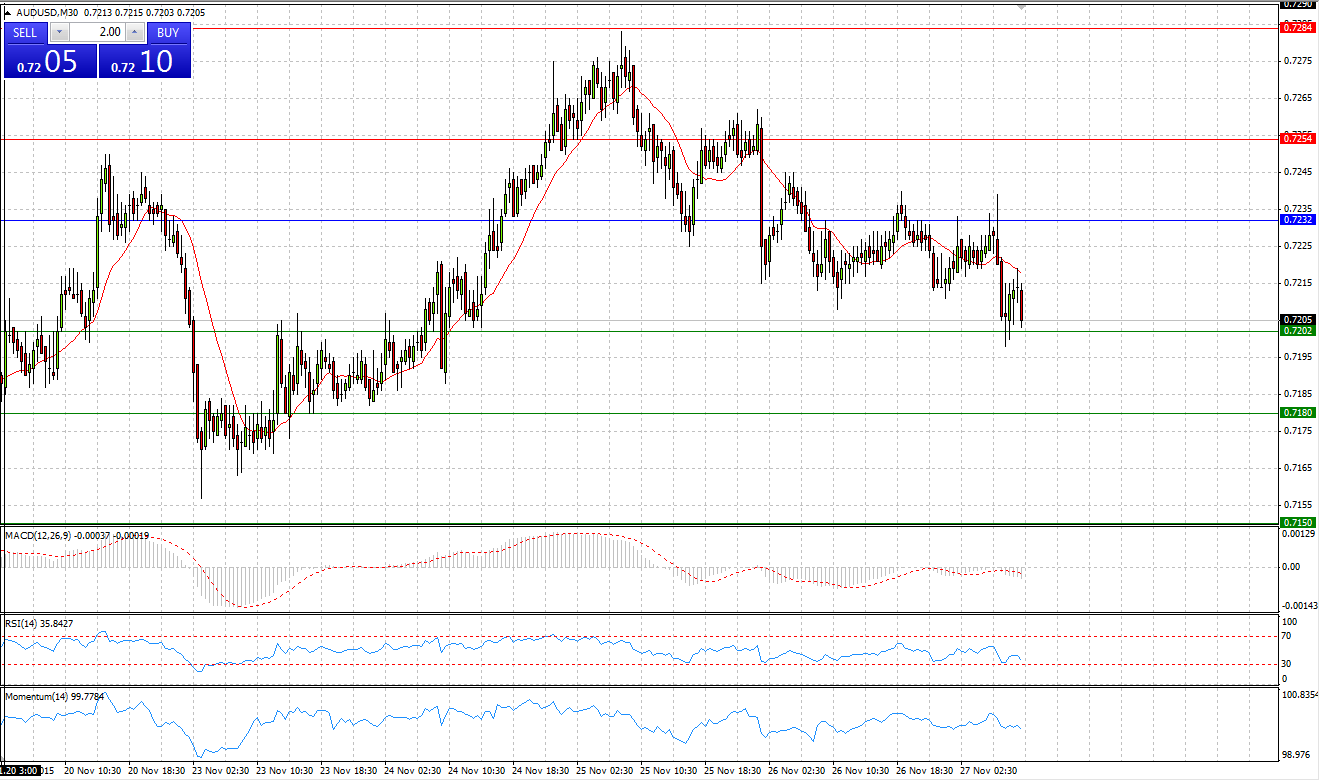

Market Scenario 1: Long positions above 0.7232 with targets at 0.7254 and 0.7284

Market Scenario 2: Short positions below 0.7232 with targets at 0.7202 and 0.7180

Comment: Amid adverse news out of Australian’s Private Capital Expenditure, Aussie came under selling pressure and closed yesterday’s session with 30 pips loss against US dollar, erasing almost all the gains it managed to achieve on Tuesday. Today, Aussie continues trading under pressure, testing the First support level.

Supports and Resistances:

R3 0.7306

R2 0.7284

R1 0.7254

PP 0.7232

S1 0.7202

S2 0.7180

S3 0.7150

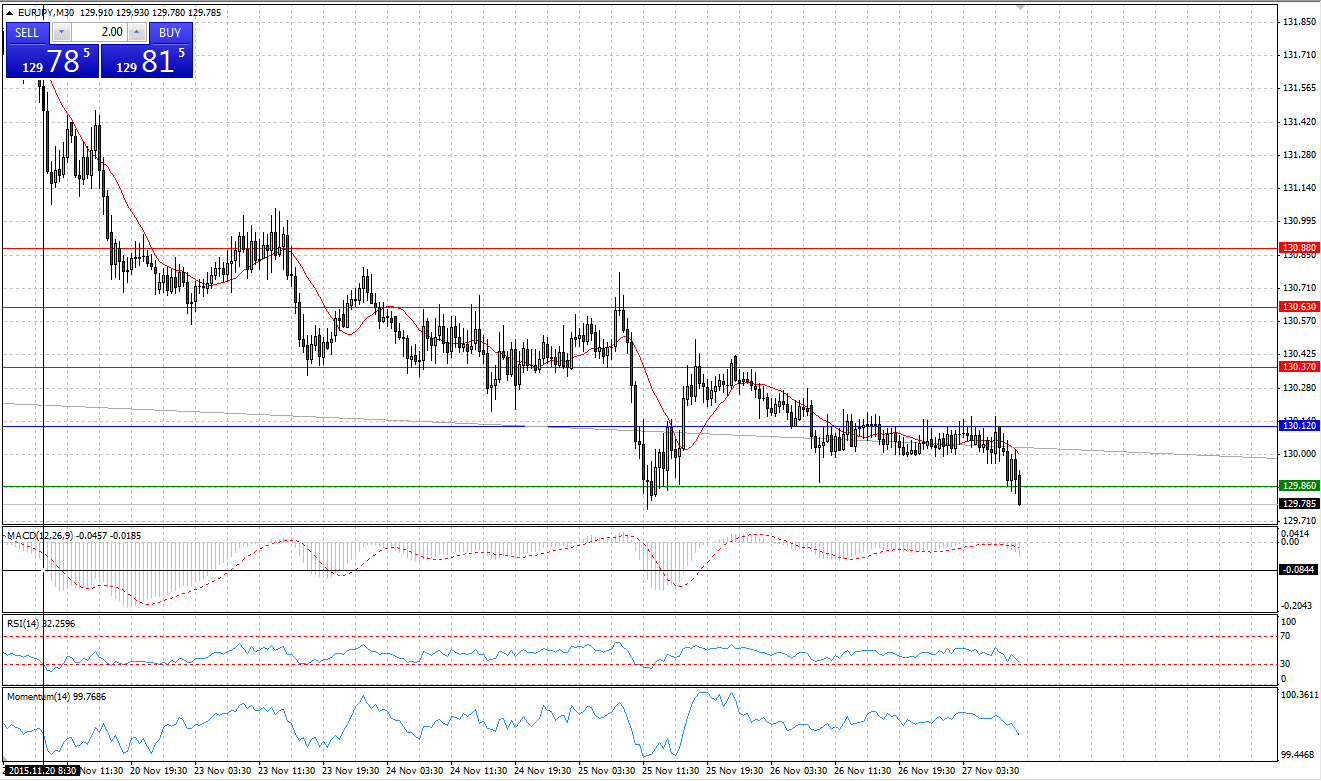

Market Scenario 1: Long positions above 130.12 with targets at 130.37 and 130.63

Market Scenario 2: Short positions below 130.12 with targets at 129.86 and 129.61

Comment: European currency continues losing its positions against the Japanese yen for the fourth day in a row, dropping below psychologically important level of 130 yen per 1 euro. Currently the pair was already sent below the First support level, with the aim to break through its recent low of 129.76 and then test the Second Support level.

Supports and Resistances:

R3 130.88

R2 130.63

R1 130.37

PP 130.12

S1 129.86

S2 129.61

S3 129.35

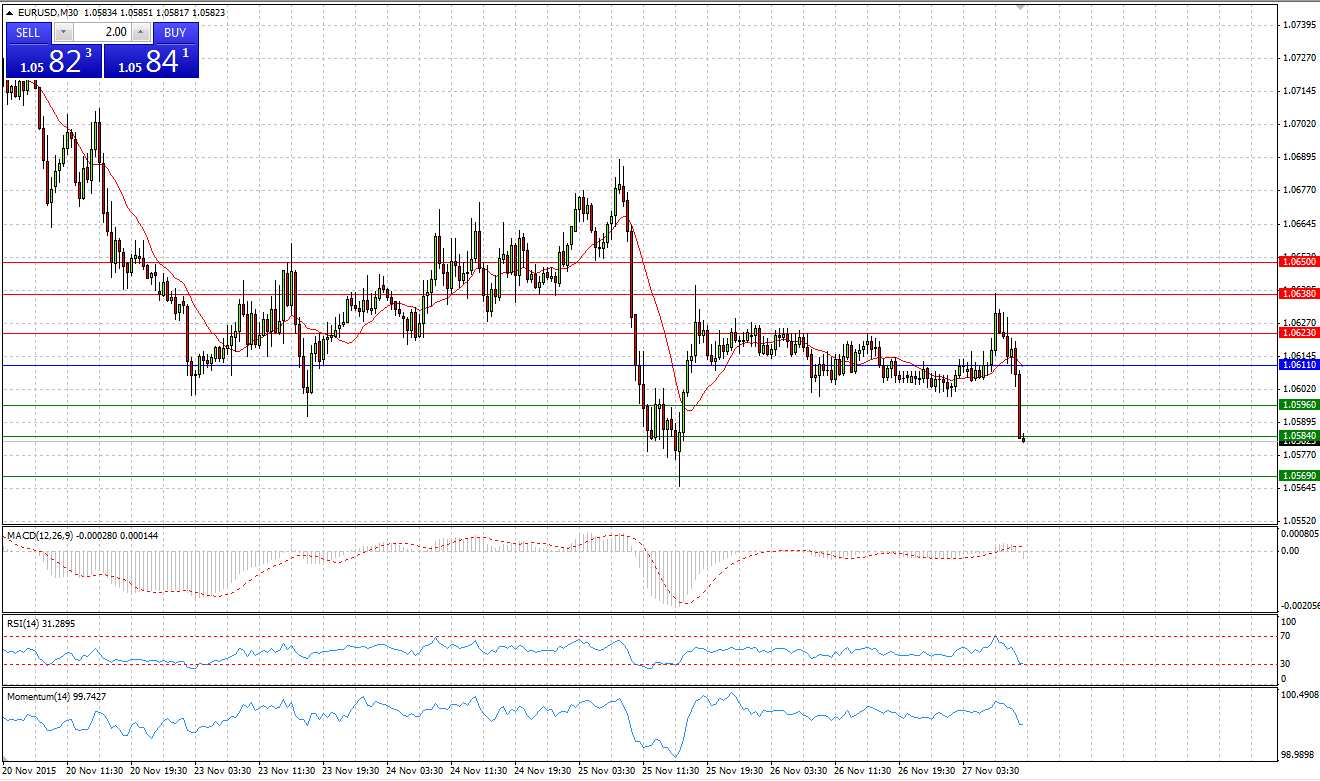

Market Scenario 1: Long positions above 1.0611 with targets at 1.0623 and 1.0638

Market Scenario 2: Short positions below 1.0611 with targets at 1.0596 and 1.0584

Comment: European currency continues weakening against US dollar amid disappointing news from the European area. Bears managed to break through the Pivot Point and the first Support level and currently testing the Second one. If it succeeds in doing so, the pair might undertake an attempt to test its lowest at 1.0565 reached on 25th of November.

Supports and Resistances:

R3 1.0650

R2 1.0638

R1 1.0623

PP 1.0611

S1 1.0596

S2 1.0584

S3 1.0569

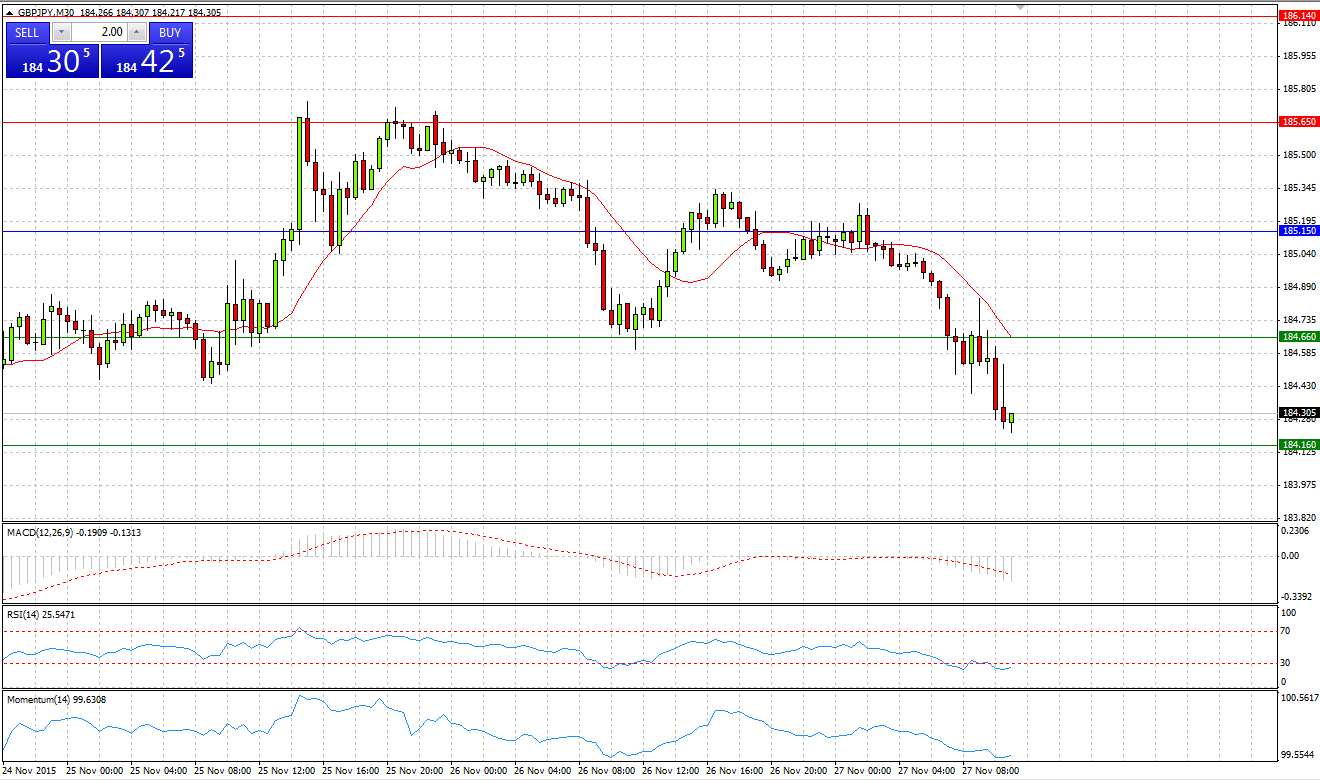

Market Scenario 1: Long positions above 185.15 with targets at 185.65 and 186.14

Market Scenario 2: Short positions below 185.15 with targets at 184.66 and 184.16

Comment: Sterling, being unable to sustain the selling pressure, continued moving downwards against Japanese yen, reaching today its lowest level since 29th of October. Pivot Point and the First Support level has been already broken, currently the pair is testing the Second Support level

Supports and Resistances:

R3 186.64

R2 186.14

R1 185.65

PP 185.15

S1 184.66

S2 184.16

S3 183.67

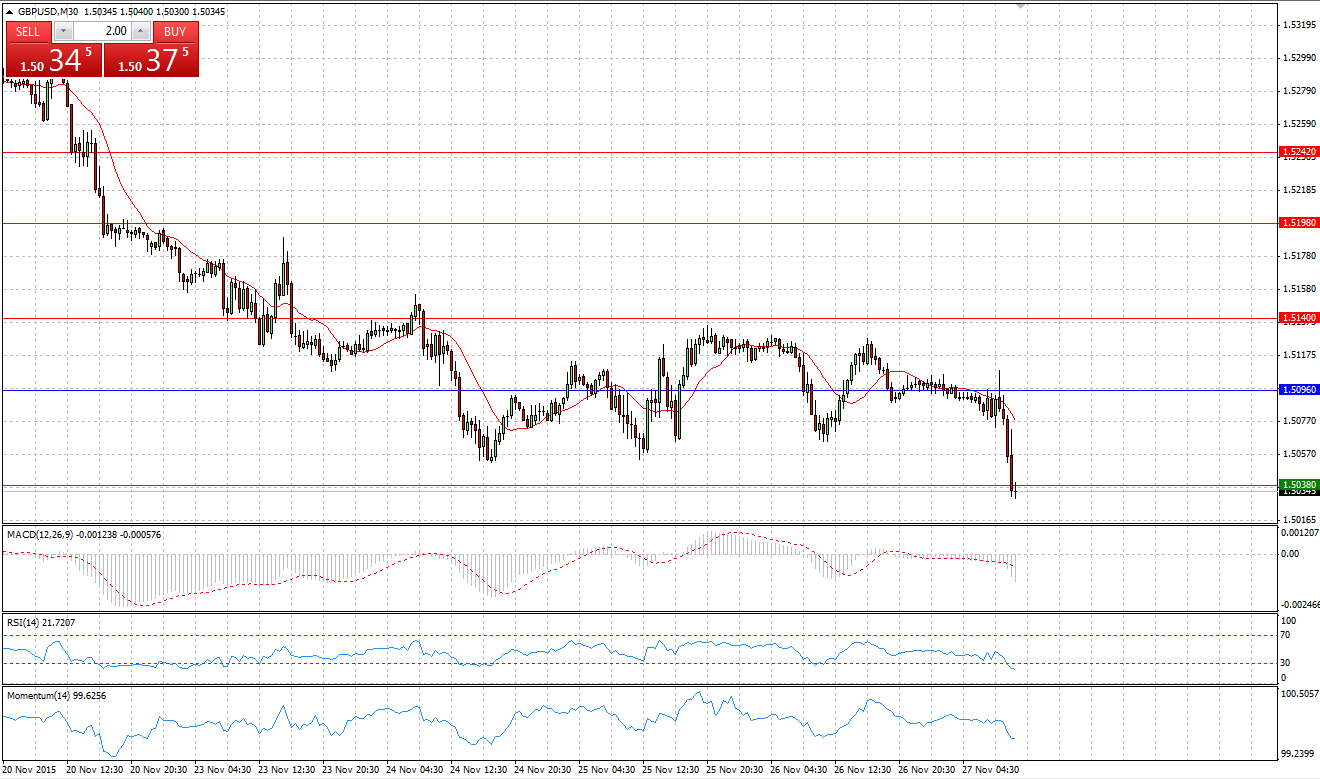

GBP/USD

Market Scenario 1: Long positions above 1.5096 with targets at 1.5140 and 1.5198

Market Scenario 2: Short positions below 1.5096 with targets at 1.5038 and 1.4994

Comment: Sterling, amid disappointing financial data, started losing its positions against US dollar and was sent almost to the lowest level at 1.5025 reached on 6th of November. GBP/USD is currently trading below pivot point level, with the aim to break through its recent bottom of 1.5025

Supports and Resistances:

R3 1.5242

R2 1.5198

R1 1.5140

PP 1.5096

S1 1.5038

S2 1.4994

S3 1.4936

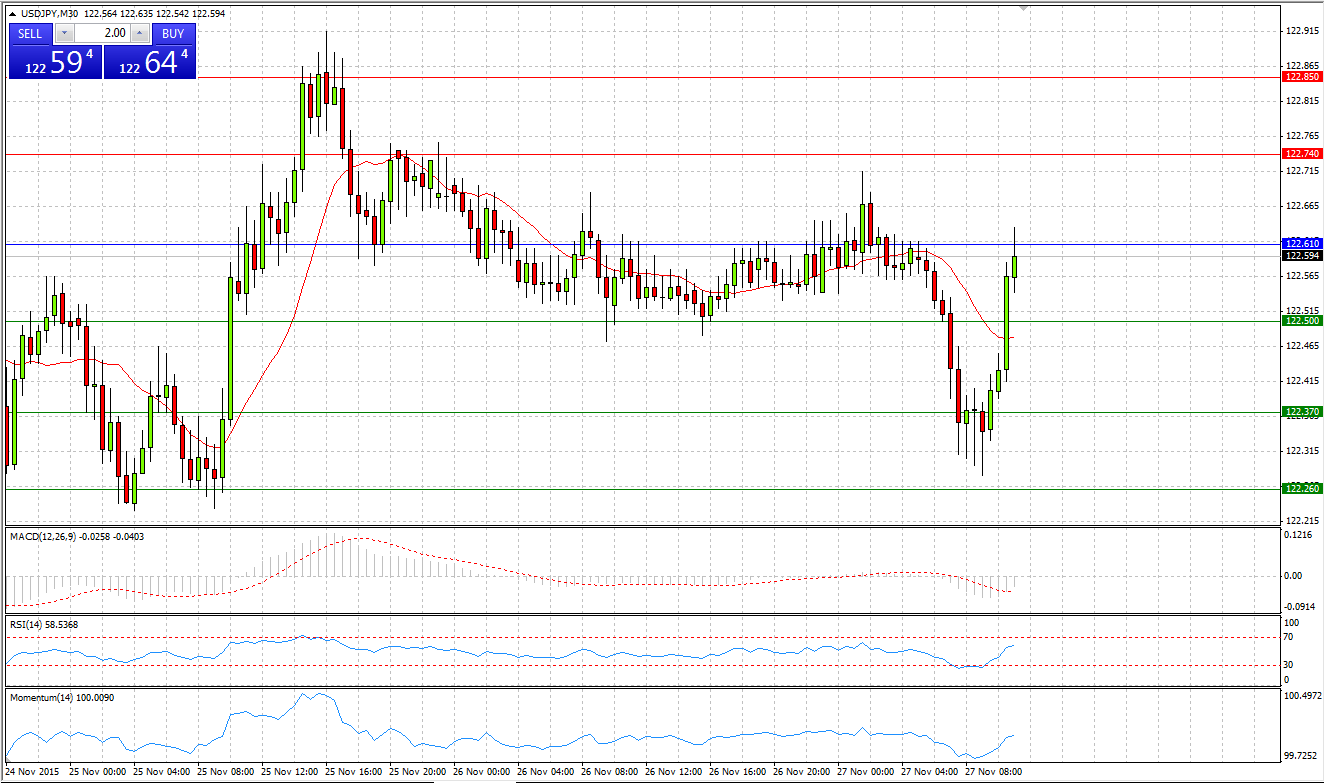

Market Scenario 1: Long positions above 122.61 with targets at 122.74 and 122.85

Market Scenario 2: Short positions below 122.61 with targets at 122.50 and 122.37

Comment: US dollar continues finding support at 122.26, which is the 3rd Support level against Japanese yen. Currently the pair is trying to break through Pivot Point Level.

Supports and Resistances:

R3 122.98

R2 122.85

R1 122.74

PP 122.61

S1 122.50

S2 122.37

S3 122.26

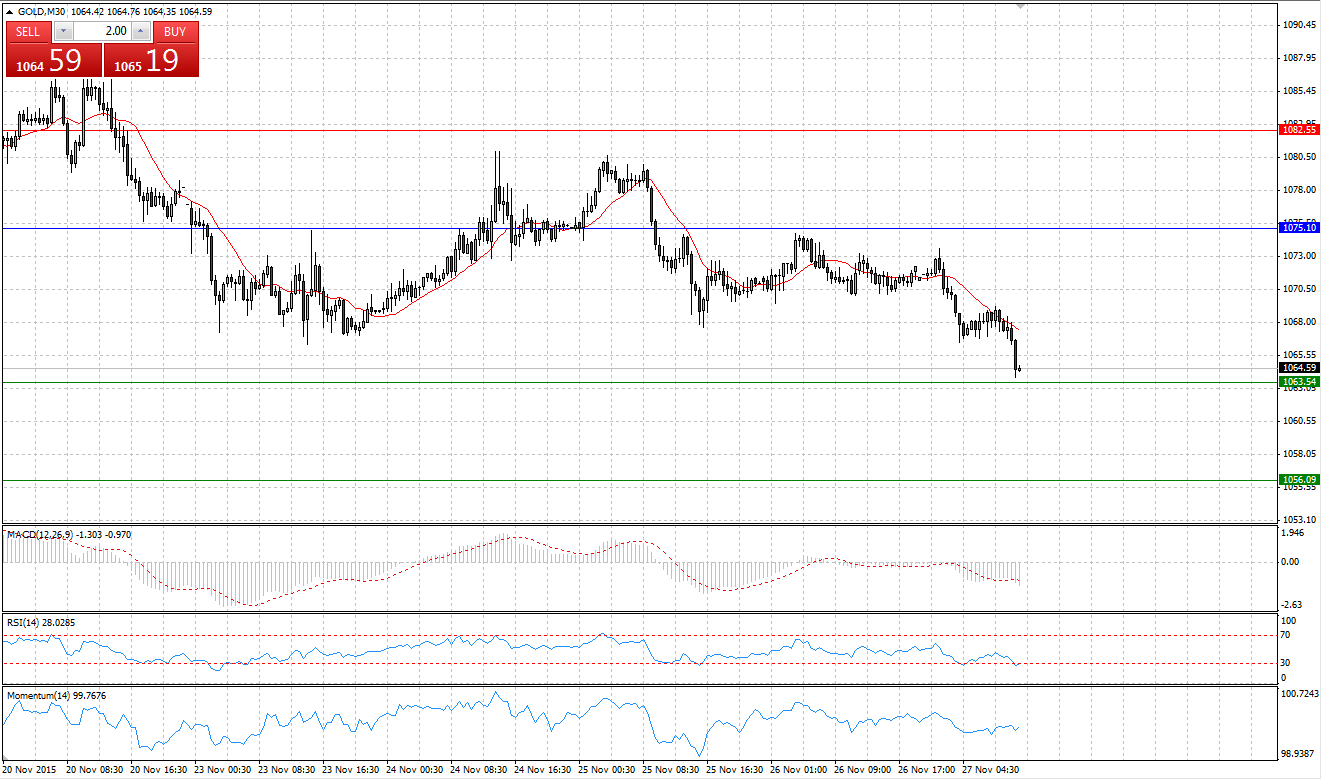

GOLD

Market Scenario 1: Long positions above 1075.10 with targets at 1082.55 and 1094.11

Market Scenario 2: Short positions below 1075.10 with targets at 1063.54 and 1056.09

Comment: Gold, reached a new low at 1063.85, the lowest level since February 2010. Currently gold is trading 1 dollar away from the first Support level

Supports and Resistances:

R3 1113.12

R2 1094.11

R1 1082.55

PP 1075.10

S1 1063.54

S2 1056.09

S3 1037.08

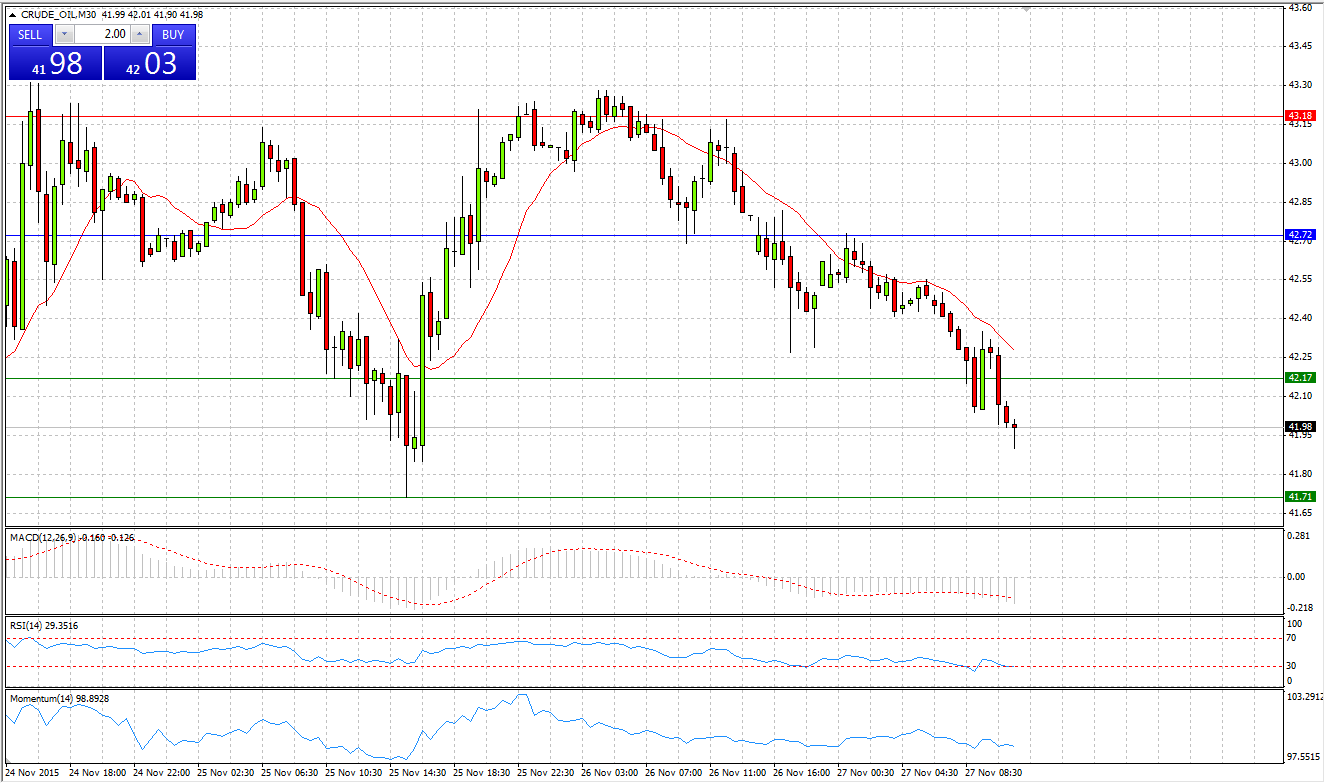

CRUDE OIL

Market Scenario 1: Long positions above 42.72 with targets at 43.18 and 43.73

Market Scenario 2: Short positions below 42.72 with targets at 42.17 and 41.71

Comment: Appreciation of crude oil has been stopped at 43.28 US dollar a barrel and currently crude is trading slightly below 42 US dollar.

Supports and Resistances:

R3 44.74

R2 43.73

R1 43.18

PP 42.72

S1 42.17

S2 41.71

S3 40.70

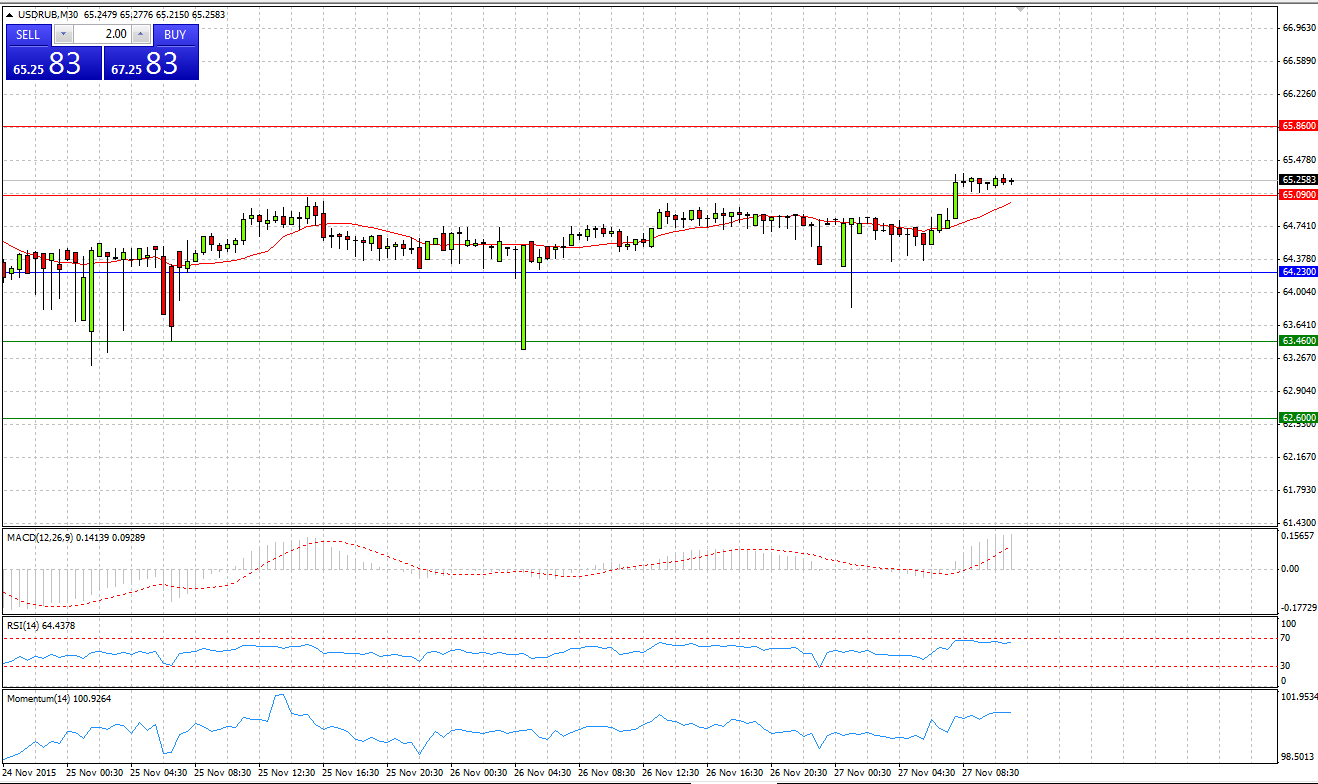

USD/RUB

Market Scenario 1: Long positions above 64.23 with targets at 65.09 and 65.86

Market Scenario 2: Short positions below 64.23 with targets at 63.46 and 62.60

Comment: USD/RUB is trading more or less flat despite the tensions between Russia and Turkey. However, 66 ruble per 1 USD is the level to watch as If the threshold is taken the pair may continue to appreciate.

Supports and Resistances:

R3 67.49

R2 65.86

R1 65.09

PP 64.23

S1 63.46

S2 62.60

S3 60.97