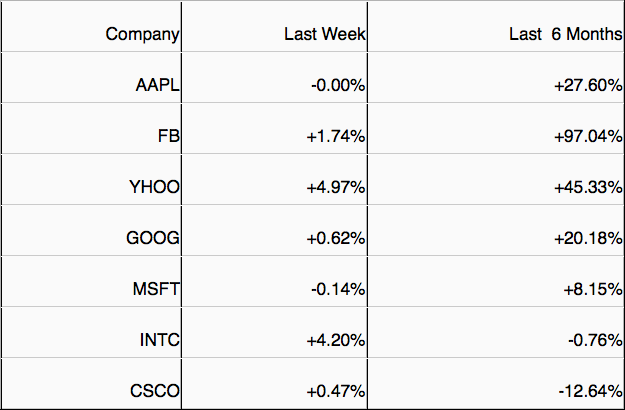

Last week, Yahoo (YHOO) continued on its buying spree (this time with a focus on video), while Intel (INTC) shares responded to data that the disrupting tablet market could be letting off.

Yahoo’s Video Investments Continue

Last week, Yahoo made three acquisitions, two of which could help video delivery at the company. Yahoo’s recent product introductions and revamps have included an element of coolness and any future video platform from the company is likely to fit the same description.

The first of the two acquisitions was a team of developers at DreamWorks Animation that created the app called Ptch. The app allows the compiling of event photos and videos by multiple users on their smartphones to create a more complete picture of the event. Ptch is being shut down, with the technology moving to Yahoo.

The other acquisition was of a startup called EvntLive, which has developed a platform for streaming of live concerts, on-demand streaming of previously-recorded live shows and an interactive platform for sharing opinions and comments.

Mayer said earlier that the focus of acquisitions was likely to move from mobile to advertising technology and video. These acquisitions indicate that we are probably looking at a new or revamped video platform from Yahoo that will take video consumption to the next level.

Moderating Tablet Demand Breathes Life into Intel

Investment firm J.P. Morgan Securities published a report on Dec 4 that provided data pointing to softening tablet demand this year followed by strengthening PC demand next year. The firm noted some positive signs in the PC supply chain for the first time in two years. Shares of Intel, which is still largely dependent on the PC market, jumped in response.

Earlier in the week, a Wells Fargo analyst reiterated his Outperform rating on Intel shares. The analyst said that there were chances of margin improvement due to stable chip prices and lower processing costs. But Intel has already decided to push its advanced technology into the mobile segment until more suitable mobile-ready products are available. Therefore, although its processing costs continue to decline, the company’s attempt to capture market share (even at the lowest-end Chromebooks) will remain a pressure on margins.

Intel is still largely viewed as a PC component supplier. While its latest mobile products hold promise, Intel has missed the 2013 holiday season, which means that the large-scale adoption of its latest mobile chips has been pushed back a few quarters. That said, Intel’s 2014 guidance doesn’t look aggressive, so any improvement in PC demand should be good news for the company.

The Secret Behind Facebook’s Mobile Growth

Facebook’s (FB) mobile business appears to have grown in leaps and bounds and last week, a product manager at the company explained how. The secret appears to be a phenomenon called mobile app install ads, which are nothing more than ads for apps that get streamed in the Facebook news feed.

In itself this doesn’t appear to be too exciting since most ads on Facebook appear in the newsfeed. But the reason this has proved so successful is that a person clicking on the ad is taken right away to the app download page, which increases the chances of the app getting installed.

Facebook also provided some rather astonishing numbers of the apps downloaded this way. It says that there were 175 million downloads since January. Since it had stated earlier that there were 25 million downloads in the first quarter, this means 150 million downloads in the few months since then, which looks to be a very high growth rate. Social-ad shop AdParlor estimates that Facebook charges $2.50 per install, which means that nearly a fifth of its mobile ad revenue comes from these apps.

Facebook’s huge success with mobile app install ads could be the reason that other social networking companies, such as Twitter (TWTR) are also testing the format.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Tech Stocks: The Week Ahead

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.