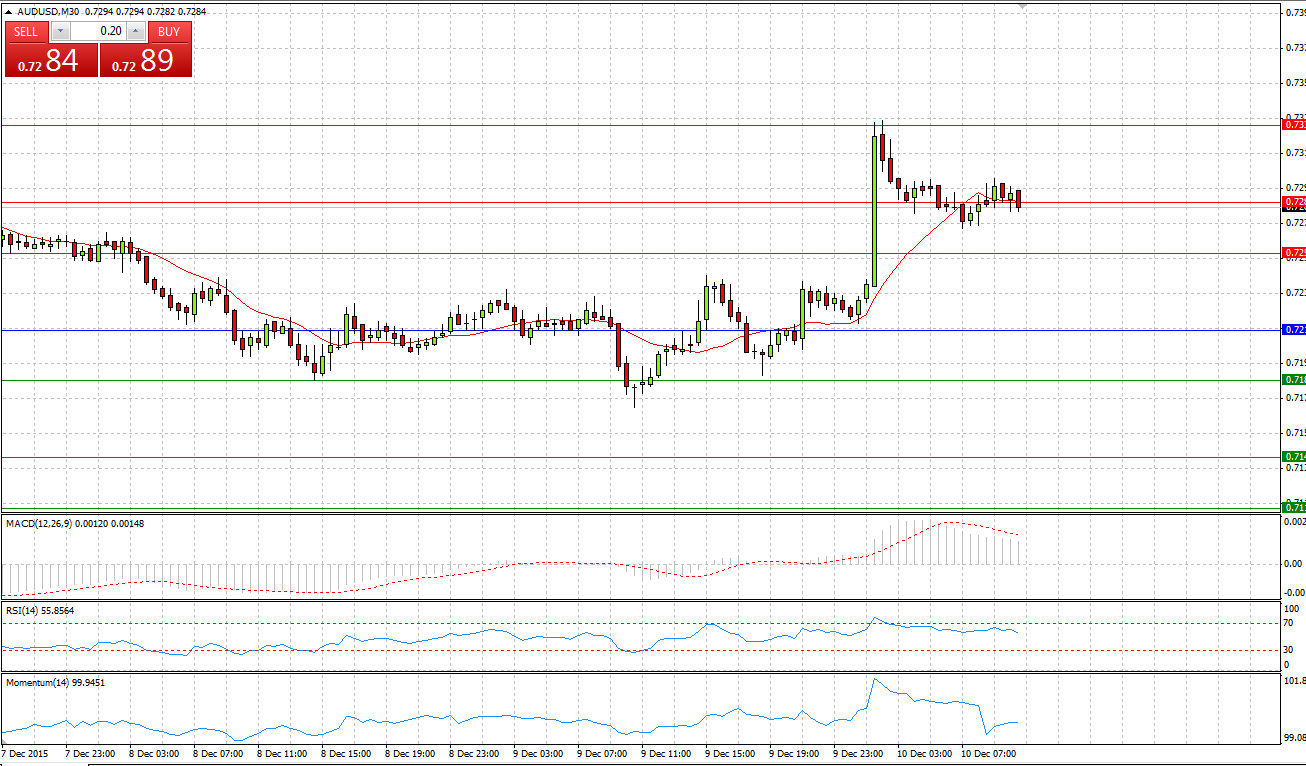

Market Scenario 1: Long positions above 0.7214 with targets at 0.7258 and 0.7287

Market Scenario 2: Short positions below 0.7214 with targets at 0.7185 and 0.7141

Comment: Aussie during early Asian session surged by 60 pips against US dollar amid positive news form Australian Bureau of Statistics showing that during last month 71,400 people have been employed, which is way above market expectations of 10,000 decrease. Australian unemployment went down by 0.2%, from 6.0% to 5.8%.

Supports and Resistances:

R3 0.7331

R2 0.7287

R1 0.7258

PP 0.7214

S1 0.7185

S2 0.7141

S3 0.7112

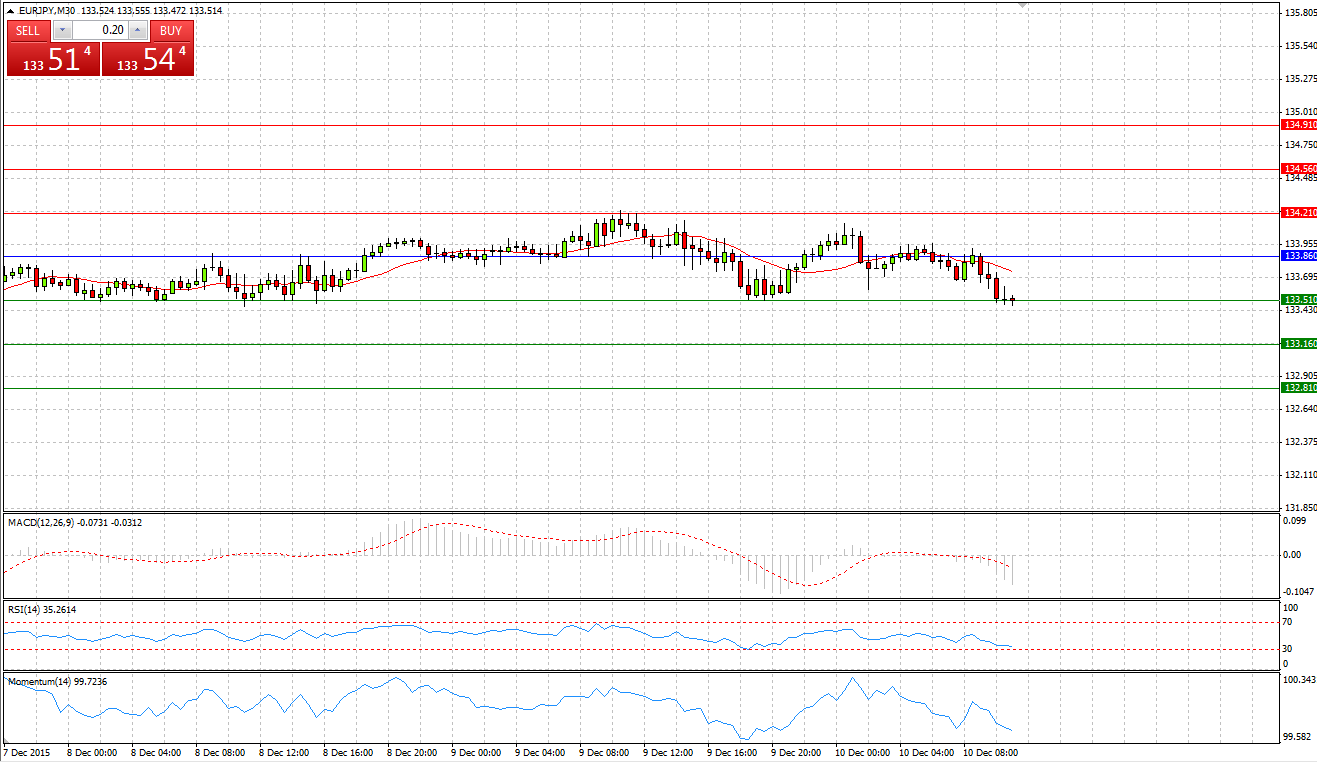

EUR/JPY

Market Scenario 1: Long positions above 133.86 with targets at 134.21 and 134.56

Market Scenario 2: Short positions below 133.86 with targets at 133.51 and 133.16

Comment: After last week’s rally when European currency appreciated against Japanese yen for more than 300 pips, the pair entered into consolidation area. EUR/JPY is trading in the range between R2 and S2.

Supports and Resistances:

R3 134.91

R2 134.56

R1 134.21

PP 133.86

S1 133.51

S2 133.16

S3 132.81

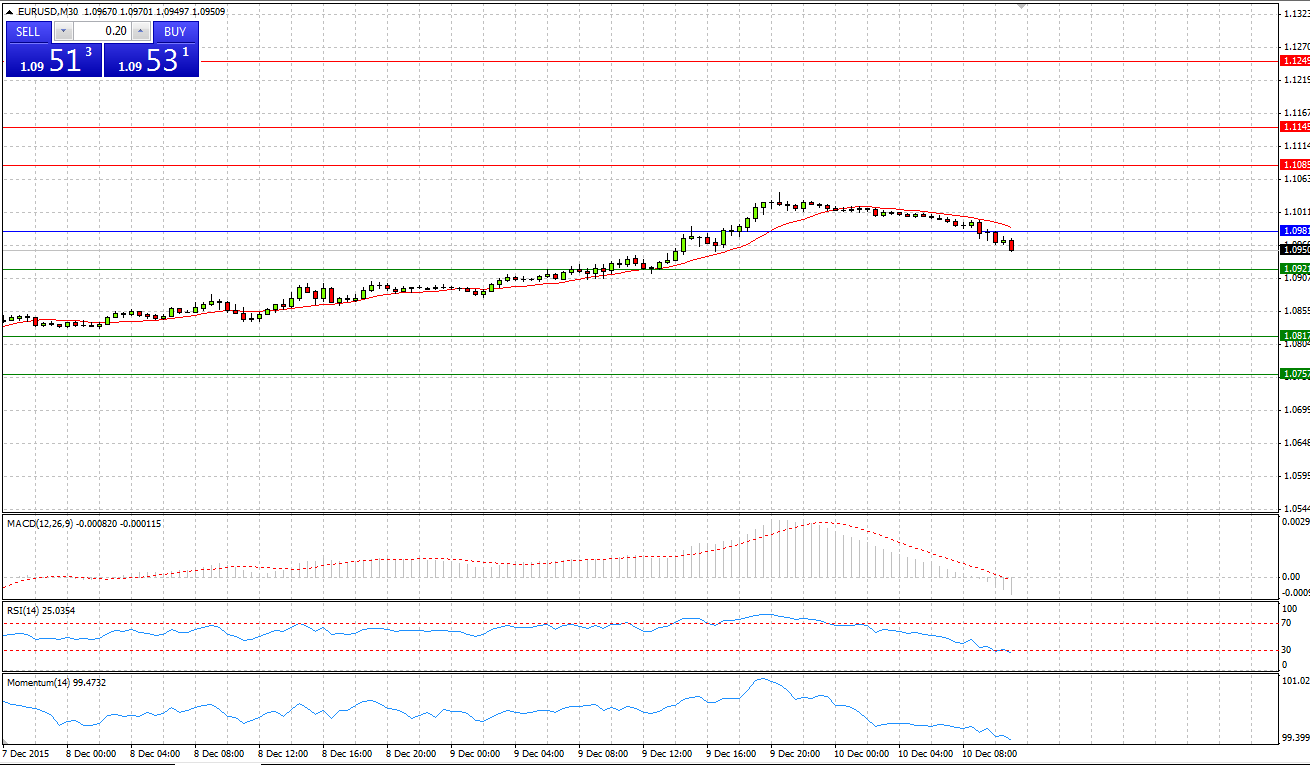

Market Scenario 1: Long positions above 1.0981 with targets at 1.1085 and 1.1145

Market Scenario 2: Short positions below 1.0981 with targets at 1.0921 and 1.0817

Comment: European currency during yesterday’s session rose against US dollar closing the session with more than 100 pips in profit. Today the pair is trading under pressure below Pivot Point level.

Supports and Resistances:

R3 1.1249

R2 1.1145

R1 1.1085

PP 1.0981

S1 1.0921

S2 1.0817

S3 1.0757

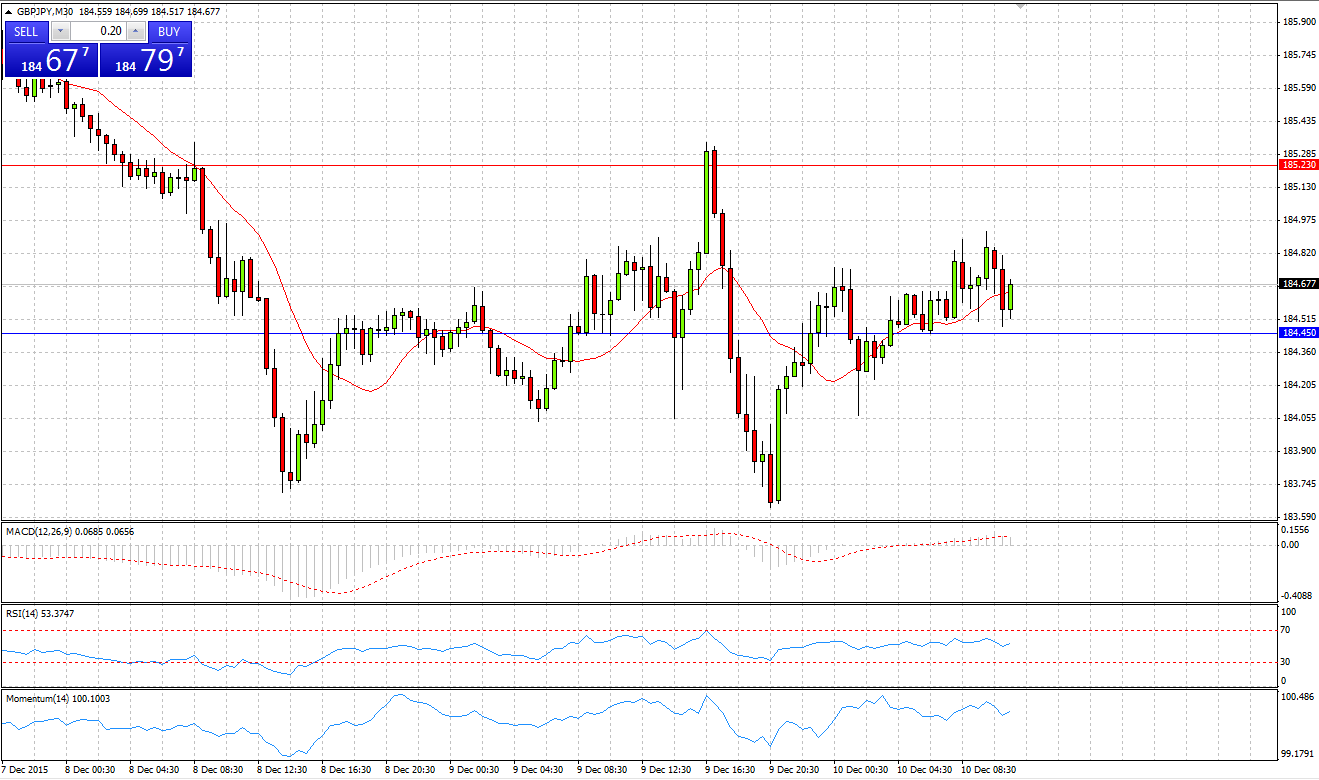

Market Scenario 1: Long positions above 184.45 with targets at 185.23 and 186.14

Market Scenario 2: Short positions below 184.45 with targets at 183.54 and 182.76

Comment: Sterling managed to suspend its depreciation against Japanese yen and closed yesterday’ session almost unchanged. Today the pair is trading flat, ahead of UK’s Official rate decision.

Supports and Resistances:

R3 186.92

R2 186.14

R1 185.23

PP 184.45

S1 183.54

S2 182.76

S3 181.85

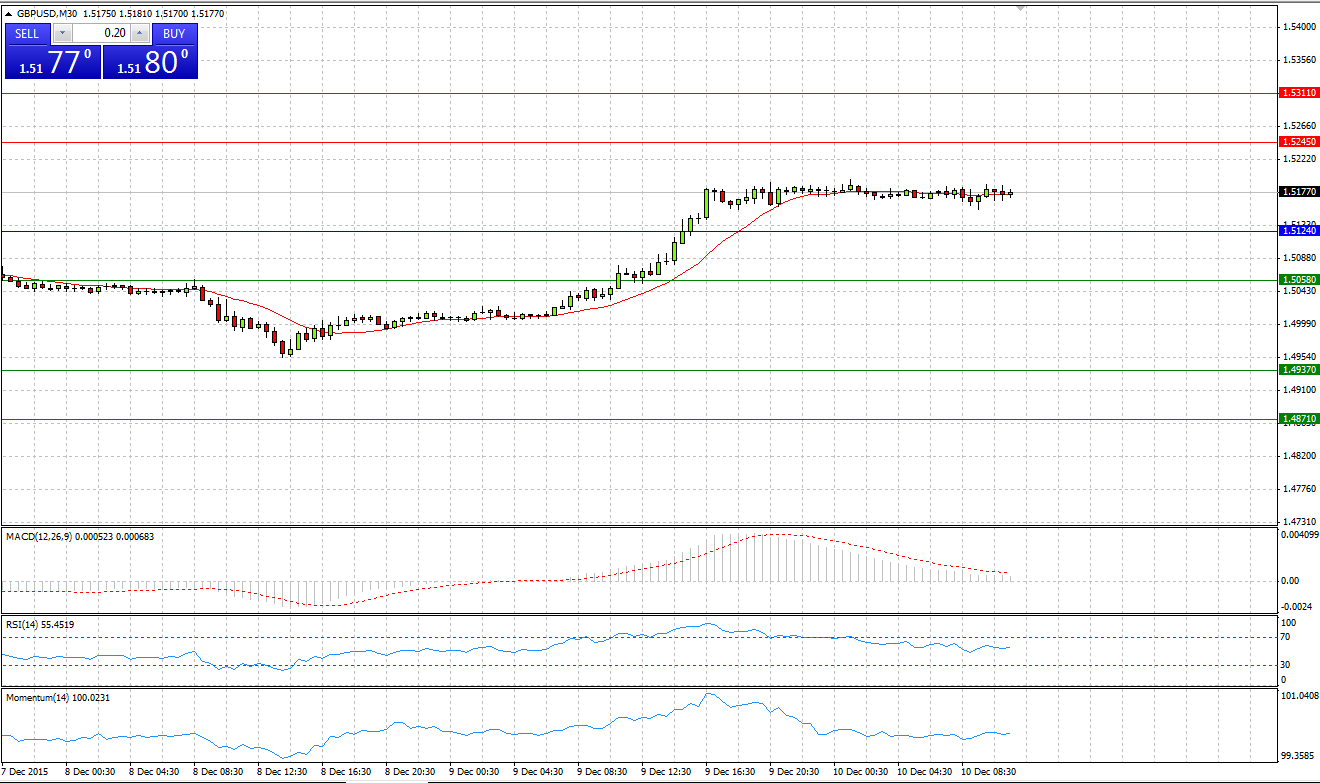

Market Scenario 1: Long positions above 1.5124 with targets at 1.5245 and 1.5311

Market Scenario 2: Short positions below 1.5124 with targets at 1.5058 and 1.4937

Comment: Sterling rose against US dollar for more than 170 pips during yesterday’s session closing the day at 1.518. Today the pair is trading flat ahead of big news out of UK

Supports and Resistances:

R3 1.5432

R2 1.5311

R1 1.5245

PP 1.5124

S1 1.5058

S2 1.4937

S3 1.4871

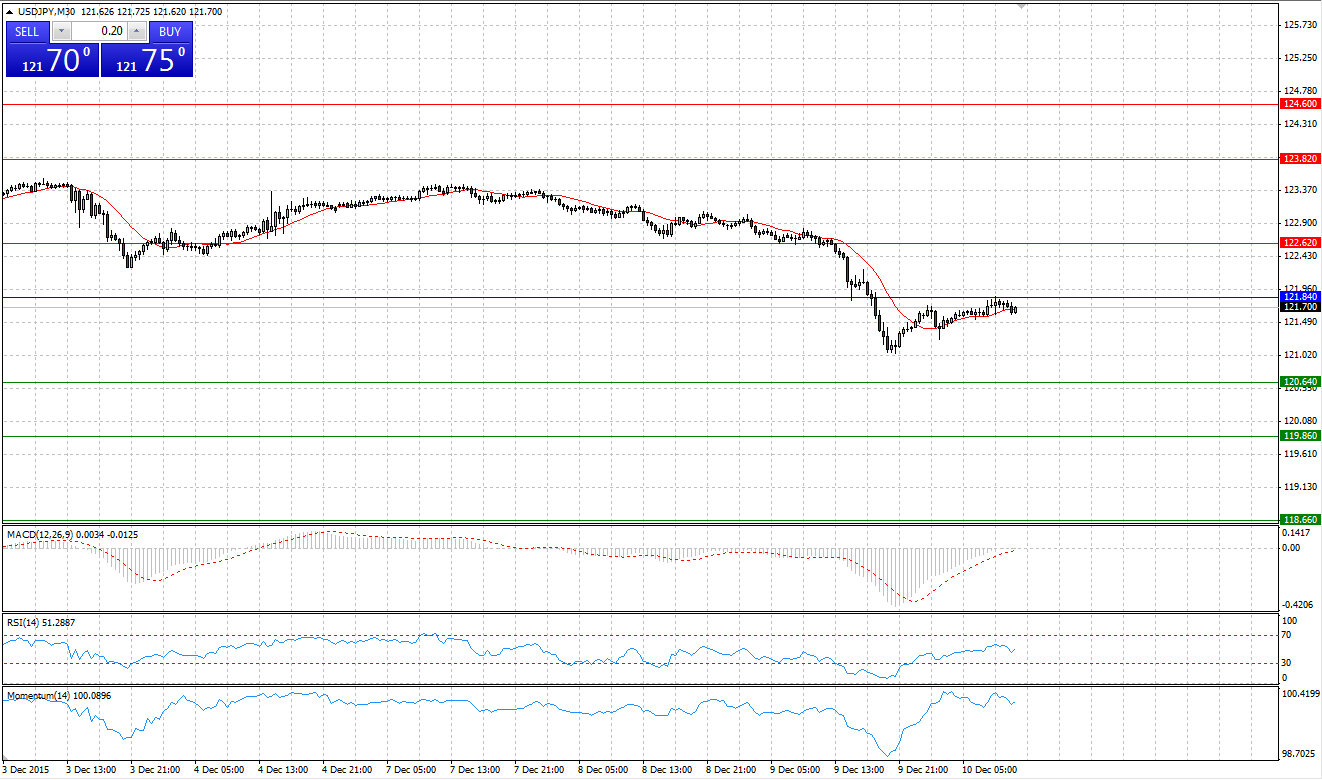

Market Scenario 1: Long positions above 121.84 with targets at 122.62 and 123.82

Market Scenario 2: Short positions below 121.84 with targets at 120.64 and 119.86

Comment: US dollar came under pressure against Japanese yen during yesterday’s session and lost more than 140 Pips in one day. Currently the pair is trading flat below Pivot Point level.

Supports and Resistances:

R3 124.60

R2 123.82

R1 122.62

PP 121.84

S1 120.64

S2 119.86

S3 118.66

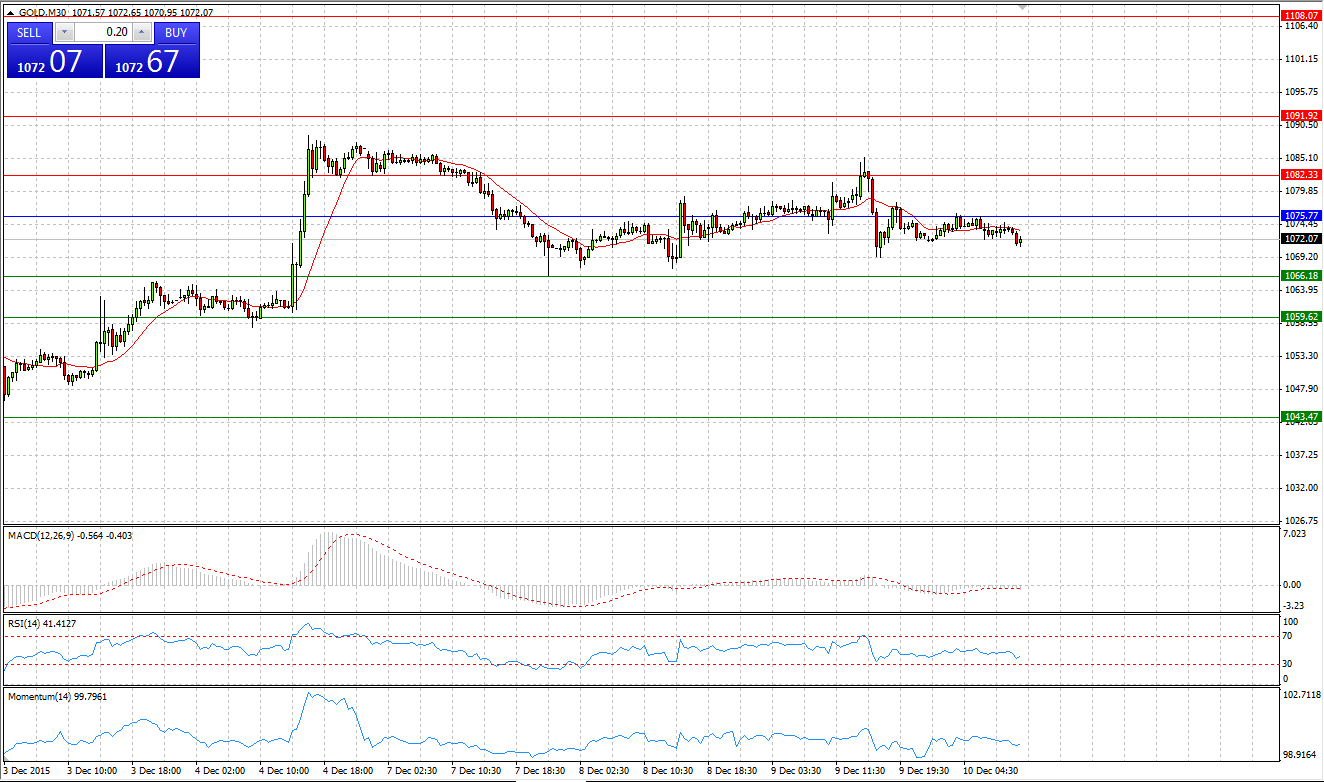

GOLD

Market Scenario 1: Long positions above 1075.77 with targets at 1082.33 and 1091.92

Market Scenario 2: Short positions below 1075.77 with targets at 1066.18 and 1059.62

Comment: Gold continues trading in the range against US dollar for the third day in a row between S1 and R2. Currently it’s trading below Pivot Point level.

Supports and Resistances:

R3 1108.07

R2 1091.92

R1 1082.33

PP 1075.77

S1 1066.18

S2 1059.62

S3 1043.47

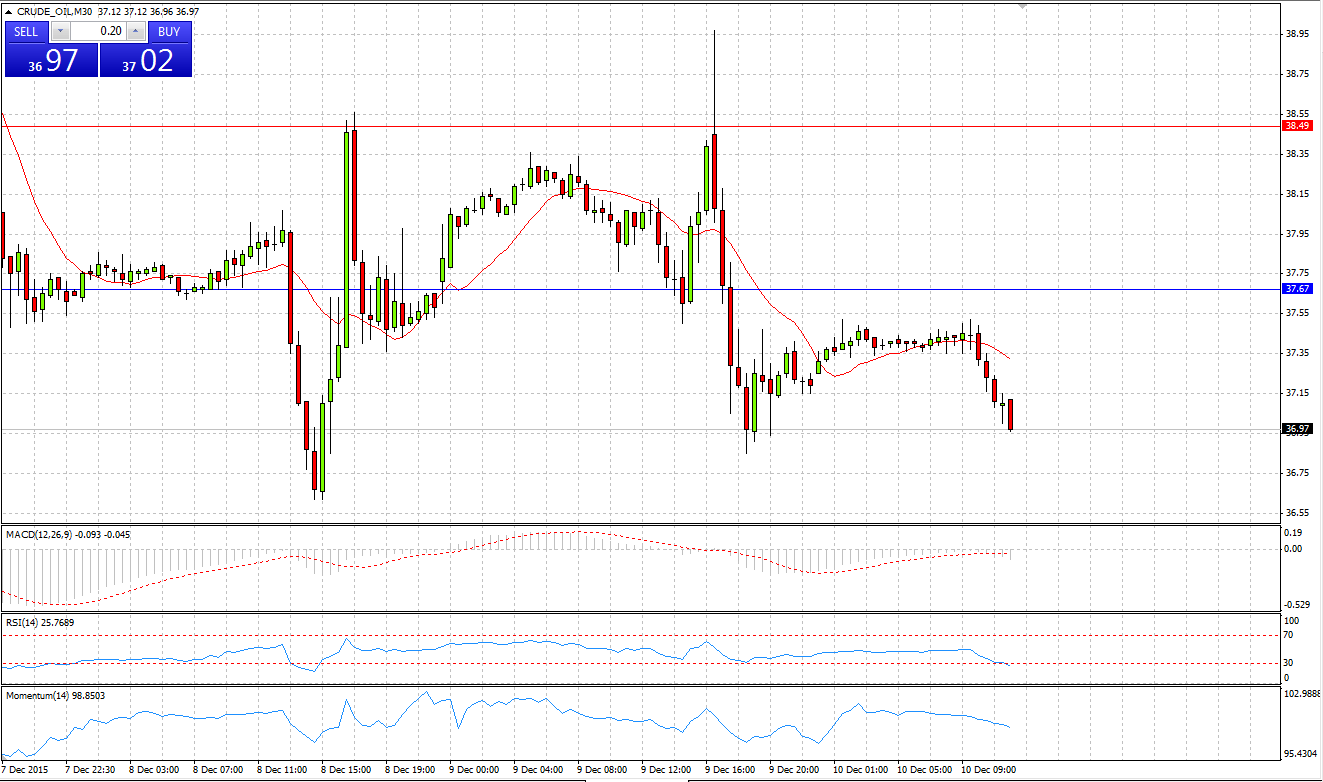

CRUDE OIL

Market Scenario 1: Long positions above 37.67 with targets at 38.72 and 39.61

Market Scenario 2: Short positions below 37.67 with targets at 36.78 and 35.73

Comment: Crude oil continue trading under pressure. Analysts predict that the price will remain below 50 USD per barrel for the whole 2016.

Supports and Resistances:

R3 41.91

R2 39.79

R1 38.49

PP 37.67

S1 36.37

S2 35.55

S3 33.43

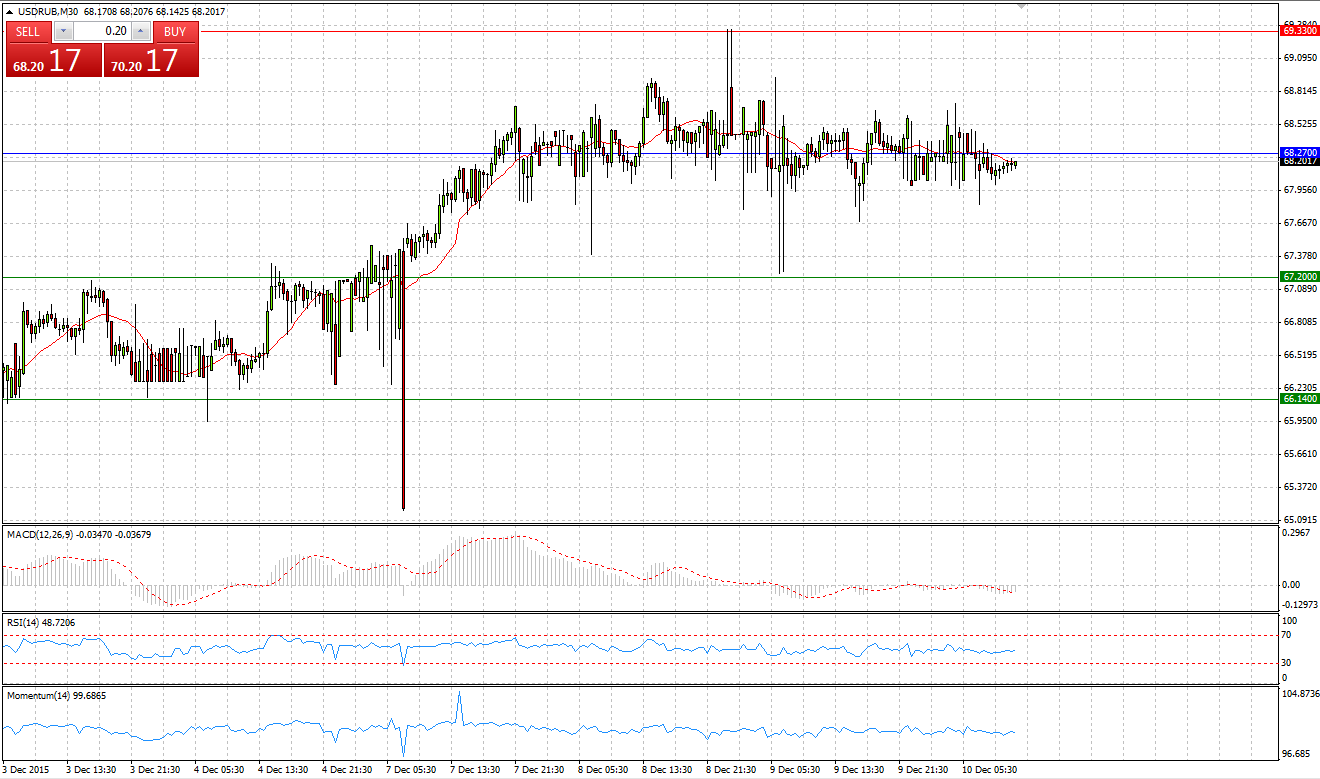

Market Scenario 1: Long positions above 68.27 with targets at 69.33 and 70.40

Market Scenario 2: Short positions below 68.27 with targets at 67.20 and 66.14

Comment: US dollar reached a new high during yesterday’s session against Russian ruble at 69.35, 65 cents away from psychologically important level of 70 Russian ruble per US dollar. Today the pair is trading calmly around Pivot Point level

Supports and Resistances:

R3 72.53

R2 70.40

R1 69.33

PP 68.27

S1 67.20

S2 66.14

S3 64.01