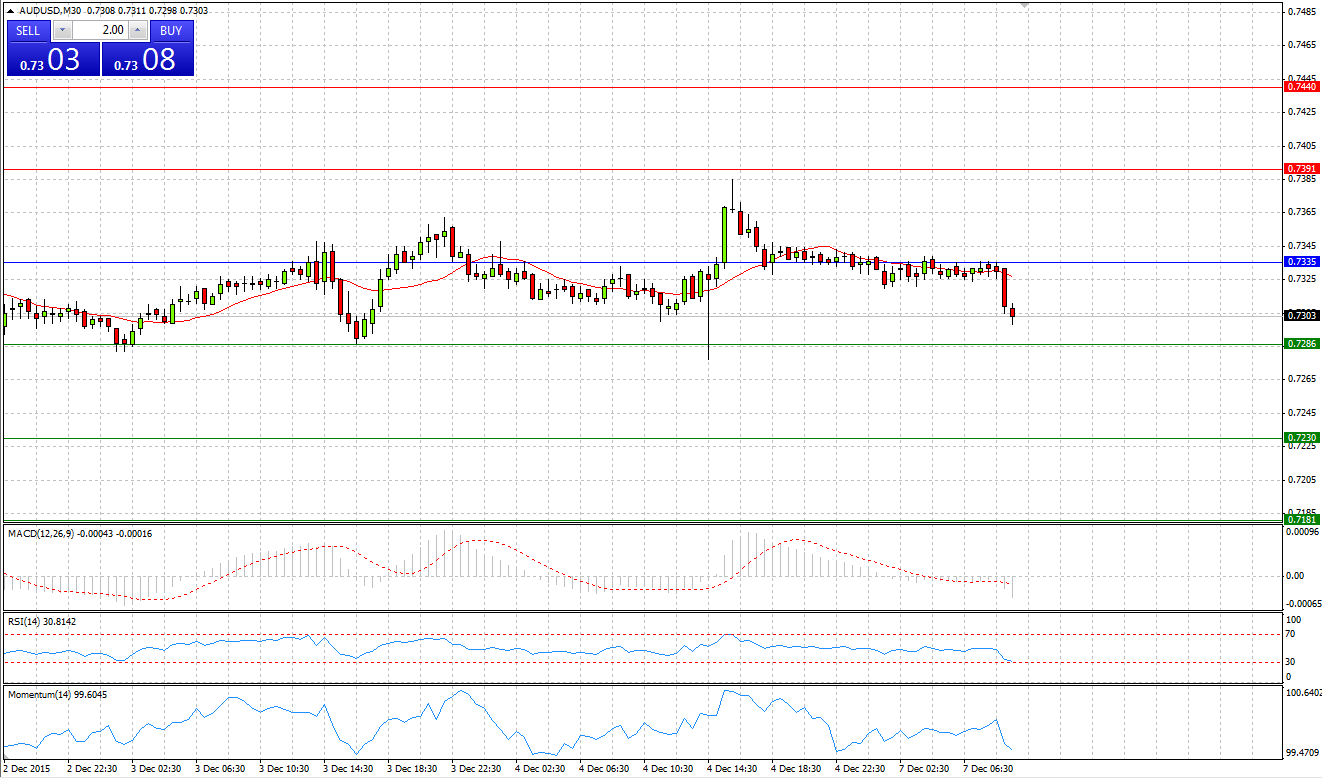

Market Scenario 1: Long positions above 0.7335 with targets at 0.7391 and 0.7440

Market Scenario 2: Short positions below 0.7335 with targets at 0.7286 and 0.7230

Comment: Aussie during Friday’s session reached a new high at 0.7385 against US dollar, the highest level since 13th of August. Today AUD/USD is trading under pressure below Pivot Point level.

Supports and Resistances:

R3 0.7496

R2 0.7440

R1 0.7391

PP 0.7335

S1 0.7286

S2 0.7230

S3 0.7181

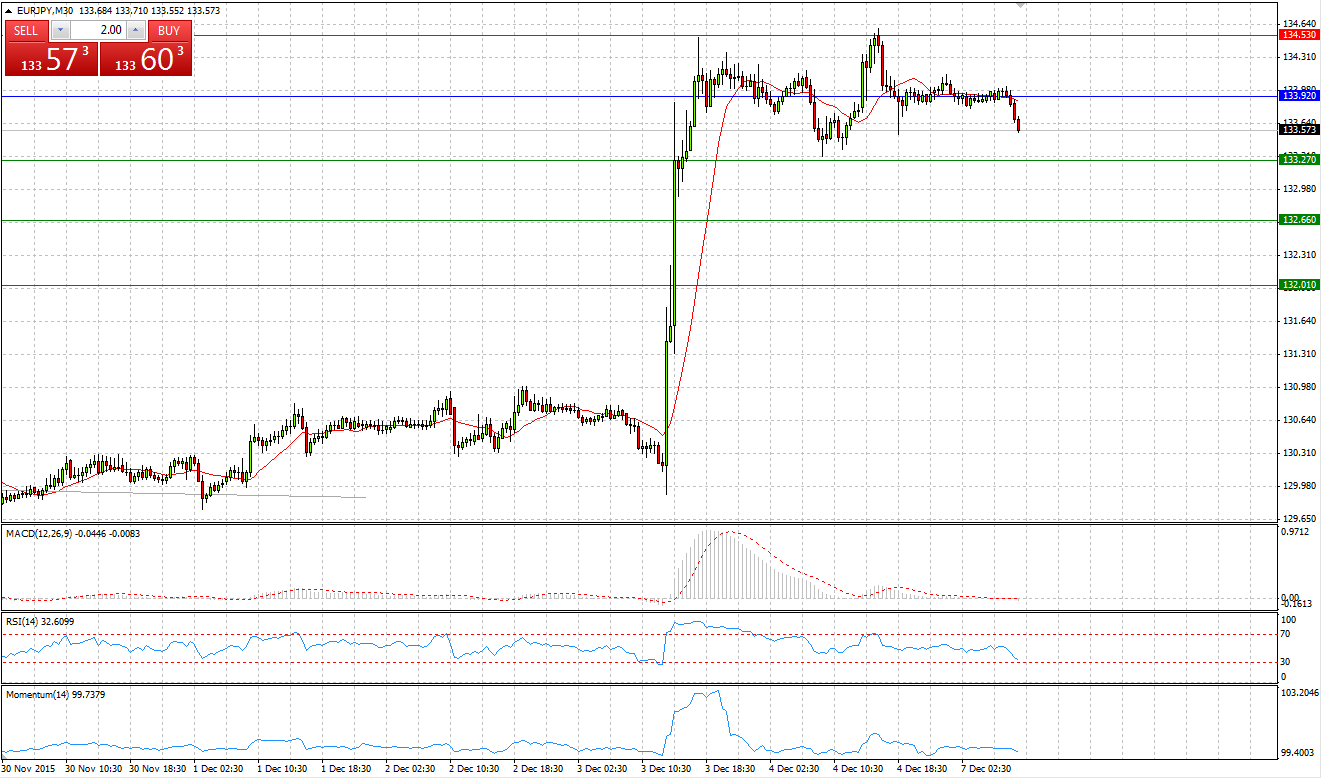

EUR/JPY

Market Scenario 1: Long positions above 132.91 with targets at 135.67 and 137.26

Market Scenario 2: Short positions below 132.91 with targets at 131.32 and 128.56

Comment: After Thursday’s rally when European currency appreciated for more than 300 pips per one day against Japanese yen, the pair has been trading flat. Today EUR/JPY is trading cautiously ahead of BOJ governor Kuroda’s speech.

Supports and Resistances:

R3 135.79

R2 135.18

R1 134.53

PP 133.92

S1 133.27

S2 132.66

S3 132.01

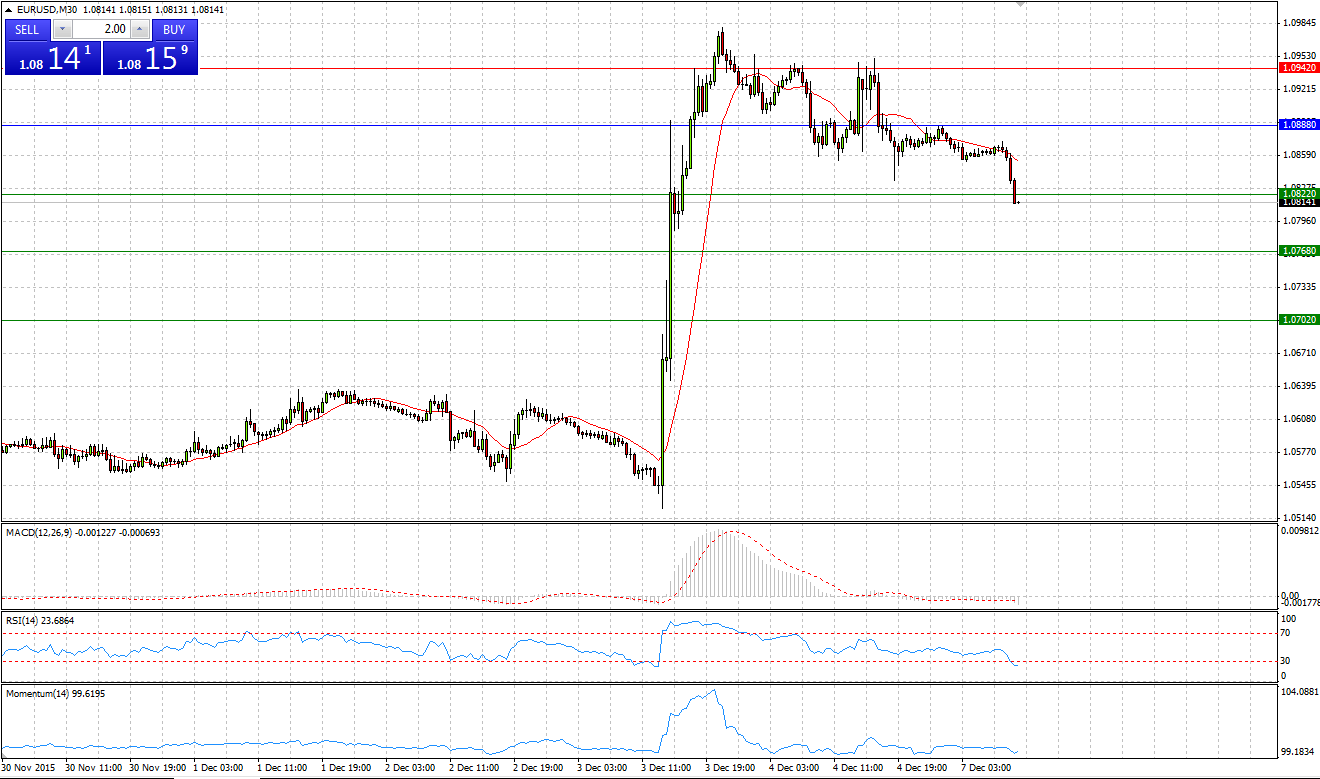

EUR/USD

Market Scenario 1: Long positions above 1.0888 with targets at 1.0942 and 1.1008

Market Scenario 2: Short positions below 1.0888 with targets at 1.0822 and 1.0768

Comment: European currency gradually giving back its positions achieved on Thursday’s session against US dollar amid expectations that Fed Reserve will hike rate this year. Currently EUR/USD is trading below the First Support level aiming to test the Second One.

Supports and Resistances:

R3 1.1062

R2 1.1008

R1 1.0942

PP 1.0888

S1 1.0822

S2 1.0768

S3 1.0702

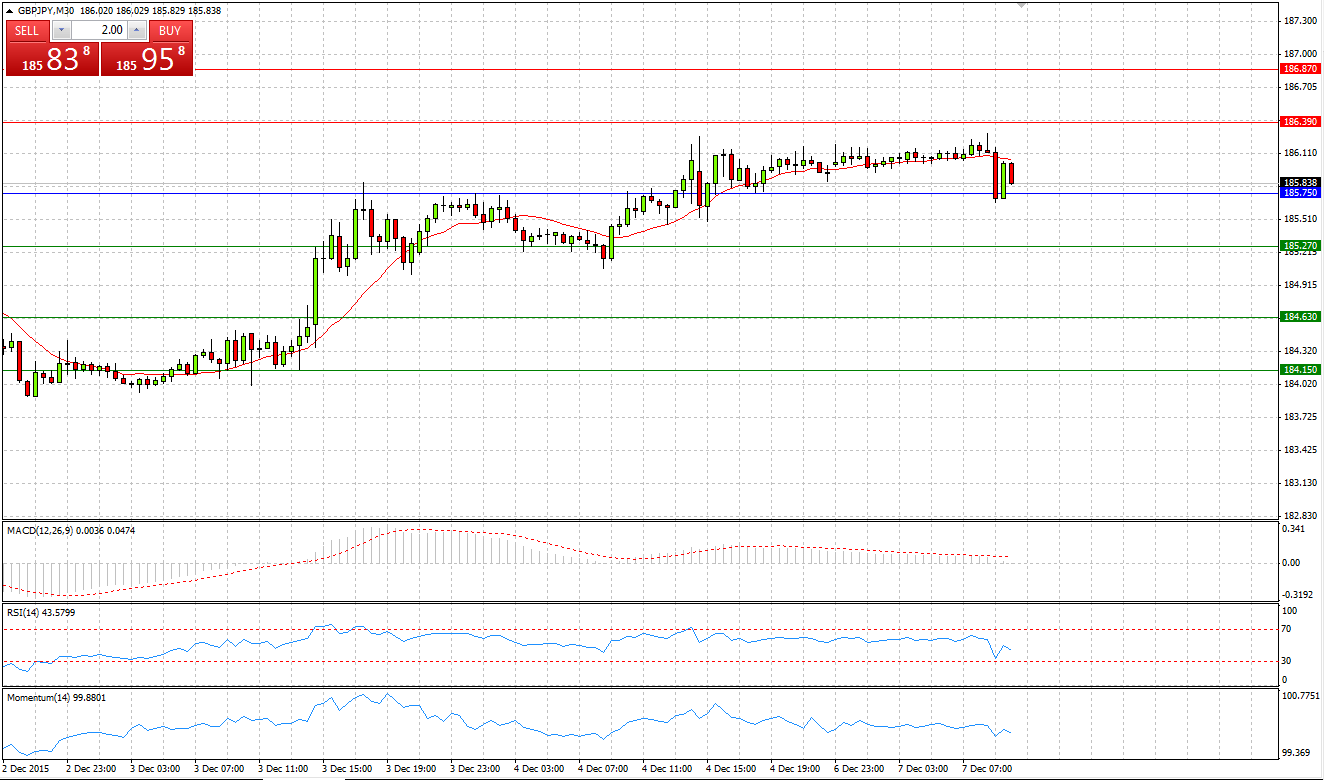

Market Scenario 1: Long positions above 185.75 with targets at 186.39 and 186.87

Market Scenario 2: Short positions below 185.75 with targets at 185.27 and 184.63

Comment: Sterling facing difficulties to break through the first Resistance level at 186.39 for the last two days. With an empty financial calendar today, it is expected that the pair will remain trading in the range.

Supports and Resistances:

R3 187.51

R2 186.87

R1 186.39

PP 185.75

S1 185.27

S2 184.63

S3 184.15

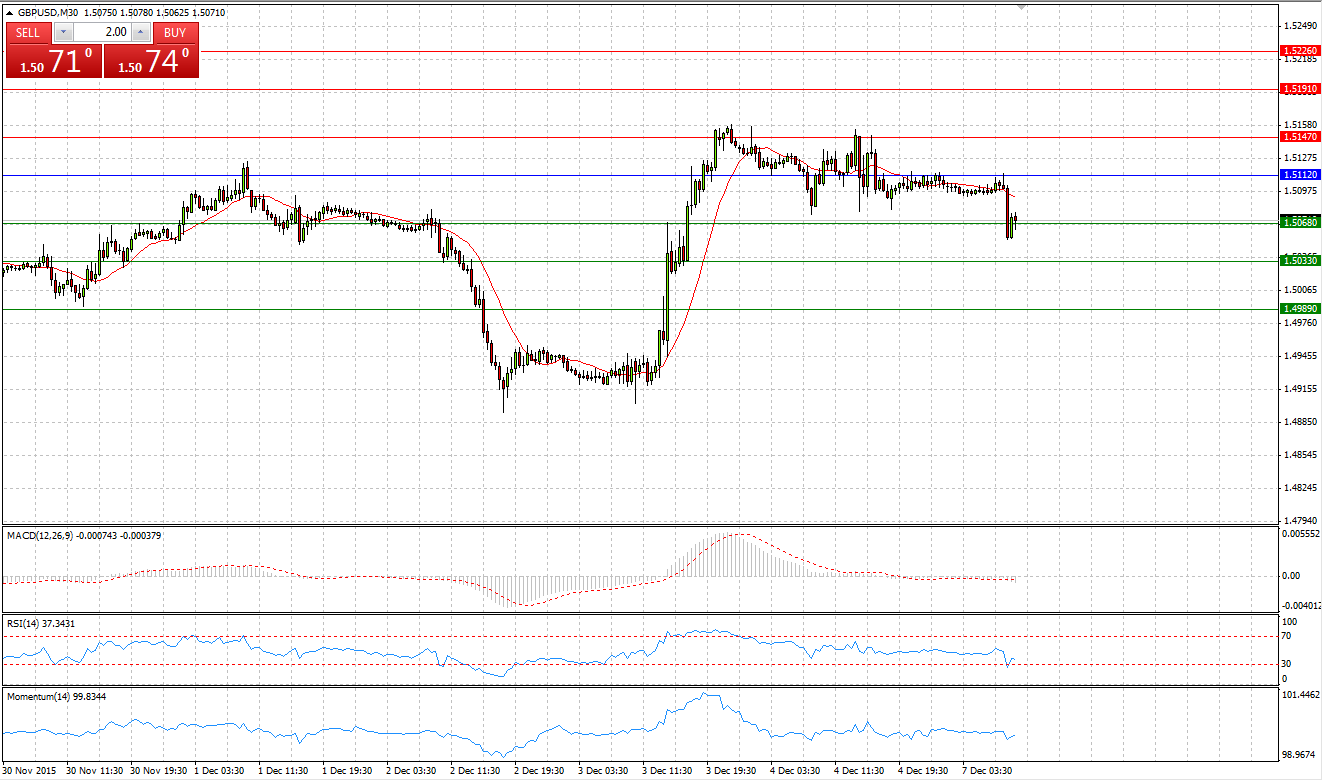

Market Scenario 1: Long positions above 1.5112 with targets at 1.5147 and 1.5191

Market Scenario 2: Short positions below 1.5112 with targets at 1.5068 and 1.5033

Comment: Sterling is trading under pressure since Friday’s session against US dollar sinking below 1.51. Today at 16:00 GMT+1 BOE governor Carney will give a speech in Brussels

Supports and Resistances:

R3 1.5226

R2 1.5191

R1 1.5147

PP 1.5112

S1 1.5068

S2 1.5033

S3 1.4989

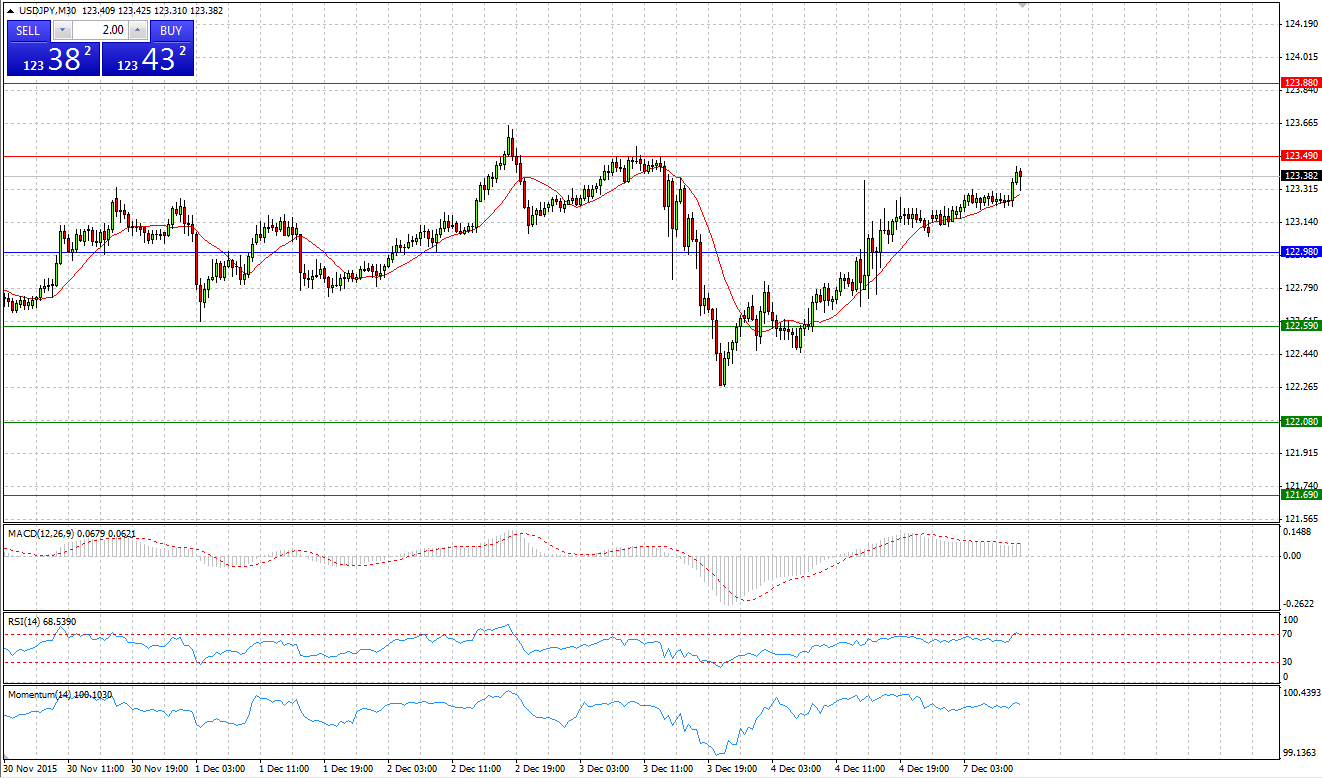

Market Scenario 1: Long positions above 122.98 with targets at 123.49 and 123.88

Market Scenario 2: Short positions below 122.98 with targets at 122.59 and 122.08

Comment: US dollar continues undertaking attempts to break through the first Resistance level, however, the level remains inapproachable. Currently the pair is trading close to R1

Supports and Resistances:

R3 124.39

R2 123.88

R1 123.49

PP 122.98

S1 122.59

S2 122.08

S3 121.69

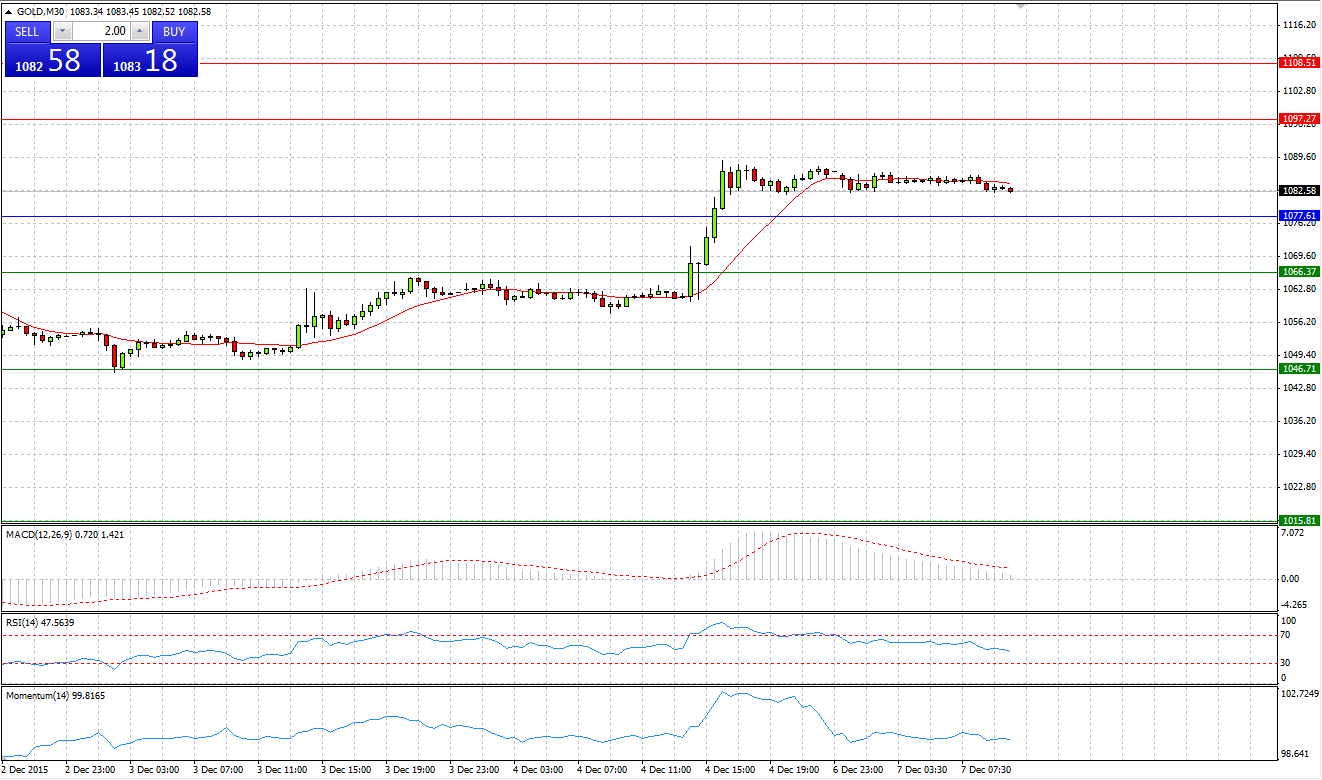

GOLD

Market Scenario 1: Long positions above 1077.61 with targets at 1097.27 and 1108.51

Market Scenario 2: Short positions below 1077.61 with targets at 1066.37 and 1046.71

Comment: Gold during Friday’s session rose for almost 25 US dollar per one day the sharpest increase since second of October. At the time being, gold is trading above Pivot Point level.

Supports and Resistances:

R3 1139.41

R2 1108.51

R1 1097.27

PP 1077.61

S1 1066.37

S2 1046.71

S3 1015.81

CRUDE OIL

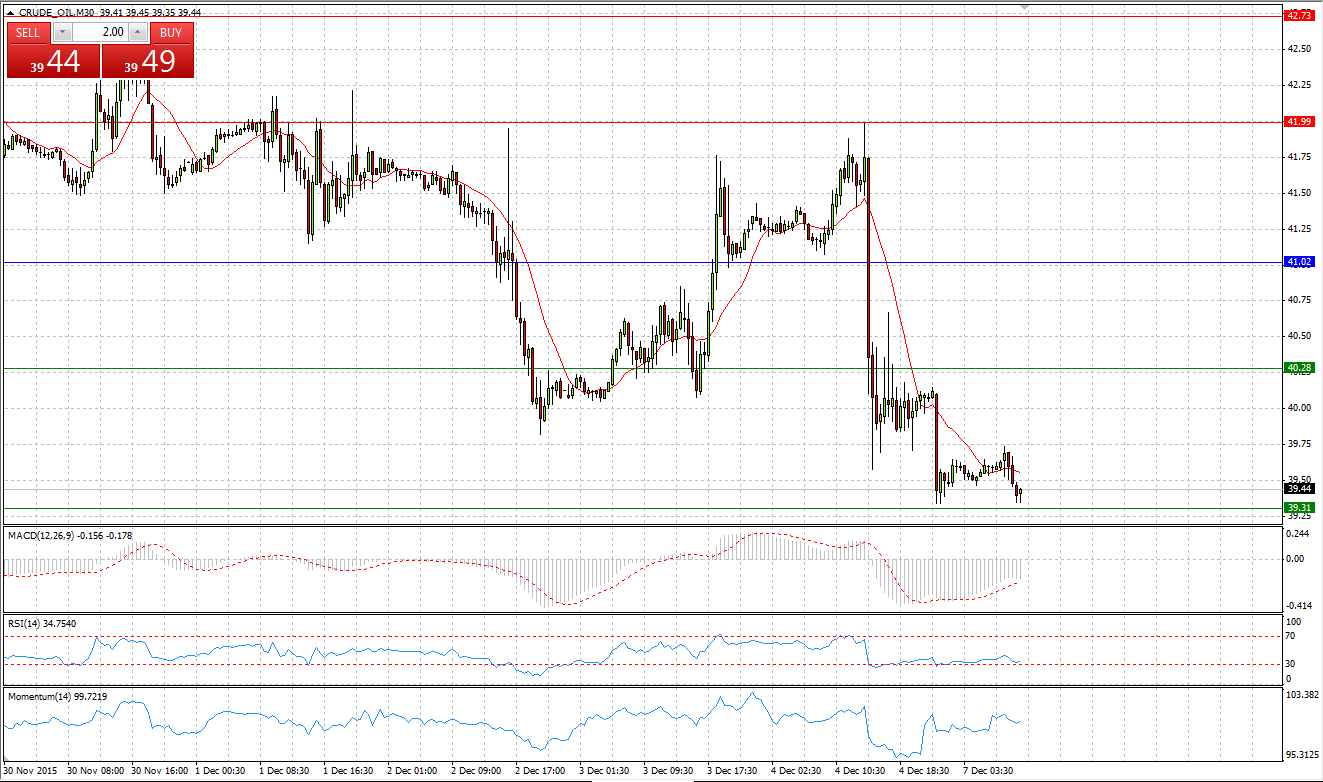

Market Scenario 1: Long positions above 41.02 with targets at 41.99 and 42.73

Market Scenario 2: Short positions below 41.02 with targets at 40.28 and 39.31

Comment: After OPEC’s meeting, where OPEC members decided to keep pumping oil with the same volume, crude came under pressure and dropped below psychologically important level of 40 US dollar a barrel. Currently crude already broke through Pivot Point and first Support level and testing the Second one.

Supports and Resistances:

R3 44.44

R2 42.73

R1 41.99

PP 41.02

S1 40.28

S2 39.31

S3 37.60

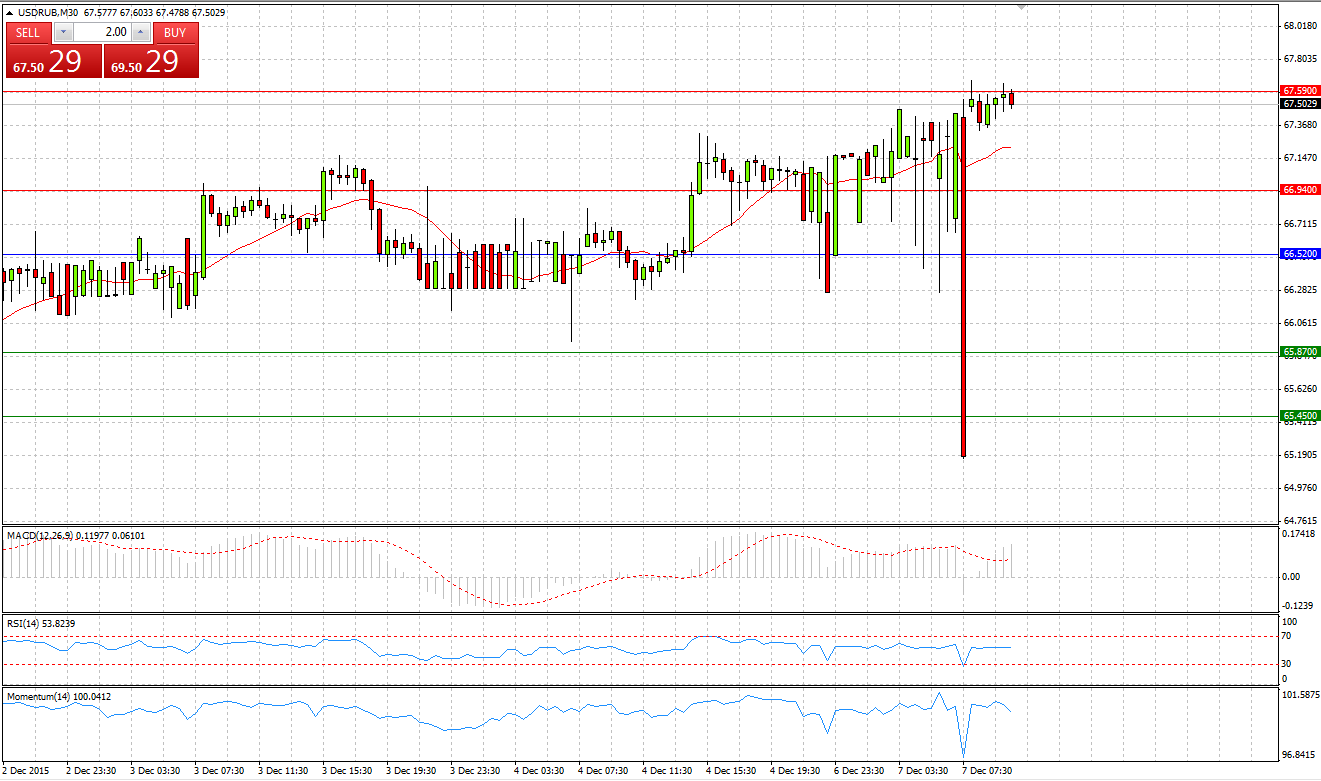

Market Scenario 1: Long positions above 64.77 with targets at 69.60 and 72.14

Market Scenario 2: Short positions below 64.77 with targets at 62.23 and 57.40

Comment: US dollar continues appreciating against Russian ruble for sixth day in the row, reaching its highest level at 67.66 amid disappointing news from OPEC, which led crude prices to fall.

Supports and Resistances:

R3 79.51

R2 72.14

R1 69.60

PP 64.77

S1 62.23

S2 57.40

S3 50.03