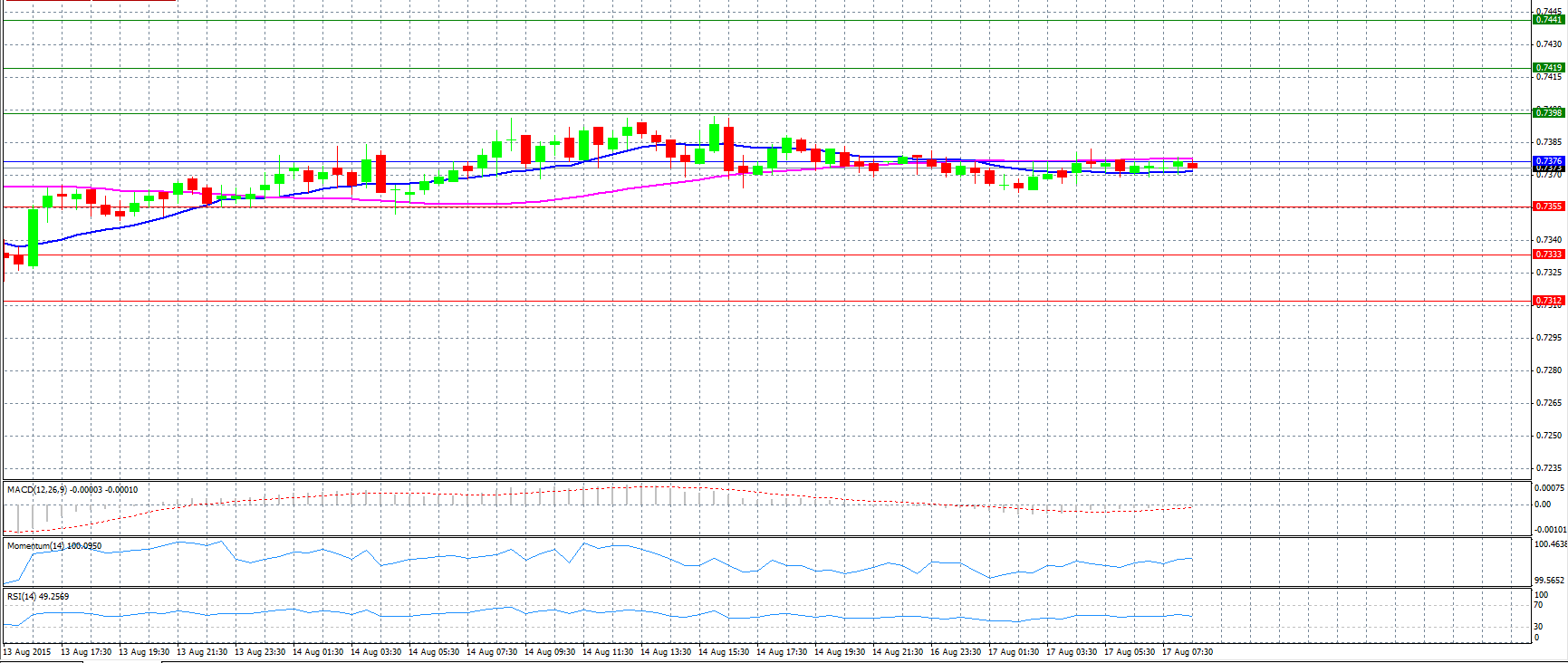

Market Scenario 1: Long positions above 0.7376 with targets @ 0.7398 & 0.7419.

Market Scenario 2: Short positions below 0.7376 with targets @ 0.7355 & 0.7333.

Comment: The pair trades neutral near pivot point 0.7376.

Supports and Resistances:

R3 0.7441

R2 0.7419

R1 0.7398

PP 0.7376

S1 0.7355

S2 0.7333

S3 0.7312

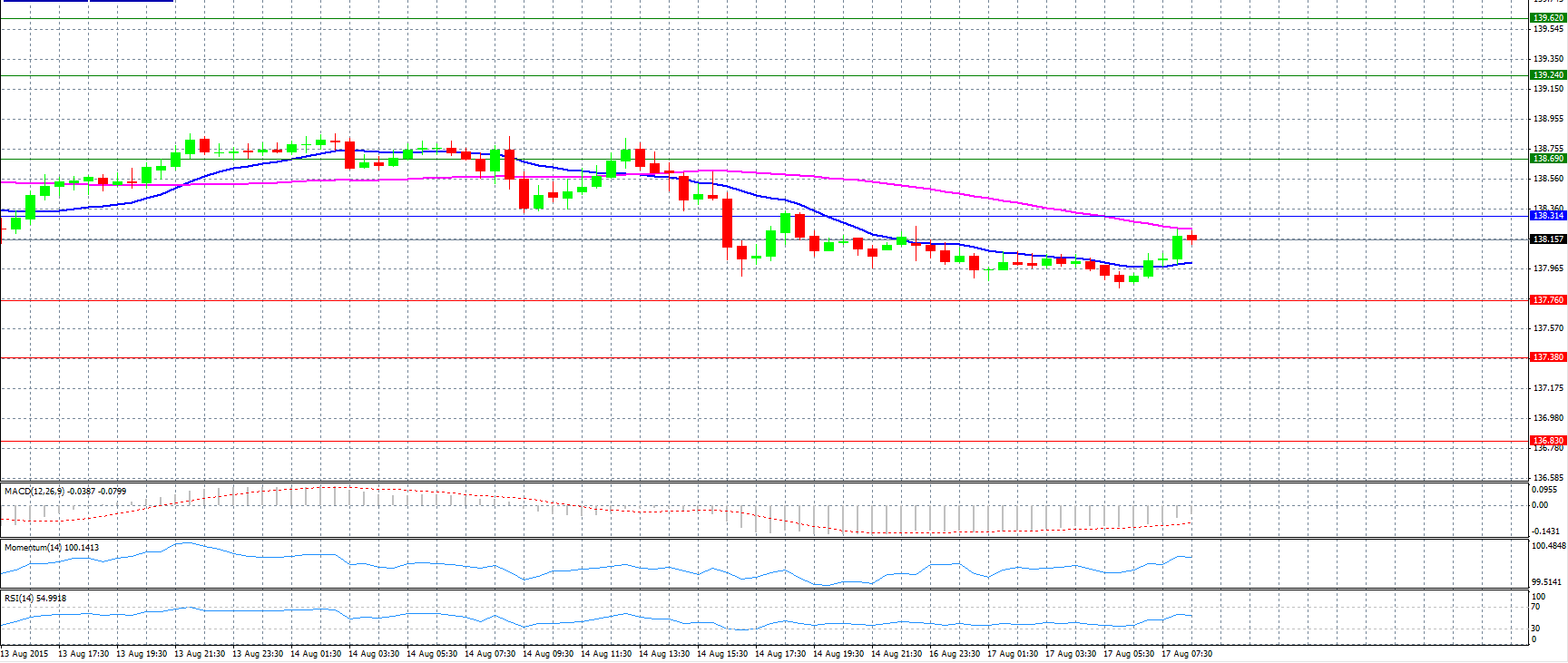

Market Scenario 1: Long positions above 138.31 with targets @ 138.69 & 139.24.

Market Scenario 2: Short positions below 138.31 with targets @ 137.76 & 137.38.

Comment: The pair rose over 138.10 level.

Supports and Resistances:

R3 139.62

R2 139.24

R1 138.69

PP 138.31

S1 137.76

S2 137.38

S3 136.83

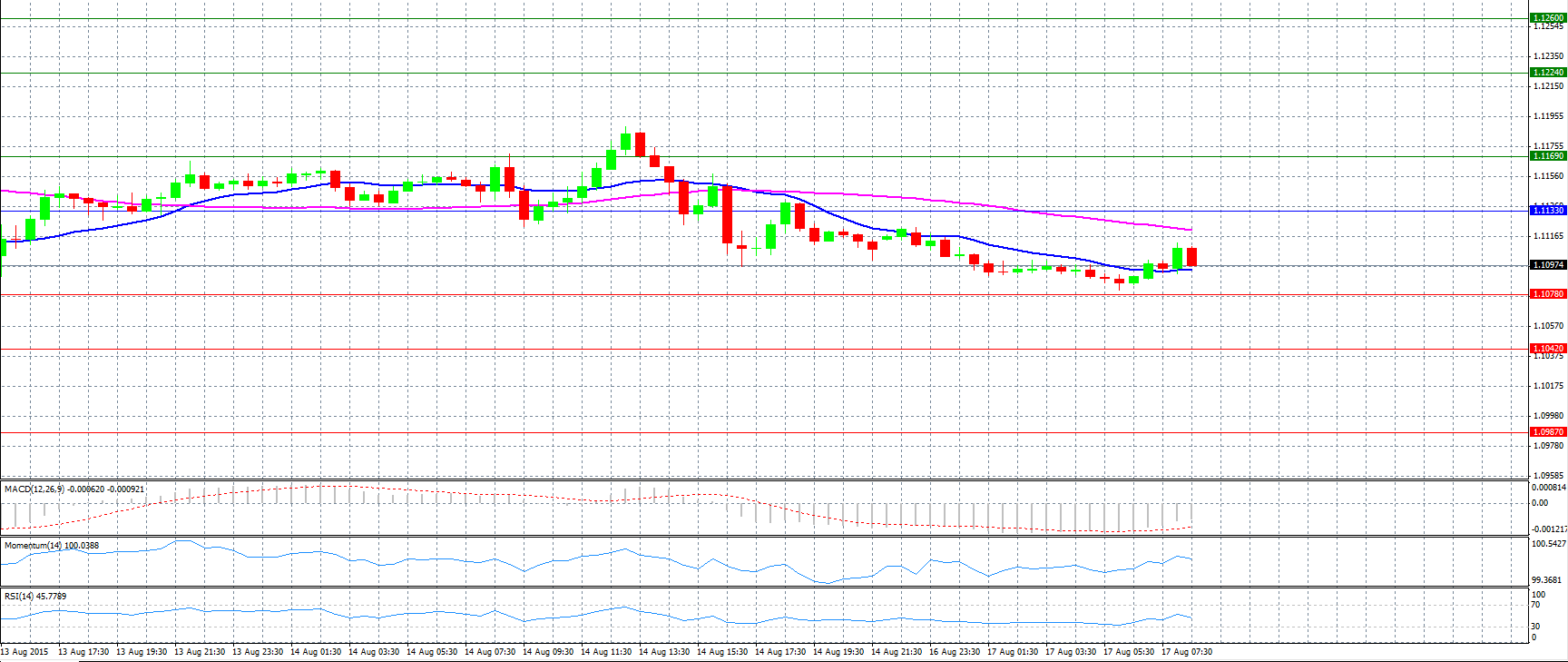

Market Scenario 1: Long positions above 1.1133 with targets @ 1.1169 & 1.1224.

Market Scenario 2: Short positions below 1.1133 with targets @ 1.1078 & 1.1042.

Comment: The pair heads for a retest of 1.1100 level.

Supports and Resistances:

R3 1.1260

R2 1.1224

R1 1.1169

PP 1.1133

S1 1.1078

S2 1.1042

S3 1.0987

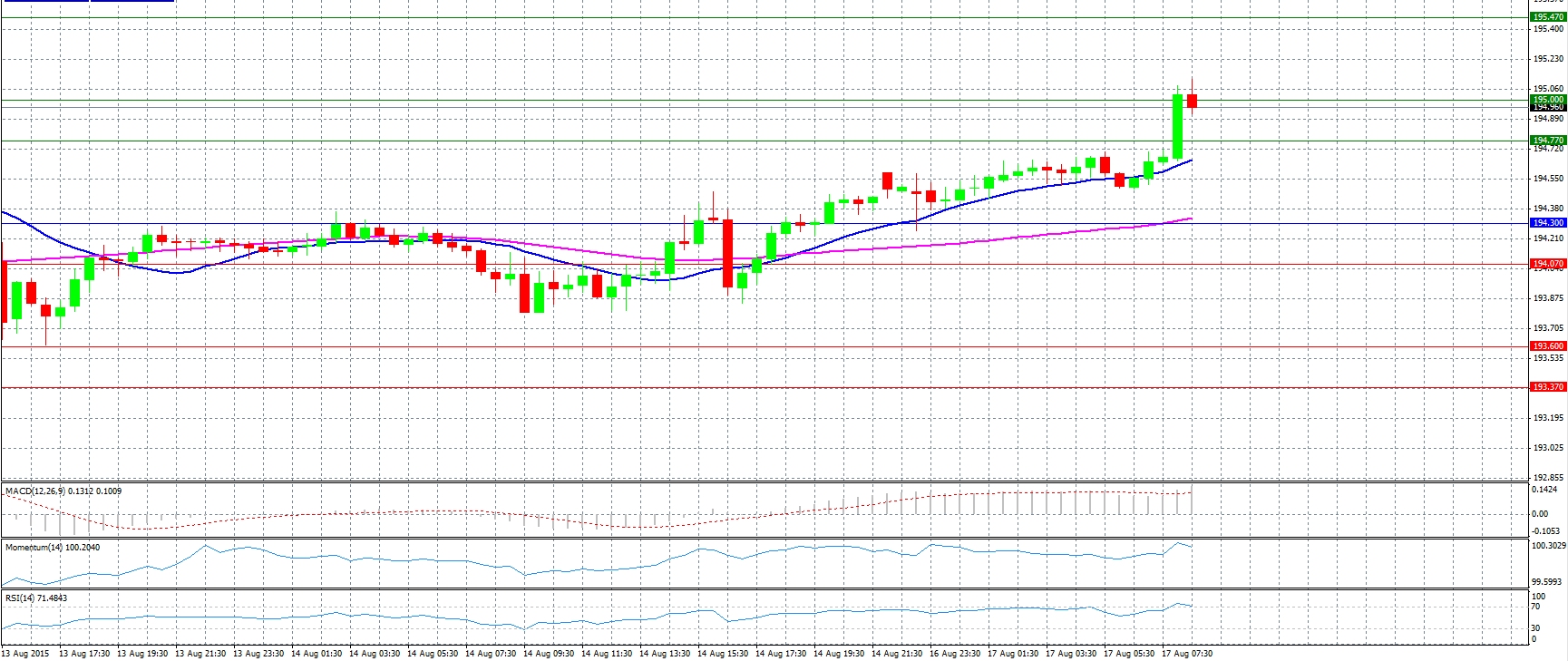

Market Scenario 1: Long positions above 194.30 with targets @ 194.77 & 195.00.

Market Scenario 2: Short positions below 194.30 with targets @ 194.07 & 193.60.

Comment: The pair jumped and now faces resistance at 195.00 level.

Supports and Resistances:

R3 195.47

R2 195.00

R1 194.77

PP 194.30

S1 194.07

S2 193.60

S3 193.37

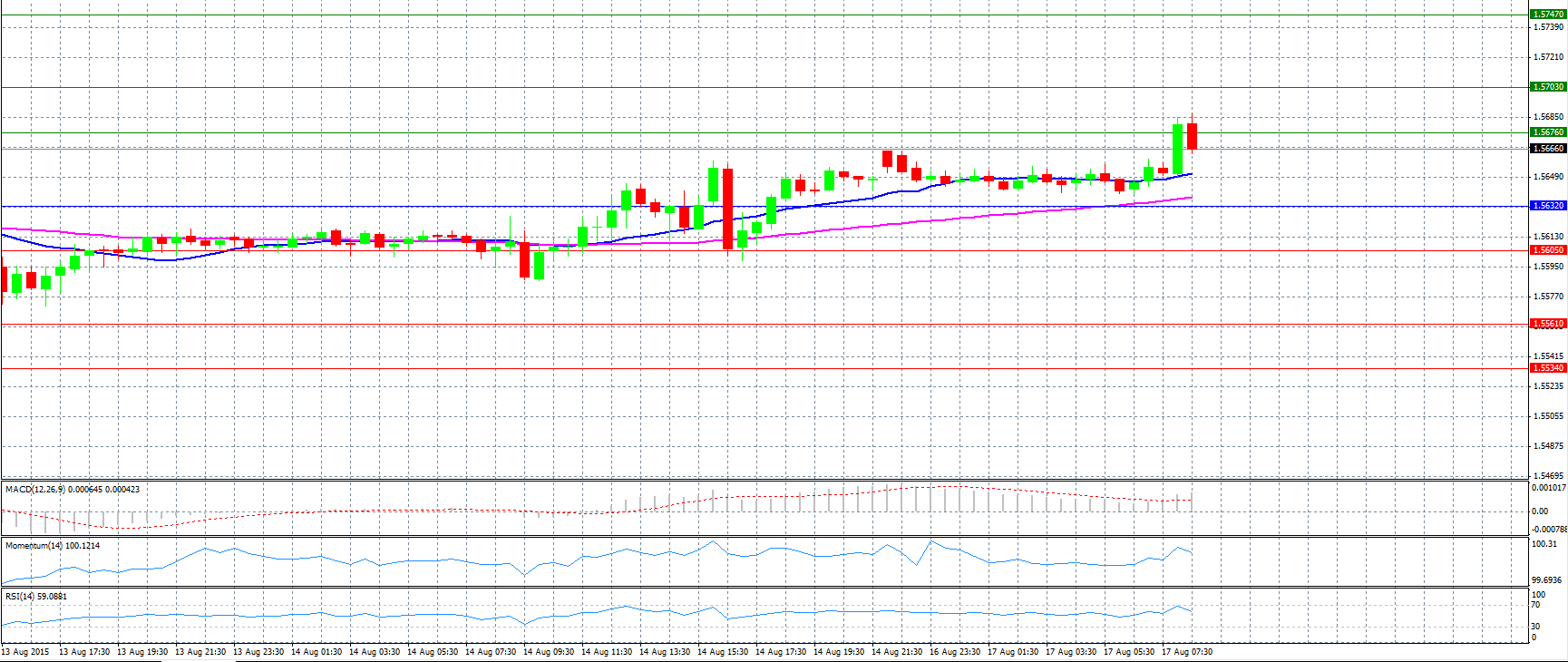

Market Scenario 1: Long positions above 1.5632 with targets @ 1.5676 & 1.5703.

Market Scenario 2: Short positions below 1.5632 with targets @ 1.5605 & 1.5561.

Comment: The pair is pushed by the European desks which are bidding for the pound to a new session high of 1.5688 level.

Supports and Resistances:

R3 1.5747

R2 1.5703

R1 1.5676

PP 1.5632

S1 1.5605

S2 1.5561

S3 1.5534

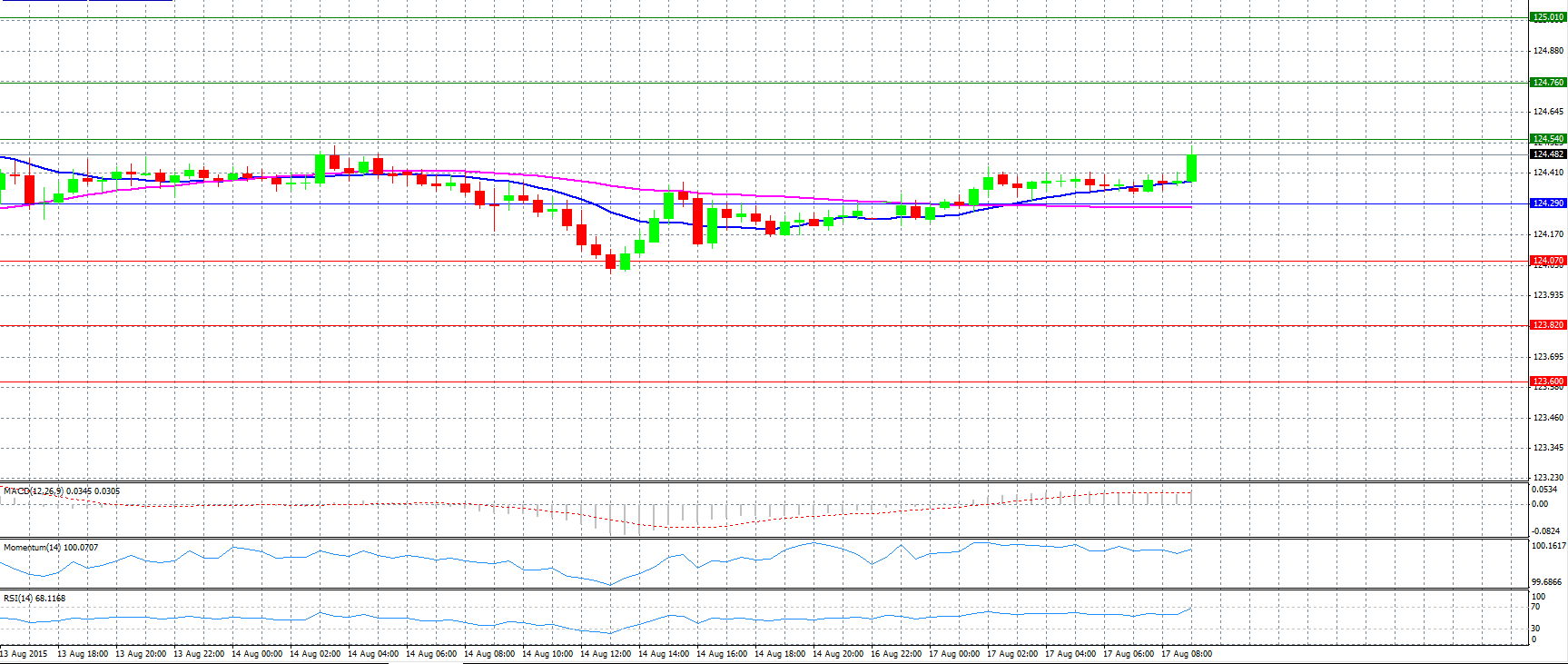

Market Scenario 1: Long positions above 124.29 with targets @ 124.54 & 124.76.

Market Scenario 2: Short positions below 124.29 with targets @ 124.07 & 123.82.

Comment: The pair recovered from session lows and tries again a bounce towards 124.50 level.

Supports and Resistances:

R3 125.01

R2 124.76

R1 124.54

PP 124.29

S1 124.07

S2 123.82

S3 123.60

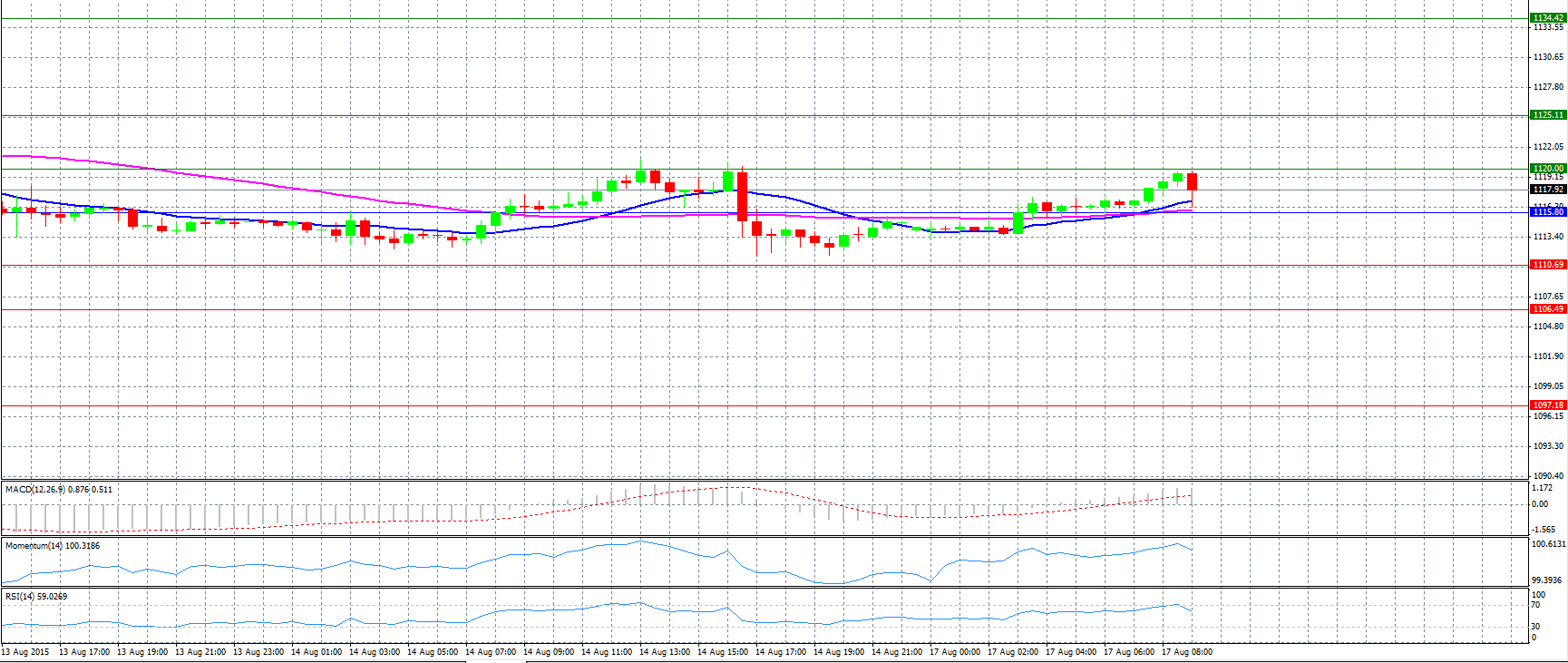

Market Scenario 1: Long positions above 1115.80 with targets @ 1120.00 & 1125.11.

Market Scenario 2: Short positions below 1115.80 with targets @ 1110.69 & 1106.49.

Comment: Gold prices rise as yuan fears keep safe-haven draw.

Supports and Resistances:

R3 1134.42

R2 1125.11

R1 1120.00

PP 1115.80

S1 1110.69

S2 1106.49

S3 1097.18

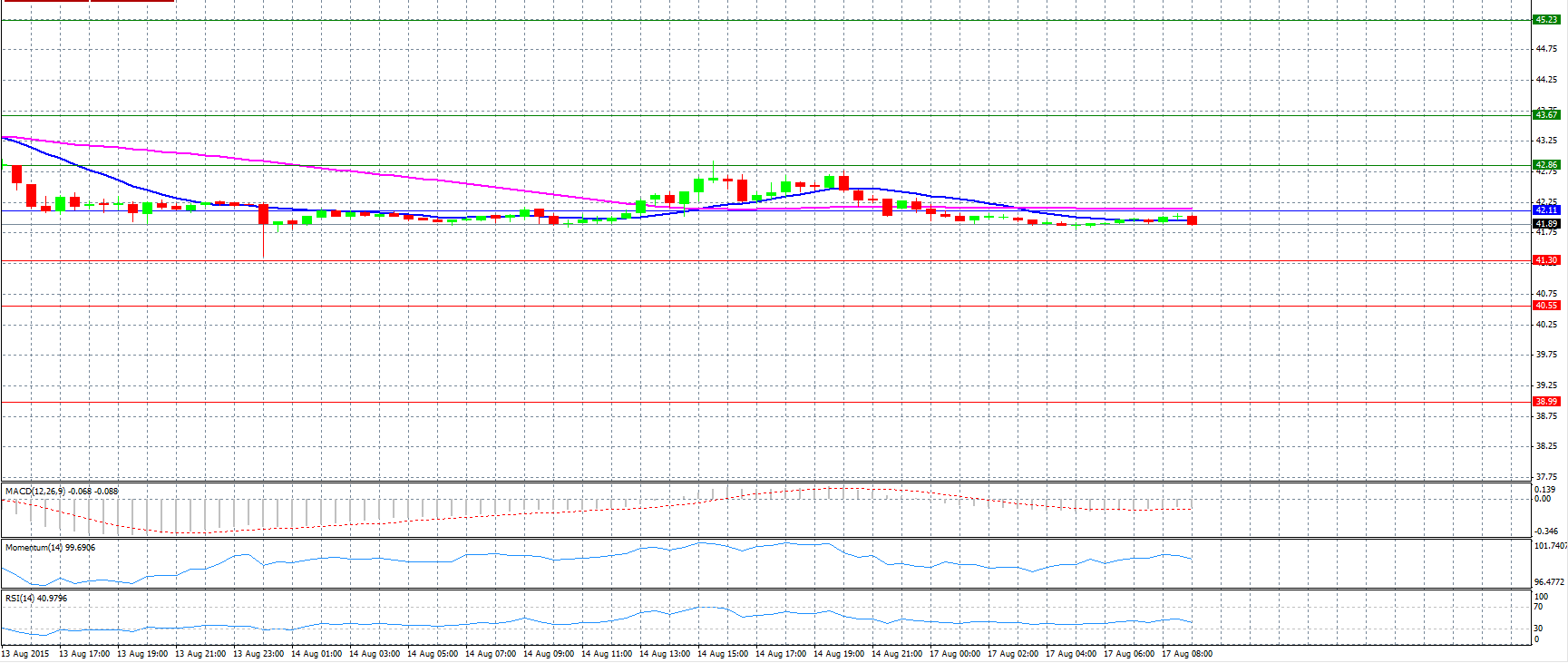

Market Scenario 1: Long positions above 42.11 with targets @ 42.86 & 43.67.

Market Scenario 2: Short positions below 42.11 with targets @ 41.30 & 40.55.

Comment: Crude oil prices trade unchanged below pivot point 42.11.

Supports and Resistances:

R3 45.23

R2 43.67

R1 42.86

PP 42.11

S1 41.30

S2 40.55

S3 38.99

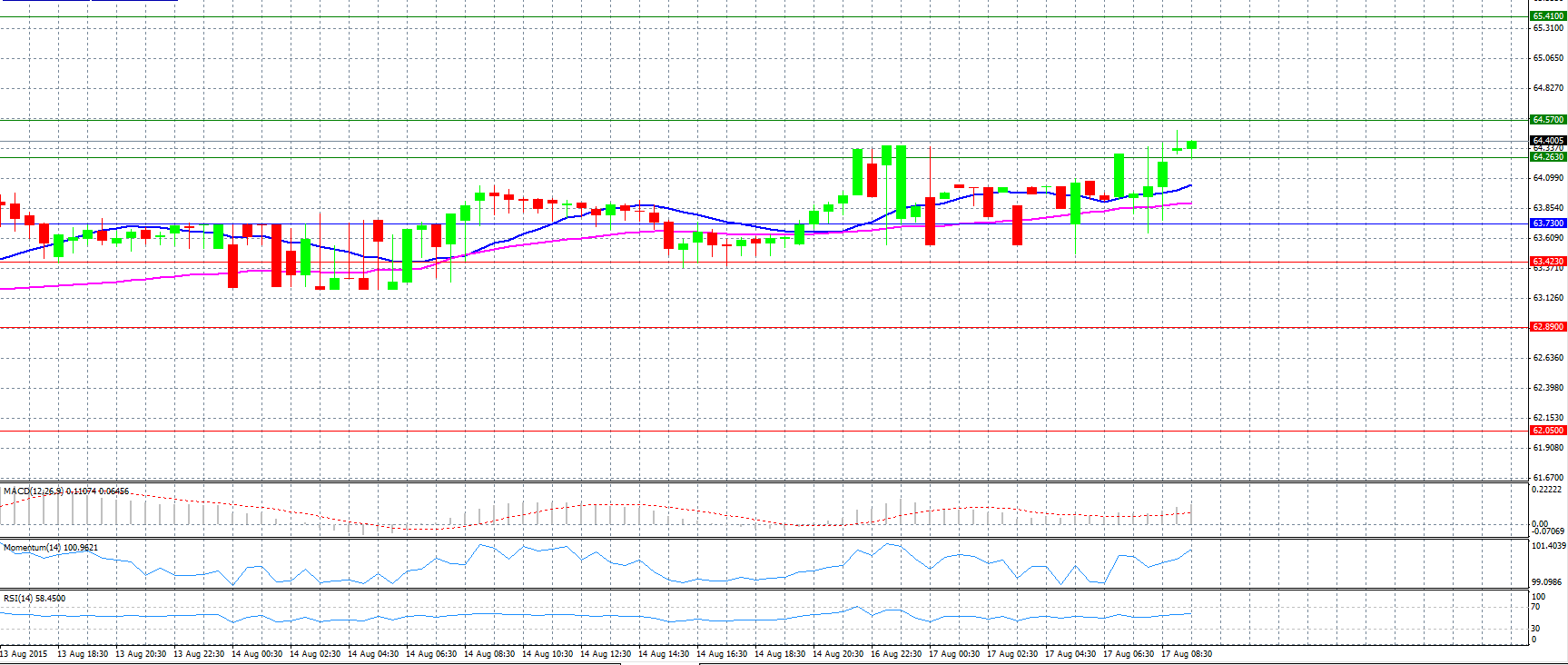

Market Scenario 1: Long positions above 63.730 with targets @ 64.263 & 64.570.

Market Scenario 2: Short positions below 63.730 with targets @ 63.423 & 62.890.

Comment: The pair advanced and surpassed resistance level 64.263.

Supports and Resistances:

R3 65.410

R2 64.570

R1 64.263

PP 63.730

S1 63.423

S2 62.890

S3 62.050