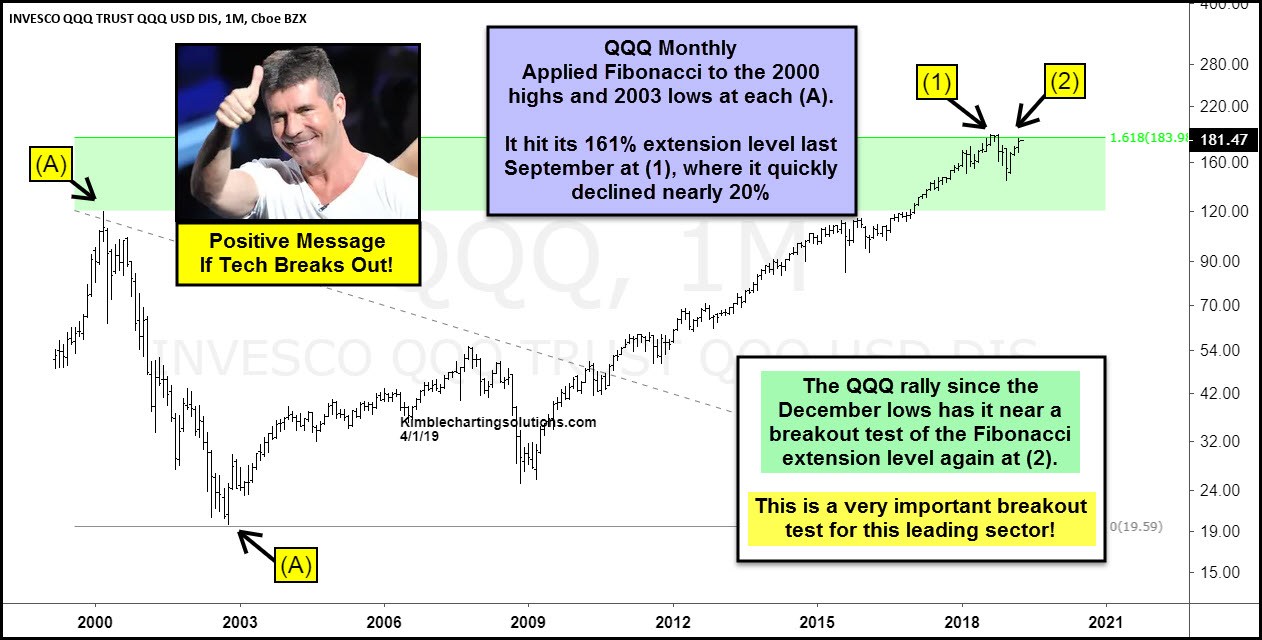

Tech ETF QQQ is testing a key Fibonacci level that dates all the way back to its lows back in 2003. If it succeeds in breaking above this Fibonacci level, will it send a positive message to Tech and the broad markets? I think it will.

Fibonacci was applied to the 2000 highs and 2003 lows at each (A). The 161% Fibonacci extension level off these key price points comes into play around the 184 level. QQQ closed a couple of points above this key level in September, then selling pressure took over, erasing nearly 20% of its value.

The rally off the lows in December now has QQQ a couple of percent below the Fibonacci extension level and last year's highs at (2).

Is a breakout about to take place or is Tech going to Double-Top at the Fibonacci 161% extension level?

In my humble opinion, one should keep a close eye on QQQ at this price level because what it does from here most likely will send a very important intermediate message to the broad markets going forward.