Market Scenario 1: Long positions above 0.7673 with target at 0.7708.

Market Scenario 2: Short positions below 0.7609 with target at 0.7574.

Comment: The pair might have a downside potential towards 0.7530 on a break below 0.7630, according to analysts.

Supports and Resistances:

R3 0.7807

R2 0.7772

R1 0.7708

PP 0.7673

S1 0.7609

S2 0.7574

S3 0.7510

Market Scenario 1: Long positions above 137.02 with target at 137.90.

Market Scenario 2: Short positions below 136.52 with target at 135.64.

Comment: The pair rose and surpassed pivot point 136.52.

Supports and Resistances:

R3 138.40

R2 137.90

R1 137.02

PP 136.52

S1 135.64

S2 135.14

S3 134.26

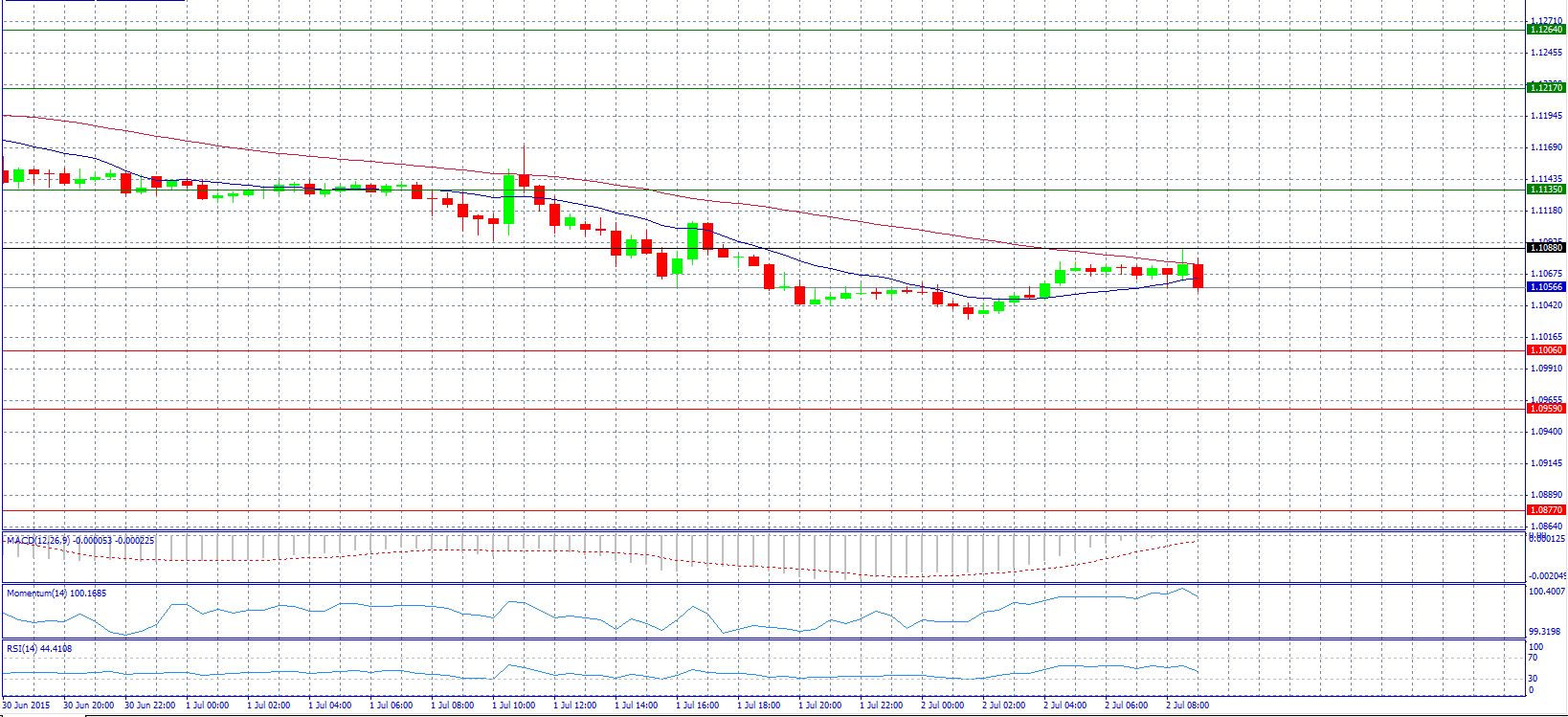

Market Scenario 1: Long positions above 1.1088 with target at 1.1135.

Market Scenario 2: Short positions below 1.1006 with target at 1.0959.

Comment: The pair is erasing profits ahead of US non-farm payrolls report.

Supports and Resistances:

R3 1.1264

R2 1.1217

R1 1.1135

PP 1.1088

S1 1.1006

S2 1.0959

S3 1.0877

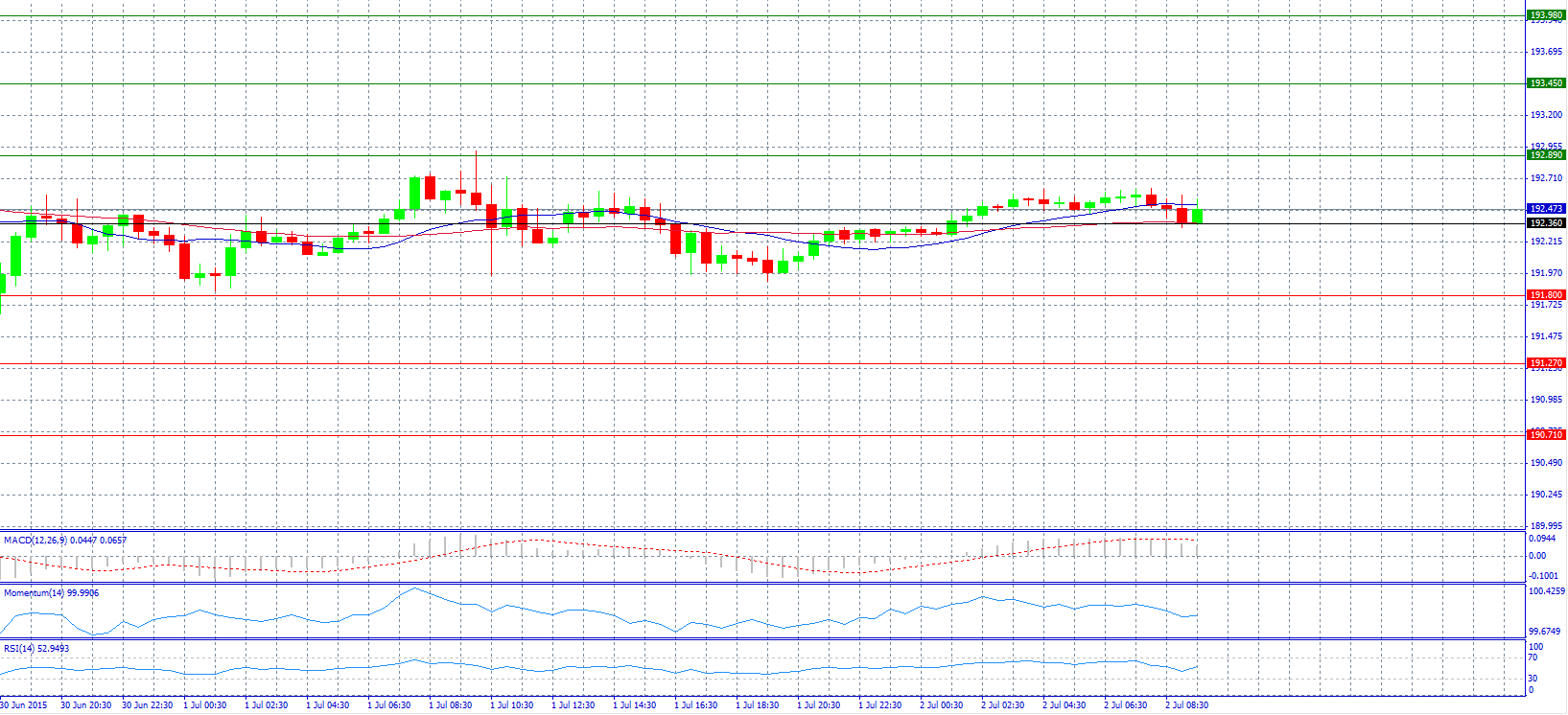

Market Scenario 1: Long positions above 192.36 with target at 192.89.

Market Scenario 2: Short positions below 192.36 with target at 191.80.

Comment: The pair trades neutral above pivot point 192.36.

Supports and Resistances:

R3 193.98

R2 193.45

R1 192.89

PP 192.36

S1 191.80

S2 191.27

S3 190.71

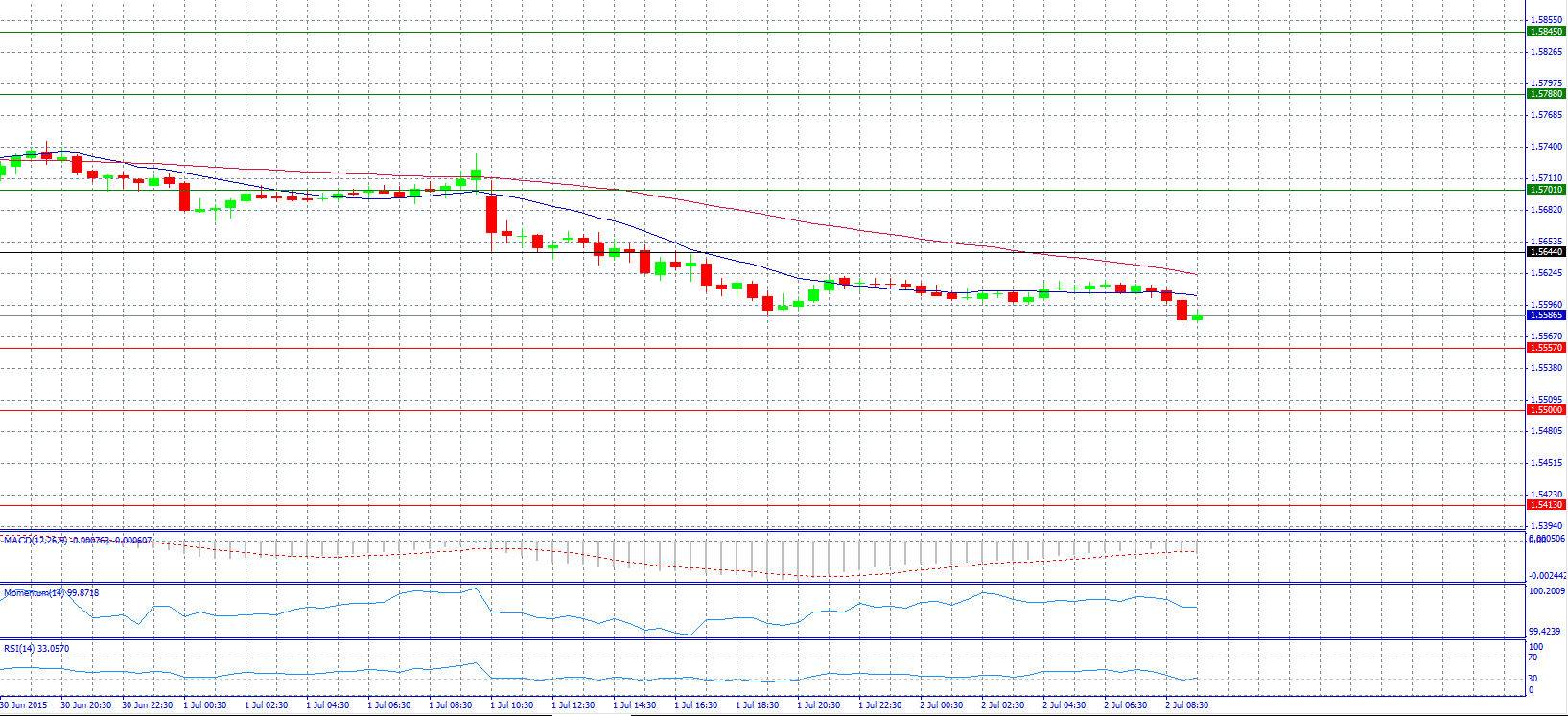

Market Scenario 1: Long positions above 1.5644 with target at 1.5701.

Market Scenario 2: Short positions below 1.5557 with target at 1.5500.

Comment: The pair is expected to extend losses towards 1.5549 because it broke below 1.5606, according to analysts.

Supports and Resistances:

R3 1.5845

R2 1.5788

R1 1.5701

PP 1.5644

S1 1.5557

S2 1.5500

S3 1.5413

Market Scenario 1: Long positions above 123.47 with target at 123.79.

Market Scenario 2: Short positions below 123.47 with target at 122.92.

Comment: The pair strengthened and now faces resistance level 123.47 ahead of US data.

Supports and Resistances:

R3 124.34

R2 123.79

R1 123.47

PP 122.92

S1 122.60

S2 122.05

S3 121.73

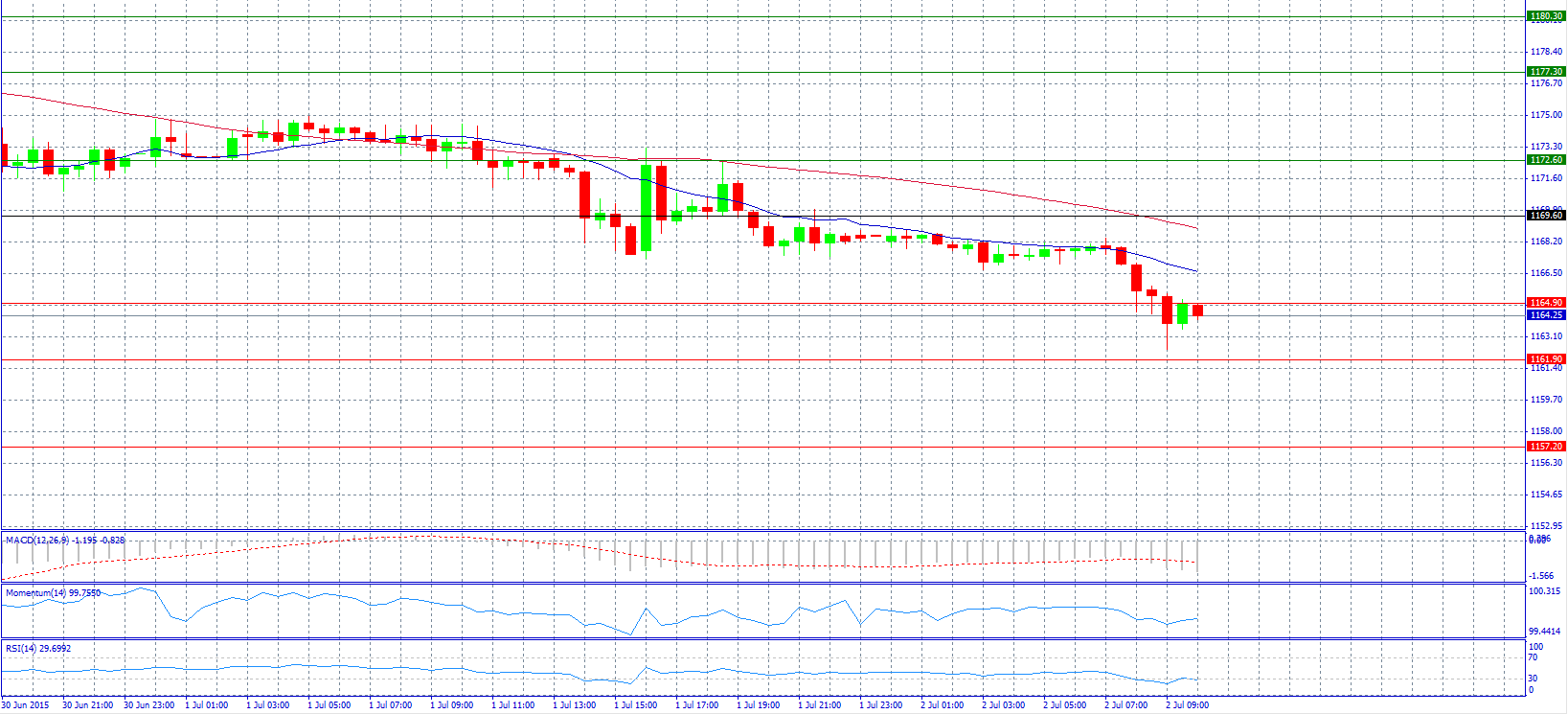

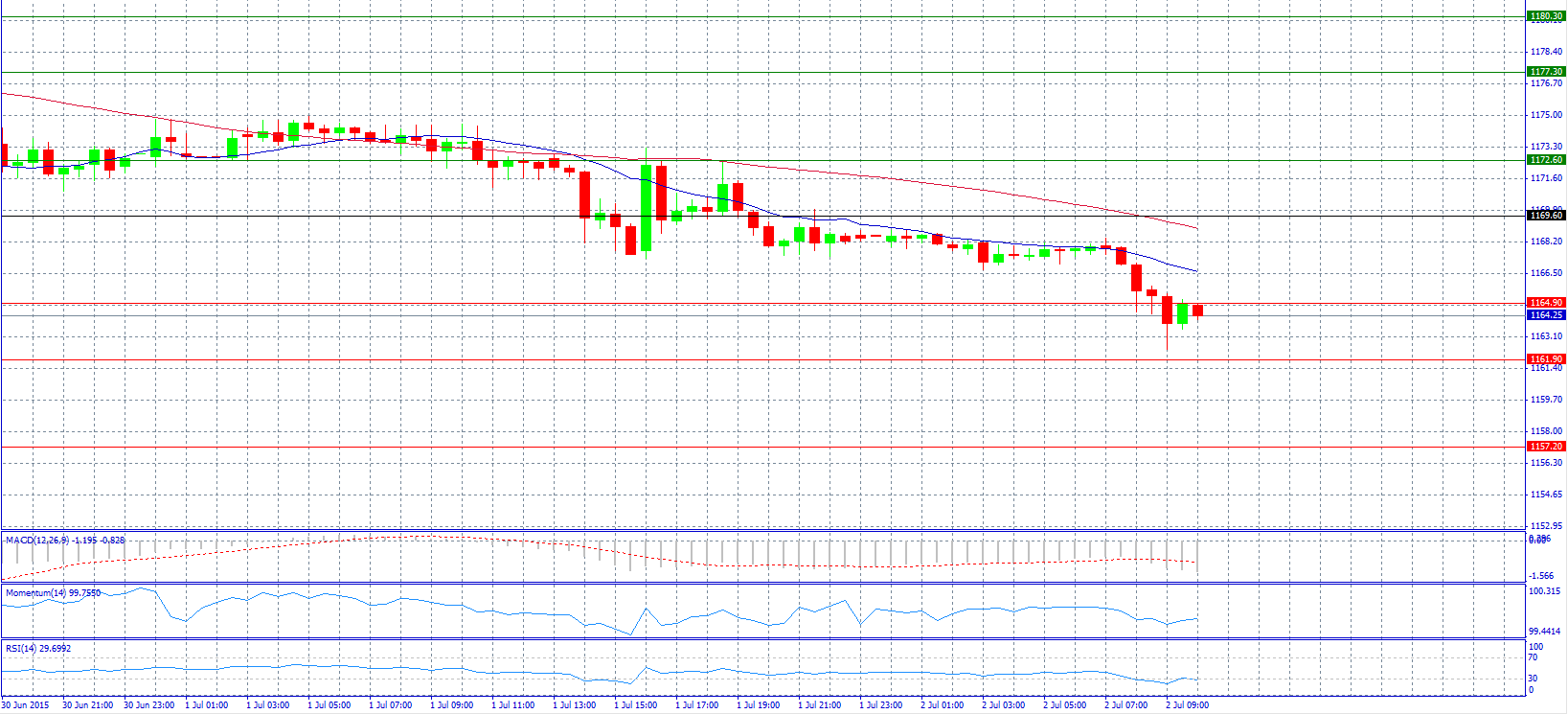

Market Scenario 1: Long positions above 1164.90 with target at 1169.60.

Market Scenario 2: Short positions below 1161.90 with target at 1157.20.

Comment: Gold prices continue to decline below support level 1164.90.

Supports and Resistances:

R3 1180.30

R2 1177.30

R1 1172.60

PP 1169.60

S1 1164.90

S2 1161.90

S3 1157.20

Market Scenario 1: Long positions above 57.51 with target at 58.34.

Market Scenario 2: Short positions below 56.04 with target at 55.21.

Comment: Crude oil prices weakened and fell below pivot point 57.51.

Supports and Resistances:

R3 60.64

R2 59.81

R1 58.34

PP 57.51

S1 56.04

S2 55.21

S3 53.74

Market Scenario 1: Long positions above 54.426 with target at 55.120.

Market Scenario 2: Short positions below 54.426 with target at 54.007.

Comment: The pair struggles to stay above pivot point 54.426.

Supports and Resistances:

R3 56.652

R2 55.539

R1 55.120

PP 54.426

S1 54.007

S2 53.313

S3 52.200