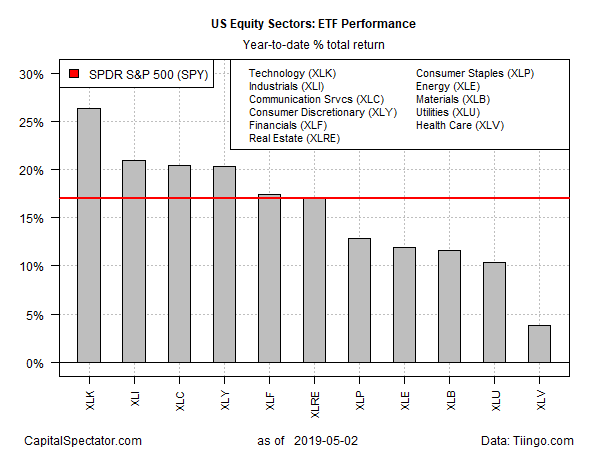

Technology shares remain the top-performing sector in this year’s broad-based stock market rally, based on a set of exchange-traded funds. After stumbling in late-March, the tech sector rebounded in April and still leads the rest of the field by a healthy margin.

Technology Select Sector SPDR (NYSE:XLK) is up a strong 26.4% year to date through yesterday’s close (May 2). The fund’s return is comfortably above the second-best year-to-date performance via Industrial Select Sector SPDR (NYSE:XLI), which has increased 21.0%.

For context, the broad stock market is up 17.0% so far in 2019, based on SPDR S&P 500 (NYSE:SPY).

Tech is winning the performance horse race so far this year, but a bullish bias is conspicuous across sector spectrum. Even the weakest performer — Health Care Select Sector SPDR (NYSE:XLV)– is posting a gain, albeit a modest 3.8% year-to-date return.

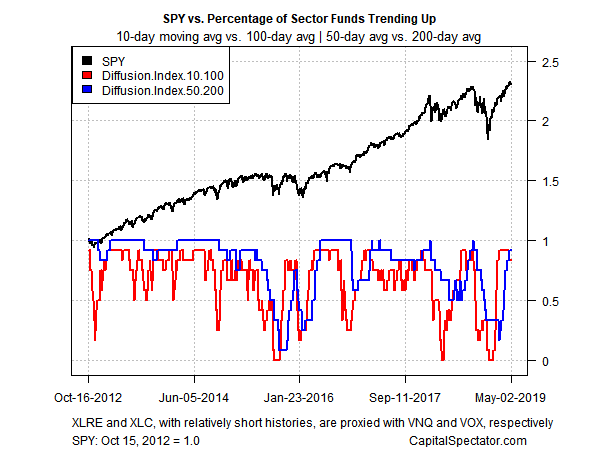

Most funds are trending positive, based on profiling momentum for all the sector funds with two sets of moving averages. The first definition compares the 10-day moving with the 100-day average, a measure of short-term trending behavior (red line in chart below). A second set of moving averages (50 and 200 days) offers an intermediate measure of the trend (blue line). The indexes range from 0 (all funds trending down) to 1.0 (all funds trending up). Based on this data through yesterday’s close, bullish momentum remains widespread (80%-plus) for most of the sector funds that comprise SPY, the broad market proxy.