- The Nasdaq has increased by 13.5% this year, despite a partial retracement last month.

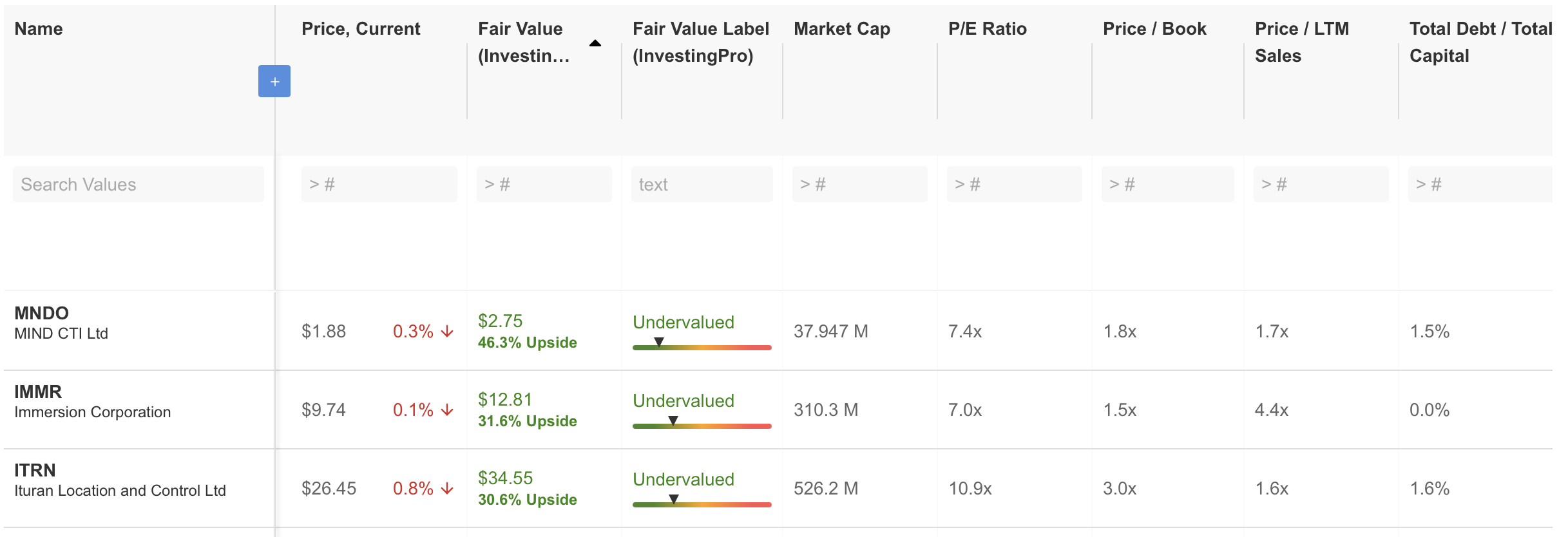

- Certain tech stocks, including Mind, Ituran, and Immersion, are expected to outperform based on their financials.

- These stocks are considered discounted by InvestingPro, indicating potential for significant growth.

- Invest like the big funds for under $9/month with our AI-powered ProPicks stock selection tool. Learn more here>>

The Nasdaq has experienced a 13.5% increase in value since the beginning of the year. Despite a partial retracement last month, the index maintains its upward trend, though its growth is lower compared to the nearly 30% increase recorded during the same period last year.

While the overall uptrend of the Nasdaq persists, certain technology stocks have the potential to outperform the index based on their financial performance. Among these, Mind Technology (NASDAQ:MIND), Ituran Location and Control (NASDAQ:ITRN), and Immersion Corporation (NASDAQ:IMMR) stand out as top choices for those looking to get into the sector now.

Let's take a deeper look at these stocks with InvestingPro to understand why they are a good bet at this point, as well as what the right levels to start scooping up shares might be. Source: InvestingPro

Source: InvestingPro

1. MIND CTI

Mind (NASDAQ:MNDO) offers online accounting software, product brokerage, customer service, and billing solutions to traditional telecommunications providers, VoIP, cable, broadband IP, wireless, and mobile virtual network operators.

Source: InvestingPro

While Mind reported flat year-on-year data in its 2023 earnings report, the company's acquisition of its first customer in Europe marks a significant development, positioning it to boost revenue.

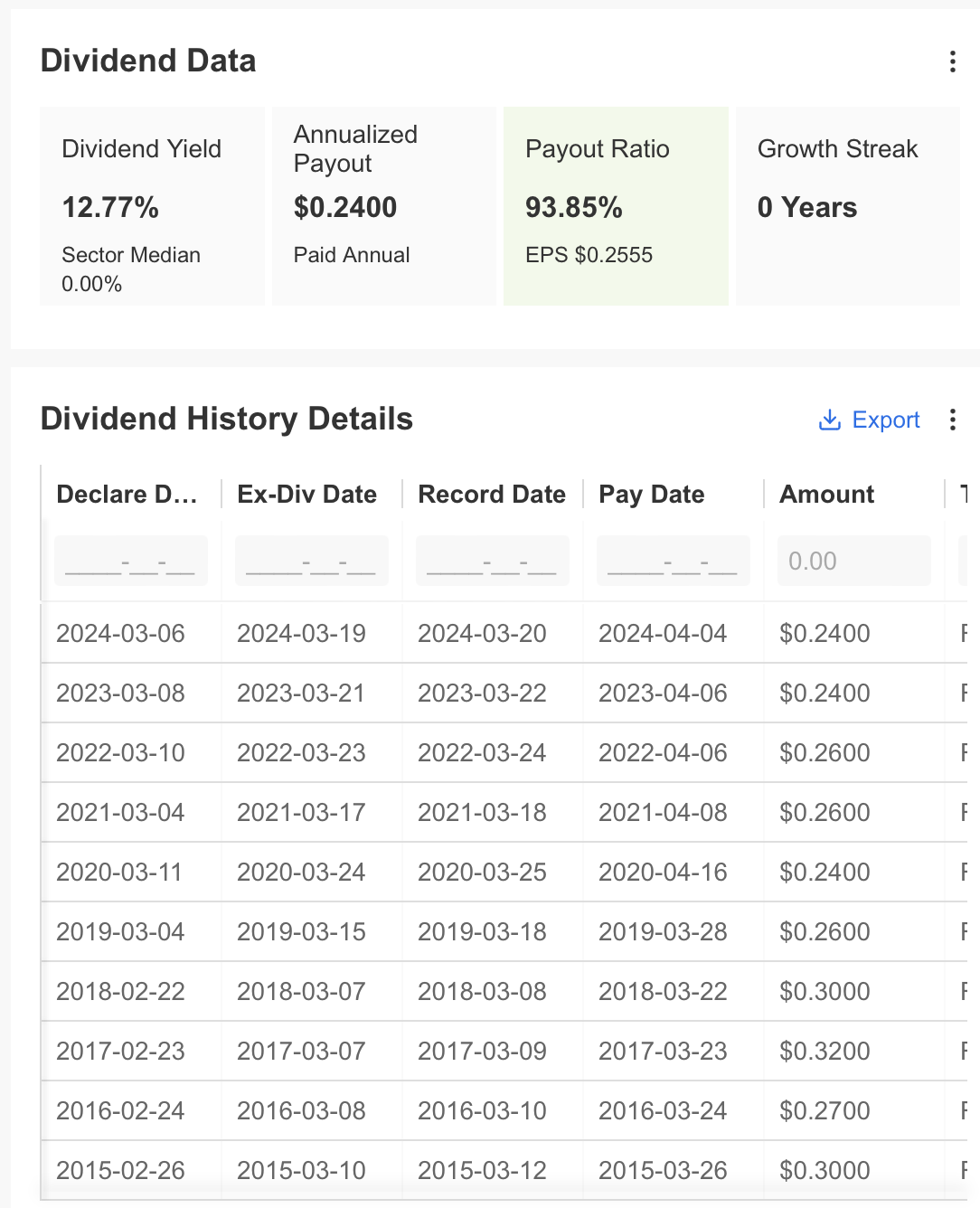

A key highlight of Mind is its long-standing history of paying dividends. With a current dividend yield of 12.77%, the stock traditionally pays dividends in March each year. However, there is a challenge for the company, as it distributes nearly 94% of its profit per share as dividends. To increase dividend payments, Mind needs to boost its net income. As long as income remains constant, dividend payments cannot grow annually.

Source: InvestingPro

The chart reveals that the price fluctuates according to the dividend payment periods. The price tends to rise steadily following the dividend announcement and retreats after the dividend distribution.

Currently, Mind's price, which climbed to $2.22 in March, finds support at an average of $1.85 post-dividend distribution. The past year's chart indicates a base has formed at these levels.

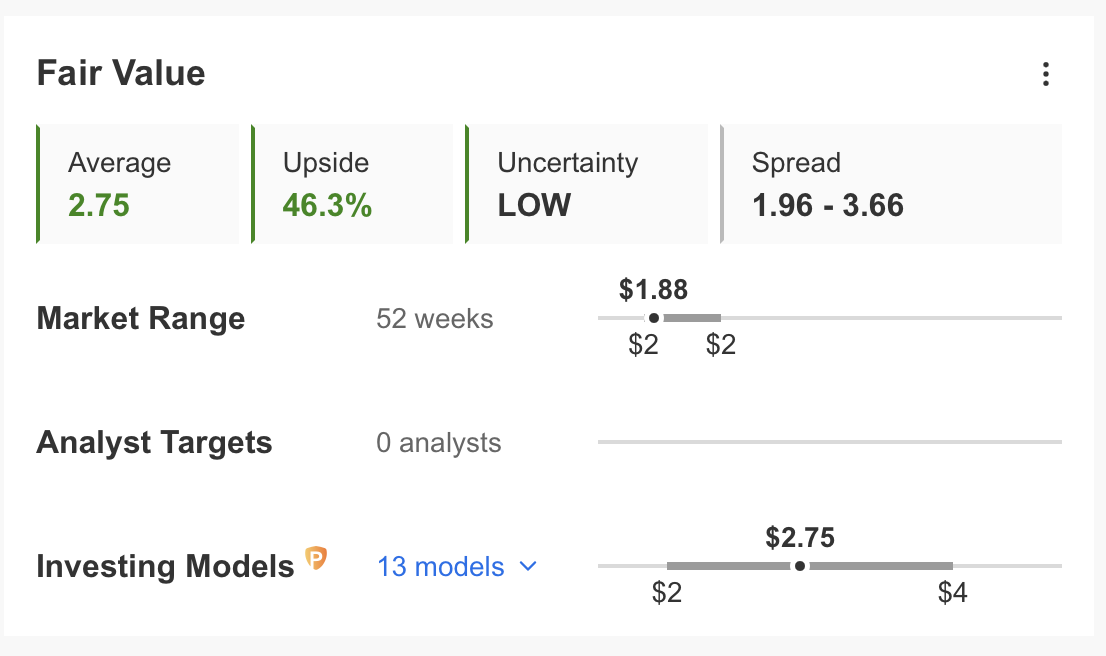

Additionally, 13 financial model valuations on InvestingPro estimate the fair price at $2.75. This suggests the stock is trading at a discount of about 46%, with potential for a rebound from its lows over the next year.

Source: InvestingPro

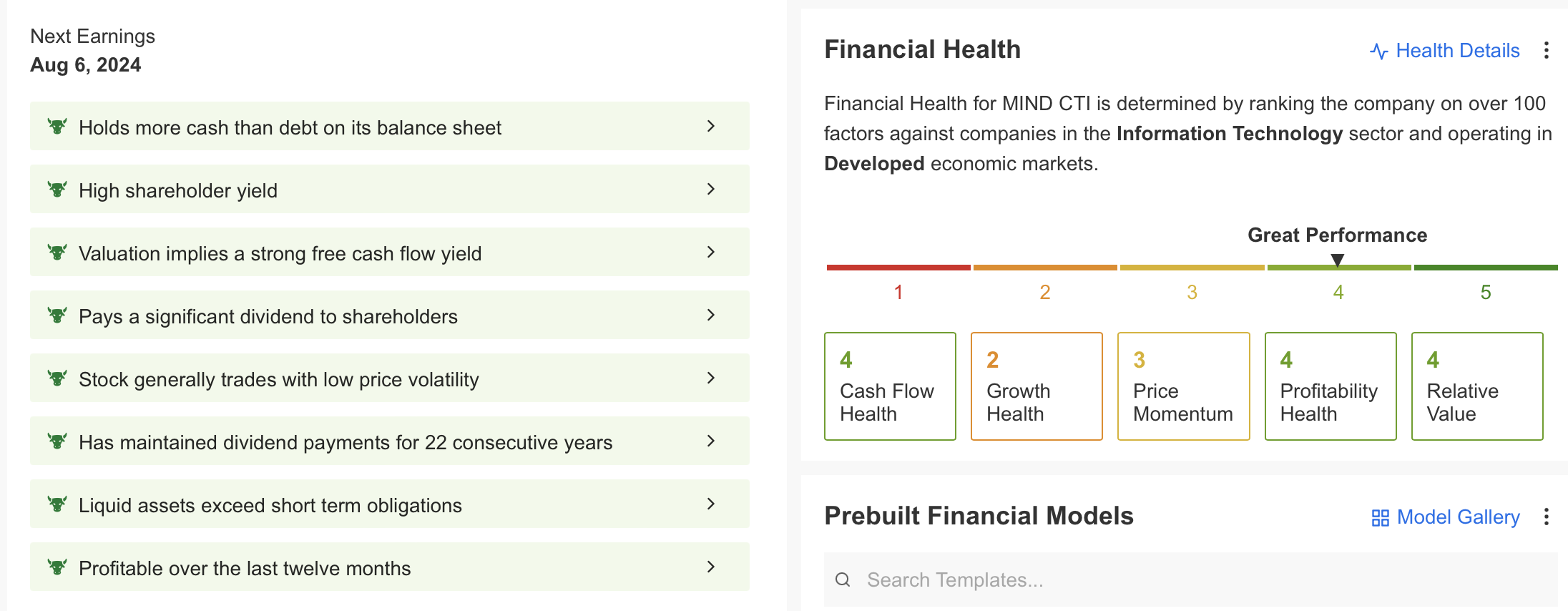

However, Mind has had a good performance with its high dividend yield, low price volatility, cash on balance sheet above debt and profitability in the last year. The company, which is seen to be in good condition in cash and profitability items, has room for improvement in terms of growth.

Source: InvestingPro

2. Ituran Location and Control

Ituran, which provide vehicle tracking systems, fleet management, and remote measurement and control systems across many countries, has underperformed the index and shown a range-bound movement since the beginning of the year.

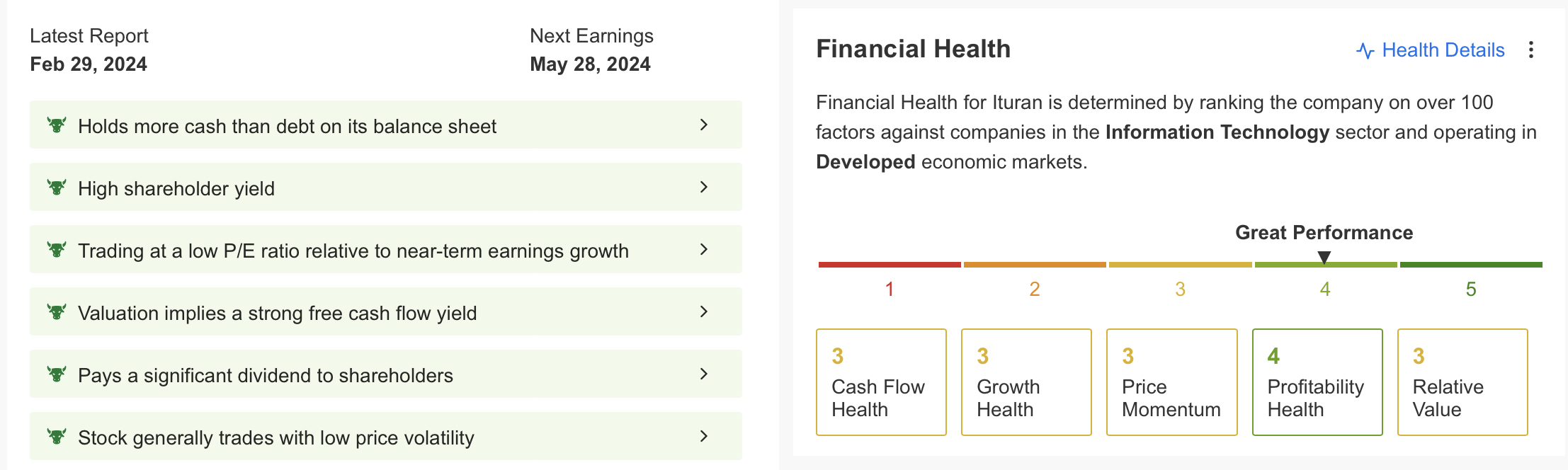

Source: InvestingPro

Examining the last year's price performance, Ituran entered an upward trend in the second half of the year after a flat performance in the same period the previous year.

However, the company's overall performance has been labeled as very good, with profit margins and cash flow exceeding expectations last year.

Source: InvestingPro

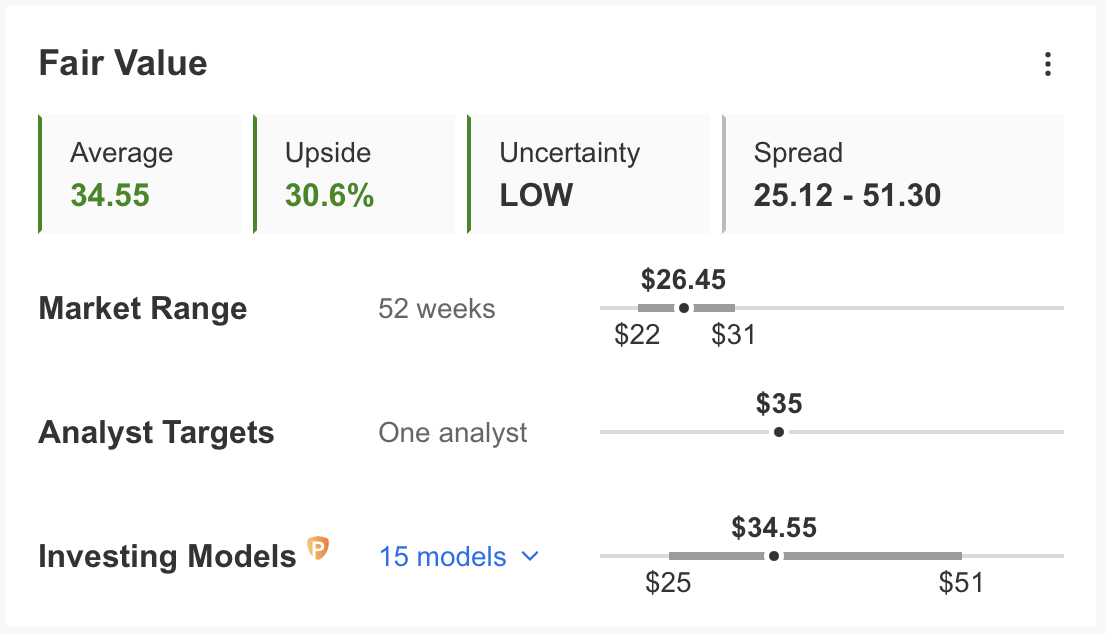

While the company's expectations for 2024 are also positive, new orders are expected to increase. According to current financials and expectations, InvestingPro currently calculates the fair value at $34.55.

Source: InvestingPro

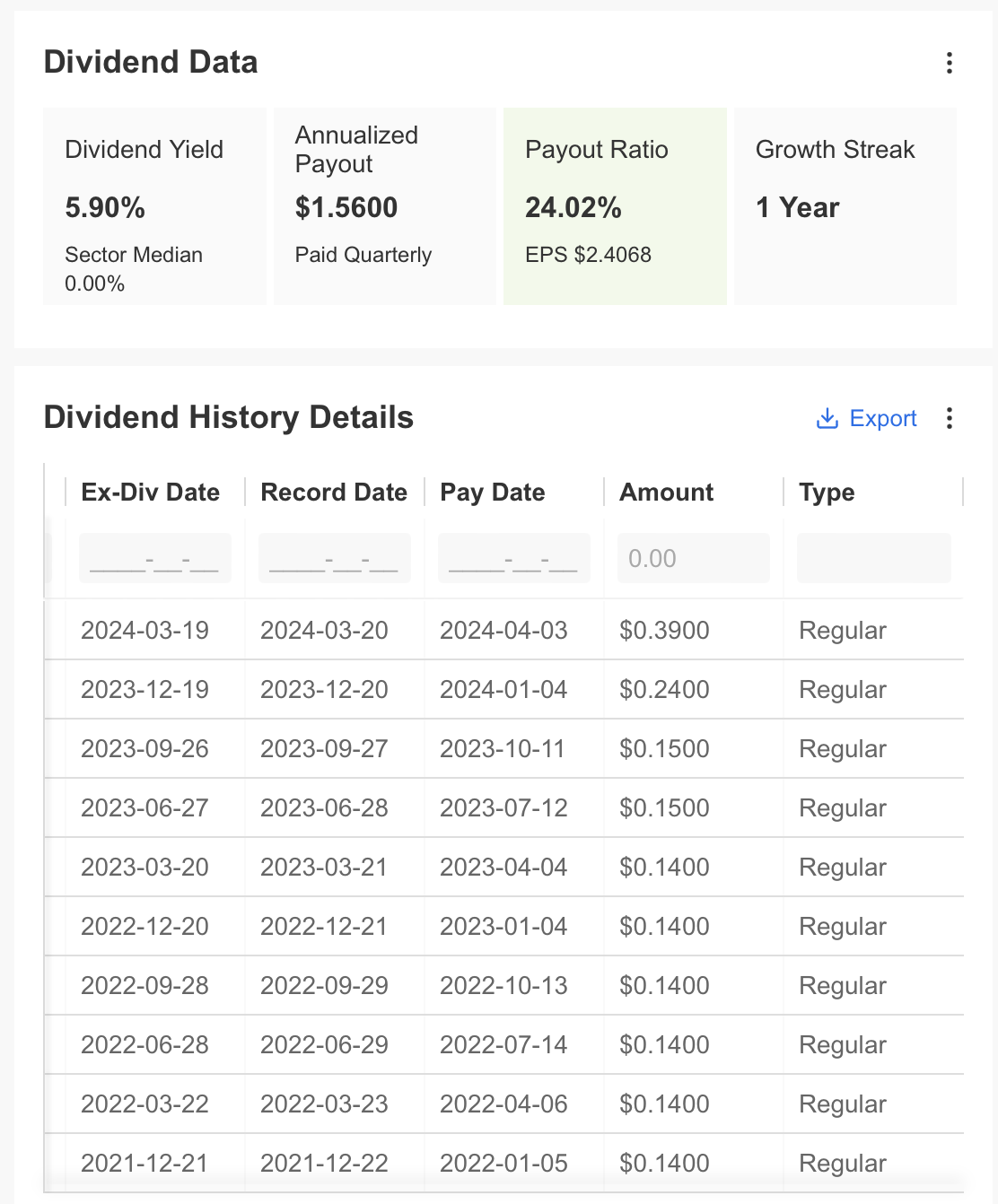

However, while the company stands out with its regular dividend payments, the potential to increase dividend payments is one of the factors that make the stock attractive.

Source: InvestingPro

3. Immersion Corporation

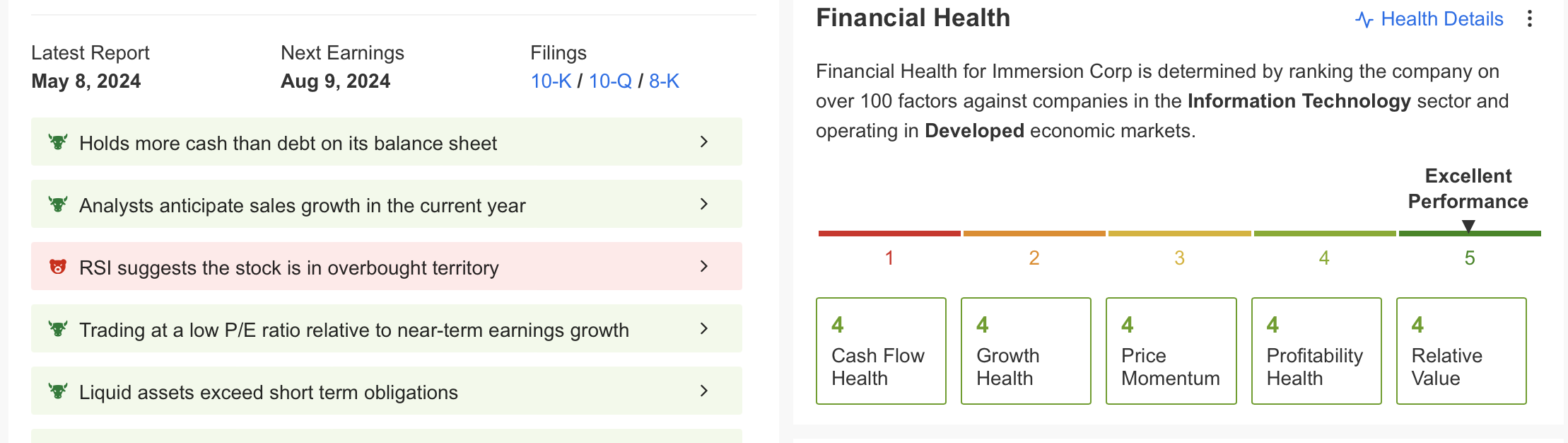

Immersion (NASDAQ:IMMR), serving markets such as mobility, gaming, automotive, virtual and augmented reality, wearables, and the Internet of Things across residential, commercial, and industrial sectors, announced an impressive earnings report for the first quarter of the year.

Source: InvestingPro

The company saw a substantial increase in net income, with revenue rising from $7.07 million in the same period last year to $43.84 million. Earnings per share exceeded expectations, reaching $0.63. The company's improved profitability, driven by effective cost management, positively impacted its share price.

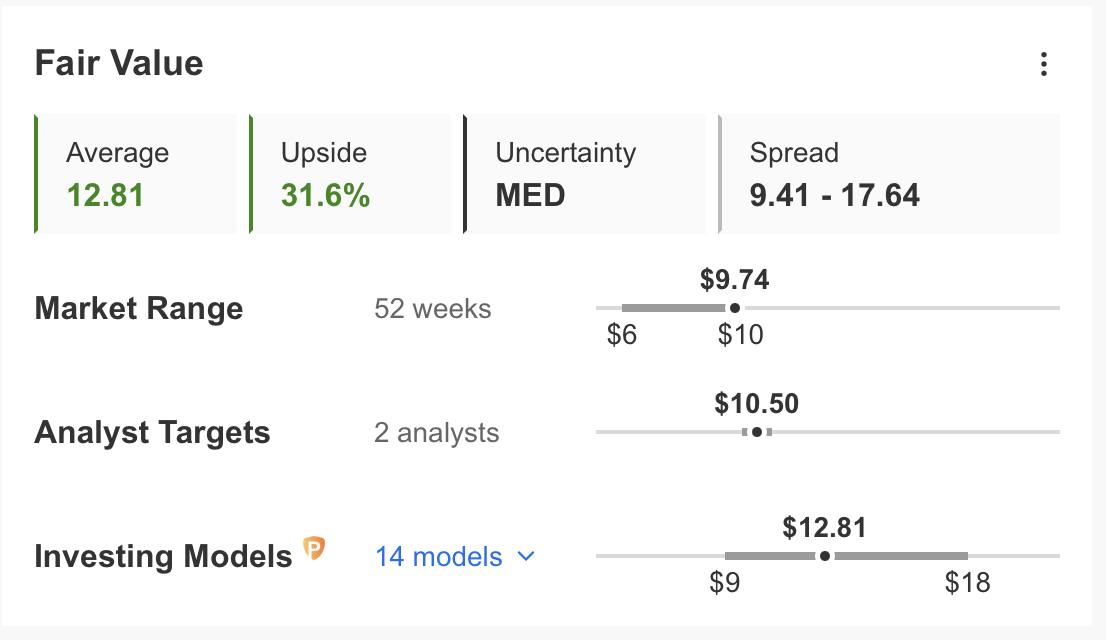

Following the earnings report, Immersion's price surged, achieving a 32% increase in May and reaching $9.70. According to InvestingPro's fair value analysis, which uses 14 financial models, the stock is still discounted and has an estimated upside potential of around 30%.

Source: InvestingPro

However, the company recently announced that it will pay its quarterly dividend in July. This may provide an additional demand increase for the shares, which makes regular dividend payments.

Source: InvestingPro

In addition, analysts expect the company to increase sales this year and accordingly, profitability is expected to continue. Immersion, which offers a solid financial structure with liquid assets exceeding short-term debt, also has the highest rating in InvestingPro's financial condition report.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship "Tech Titans," which outperformed the market by a lofty 1,745% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here and never miss a bull market again!

Don't forget your free gift! Use coupon codes OAPRO1 and OAPRO2 at checkout to claim an extra 10% off on the Pro yearly and bi-yearly plans.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.