Market Scenario 1: Long positions above 0.7223 with targets at 0.7259 and 0.7306

Market Scenario 2: Short positions below 0.7223 with targets at 0.7176 and 0.7140

Comment: Aussie continues falling against US dollar for the second day in the row, closing yesterday’s session with 40 pips loss. Today, during the early European session, the pair came under pressure and was sent below Pivot Point and the first Support level.

Supports and Resistances:

R3 0.7342

R2 0.7306

R1 0.7259

PP 0.7223

S1 0.7176

S2 0.7140

S3 0.7093

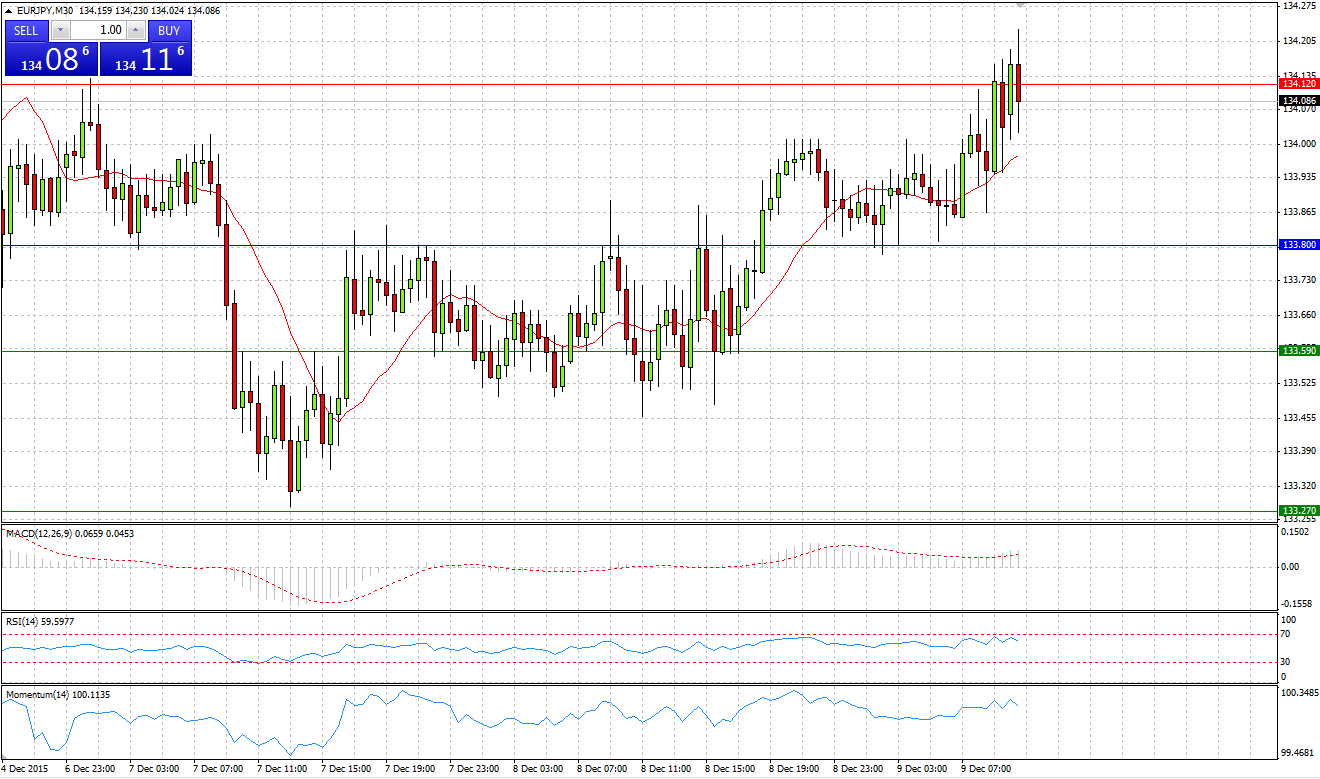

EUR/JPY

Market Scenario 1: Long positions above 133.80 with targets at 134.12 and 134.33

Market Scenario 2: Short positions below 133.80 with targets at 133.59 and 133.27

Comment: European currency managed to return some of its losses against Japanese yen during yesterday’s session closing the day in positive territory. Today amid positive news out of Germany, EUR/JPY broke through Pivot Point level and undertook an attempt to test the first Support level.

Supports and Resistances:

R3 134.65

R2 134.33

R1 134.12

PP 133.80

S1 133.59

S2 133.27

S3 133.06

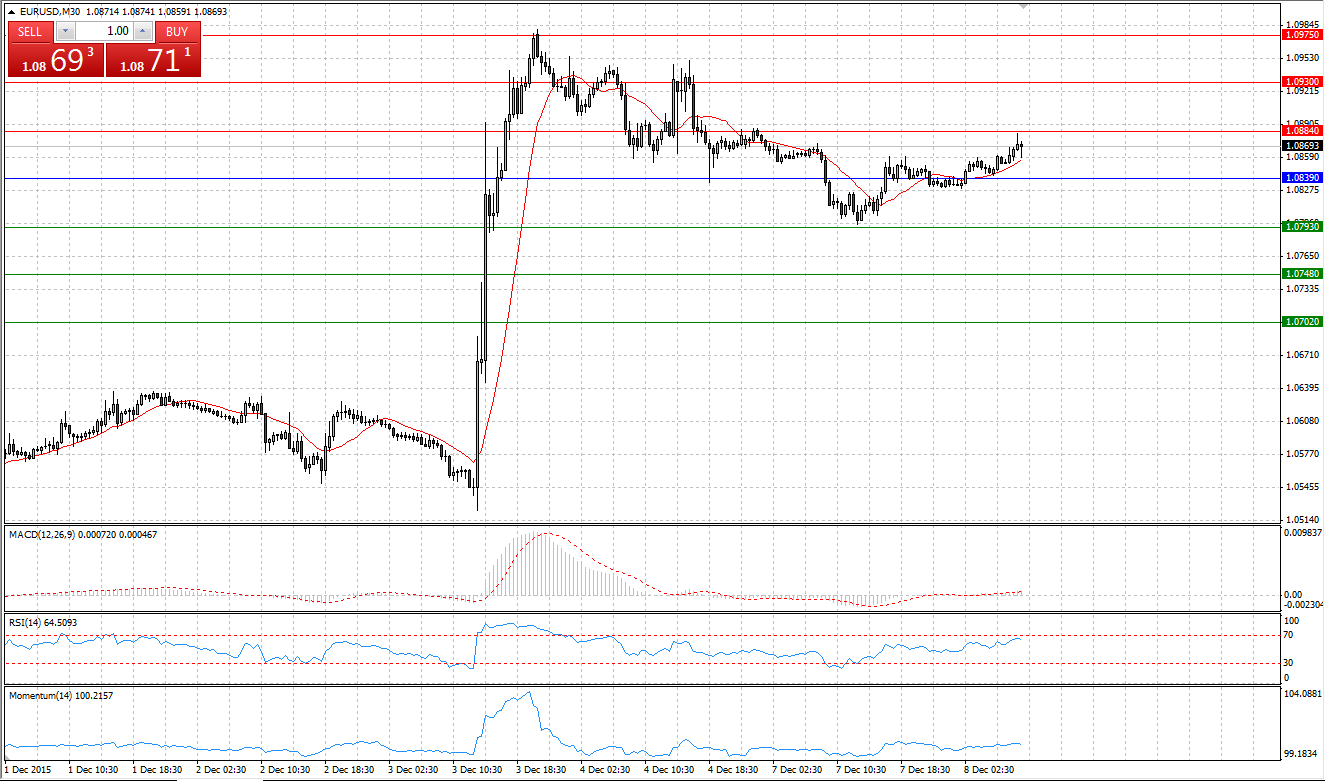

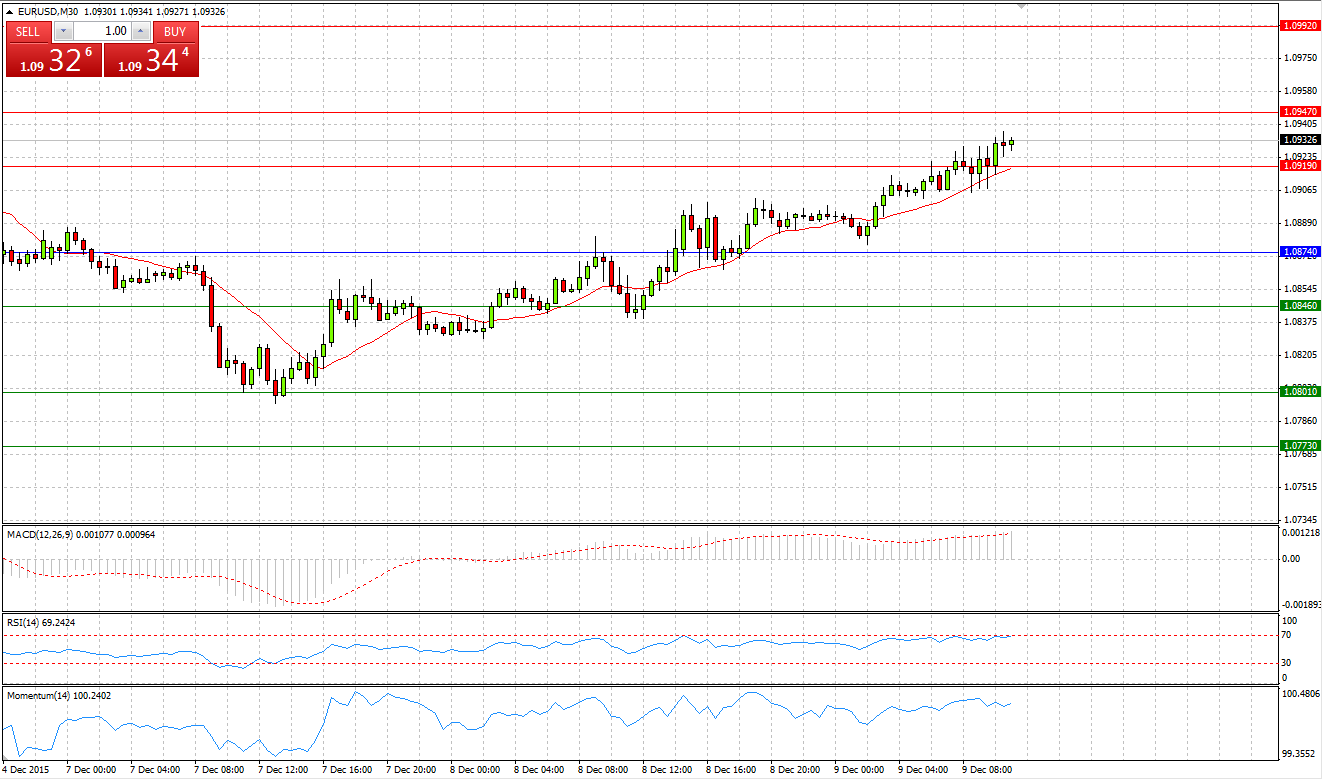

Market Scenario 1: Long positions above 1.0874 with targets at 1.0919 and 1.0947

Market Scenario 2: Short positions below 1.0874 with targets at 1.0846 and 1.0801

Comment: European currency during yesterday’s session re-gained all its losses incurred on Monday against US dollar, closing the day with 60 pips profit. Today the pair amid promising news out of Eurozone broke through both Resistance levels aiming to test the last one at 1.0992

Supports and Resistances:

R3 1.0992

R2 1.0947

R1 1.0919

PP 1.0874

S1 1.0846

S2 1.0801

S3 1.0773

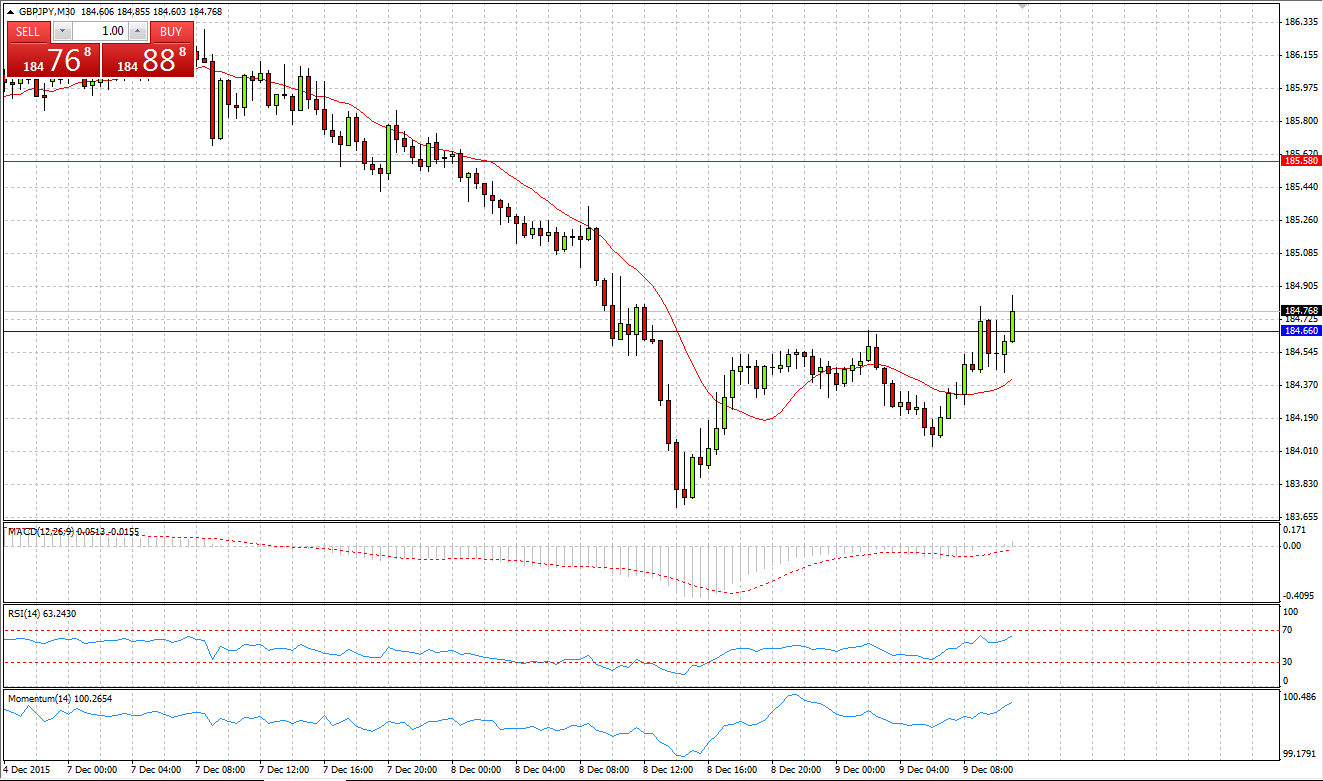

Market Scenario 1: Long positions above 184.66 with targets at 185.58 and 186.66

Market Scenario 2: Short positions below 184.66 with targets at 183.58 and 182.66

Comment: Sterling dropped during yesterday’s session against Japanese yen amid disappointing news from UK’s manufacturing production sector, which shrunk 0.4 %. Today sterling is trading positively above Pivot Point level.

Supports and Resistances:

R3 187.58

R2 186.66

R1 185.58

PP 184.66

S1 183.58

S2 182.66

S3 181.58

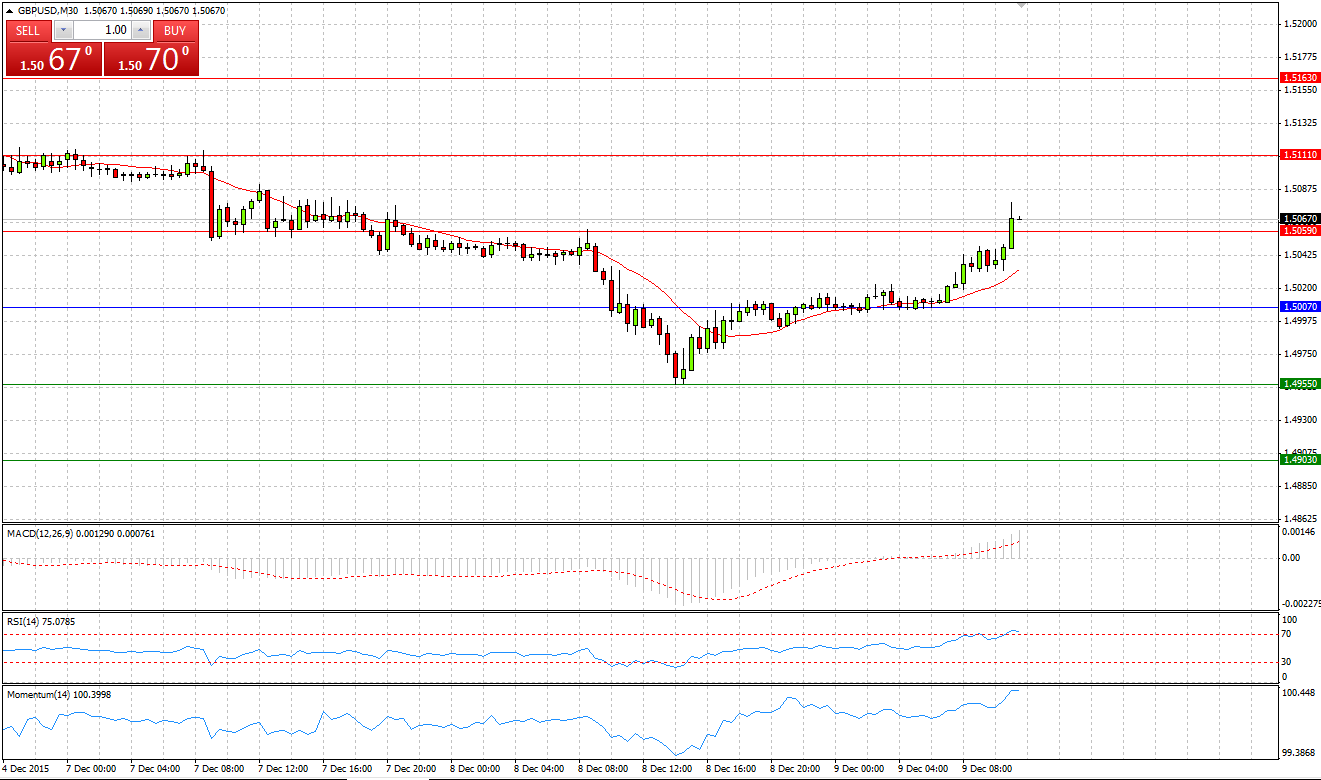

Market Scenario 1: Long positions above 1.5007 with targets at 1.5059 and 1.5111

Market Scenario 2: Short positions below 1.5007 with targets at 1.4955 and 1.4903

Comment: Sterling during yesterday’s session came under selling pressure and dropped to the First support level at 1.4955 against the US dollar; however, by the end of the day, British pound managed to return some of its losses and close the day above 1.50. At the time, the pair behaved very positively, having broken through the First Resistance level.

Supports and Resistances:

R3 1.5163

R2 1.5111

R1 1.5059

PP 1.5007

S1 1.4955

S2 1.4903

S3 1.4851

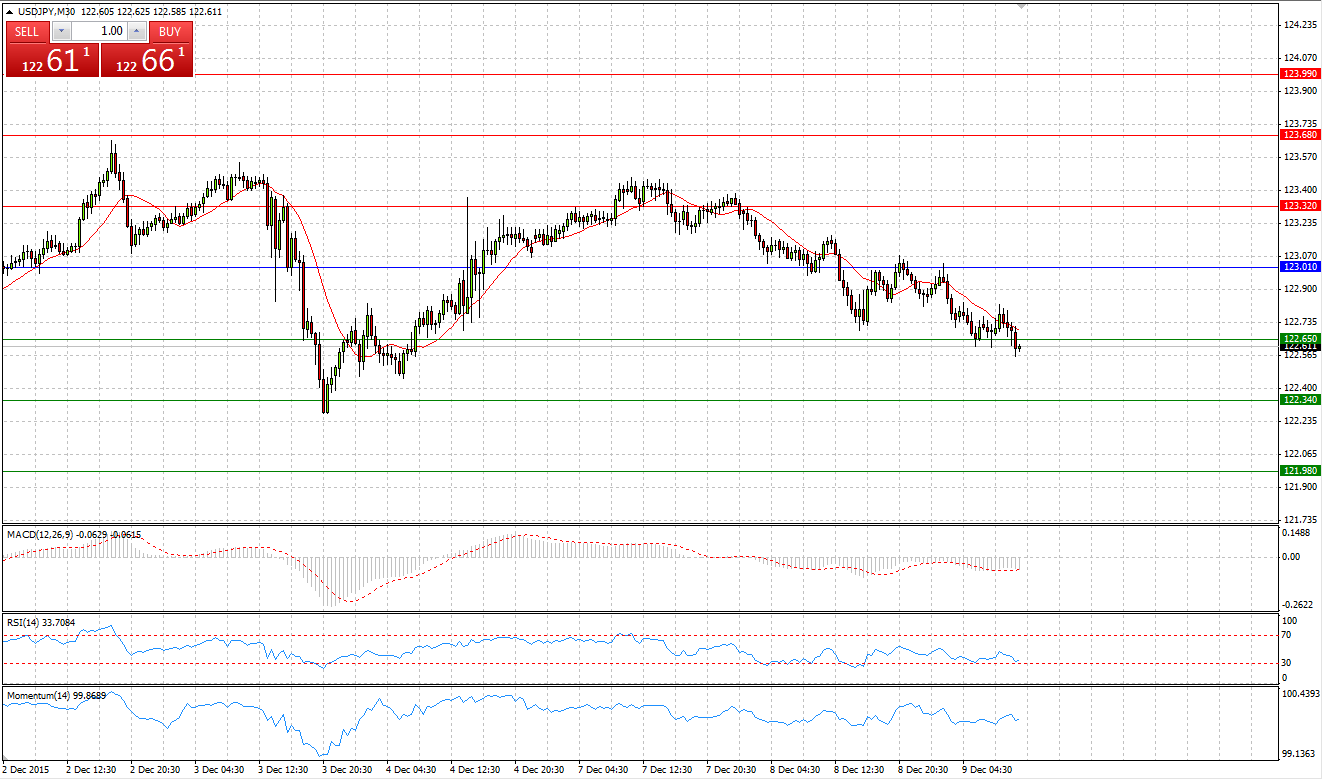

Market Scenario 1: Long positions above 123.01 with targets at 123.32 and 123.68

Market Scenario 2: Short positions below 123.01 with targets at 122.65 and 122.34

Comment: US dollar continues trading in the range between S2 and R2 against Japanese yen. Range – Bound Strategy can be applied.

Supports and Resistances:

R3 123.99

R2 123.68

R1 123.32

PP 123.01

S1 122.65

S2 122.34

S3 121.98

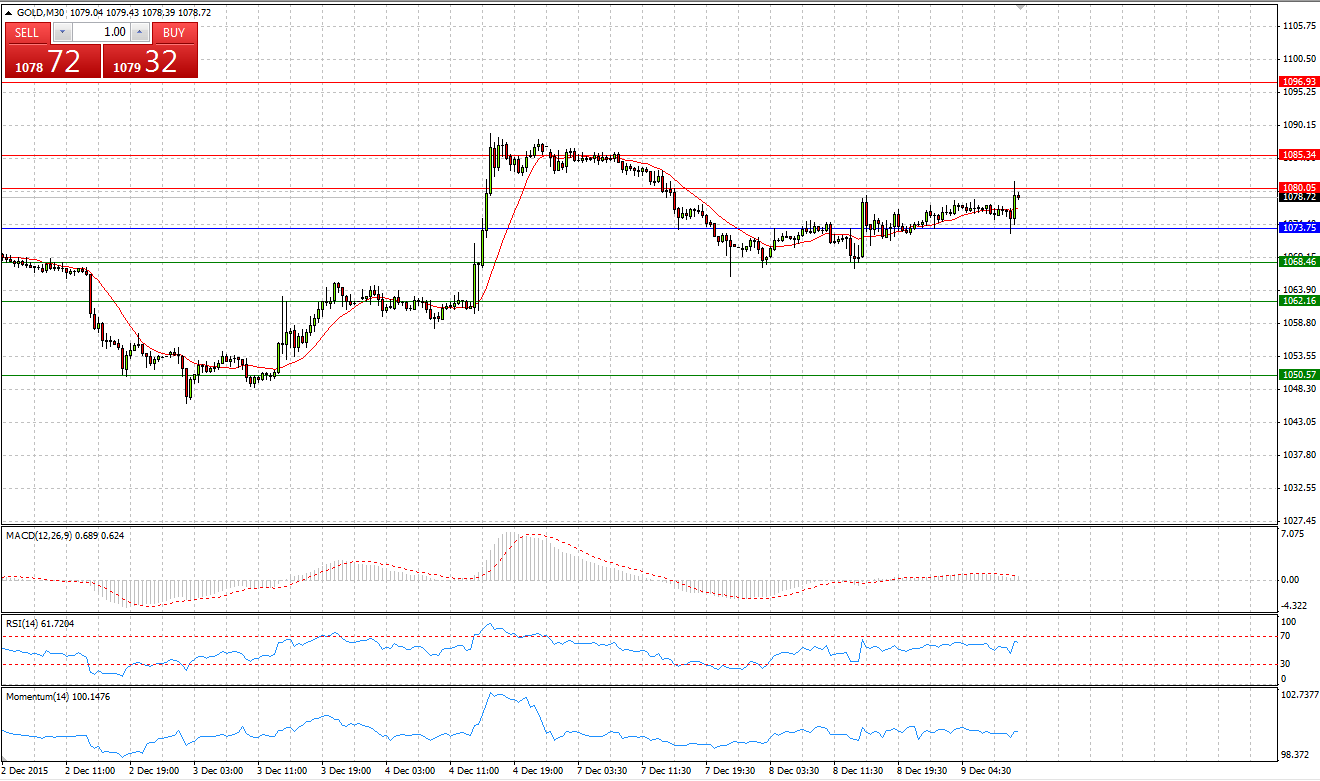

GOLD

Market Scenario 1: Long positions above 1073.75 with targets at 1080.05 and 1085.34

Market Scenario 2: Short positions below 1073.75 with targets at 1068.46 and 1062.16

Comment: Gold during yesterday’s session managed to return some of its losses incurred on Monday, closing the day with 4 USD profit. Today gold continues trading with positive bias above Pivot point level.

Supports and Resistances:

R3 1096.93

R2 1085.34

R1 1080.05

PP 1073.75

S1 1068.46

S2 1062.16

S3 1050.57

CRUDE OIL

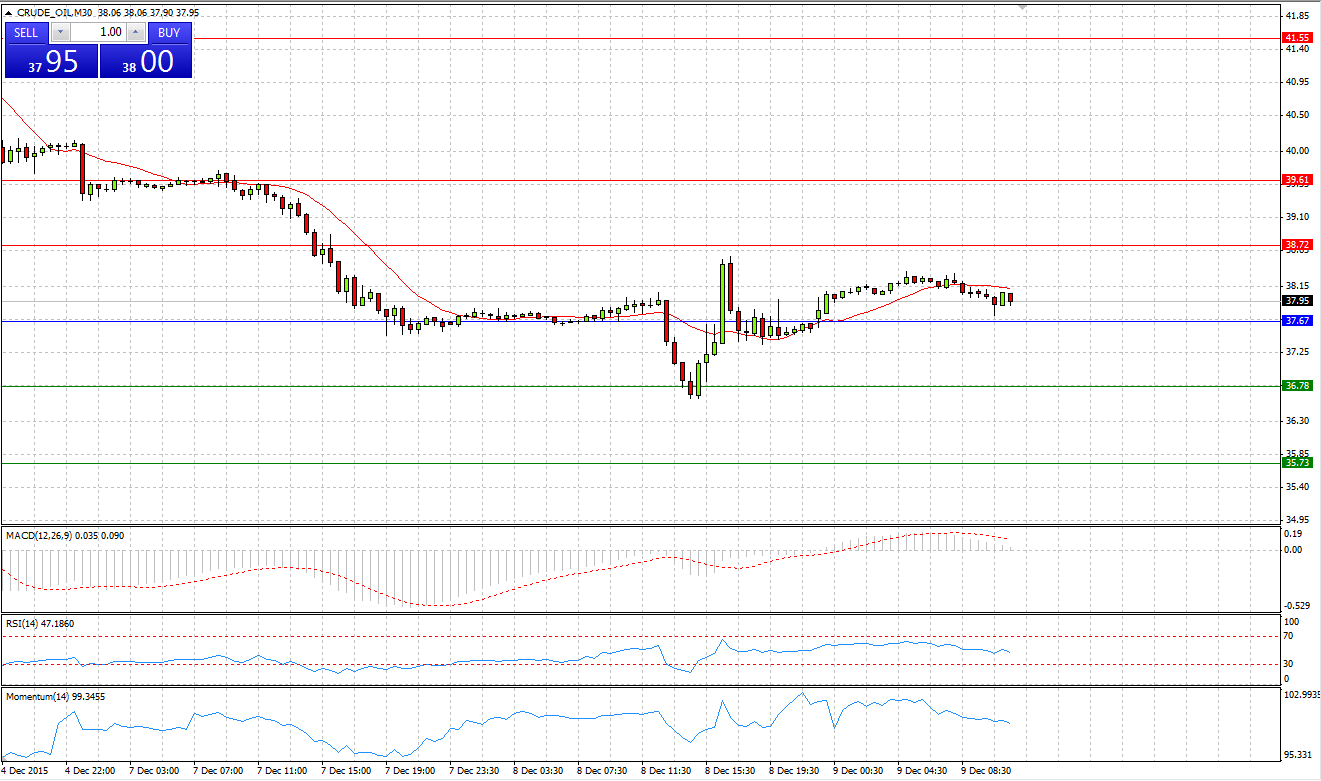

Market Scenario 1: Long positions above 37.67 with targets at 38.72 and 39.61

Market Scenario 2: Short positions below 37.67 with targets at 36.78 and 35.73

Comment: Having sunk to 36.62 US dollar per barrel, crude managed to regain the control and closed the day at positive territory at 37.83. Today crude is trading calmly slightly below Pivot point level.

Supports and Resistances:

R3 41.55

R2 39.61

R1 38.72

PP 37.67

S1 36.78

S2 35.73

S3 33.79

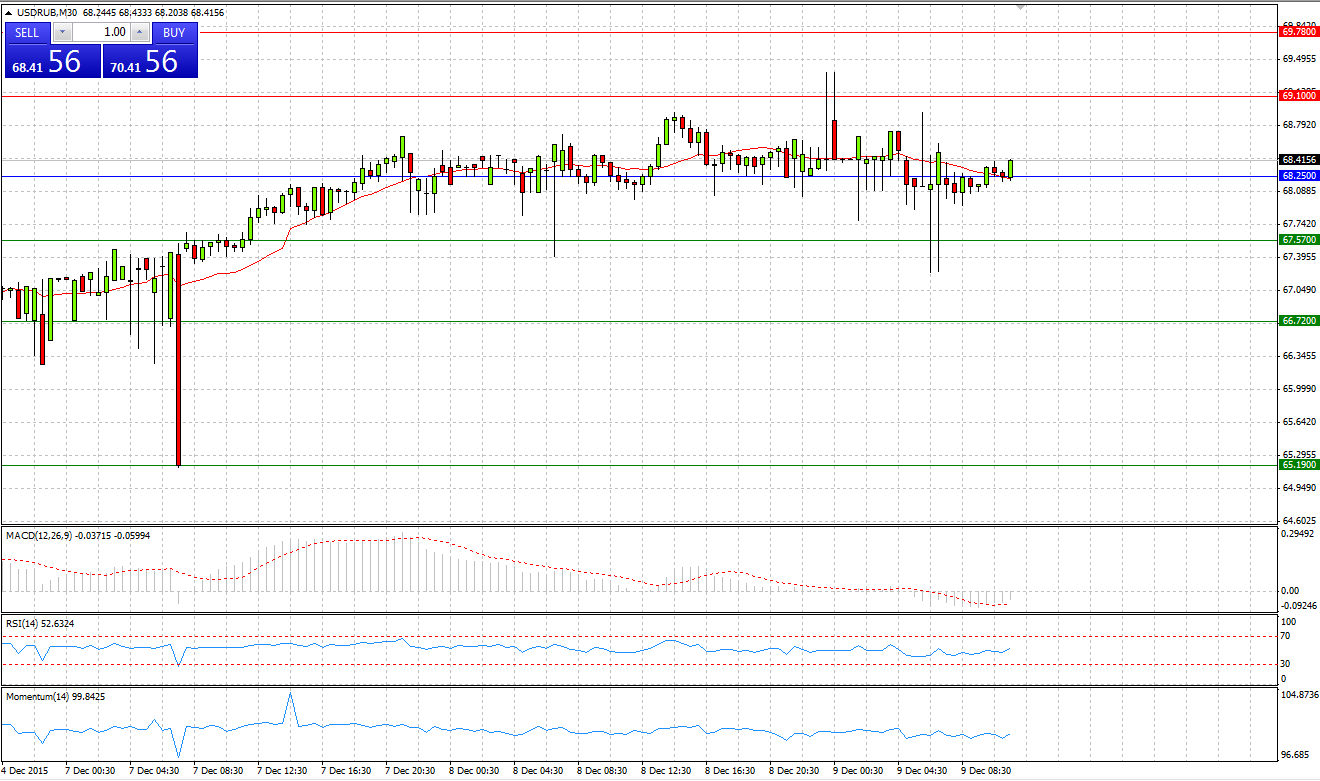

USD/RUB

Market Scenario 1: Long positions above 68.25 with targets at 69.10 and 69.78

Market Scenario 2: Short positions below 68.25 with targets at 67.57 and 66.72

Comment: US dollar recorded 7 days in the row of consecutive gains against Russian ruble, gradually approaching psychologically important level of 70 ruble per 1 US dollar. Currently the pair is trading above Pivot point level.

Supports and Resistances:

R3 71.31

R2 69.78

R1 69.10

PP 68.25

S1 67.57

S2 66.72

S3 65.19