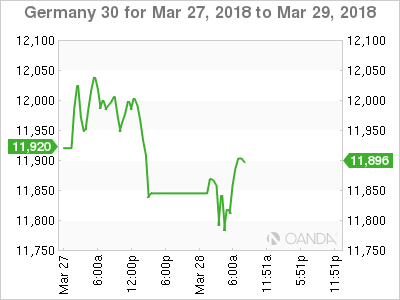

The DAX index has posted strong losses in the Wednesday session. Currently, the DAX is trading at 11,888 points, down 0.68% on the day. Earlier in the session, the index was down about 1 percent. In economic news, German GfK Consumer Climate ticked higher to 10.9, above the estimate of 10.7 points. In the US, Final GDP is expected to be revised upwards to 2.7%, after the initial reading of 2.5% back in February. On Thursday, Germany releases Preliminary CPI, which is expected to remain unchanged at 0.5%. German unemployment change is forecast to post another strong decline, with an estimate of 15 thousand.

Investors continue to be treated to significant volatility from the stock markets. European stock markets have reversed directions on Wednesday, recording strong losses. Technological stocks have led the downward movement, as Facebook (NASDAQ:FB) shares remain under pressure after reports of privacy violations affecting millions of users. Bank stocks are also lower, following a decline in bond yields. On the DAX, Commerzbank (DE:CBKG) has plunged 2.44% and Deutsche Bank (DE:DBKGn) has dropped 0.70%.

The tariff dispute between the US and China has shaken up global stock markets. Investors lost their risk appetite last week after President Trump’s dramatic announcement that he was imposing stiff tariffs on up to $60 billion in Chinese imports. China vowed to retaliate and slap imports on a range of US products. This move came on the heels of a blanket US tariff on steel imports. Although Trump backtracked and exempted Canada, Mexico and other countries from the steel tariffs, the threat of a global trading war has unnerved investors.

This week, however, China was singing a more conciliatory tune, saying it would apply to the World Trade Organization to overturn the tariffs. The US has imposed the tariffs under a national security provision, but China has argued that the move is a trade barrier with the intent of protecting domestic producers. Although the dispute has not been resolved, the Chinese move has eased tensions and restored investor risk appetite on Tuesday, in the hope that both the US and China policymakers will climb down from their trees and reach some agreement instead of slapping tariffs on each other.

Complicatedly Confounding Currency Moves

Risk Aversion Has Stamina as Tech Sector Quivers

EUR/USD Fundamentals

Wednesday (March 28)

- 2:00 German GfK Consumer Climate. Estimate 10.7. Actual 10.9

- 8:30 US Final GDP. Estimate 2.7%

Thursday (March 29)

- All Day – German Preliminary CPI. Estimate 0.5%

- 3:55 German Unemployment Change. Estimate -15K

*All release times are DST

*Key events are in bold

DAX, Wednesday, March 28 at 7:15 EDT

Prev. Close: 11,970 Open: 11,871 High: 11,902 Low: 11,768 Close: 11,888