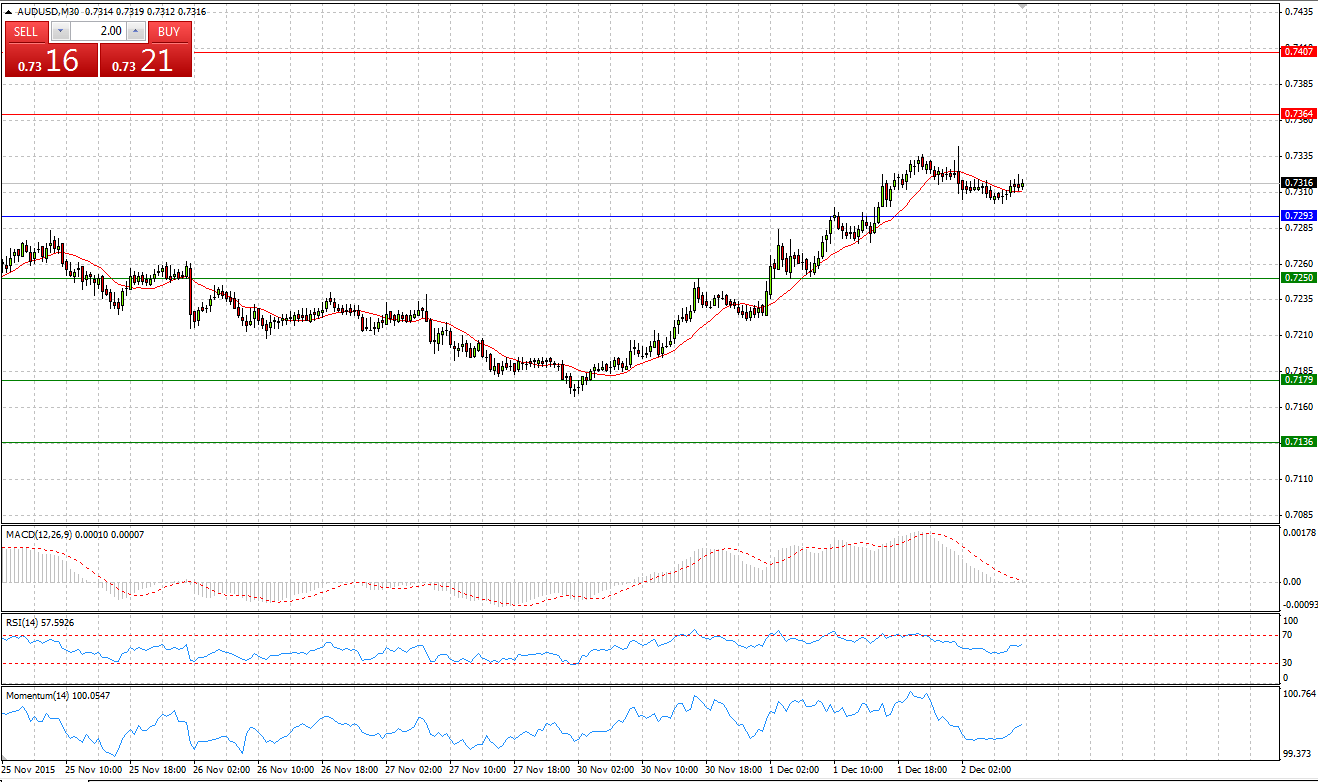

Market Scenario 1: Long positions above 0.7293 with targets at 0.7364 and 0.7407

Market Scenario 2: Short positions below 0.7293 with targets at 0.7250 and 0.7179

Comment: Aussie during yesterday’s session appreciated for almost 100 pips per one day against US dollar amid disappointing news from US, closing the session at 0.7336. Today AUD/USD is trading calmly, despite positive news of Australian GDP.

Supports and Resistances:

R3 0.7478

R2 0.7407

R1 0.7364

PP 0.7293

S1 0.7250

S2 0.7179

S3 0.7136

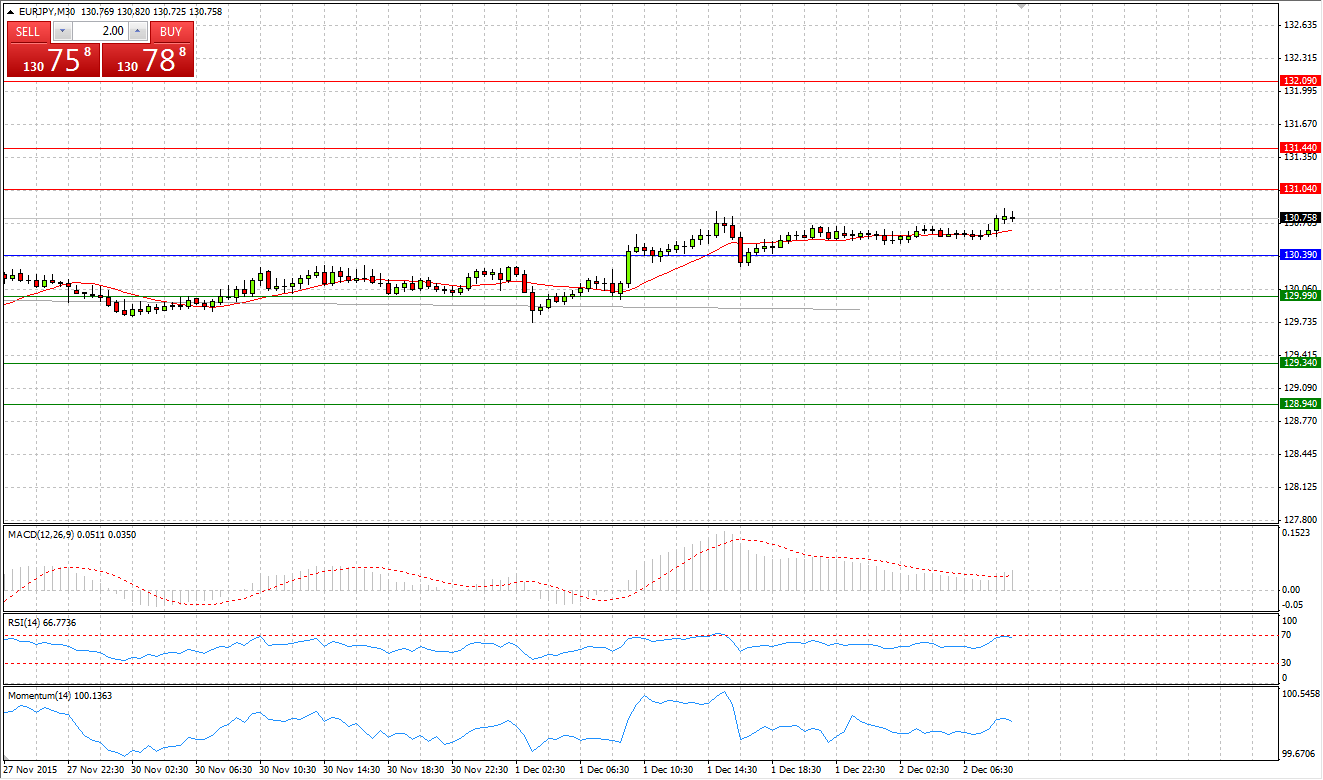

Market Scenario 1: Long positions above 130.39 with targets at 131.04 and 131.44

Market Scenario 2: Short positions below 130.39 with targets at 129.99 and 129.34

Comment: European single currency surged against Japanese yen during yesterday’s session and closed the day above psychologically important level of 130 Japanese yen per euro. Today, positive news from European Economic Area continue supporting the currency and the pair is aiming to test the First Resistance level

Supports and Resistances:

R3 132.09

R2 131.44

R1 131.04

PP 130.39

S1 129.99

S2 129.34

S3 128.94

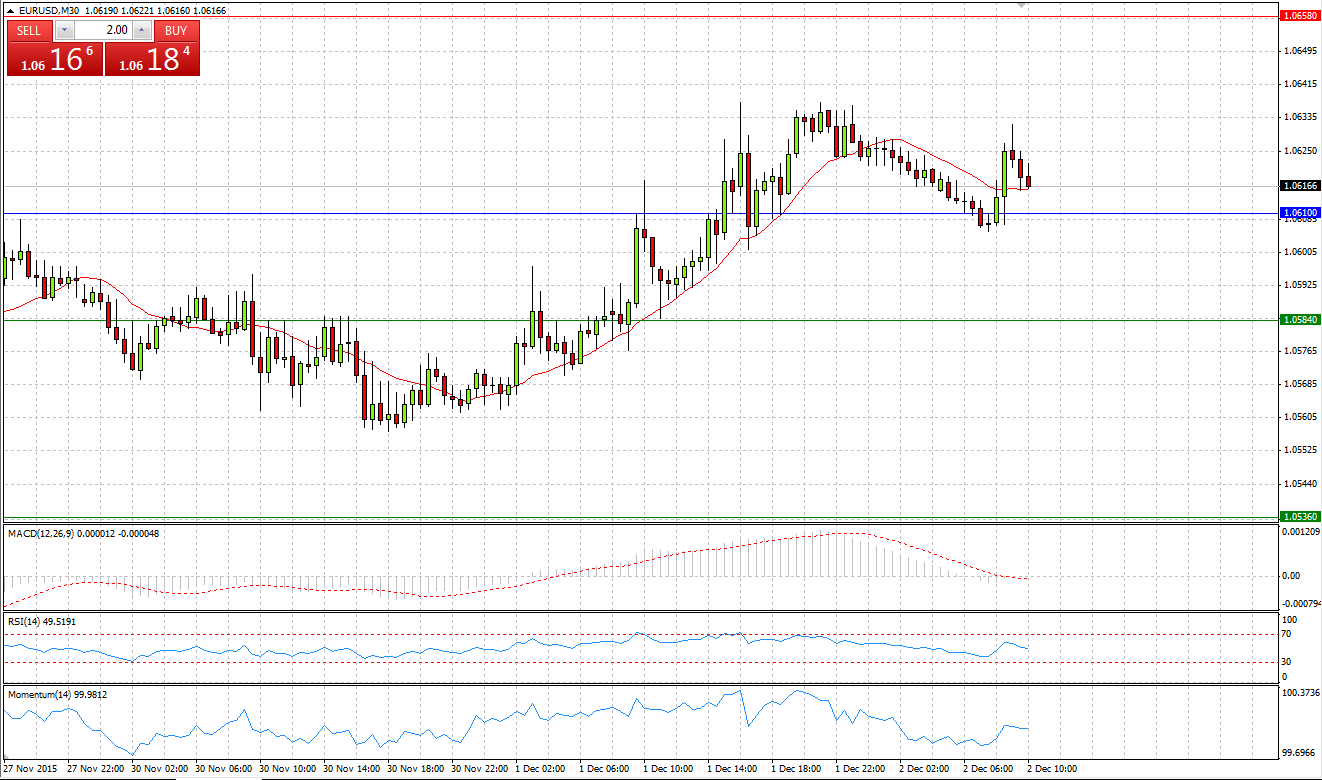

Market Scenario 1: Long positions above 1.0610 with targets at 1.0658 and 1.0684

Market Scenario 2: Short positions below 1.0610 with targets at 1.0584 and 1.0536

Comment: European currency after a number of consecutive days of losses managed to feel the ground and close the day with 50 pips gain against US dollar amid unexpectedly improved European unemployment rate. Today the pair is trading flat slightly above Pivot Point level.

Supports and Resistances:

R3 1.0732

R2 1.0684

R1 1.0658

PP 1.0610

S1 1.0584

S2 1.0536

S3 1.0510

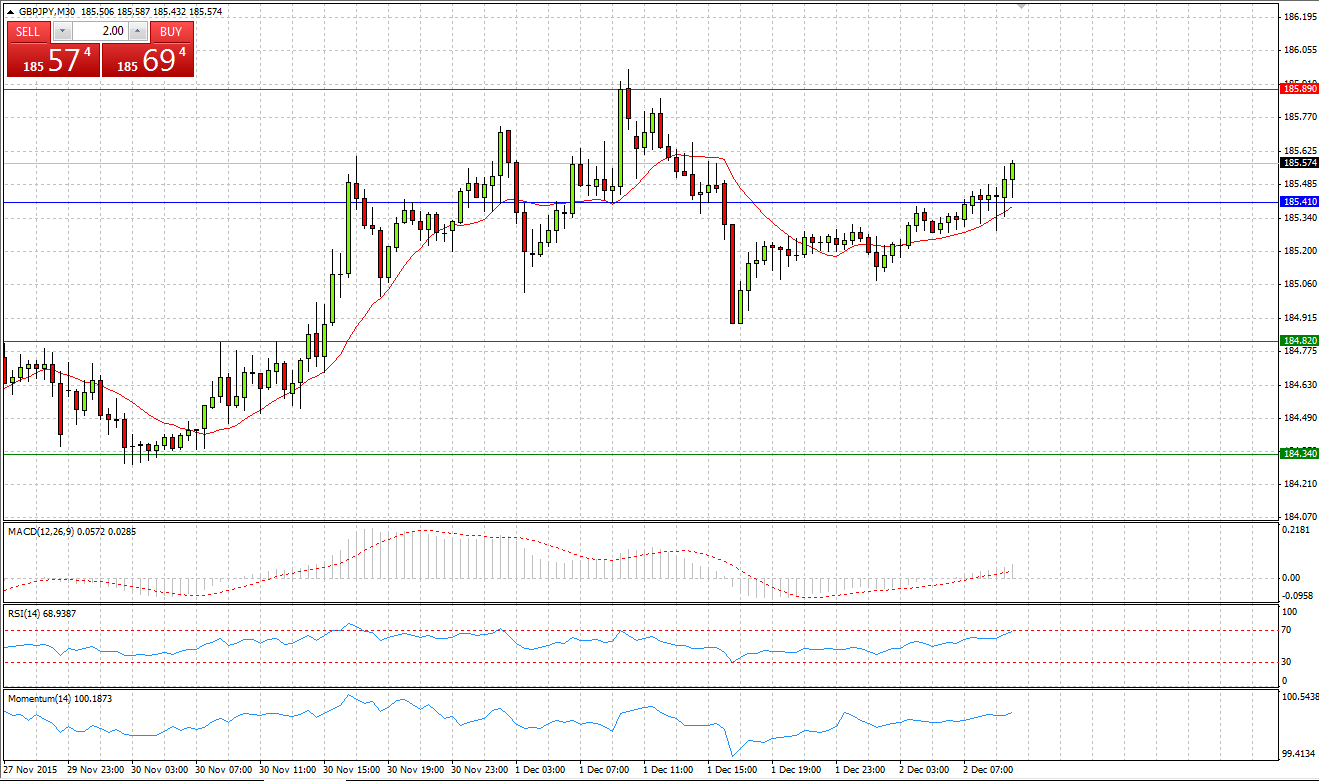

Market Scenario 1: Long positions above 185.41 with targets at 185.89 and 186.48

Market Scenario 2: Short positions below 185.41 with targets at 184.82 and 184.34

Comment: Sterling closed yesterday’s session on negative territory against Japanese yen amid disappointing news from UK’s manufacturing sector, which shrank more than analysts expected. Today the pair is trading with a positive mood slightly above Pivot point level.

Supports and Resistances:

R3 186.96

R2 186.48

R1 185.89

PP 185.41

S1 184.82

S2 184.34

S3 183.75

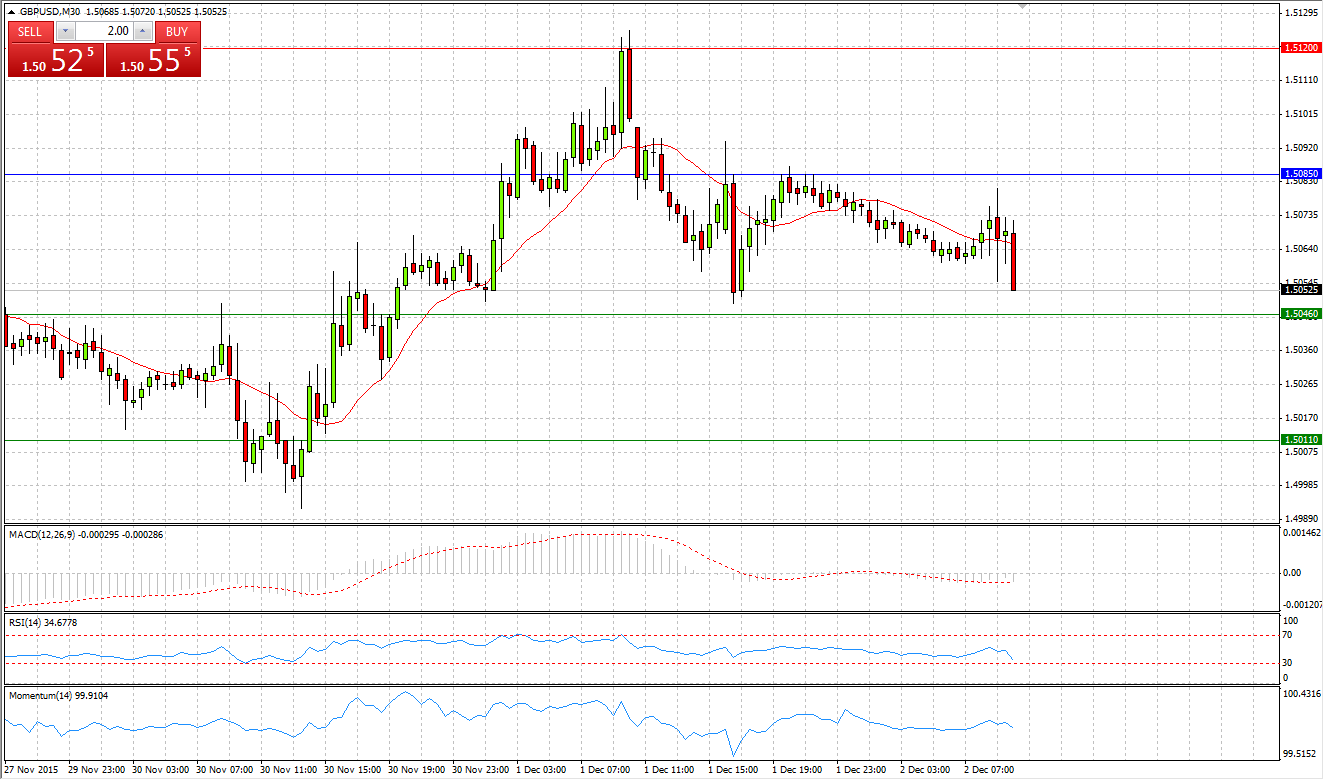

Market Scenario 1: Long positions above 1.5085 with targets at 1.5120 and 1.5159

Market Scenario 2: Short positions below 1.5085 with targets at 1.5046 and 1.5011

Comment: Having tested the first Resistance level during yesterday’s session, sterling encountered selling pressure and retreated closing the day almost unchanged against US dollar. Today the pair is trading calmly ahead of the speech of Fed Chair Yellen.

Supports and Resistances:

R3 1.5194

R2 1.5159

R1 1.5120

PP 1.5085

S1 1.5046

S2 1.5011

S3 1.4972

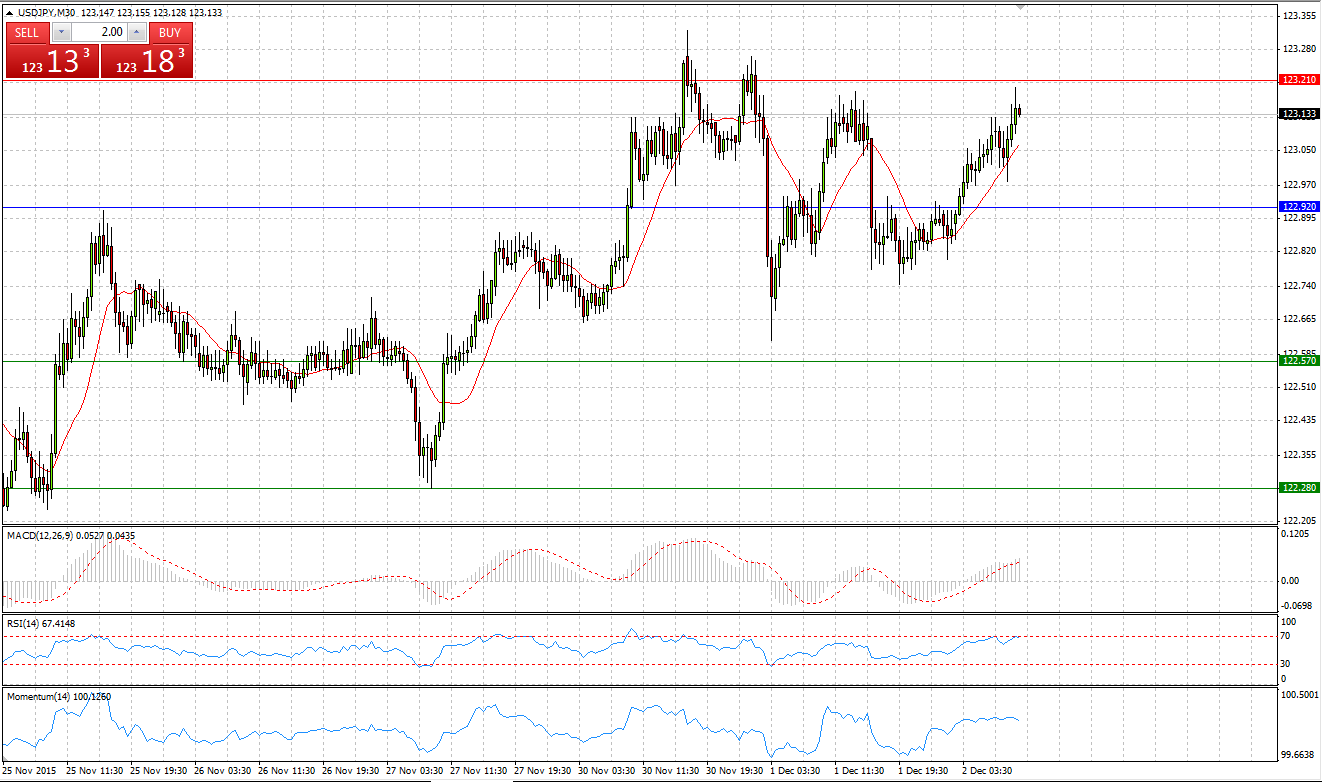

Market Scenario 1: Long positions above 122.92 with targets at 123.21 and 123.56

Market Scenario 2: Short positions below 122.92 with targets at 122.57 and 122.28

Comment: US dollar encountered a difficulty to break through the first Resistance Level against Japanese yen during yesterday’s session and retreated, closing the day in negative territory. Today the pair undertook another attempt to break through this level, however, the level remained firm.

Supports and Resistances:

R3 123.85

R2 123.56

R1 123.21

PP 122.92

S1 122.57

S2 122.28

S3 121.93

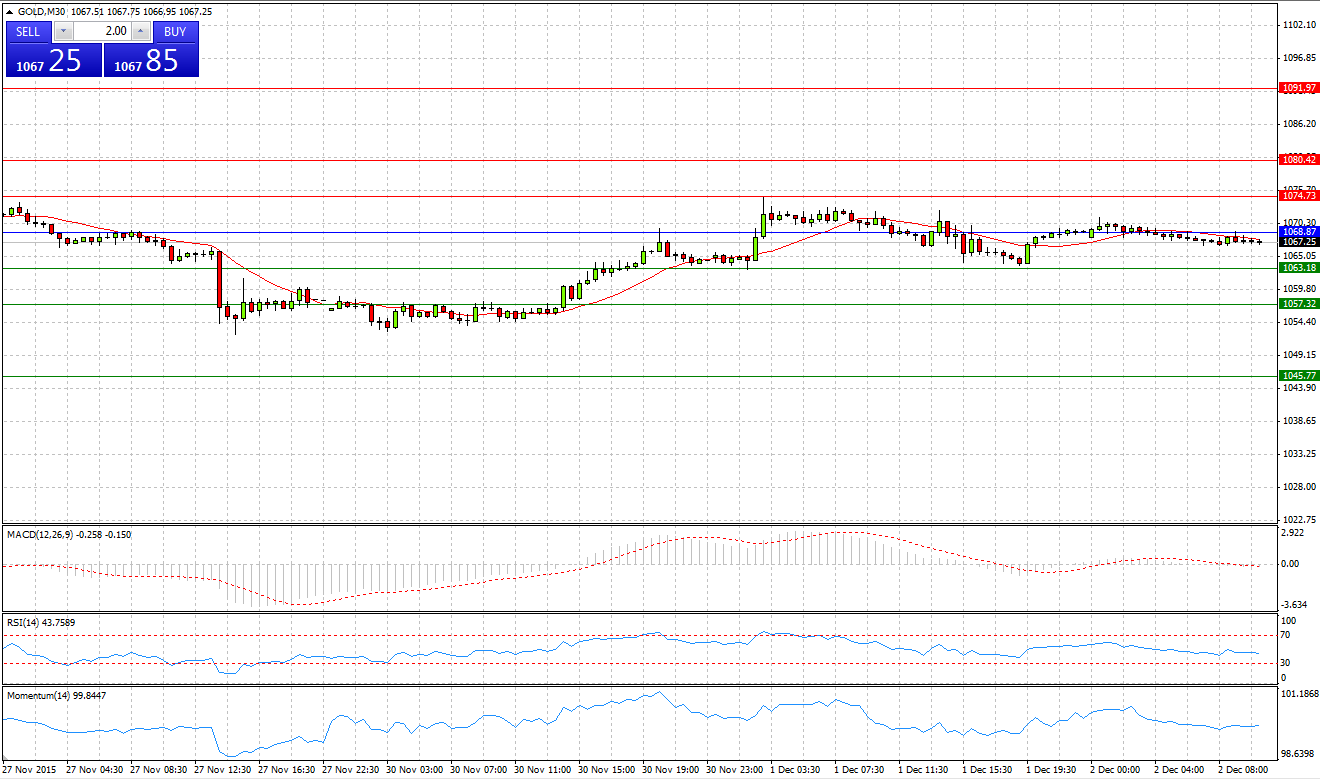

GOLD

Market Scenario 1: Long positions above 1068.87 with targets at 1074.73 and 1080.42

Market Scenario 2: Short positions below 1068.87 with targets at 1063.18 and 1057.32

Comment: Gold recorded a second day in the row of consecutive gains against US dollar, closing the day at 1069.05. Today bullion is trading flat slightly below Pivot Point level ahead of the speech of Fed Chair Yellen.

Supports and Resistances:

R3 1091.97

R2 1080.42

R1 1074.73

PP 1068.87

S1 1063.18

S2 1057.32

S3 1045.77

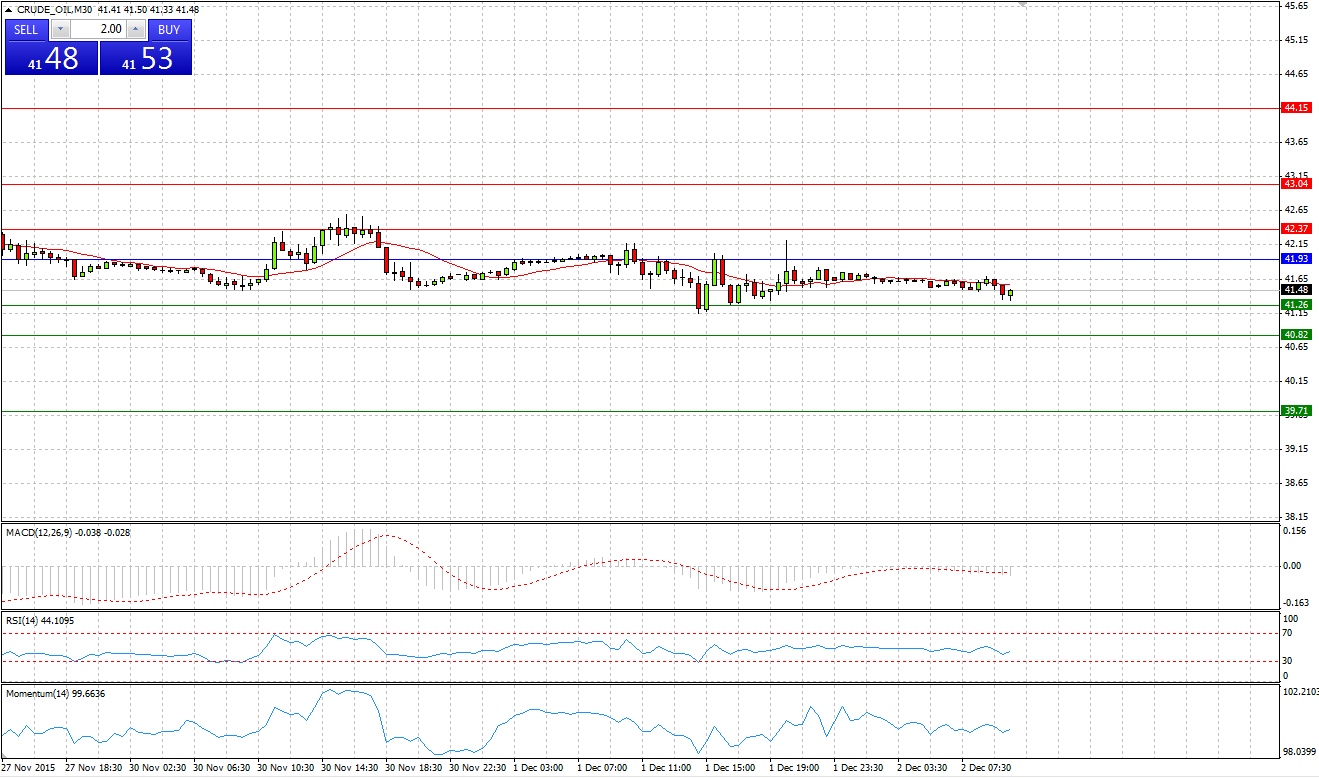

CRUDE OIL

Market Scenario 1: Long positions above 41.66 with targets at 42.18 and 42.72

Market Scenario 2: Short positions below 41.66 with targets at 41.12 and40.60

Comment: Crude oil continues trading flat ahead of the OPEC meeting, which is scheduled on 4th of December. Expectations are high that Friday's meeting of the Organization of the Petroleum Exporting Countries in Vienna will choose to continue pumping crude at record levels to defend market share against non-member oil producers such as the United States and Russia.

Supports and Resistances:

R3 43.78

R2 42.72

R1 42.18

PP 41.66

S1 41.12

S2 40.60

S3 39.54

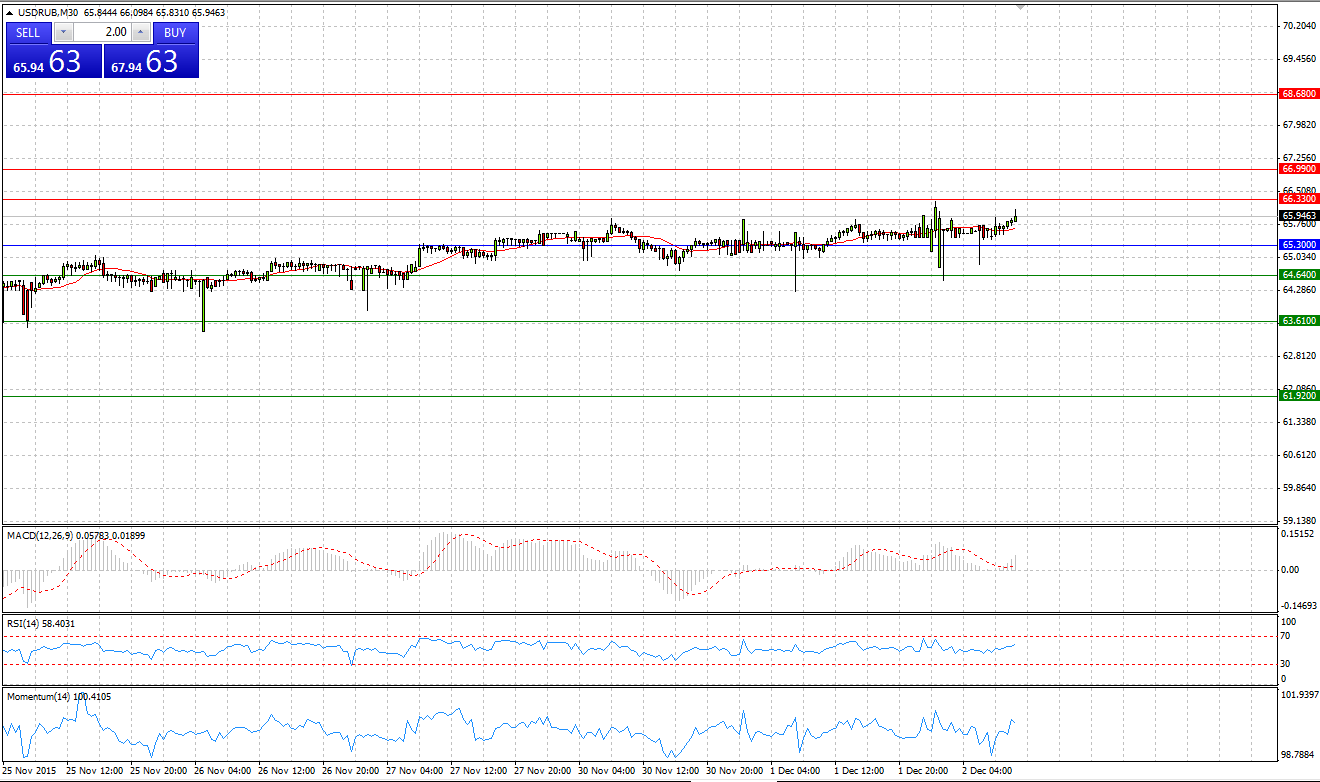

Market Scenario 1: Long positions above 65.30 with targets at 65.30 and 66.99

Market Scenario 2: Short positions below 65.30 with targets at 64.64 and 63.61

Comment: Bears continue constraining the pair below important level of 66 Russian rubles per 1 US dollar. However, possible positive news of out US and as well as a rate hike along with OPEC’s potential decision to continue defending the market share by increasing the output will definitely provide additional support to bulls and the level will fall.

Supports and Resistances:

R3 68.68

R2 66.99

R1 66.33

PP 65.30

S1 64.64

S2 63.61

S3 61.92