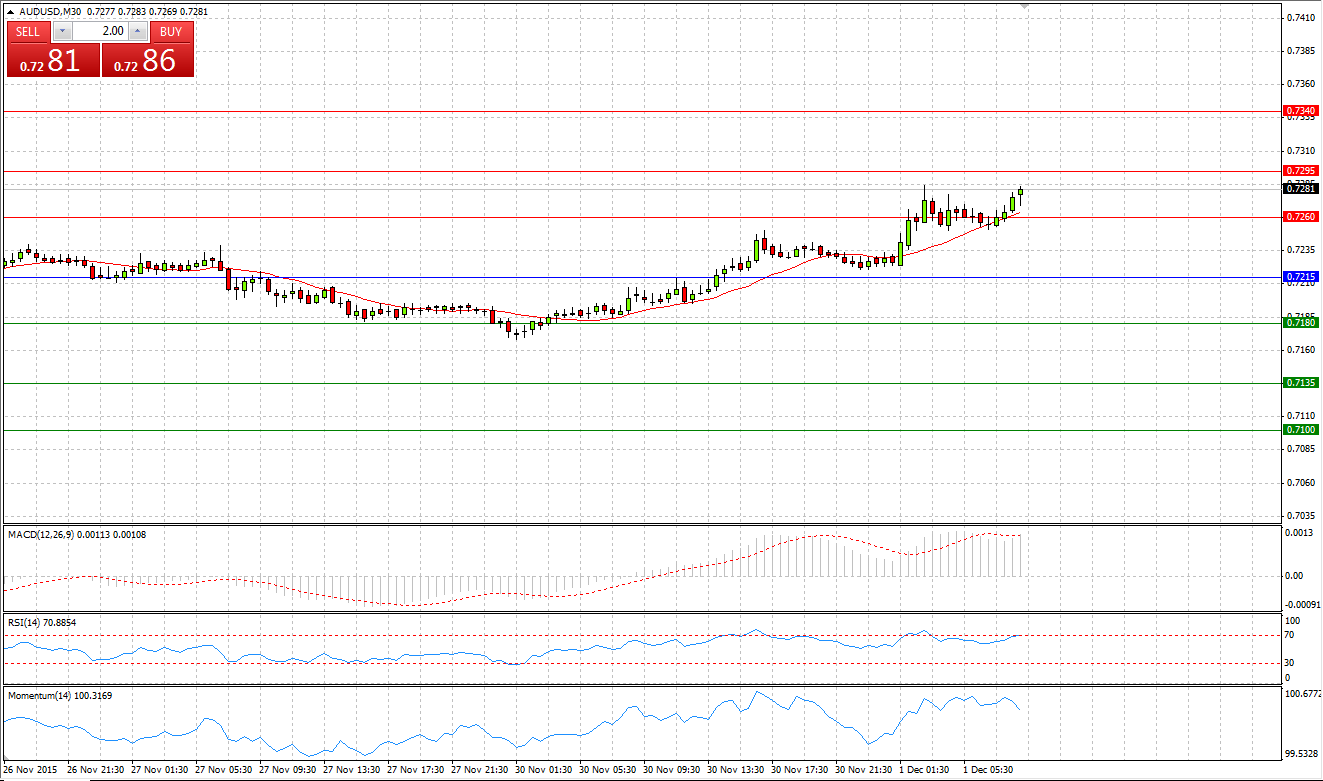

Market Scenario 1: Long positions above 0.7215 with targets at 0.7260 and 0.7295

Market Scenario 2: Short positions below 0.7215 with targets at 0.7180 and 0.7135

Comment: Having gathered the strength, Aussie closed yesterday session in positive territory, regaining all the losses incurred on Friday. Today AUD/USD continue trading positively, having already broken through the First resistance level and aiming to test the second one.

Supports and Resistances:

R3 0.7340

R2 0.7295

R1 0.7260

PP 0.7215

S1 0.7180

S2 0.7135

S3 0.7100

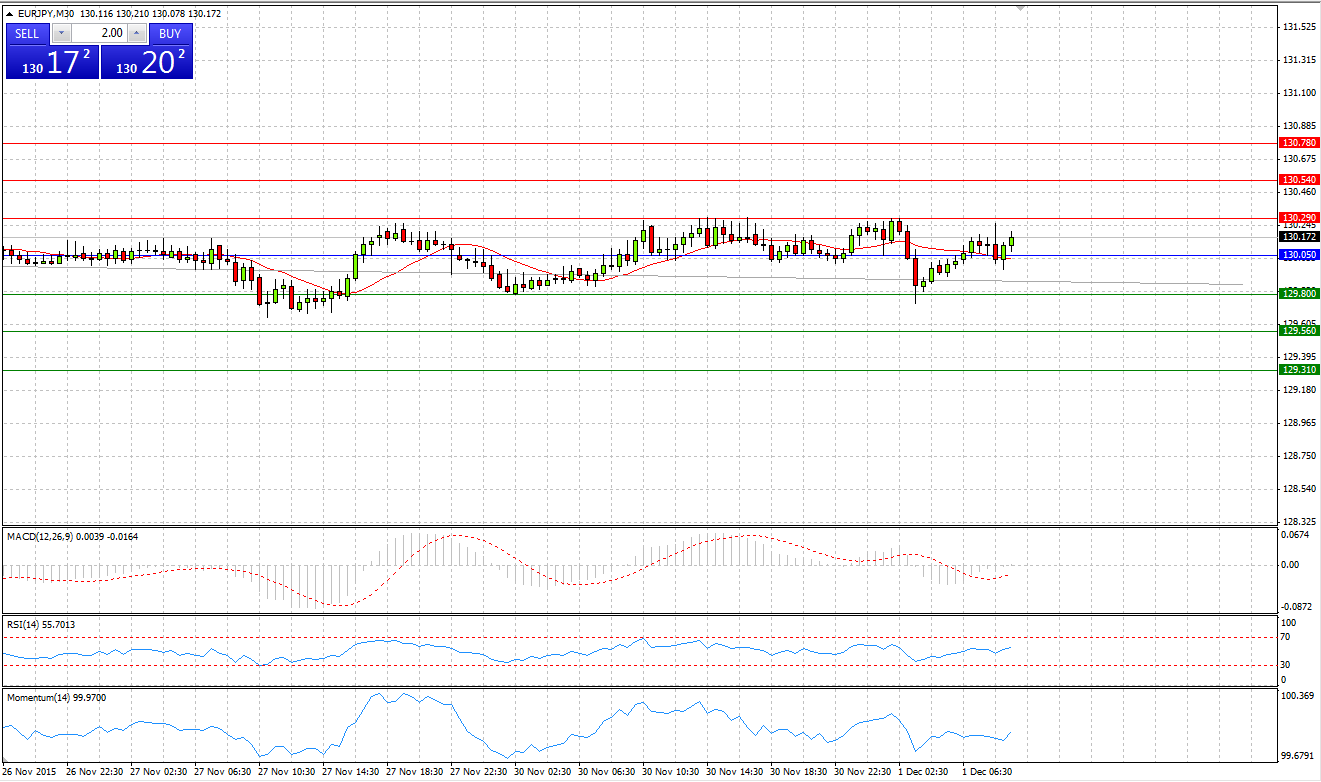

Market Scenario 1: Long positions above 130.05 with targets at 130.29 and 130.54

Market Scenario 2: Short positions below 130.05 with targets at 129.80 and 129.56

Comment: Having reached its lowest level at 129.65 on 27th of November, European currency has been trading flat against Japanese yen. Currently the pair is trading above Pivot Point level.

Supports and Resistances:

R3 130.78

R2 130.54

R1 130.29

PP 130.05

S1 129.80

S2 129.56

S3 129.31

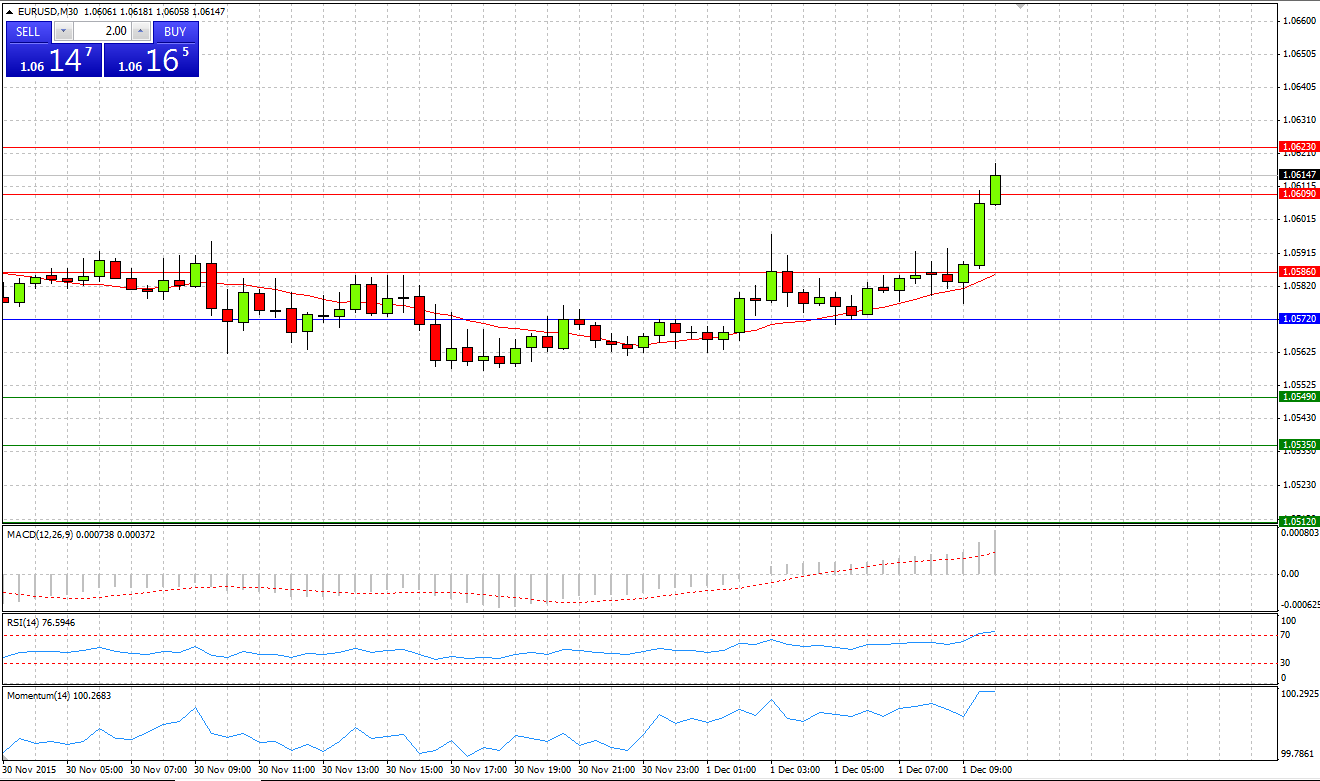

Market Scenario 1: Long positions above 1.0572 with targets at 1.0586 and 1.0609

Market Scenario 2: Short positions below 1.0572 with targets at 1.0549 and 1.0535

Comment: Having reached a fresh low during yesterday’s session at 1.0557 European currency managed to find solid ground and today is trading very positively, having broken through the First and the Second Resistance levels aiming to test the last one.

Supports and Resistances:

R3 1.0623

R2 1.0609

R1 1.0586

PP 1.0572

S1 1.0549

S2 1.0535

S3 1.0512

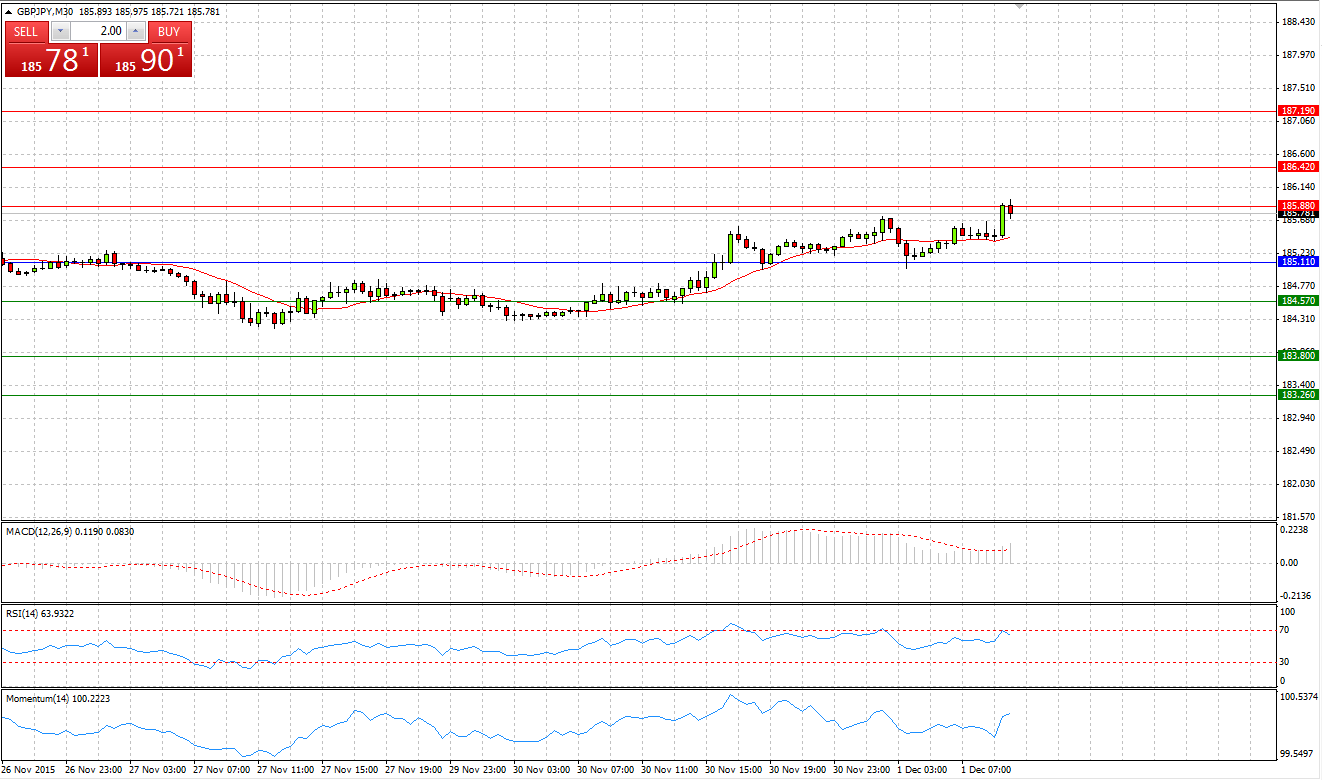

Market Scenario 1: Long positions above 185.11 with targets at 185.88 and 186.42

Market Scenario 2: Short positions below 185.11 with targets at 184.57 and 183.80

Comment: Sterling was trading very positively during yesterday’s session, closing yesterday’s session with almost 100 pips profit against Japanese yen amid positive economic news out of UK. Today, sterling continued its upward move and is currently testing the First Resistance level.

Supports and Resistances:

R3 187.19

R2 186.42

R1 185.88

PP 185.11

S1 184.57

S2 183.80

S3 183.26

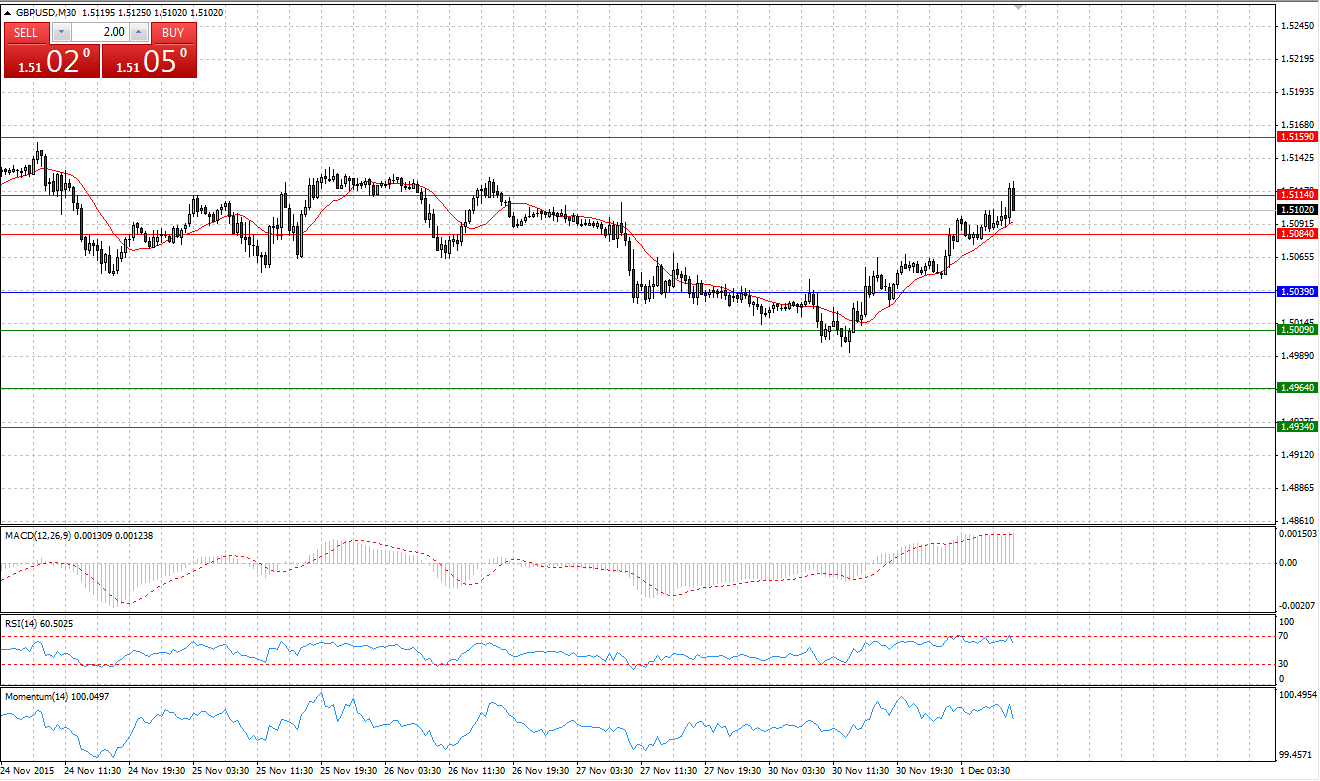

GBP/USD

Market Scenario 1: Long positions above 1.5039 with targets at 1.5084 and 1.5114

Market Scenario 2: Short positions below 1.5039 with targets at 1.5009 and 1.4964

Comment: Having sunk below 1.50 against US dollar during yesterday’s session, sterling found support and closed the day in positive territory. This was a very positive sign. Today GBP/USD continued regaining its losses incurred on Friday’s session, breaking through the Pivot Point and the First Resistance level and aiming to break through the Second one

Supports and Resistances:

R3 1.5159

R2 1.5114

R1 1.5084

PP 1.5039

S1 1.5009

S2 1.4964

S3 1.4934

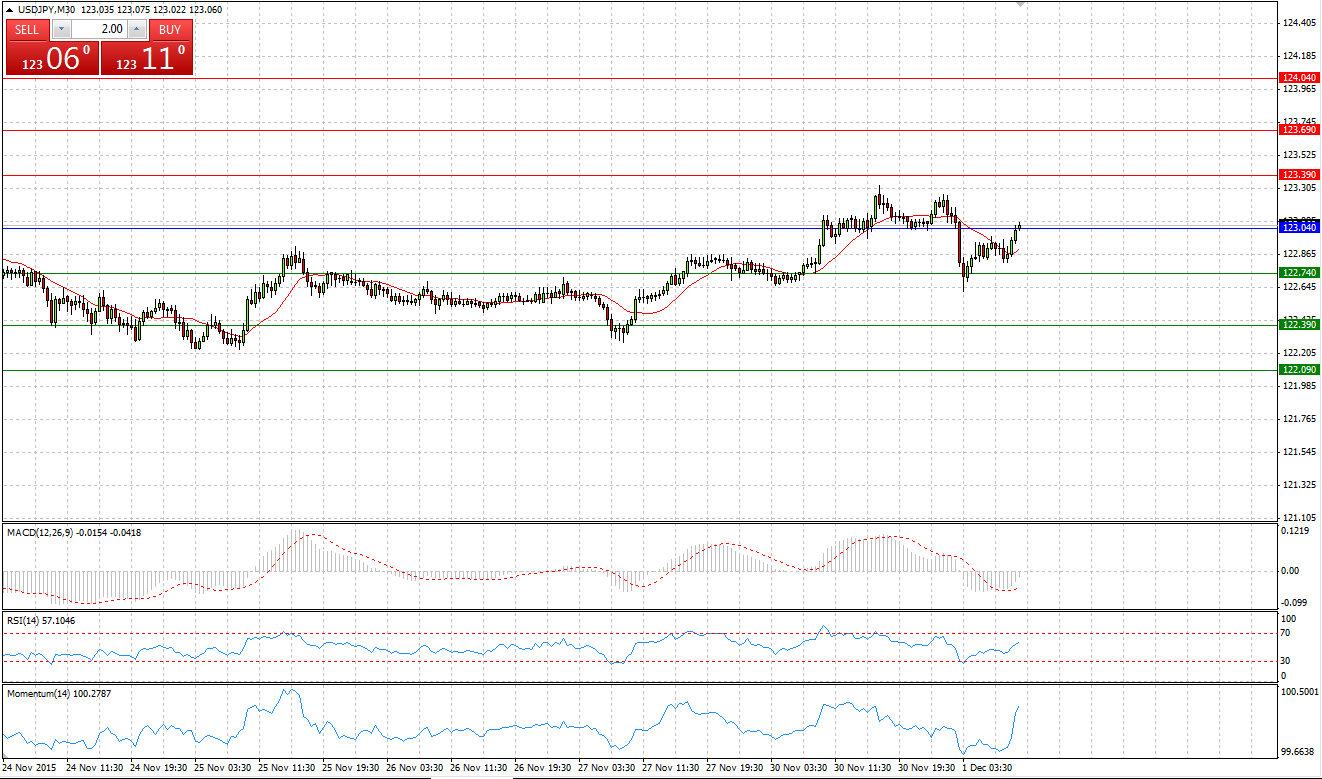

Market Scenario 1: Long positions above 123.04 with targets at 123.39 and 123.69

Market Scenario 2: Short positions below 123.04 with targets at 122.74 and 122.39

Comment: USD closed yesterday’s session with 40 pips profit against Japanese yen. During early Asian session, the pair encountered selling pressure and dropped to 122.62; however, bulls managed to regain the control and now the pair is trading close to its opening price.

Supports and Resistances:

R3 124.04

R2 123.69

R1 123.39

PP 123.04

S1 122.74

S2 122.39

S3 122.09

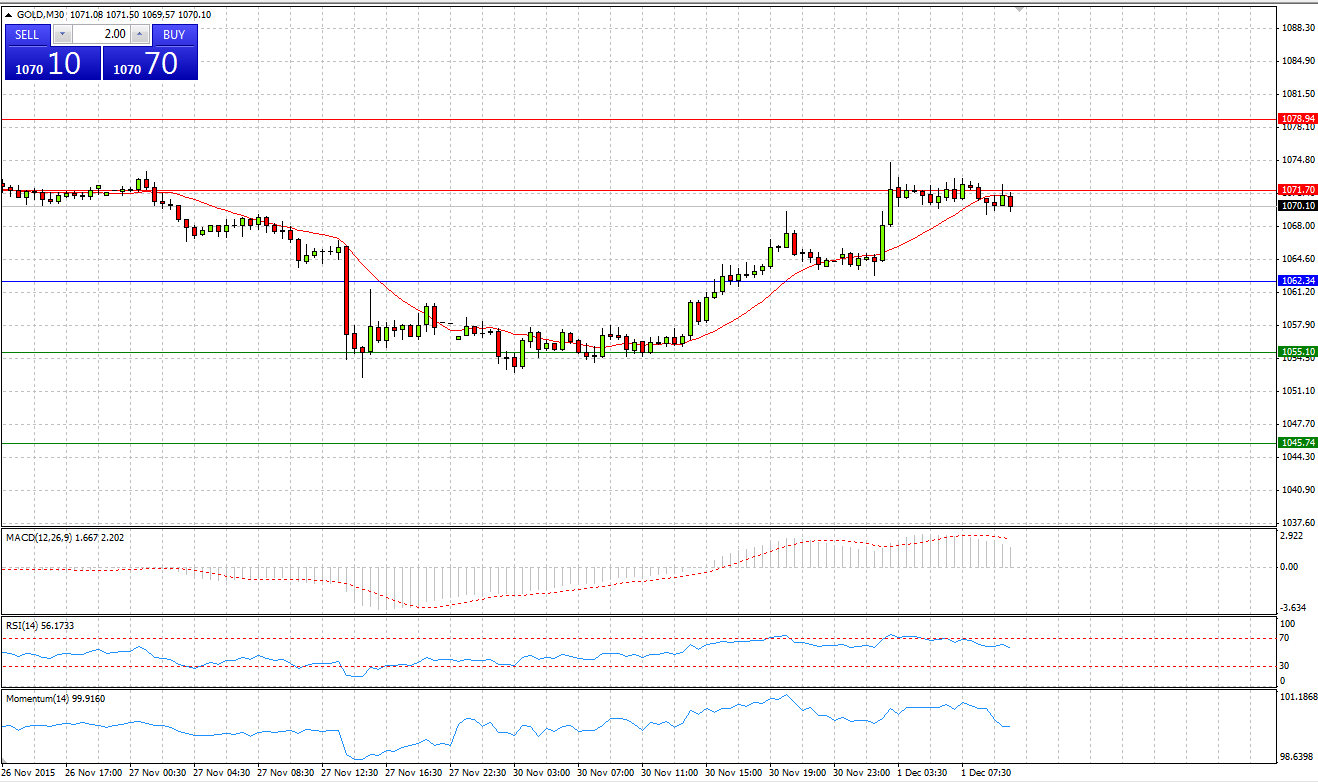

GOLD

Market Scenario 1: Long positions above 1062.34 with targets at 1071.70 and 1078.94

Market Scenario 2: Short positions below 1062.34 with targets at 1055.10 and 1045.74

Comment: Gold during yesterday’s session managed to regain some of its losses incurred on Friday session against US dollar. Today gold continues its upward move, having broken through the Pivot Point level and testing the First Resistance level.

Supports and Resistances:

R3 1095.54

R2 1078.94

R1 1071.70

PP 1062.34

S1 1055.10

S2 1045.74

S3 1029.14

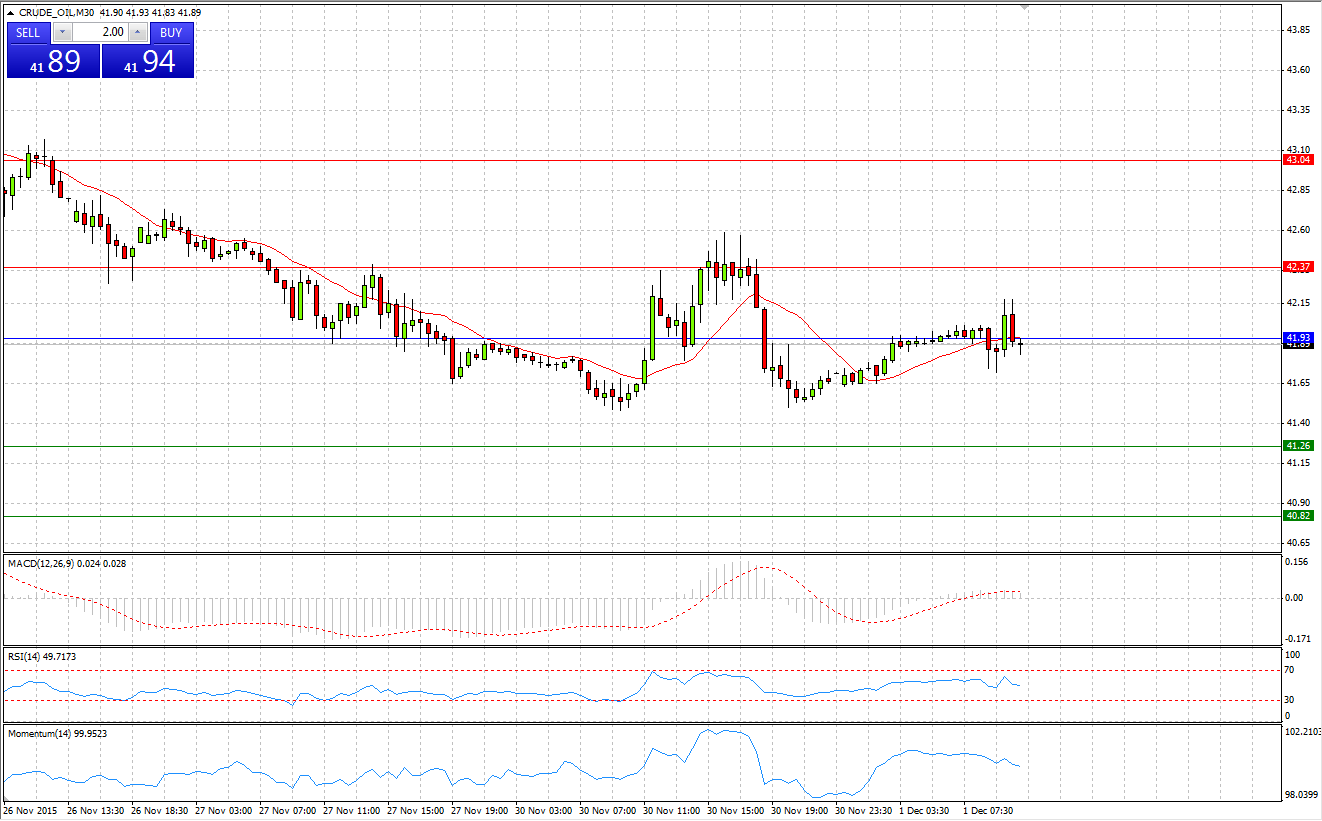

CRUDE OIL

Market Scenario 1: Long positions above 41.93 with targets at 42.37 and 43.04

Market Scenario 2: Short positions below 41.93 with targets at 41.26 and 40.82

Comment: Crude closed yesterday’s session with almost no change against US dollar. Today, crude is trading positively, however, it faces strong selling pressure above 42 US dollar per barrel.

Supports and Resistances:

R3 44.15

R2 43.04

R1 42.37

PP 41.93

S1 41.26

S2 40.82

S3 39.71

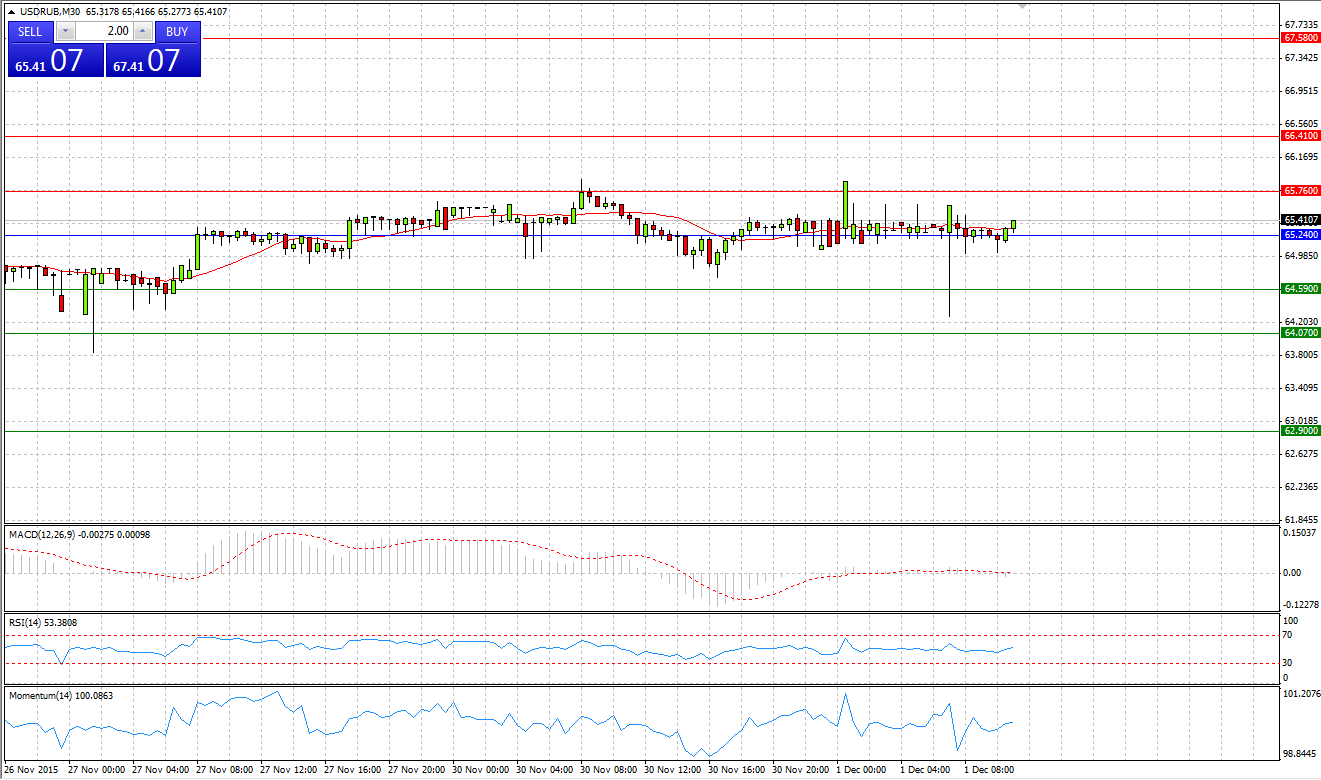

USD/RUB

Market Scenario 1: Long positions above 65.24 with targets at 65.76 and 66.41

Market Scenario 2: Short positions below 65.24 with targets at 64.59 and 64.07

Comment: USD/RUB continue trading below important level of 66 ruble per US dollar. If the pair succeed to break through this level, USD/RUB may continue appreciating further.

Supports and Resistances:

R3 67.58

R2 66.41

R1 65.76

PP 65.24

S1 64.59

S2 64.07

S3 62.90