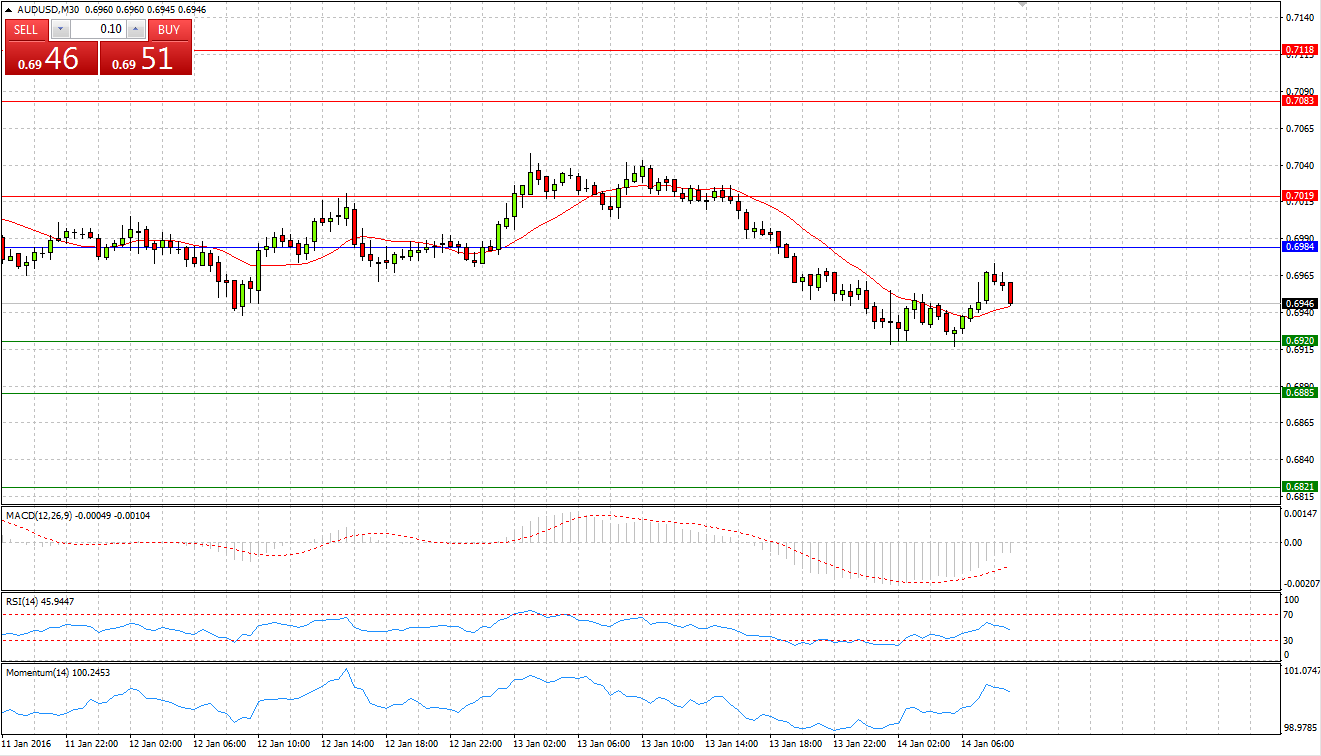

Market Scenario 1: Long positions above 0.6984 with targets at 0.7019 & 0.7083

Market Scenario 2: Short positions below 0.6984 with targets at 0.6920 & 0.6885

Comment: Having broken through the First Resistance level and on the way to the second one, Aussie came under selling pressure and was sent below Pivot Point level, closing the session at 0.6956 US Dollars per 1 Australian Dollar. Today the pair continues trading under pressure below Pivot Point level.

Supports and Resistances:

R3 0.7118

R2 0.7083

R1 0.7019

PP 0.6984

S1 0.6920

S2 0.6885

S3 0.6821

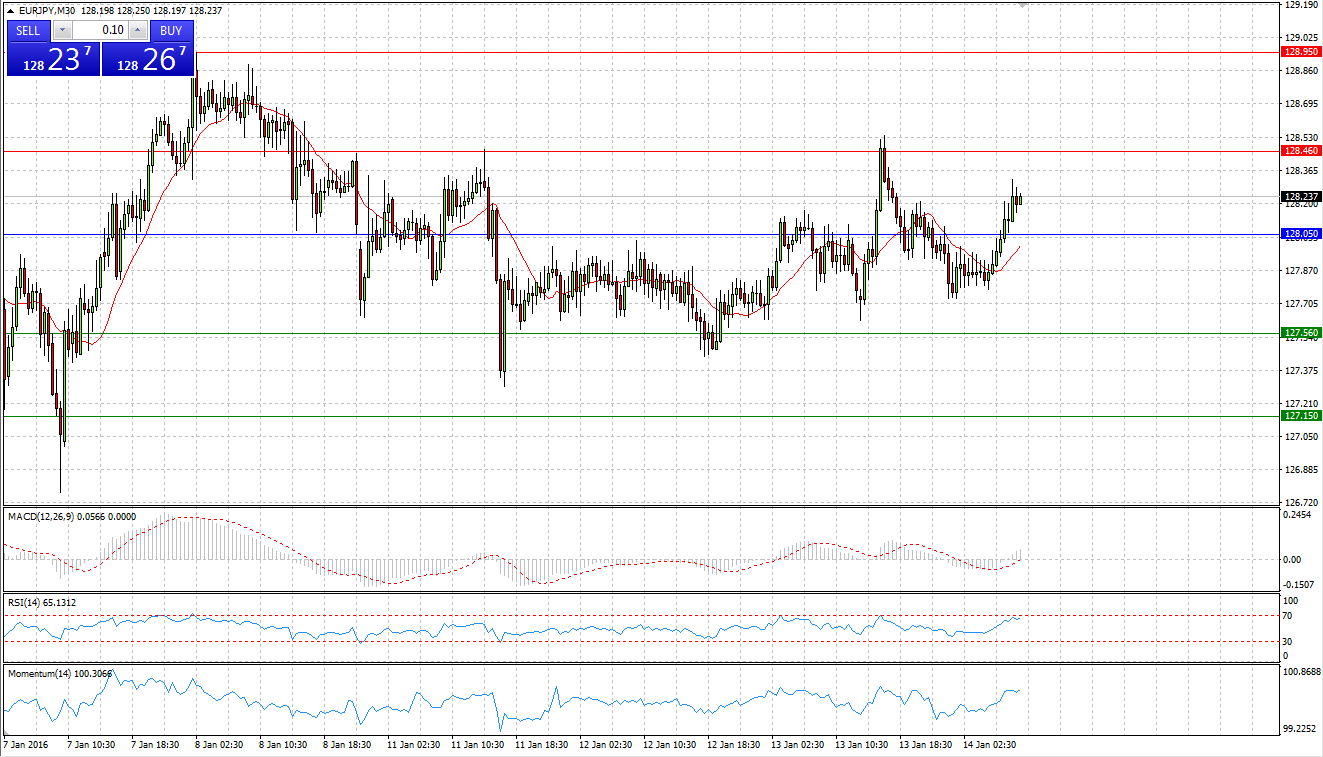

Market Scenario 1: Long positions above 128.05 with targets at 128.46 & 128.95

Market Scenario 2: Short positions below 128.05 with targets at 127.56 & 127.15

Comment: European currency managed to close yesterday’s session against Japanese Yen in positive territory, for the first time in four sessions. Today the pair is trading with positive bias having broken through the Pivot Point level and aiming to test the First Resistance level.

Supports and Resistances:

R3 129.36

R2 128.95

R1 128.46

PP 128.05

S1 127.56

S2 127.15

S3 126.66

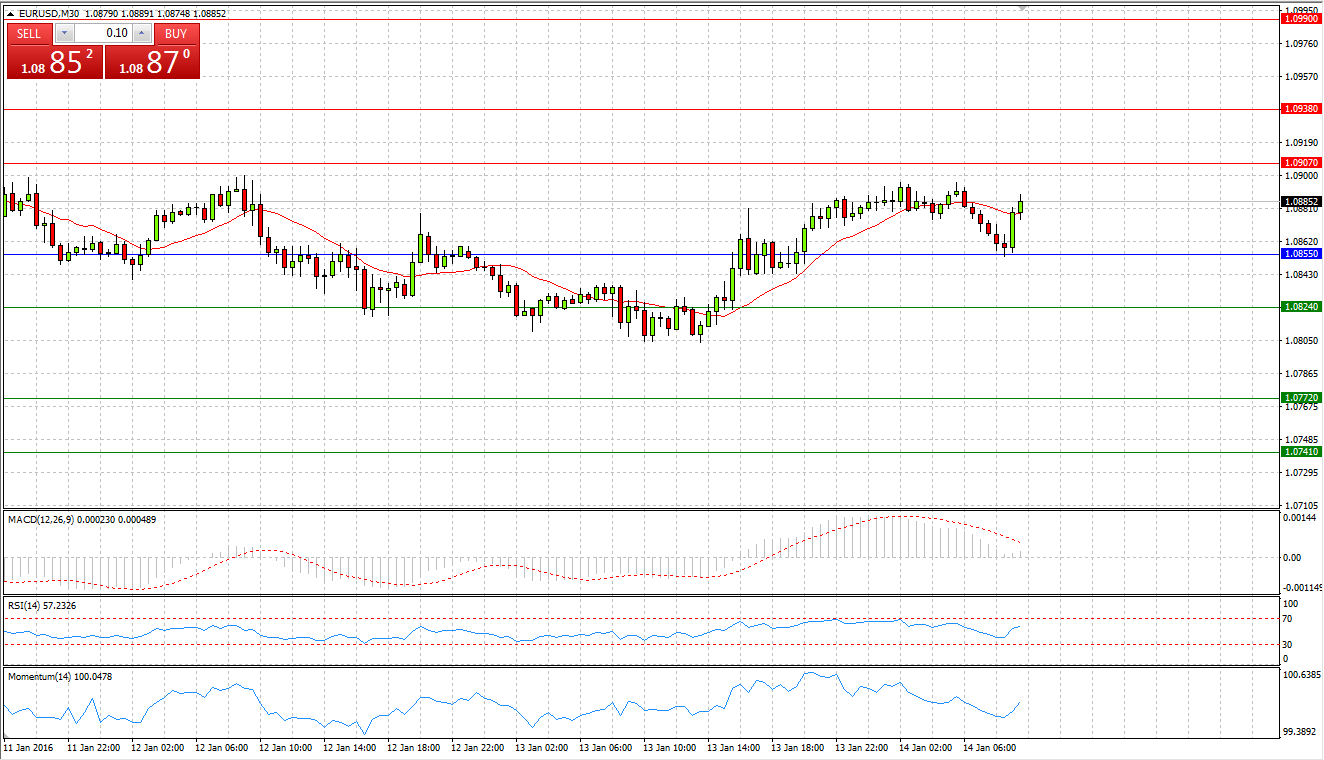

Market Scenario 1: Long positions above 1.0855 with targets at 1.0907 & 1.0938

Market Scenario 2: Short positions below 1.0855 with targets at 1.0824 & 1.0772

Comment: European currency was traded firm against US Dollar during yesterday’s session closing the day with 30 pips profit. Today euro continues appreciating against US Dollar trading close to the first Resistance level.

Supports and Resistances:

R3 1.0990

R2 1.0938

R1 1.0907

PP 1.0855

S1 1.0824

S2 1.0772

S3 1.0741

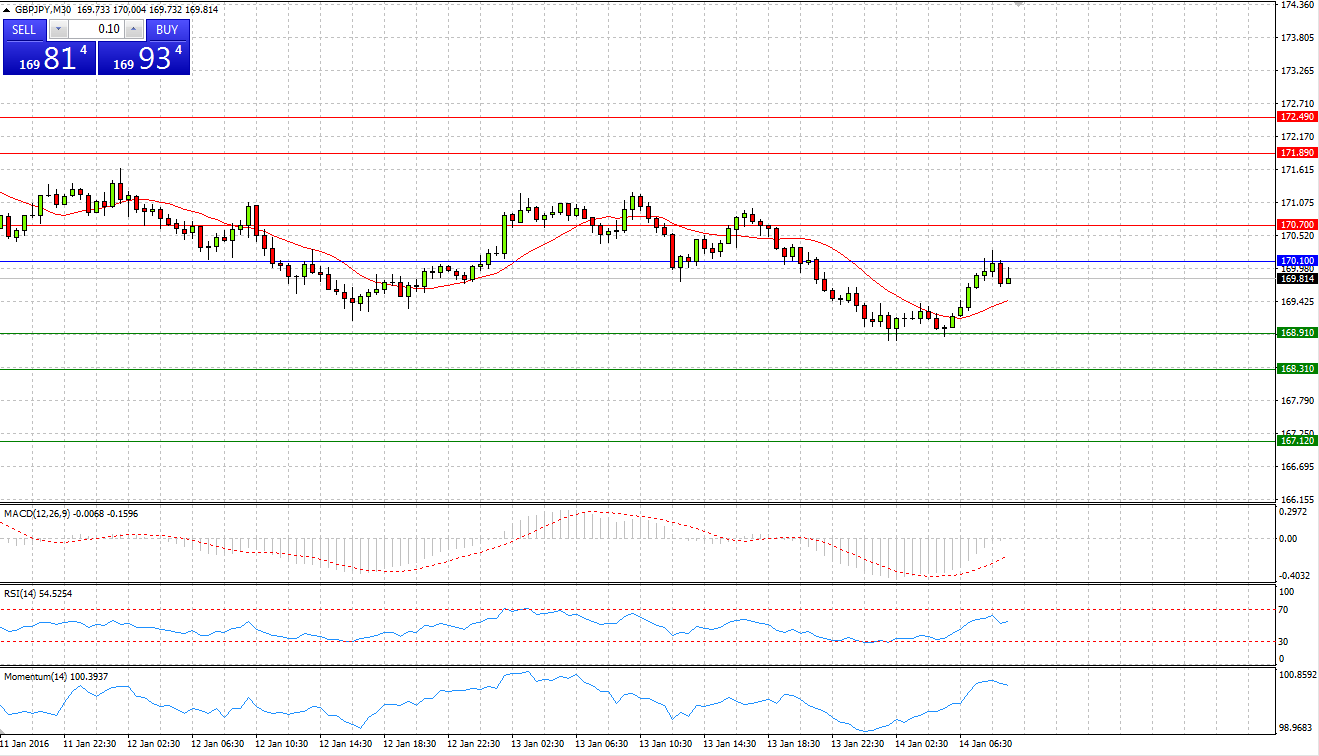

Market Scenario 1: Long positions above 170.10 with targets at 170.70 & 171.89

Market Scenario 2: Short positions below 170.10 with targets at 168.91 & 168.31

Comment: Sterling continues trading close to its lowest level against Japanese Yen, closing yesterday’s session on the negative territory. Today Sterling reached its lowest level at ¥168.77, however, managed to find support and now trading close to the Pivot Point level.

Supports and Resistances:

R3 172.49

R2 171.89

R1 170.70

PP 170.10

S1 168.91

S2 168.31

S3 167.12

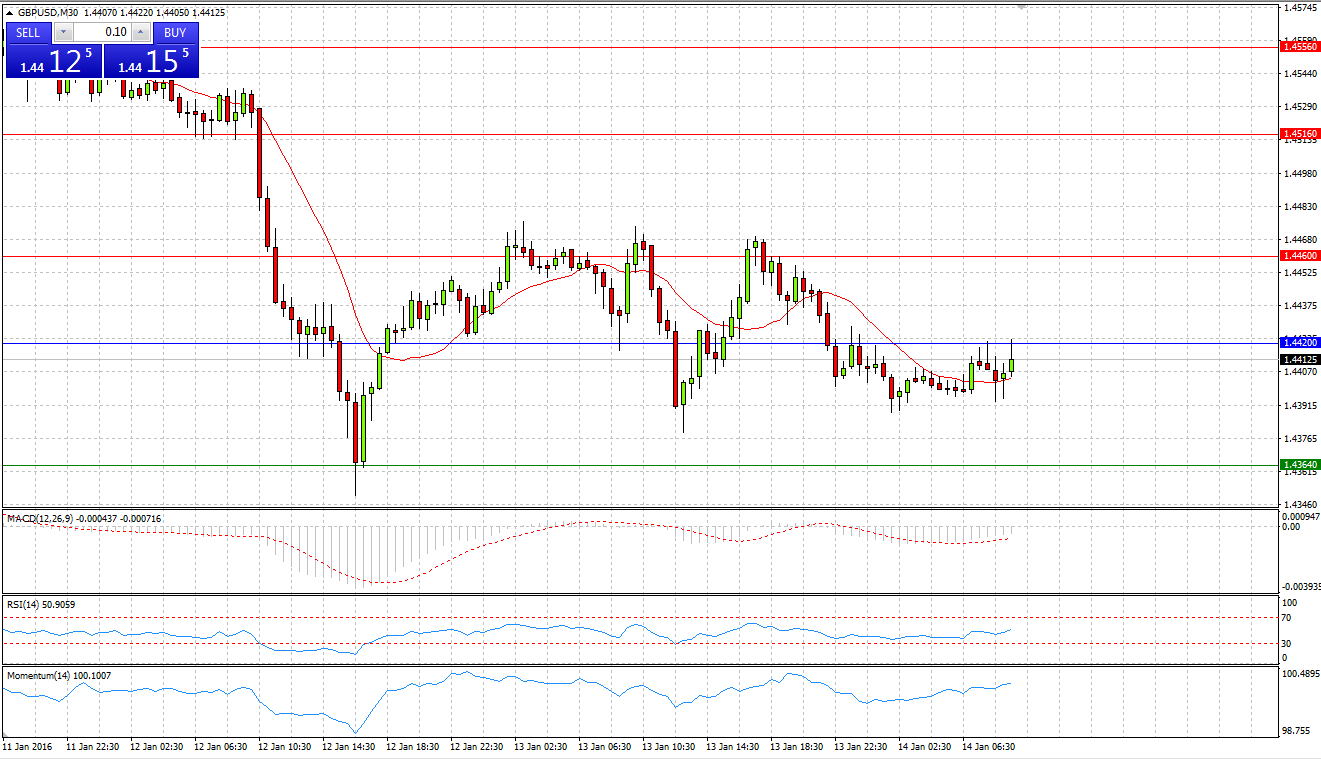

Market Scenario 1: Long positions above 1.4420 with targets at 1.4460 & 1.4460

Market Scenario 2: Short positions below 1.4420 with targets at 1.4364 & 1.4324

Comment: Sterling was trading calmly against US Dollar, closing yesterday’s session with almost no change. Today GBPUSD continues trading in the range slightly above Pivot point level.

Supports and Resistances:

R3 1.4556

R2 1.4516

R1 1.4460

PP 1.4420

S1 1.4364

S2 1.4324

S3 1.4268

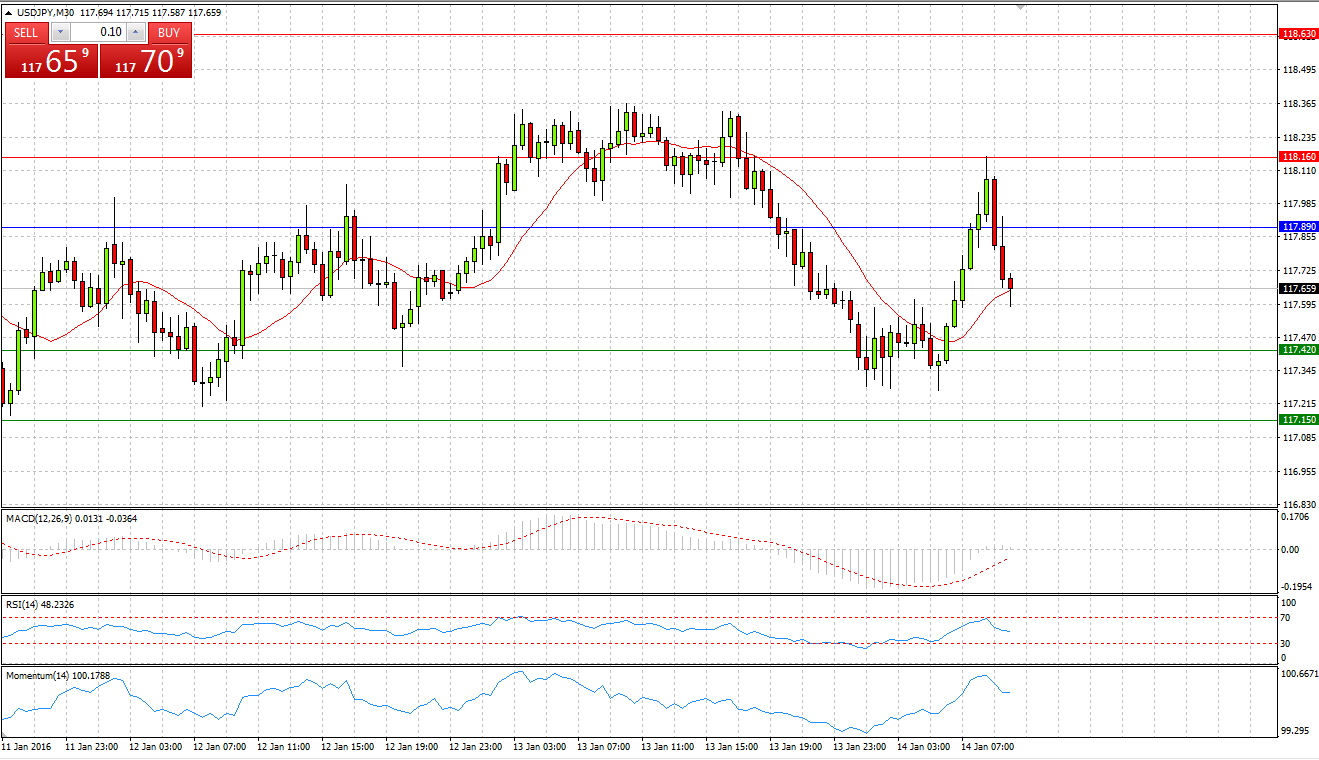

Market Scenario 1: Long positions above 117.89 with targets at 118.16 & 118.63

Market Scenario 2: Short positions below 117.89 with targets at 117.42 & 117.15

Comment:During yesterday’s session US Dollar managed to break through the first Resistance level and half way to the second one came under selling pressure and was sent below Pivot Point level, closing the session in negative territory. Today USDJPY has been very volatile, however, neither bull, nor bears succeeded in pushing the pair either direction.

Supports and Resistances:

R3 118.90

R2 118.63

R1 118.16

PP 117.89

S1 117.42

S2 117.15

S3 116.68

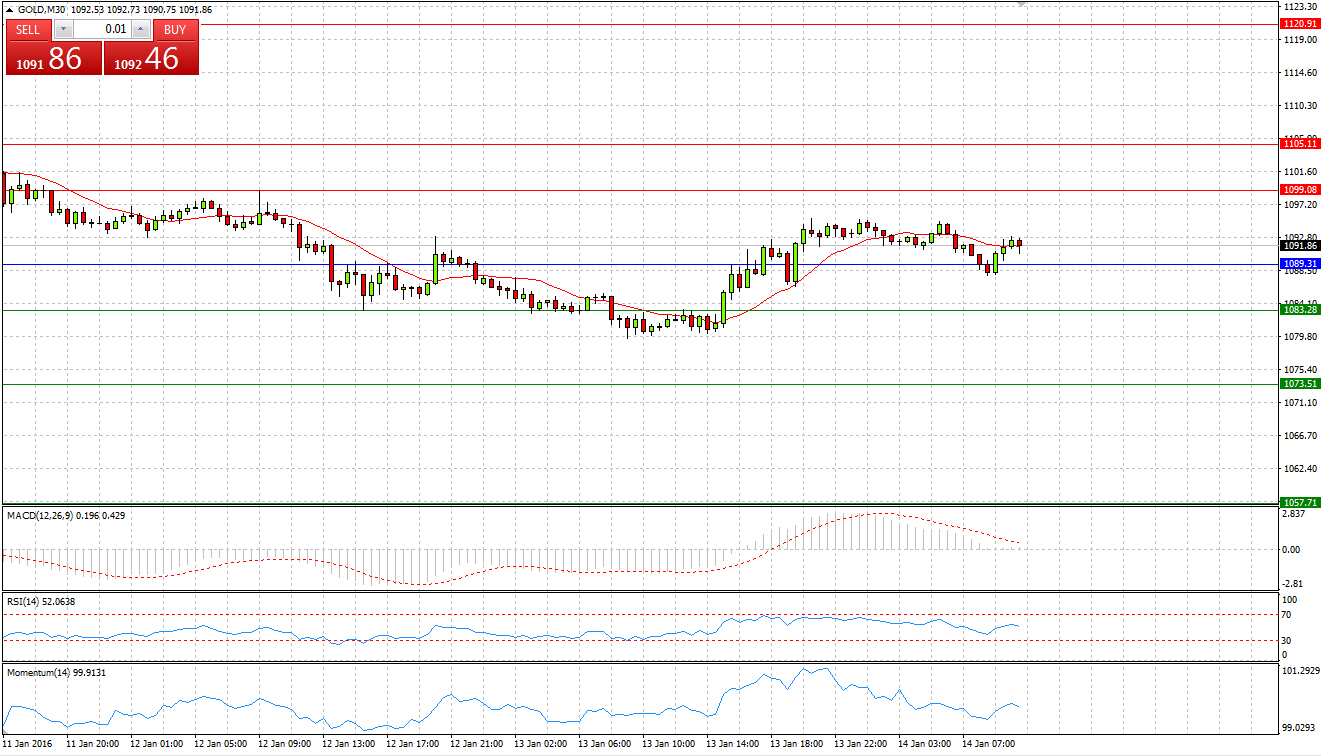

Market Scenario 1: Long positions above 1089.31 with targets at 1099.08 & 1105.11

Market Scenario 2: Short positions below 1089.31 with targets at 1083.28 & 1073.51

Comment: After three consecutive trading days of losses, gold managed during yesterday’s session to close the day in profit. Today gold is trading slightly under pressure, albeit above Pivot point level.

Supports and Resistances:

R3 1120.91

R2 1105.11

R1 1099.08

PP 1089.31

S1 1083.28

S2 1073.51

S3 1057.71

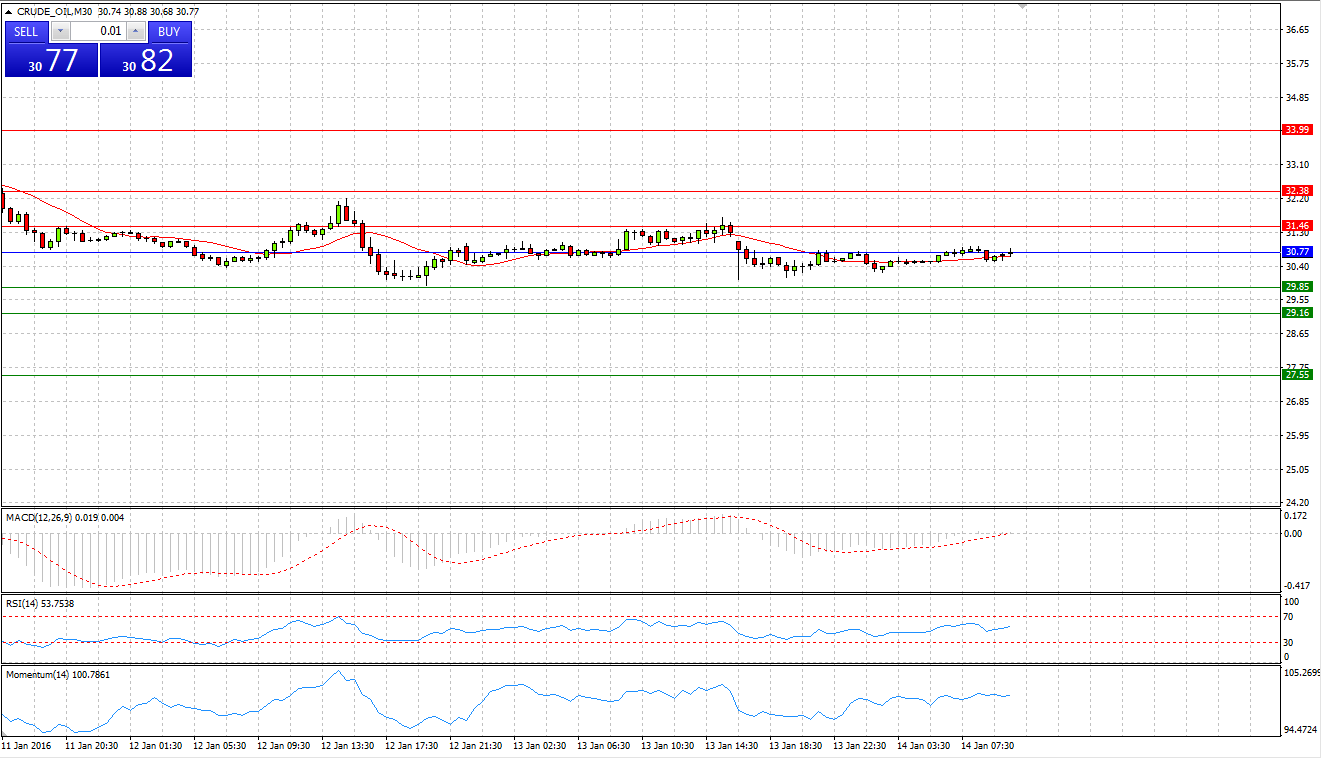

Market Scenario 1: Long positions above 30.77 with targets at 31.46 & 32.38

Market Scenario 2: Short positions below 30.77 with targets at 29.85 & 29.16

Comment: Crude oil during yesterday’s session tried to break through the Pivot Point level and the First Resistance level, however, being unable to sustain the selling pressure retreated by the end of the day to its opening price. Today Crude oil is trading positively and have already broken through the Pivot Point level.

Supports and Resistances:

R3 33.99

R2 32.38

R1 31.46

PP 30.77

S1 29.85

S2 29.16

S3 27.55

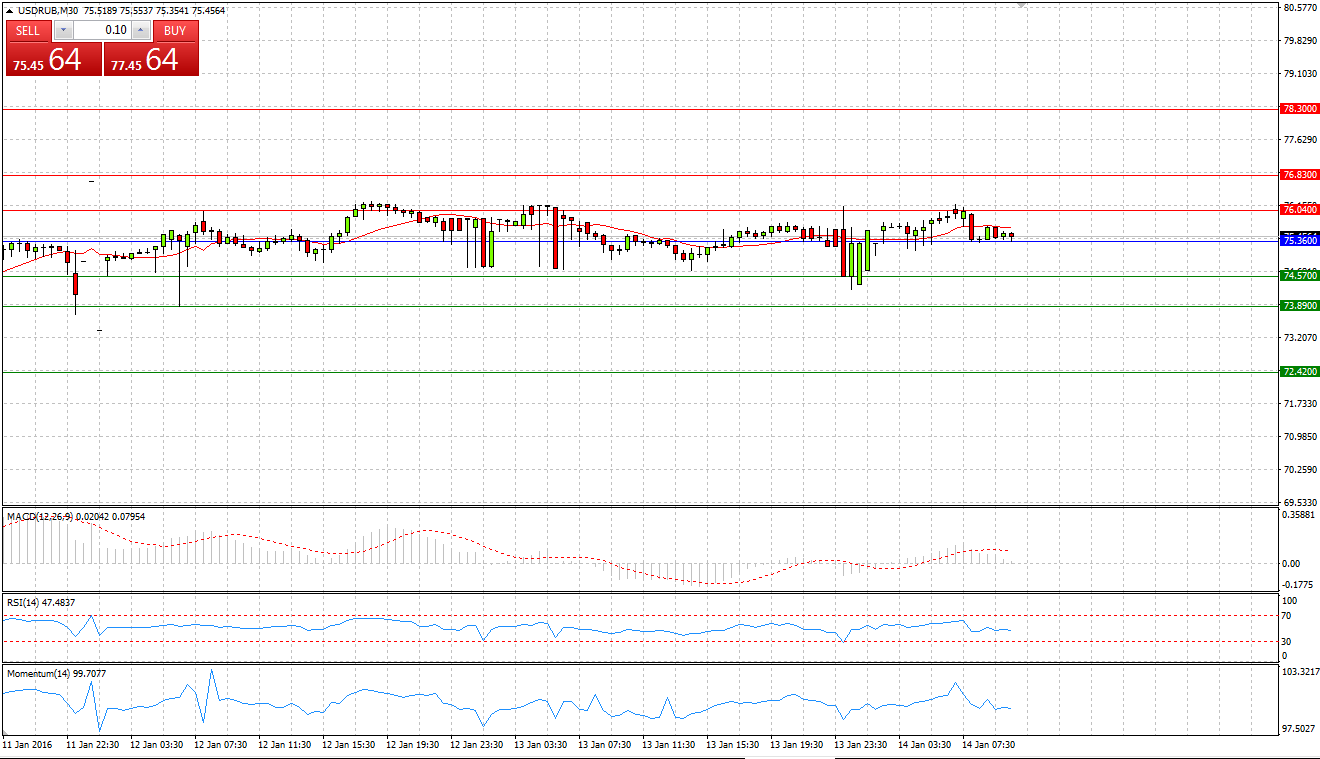

Market Scenario 1: Long positions above 75.36 with targets at 76.04 & 76.83

Market Scenario 2: Short positions below 75.36 with targets at 74.57 & 73.89

Comment: US Dollar has been trading in the range against Russian Rubble for couple of days amid lack of price change in Crude oil.

Supports and Resistances:

R3 78.30

R2 76.83

R1 76.04

PP 75.36

S1 74.57

S2 73.89

S3 72.42