Looking at the earnings calendar I see a surprising number of important tech earnings coming on Thursday, August 31 after the close. Let’s take a look at each of them and see if it might be worth the gamble to hold these stocks into the print.

Ambarella

Ambarella (AMBA) is slated to report $0.44, down from $0.54 which was reported in the year ago quarter. Revenue is expected to be $70.8M, which would be an increase from the $65.1M reported one year ago and up even more from the $64.1M reported last quarter.

The last three reports all came with revenue guidance that was below the Wall Street Consensus, and being a growth name, investors didn’t like that. In each of the last four reports, AMBA has seen its stock drop. That sort of record isn’t inspiring and right now the options market is calling for a 7% move in either direction.

AMBA is a Zacks Rank #3 (Hold) with a negative earnings ESP.

My Take: I know the Facebook (NASDAQ:FB) camera idea is out there and not too long ago AMBA was rumored to be approached on the M&A front. I would avoid this stock, but at the same time I wouldn’t short it.

Nutanix

Nutanix (NTNX) is a Zacks Rank #3 but it does have a +2% earnings ESP. NTNX is expected to show a loss of $0.38 on $218M of revenues. The company has only reported 3 times in the past but has beat on top and on bottom in each of the reports. The thing that I like to see is increased guidance and the last quarter saw just that.

Jefferies just came out with a buy rating on the stock on August 17 and put a $30 price target as well. Back in May, Goldman Sachs (NYSE:GS) upgraded the stock to buy from neutral.

My Take: this one could be big, with the options market calling for a 15% move in either direction. Last quarter the company posted some solid numbers and the stock moved higher by 11% when the options market was calling for an 18% move. I like this stock.

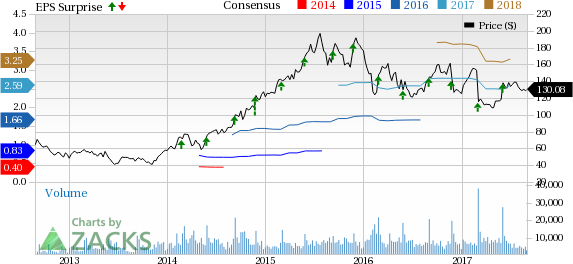

Palo Alto Networks

Palo Alto Networks (PANW) is a Zacks Rank #3 (Hold) and has a slightly negative earnings ESP. Analysts are expecting $0.79 in EPS and $487M in revenue. Over the last four reports, PANW has beat on the bottom line, but sales expectations were higher than reported in two of the reports.

The company’s third fiscal quarter which was reported at the end of February came with downside guidance and that sent the stock down 24% in the session following the release. Things got better in May when a healthy bottom line beat and guidance ahead of the consensus estimate sent the stock up by more than 17%.

My Take: The options market is looking for a 9% move, but this could move a lot more than that. The security software space heating up with Citi recently upgrading the stock with a $160 target. Northland is the bull here, with an outperform and $175 target. I like it to beat and move higher.

Palo Alto Networks, Inc. (PANW): Free Stock Analysis Report

Nutanix Inc. (NTNX): Free Stock Analysis Report

Facebook, Inc. (FB): Free Stock Analysis Report

Ambarella, Inc. (AMBA): Free Stock Analysis Report

Apple Inc. (NASDAQ:AAPL): Free Stock Analysis Report

Original post

Zacks Investment Research

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI