Let us consider the Grain_4 personal composite instrument (PCI) on the daily chart. It includes wheat, corn, soybeans and oat in equal shares 100 bushels each. The PCI is growing ahead of the US Department of Agriculture (USDA) release to be published August, 12. The administration is expected to cut crops forecast. However, there are other positive factors.

According to China National Grain and Oils Information Center (CNGOIC), the soy bean import to China in the cropping season, ending in September, will make 76mln tons, which is 8% more than in the previous season and 2mln tons above the figure, estimated by USDA. China imported 9.5mln tons of soybeans in July – 17.4% above the June volume. CNGOIC forecasts the soybean import to increase this September and August to 13mln tons as compared to 11mln the previous year. In the next season the overall import may expand to 77mln tons, while the local soybean production in China may contract from 12.15mln to 11mln tons. Wheat and corn futures are going up because of weather deterioration and probable drought in the US.

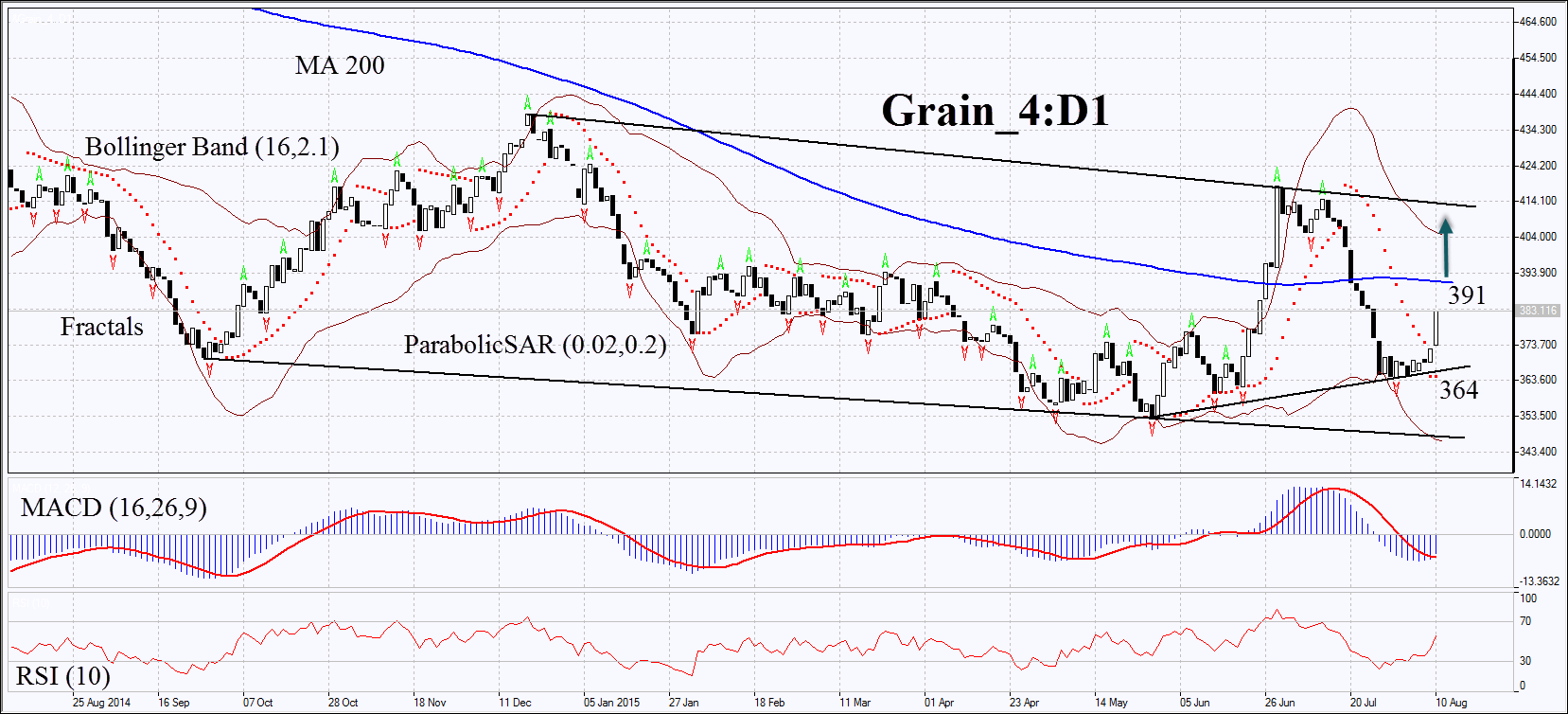

On the daily time frame the Grain_4 PCI tends to increase within a downtrend. MACD and Parabolic have shaped buy signals; RSI-Bars has crossed 50. Bollinger bands have not yet narrowed, which may indicate high volatility. A bullish trend may develop if US Department of Agriculture remarkably cuts the crops forecast, announced August 12. In this case the price will breach the 200-day moving average at 391; we may place a buy pending order at this mark. A stop loss may be placed below the latest fractal minimum and the Parabolic signal at 364 or below the 5-year minimum at 353. After pending order activation the stop loss is supposed to be moved every day to the next fractal low, following Parabolic and Bollinger® signals.

Thus, we are changing the probable profit/loss ratio to the breakeven point. The most cautious traders are recommended to switch to the H4 time frame and place a stop loss there, moving it after the trend. If the price reaches the stop loss without triggering the order, we recommend to cancel the position: the market sustains internal changes that were not considered.

Position Buy

Buy stop Above 391

Stop loss Below 364 or 353