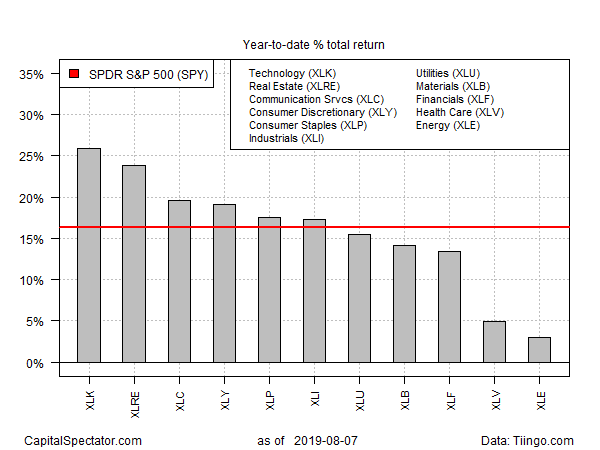

The stock market has taken investors on a white-knuckle ride in 2019, but despite the surge in volatility lately all the major equity sectors continue to post year-to-date gains, based on a set of exchange-traded funds. Leading the field by a substantial margin: technology shares, closely followed by real estate investment trusts (REITs).

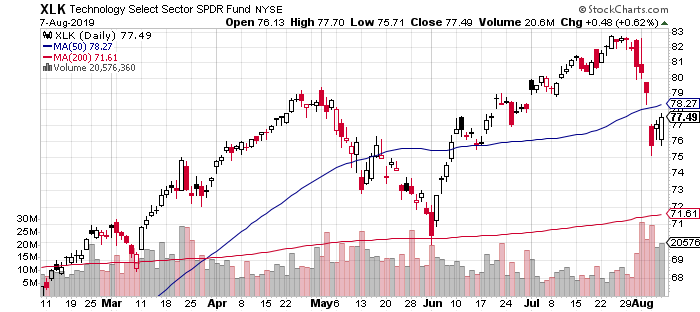

Technology Select Sector SPDR (NYSE:XLK) is up a strong 25.9% this year through last night’s close (Aug. 7). There have been two rounds of sharp swings for the ETF in 2019, but investors who’ve held on have, so far, reaped a hefty gain that’s well ahead of market generally and best the other sectors too.

One technical analysts continues to expect tech to trend higher. “We’re still above the upsloping 200-day moving average [in terms of volume], we need to be averaging 15 to 17 million shares a day in the XLK to really trigger some concern, ” Todd Gordon of TradingAnalysis.com told CNBC on Tuesday. “So everything we see here, everything aside, the motion is still intact.”

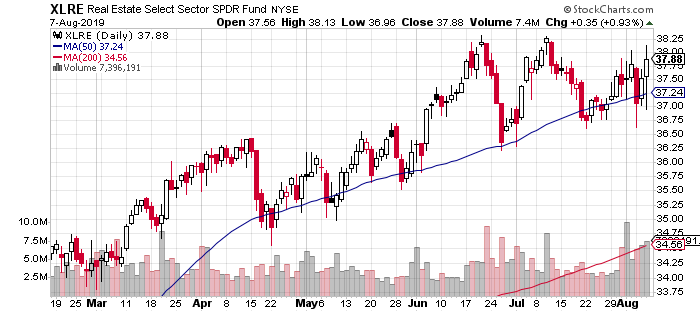

U.S. REITs continue to paint a bullish trend this year too. Although the ETF has had its share of rocky periods in 2019, the general move has been up and the current profile suggests more of the same is possible and perhaps likely.

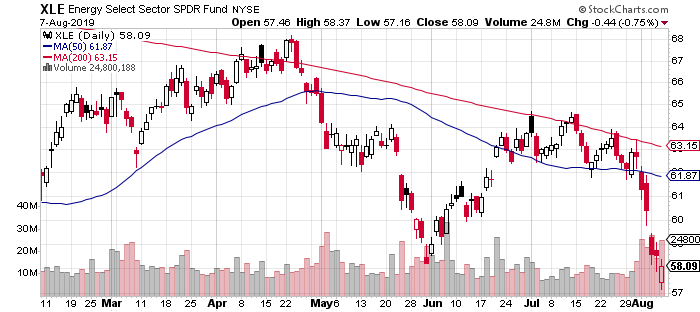

In fact, all of the U.S. equity sectors continue to post year-to-date gains at the moment. Even the beleaguered energy sector (the weakest sector for 2019 performance) has managed to hold on a to modest gain through yesterday’s close. Energy Select Sector SPDR (NYSE:XLE) is up 3.0%. But the tumbling price of crude oil lately is a headwind for energy shares. XLE’s dive in recent days suggests the ETF is a candidate for posting the first sector loss for 2019 in the near future.

Otherwise, a positive trend remains intact for most sectors, or so year-to-date results imply. The same is true for equities overall, based on SPDR S&P 500 (NYSE:SPY). This US market proxy is currently sitting on a 16.3% total return for the year.

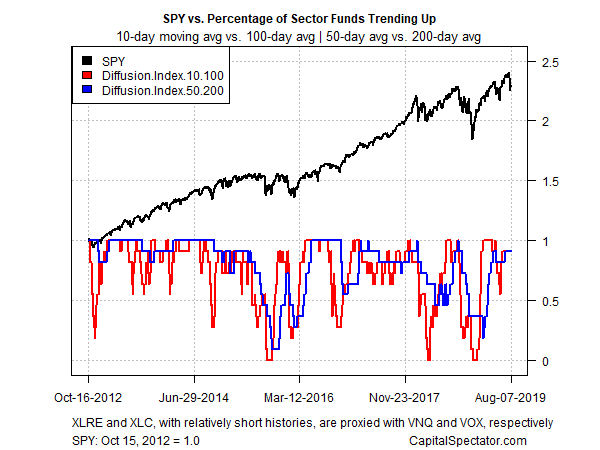

Reviewing momentum for the U.S. equity sectors continues to reflect an upside bias for the majority of funds. The analysis is based on two sets of moving averages for the ETFs listed above. The first compares the 10-day moving average with its 100-day counterpart — a proxy for short-term trending behavior (red line in chart below). A second set of moving averages (50 and 200 days) represents an intermediate measure of the trend (blue line). As of yesterday’s close, the two indicators continue to reflect positive momentum for most sectors. The question, of course, is how or if the escalating U.S.-China trade conflict will factor in to the equity rally going forward. Unclear, primarily because predicting Donald Trump’s policy decisions is a mug’s game. What we do know is that sector trends still look encouraging, at least until the next announcement from the White House.