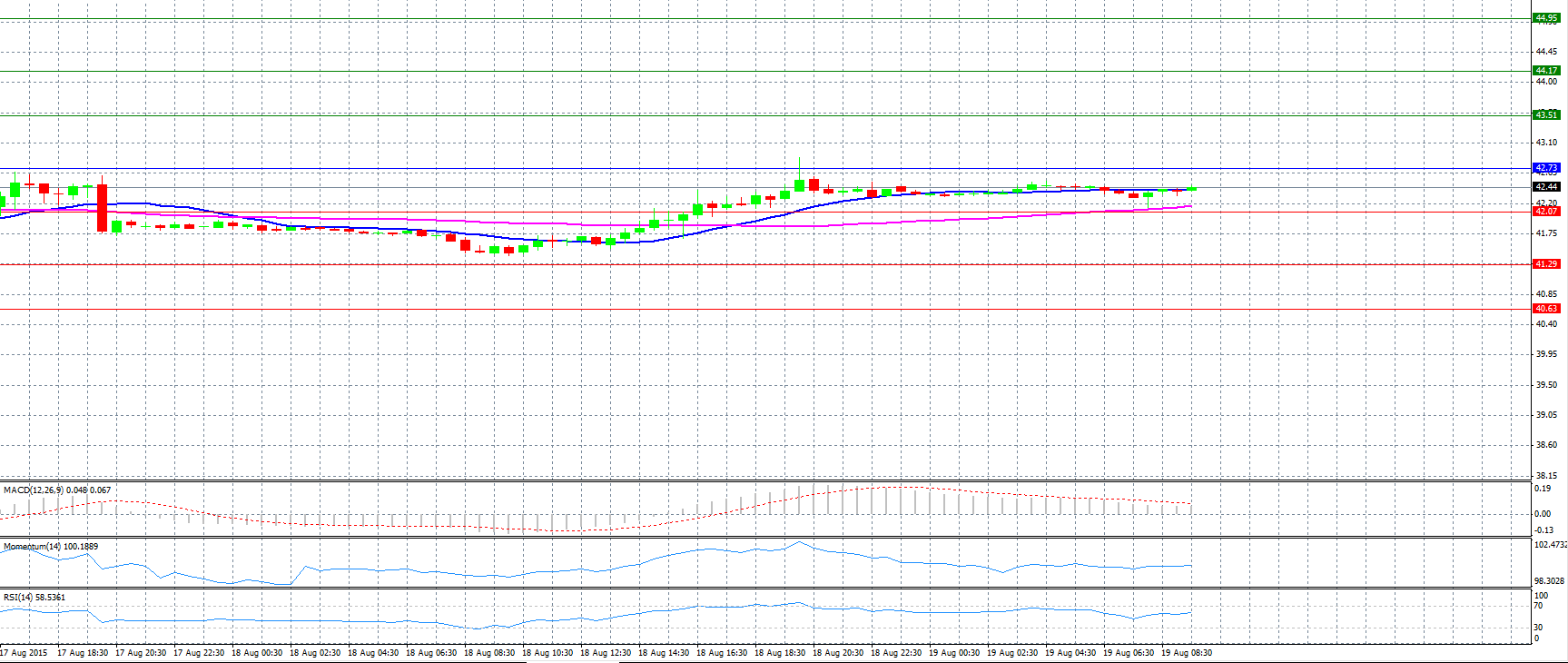

CRUDE OIL

Market Scenario 1: Long positions above 42.73 with targets at 43.51 and 44.17.

Market Scenario 2: Short positions below 42.73 with targets at 42.07 and 41.29.

Comment: Crude oil prices trade unchanged near 42.40 level.

Supports and Resistances:

R3 44.95

R2 44.17

R1 43.51

PP 42.73

S1 42.07

S2 41.29

S3 40.63

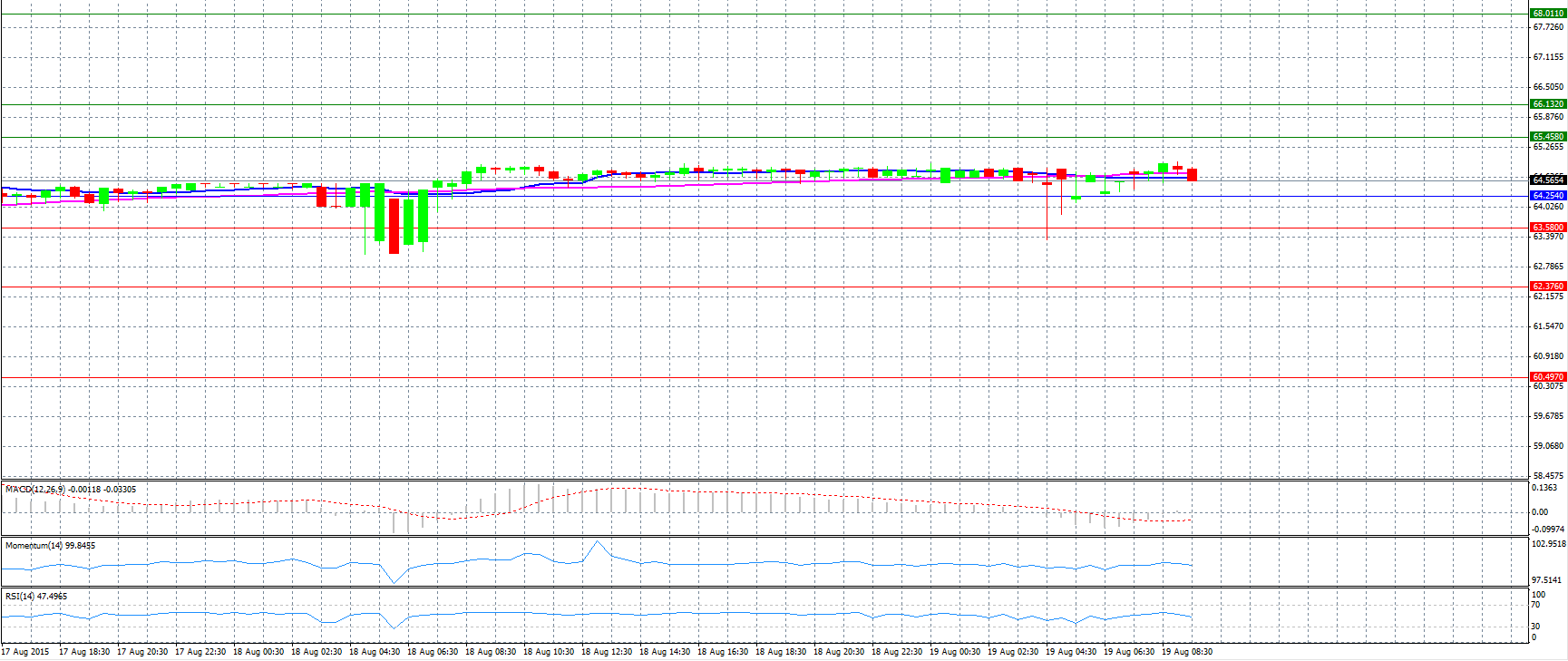

Market Scenario 1: Long positions above 64.254 with targets at 65.458 and 66.132.

Market Scenario 2: Short positions below 64.254 with targets at 63.580 and 62.376.

Comment: The pair trades neutral above pivot point 64.254.

Supports and Resistances:

R3 68.011

R2 66.132

R1 65.458

PP 64.254

S1 63.580

S2 62.376

S3 60.497