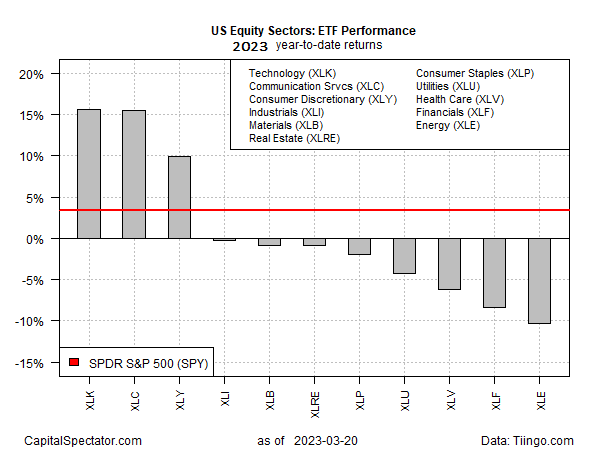

Technology is killing it – again. The sector is posting the strongest year-to-date performance for US equity sectors stocks, based on a set of ETF proxies. A close second: Communication services. Meanwhile, financials and energy are suffering this year.

After a sharp 28% loss in 2022, Technology Select Sector SPDR ETF (NYSE:XLK) is holding on to a strong 15.6% gain through Monday’s close (Mar. 20). Communication Services Select Sector SPDR ETF (NYSE:XLC) is essentially tied for first place with a fractionally softer performance.

By contrast, the formerly high-flying energy sector is the worst sector performer so far this year. Energy Select Sector SPDR ETF (NYSE:XLE) is in the hole by more than 10% in 2023 after a stellar run last year.

The financial sector is also enduring a rough ride this year as bank industry turmoil of late takes a bite of prices in this corner. Financial Select Sector SPDR ETF (NYSE:XLF) has shed 8.4% year-to-date, a loss that’s exceeded in the sector space only by energy shares.

The results arrive with a modest tailwind for equity beta writ large. US stocks are posting a modest gain so far in 2023 via SPDR S&P 500 ETF (NYSE:SPY), which is up 3.4%.

Wedbush analyst Dan Ives says tech’s fortunes have recovered recently as investors now see the stocks as a relatively safe haven in the context of recent banking woes. “There are no Sunday night jitters with tech,” he tells Yahoo Finance. An added bonus: Tech company executives have “cleared the deck” in terms of upbeat earnings and profits guidance.

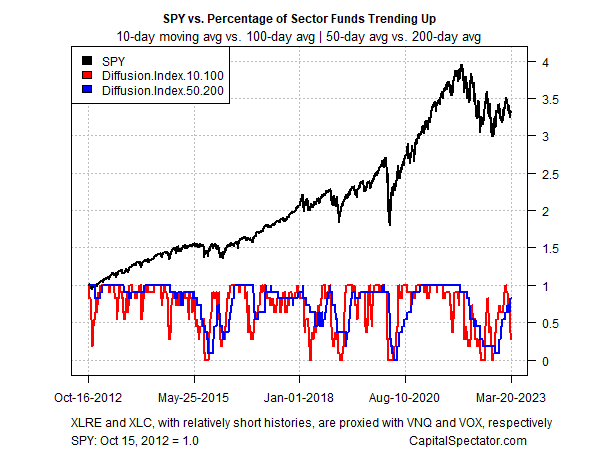

Despite the strong gains in tech and communications services this year, upside momentum for the equity sectors, overall, is showing signs of fading after the recent rebound. Using a set of moving averages to track trend strength for equity sectors points to generally weaker performance ahead vs. recent history.

The banking crisis appears contained for the moment, but the macro outlook has taken a hit, advise Morningstar analysts: “Stress in pockets of the banking system and corporate sector in the aftermath of this episode may, on the margin, bring forward the weaker economic conditions that we already expected during 2023.”

Meanwhile, Fed funds futures are pricing in moderately high odds for another ¼-point rate hike at tomorrow’s FOMC meeting (Mar. 22). But the challenge of taming still-high inflation has greater risks in the wake of bank industry turmoil.

“I wouldn’t add fuel to the fire by raising interest rates at the same time there already is a tightening of financial conditions provided by a financial shock,” advises Eric Rosengren, former president of the Boston Fed. “One 25-basis-point increase now will have a fairly modest effect on inflation, but it could have an amplified effect on financial conditions.”