Weather can increase wheat prices

We would like to consider the dynamics of personal composite instrument wheat against the ruble in this review. Is its growth possible? A rise in price of grain on world markets and weakening of the Russian currency is needed for this. The wheat harvest can be reduced in Eastern Europe due to the deterioration of weather conditions. USDA estimated US wheat area this season at 49.65 million acres which is less than the consensus forecast of market participants; though spring crop acre is minimal since 1972. The Russian currency may weaken in case the major oil producers do not agree on production "freezing” at the meeting on April 17.

Ukrainian state weather bureau stated that 26% of the winter wheat crops are at risk. UkrAgroConsult agency expects reducing of the wheat harvest in 2016 by 35% to 17.3 million tons from 26.5 million tons a year earlier. Please note that consumption in Ukraine is about 12 mln tons. The area of wheat crop in Romania decreased by 12% to 1.9 mln Ha which is the minimum for the last 11 years. The harvest in the current season is estimated in the amount from 5 up to 7.5 mln tons. It is less than 7.85 mln tons last year. Russian Agency SovEcon expects reduction of wheat harvest in Russia to 57 from 62 million tons of last year. International Grains Council has lowered the forecast of world wheat production from 734 million tons to 713 million tons in 2015/16 season. The ruble is highly dependent on world oil prices. The share of hydrocarbons in the Russian export exceeds 70%. Income from foreign supplies of oil, gas and coal, reaches a quarter of GDP. On Monday Brent crude oil quotes updated monthly minimum level due to OPEC and independent producers’ disagreements on “freeze”. The joint meeting is scheduled for the 17th of April.

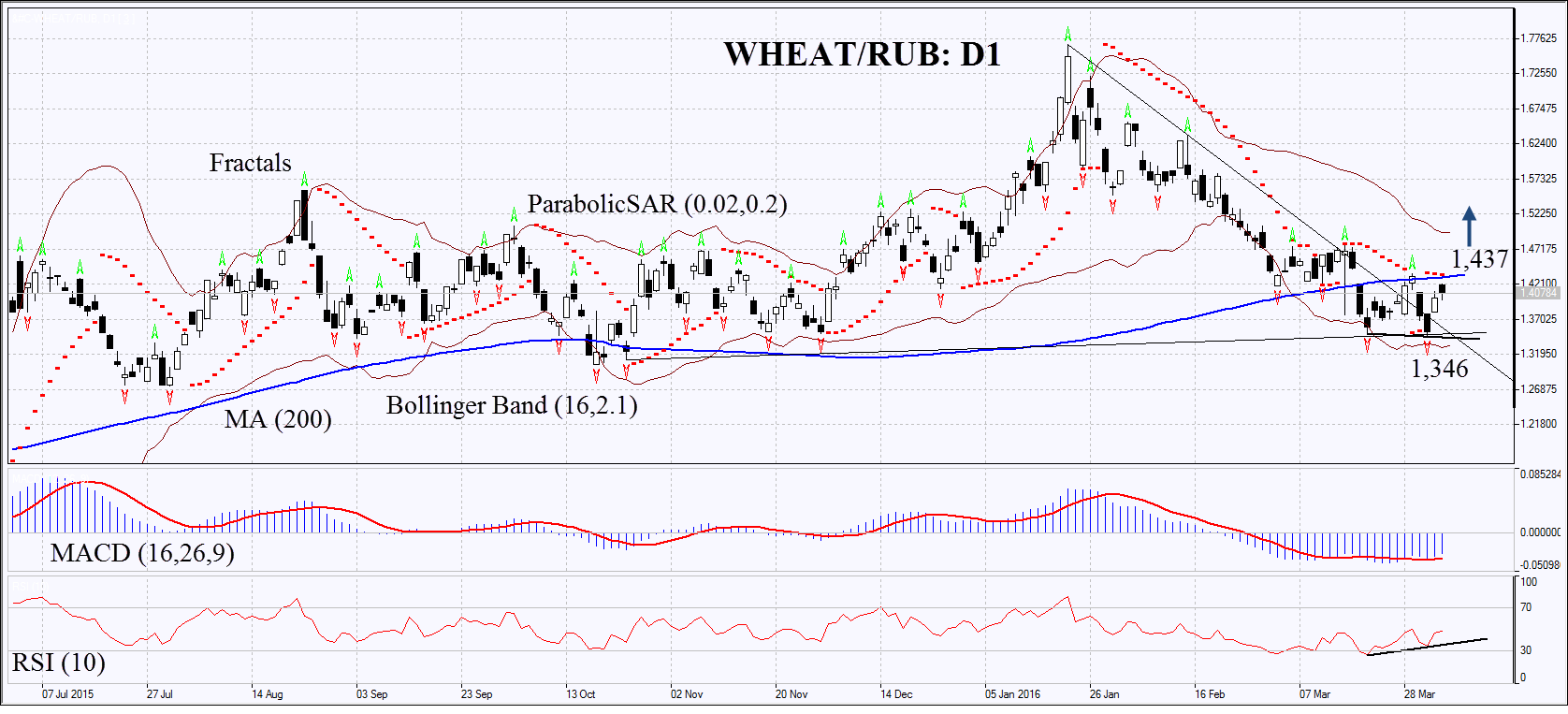

On the daily timeframe WHEAT / RUB: D1 moved from the falling trend to the neutral one. The MACD formed a signal to buy though and Parabolic still demonstrates signal to decrease. The RSI is increasing and approached the level of 50. It formed an upward divergence. Bollinger® lines are narrowed which means low volatility. We do not exclude bullish movement if the personal composite instrument exceeds the last upper fractal, the Parabolic signal and 200-day moving average line: 1.437. This level can be used as an entry point. The initial limitation of possible risk should be set below the last lower fractal and Parabolic signal: 1,346. After the opening of a pending order we shall move the stop following Bollinger and Parabolic to the next fractal low. Thus we are changing the potential ratio of profit / loss in our favor. The most cautious traders can change to 4H timeframe and set the stop-loss following the price direction. If the price overcomes the stop level (1,346) without not activating the order (1,437) – the position is recommended to be removed: market internal changes occur that were not taken into account.

Position Buy Buy stop above 1,437 Stop loss below 1,346